Alexandria Real Estate Equities, Inc. (LON:0HCH)

London · Delayed Price · Currency is GBP · Price in USD

London · Delayed Price · Currency is GBP · Price in USD | Market Cap | 6.83B -49.6% |

| Revenue (ttm) | 2.24B -3.4% |

| Net Income | -1.07B |

| EPS | -6.27 |

| Shares Out | n/a |

| PE Ratio | n/a |

| Forward PE | 1,096.72 |

| Dividend | 3.50 (6.64%) |

| Ex-Dividend Date | Dec 31, 2025 |

| Volume | 1,295 |

| Average Volume | 1,422 |

| Open | 54.11 |

| Previous Close | 56.14 |

| Day's Range | 51.34 - 54.52 |

| 52-Week Range | 44.19 - 105.04 |

| Beta | 1.32 |

| RSI | 41.47 |

| Earnings Date | Jan 26, 2026 |

About LON:0HCH

Alexandria Real Estate Equities, Inc. an S&P 500 company, is a best-in-class, mission-driven life science REIT making a positive and lasting impact on the world. With our founding in 1994, Alexandria pioneered the life science real estate niche. Alexandria is the preeminent and longest-tenured owner, operator, and developer of collaborative Mega campus ecosystems in AAA life science innovation cluster locations, including Greater Boston, the San Francisco Bay Area, San Diego, Seattle, Maryland, Research Triangle, and New York City. As of Decemb... [Read more]

News

Krilogy Financial LLC Sells 6,746 Shares of Alexandria Real Estate Equities Inc (ARE)

Krilogy Financial LLC Sells 6,746 Shares of Alexandria Real Estate Equities Inc (ARE)

EARNED WEALTH ADVISORS, LLC Sells 3,010 Shares of Alexandria Real Estate Equities Inc (ARE)

EARNED WEALTH ADVISORS, LLC Sells 3,010 Shares of Alexandria Real Estate Equities Inc (ARE)

LECAP ASSET MANAGEMENT LTD Buys 40,995 Shares of Alexandria Real Estate Equities Inc (ARE)

LECAP ASSET MANAGEMENT LTD Buys 40,995 Shares of Alexandria Real Estate Equities Inc (ARE)

Key Themes To Watch This REIT Earnings Season

Key Themes To Watch This REIT Earnings Season

TOKIO MARINE ASSET MANAGEMENT CO LTD Buys 2,758 Shares of Alexandria Real Estate Equities Inc (ARE)

TOKIO MARINE ASSET MANAGEMENT CO LTD Buys 2,758 Shares of Alexandria Real Estate Equities Inc (ARE)

VCI Wealth Management LLC Sells 11,453 Shares of Alexandria Real Estate Equities Inc (ARE)

VCI Wealth Management LLC Sells 11,453 Shares of Alexandria Real Estate Equities Inc (ARE)

Alexandria Real Estate Equities (ARE) Leads Real Estate Stocks with 19.63% Gain

Alexandria Real Estate Equities (ARE) Leads Real Estate Stocks with 19.63% Gain

Convergence Long/Short Equity ETF Buys 3,141 Shares of Alexandria Real Estate Equities Inc (ARE)

Convergence Long/Short Equity ETF Buys 3,141 Shares of Alexandria Real Estate Equities Inc (ARE)

Victory Growth and Tax Strategy Fund Buys 1,546 Shares of Alexandria Real Estate Equities Inc (ARE)

Victory Growth and Tax Strategy Fund Buys 1,546 Shares of Alexandria Real Estate Equities Inc (ARE)

Alexandria Real Estate Equities Reports 4Q25 Net Loss Per Share of $6.35; FFO Per Share – Adjusted of $2.16

Alexandria Real Estate Equities, Inc. (NYSE: ARE) reported a net loss of $1.08 billion for the fourth quarter ended December 31, 2025. The fourth quarter loss included $1.44 billion in real estate imp...

Alexandria Real Estate Equities Inc (ARE) Q4 2025 Earnings Call Highlights: Strong Leasing ...

Alexandria Real Estate Equities Inc (ARE) Q4 2025 Earnings Call Highlights: Strong Leasing Activity Amidst Market Challenges

Alexandria Real Estate Equities, Inc. Announces Cash Tender Offers

PASADENA, Calif., Jan. 27, 2026 /PRNewswire/ -- Alexandria Real Estate Equities, Inc. ("Alexandria" or the "Company") (NYSE: ARE) today announced the commencement of cash tender offers ("Tender Offers...

Q4 2025 Alexandria Real Estate Equities Inc Earnings Call Transcript

Q4 2025 Alexandria Real Estate Equities Inc Earnings Call Transcript

Alexandria Real Estate Equities (ARE) Q4 2025 Earnings Reflect Strategic Focus

Alexandria Real Estate Equities (ARE) Q4 2025 Earnings Reflect Strategic Focus

Alexandria outlines $2.9B 2026 dispositions target and expects occupancy dip in Q1 2026 as portfolio strategy intensifies

Alexandria Real Estate (ARE) Q4 2025 earnings call: 2026 dispositions, leasing, occupancy/FFO guidance, and balance sheet outlook.

Alexandria Real Estate Equities, Inc. (ARE) Q4 2025 Earnings Call Transcript

Alexandria Real Estate Equities Q4 25 Earning Conference Call At 2:00 PM ET

(RTTNews) - Alexandria Real Estate Equities, Inc. (ARE) will host a conference call at 2:00 PM ET on January 27, 2026, to discuss Q4 25 earnings results.

1 Popular REIT To Sell And 1 Hated REIT To Buy

The market is excessively focused on short-term prospects. This often leads REITs to heavily deviate from their fair market value. I highlight one popular REIT to sell and one hated REIT to buy.

AE Wealth Management LLC Sells 3,053 Shares of Alexandria Real Estate Equities Inc (ARE)

AE Wealth Management LLC Sells 3,053 Shares of Alexandria Real Estate Equities Inc (ARE)

Decoding Alexandria Real Estate Equities Inc (ARE): A Strategic SWOT Insight

Decoding Alexandria Real Estate Equities Inc (ARE): A Strategic SWOT Insight

Alexandria Real Estate Equities Q4 Loss Widens

(RTTNews) - Alexandria Real Estate Equities, Inc. (ARE) reported that its net loss attributable to the company's common stockholders for the fourth quarter widened to $1.08 billion or $6.35 per share ...

Compared to Estimates, Alexandria Real Estate Equities (ARE) Q4 Earnings: A Look at Key Metrics

Although the revenue and EPS for Alexandria Real Estate Equities (ARE) give a sense of how its business performed in the quarter ended December 2025, it might be worth considering how some key metrics...

Alexandria Real Estate Equities (ARE) Surpasses Q4 Expectations

Alexandria Real Estate Equities (ARE) Surpasses Q4 Expectations

Alexandria Real Estate Equities (ARE) Delivers Strong Q4 Results

Alexandria Real Estate Equities (ARE) Delivers Strong Q4 Results

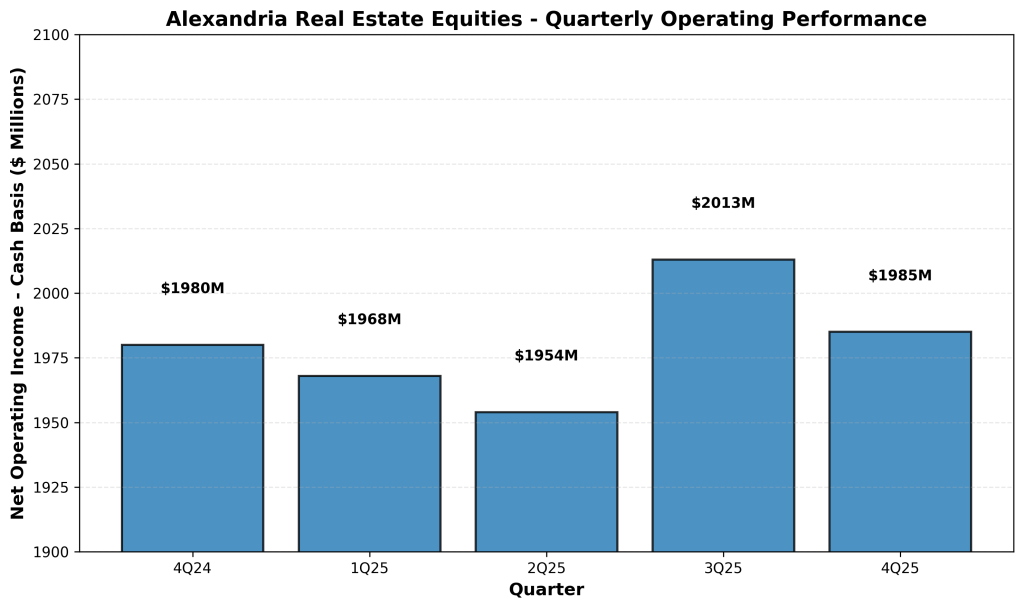

Alexandria Real Estate Equities (ARE) Reaffirms FY26 NOI Guidance

Alexandria Real Estate Equities (ARE) Reaffirms FY26 NOI Guidance