Invesco Mortgage Capital Inc. (LON:0JD3)

London · Delayed Price · Currency is GBP · Price in USD

London · Delayed Price · Currency is GBP · Price in USD | Market Cap | 469.34M +16.5% |

| Revenue (ttm) | 89.04M +51.0% |

| Net Income | 65.51M +69.1% |

| EPS | 0.98 +104.2% |

| Shares Out | n/a |

| PE Ratio | 7.16 |

| Forward PE | 3.80 |

| Dividend | 1.12 (12.59%) |

| Ex-Dividend Date | Jan 26, 2026 |

| Volume | 1,810 |

| Average Volume | 4,478 |

| Open | 8.92 |

| Previous Close | 8.92 |

| Day's Range | 8.92 - 9.17 |

| 52-Week Range | 5.89 - 9.50 |

| Beta | 1.72 |

| RSI | 59.99 |

| Earnings Date | Jan 29, 2026 |

About Invesco Mortgage Capital

Invesco Mortgage Capital Inc. operates as a real estate investment trust (REIT) that invests, finances, and manages mortgage-backed securities and other mortgage-related assets in the United States. It invests in residential mortgage-backed securities (RMBS) and commercial mortgage-backed securities (CMBS) that are guaranteed by the United States (U.S.) government agency or federally chartered corporation; RMBS and CMBS that are not issued or guaranteed by the U.S. government agency or federally chartered corporation; the U.S. treasury securiti... [Read more]

Financial Performance

In 2025, Invesco Mortgage Capital's revenue was $119.84 million, an increase of 51.01% compared to the previous year's $79.36 million. Earnings were $88.17 million, an increase of 153.64%.

Financial numbers in USD Financial StatementsNews

Invesco Mortgage Capital Inc. (IVR): SWOT Analysis

Strengths Weaknesses Opportunities Threats The post Invesco Mortgage Capital Inc. (IVR): SWOT Analysis first appeared on AlphaStreet .

Invesco Mortgage Capital Inc. (IVR): Geopolitical Risks and Tariff Impact Considerations

Geopolitical tensions, particularly in Eastern Europe and the Middle East, remain a primary risk for global financial markets and interest rate stability. Invesco Mortgage Capital Inc. (IVR) managemen...

Invesco Mortgage Capital Inc. (IVR) Portfolio Leverage Rises Amid Improved Market Conditions

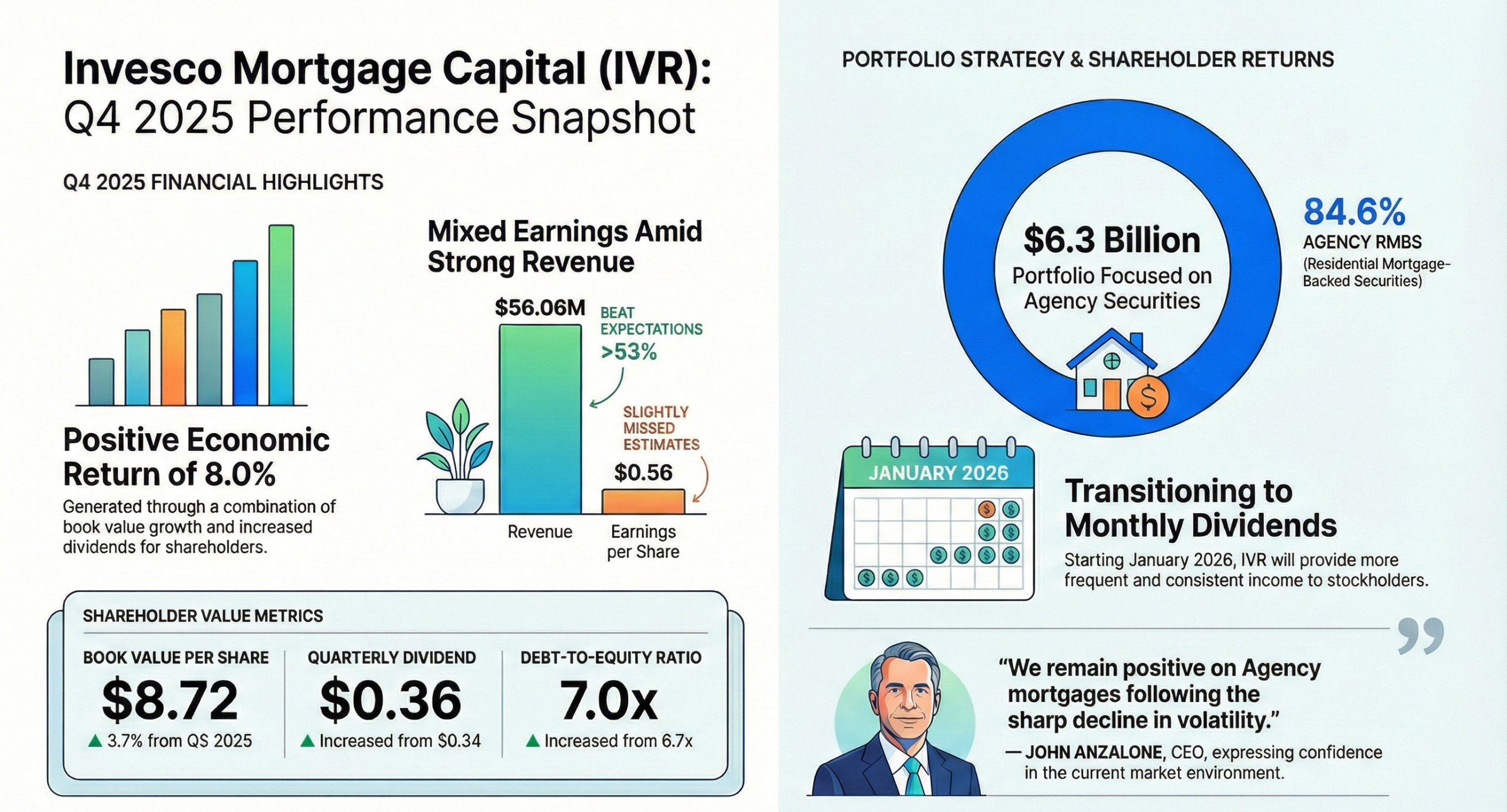

Invesco Mortgage Capital Inc. (IVR) Management modestly increased the company’s debt-to-equity ratio to 7.0x as of quarter-end, up from 6.7x in September. The $6.3 billion investment portfolio now con...

Invesco Mortgage Capital Inc. (IVR) Q4 Earnings Missed While Revenue Surpasses Estimates

Invesco Mortgage Capital Inc. (IVR) reported earnings available for distribution (EAD) of $0.56 per common share for the quarter ended Dec. 31, 2025. This result missed the analyst consensus estimate ...

Invesco Mortgage Capital Inc. (IVR) Increases Dividend Despite Earnings Miss

Shares of Invesco Mortgage Capital Inc. (IVR) rose 0.11% to $8.91 in intraday trading on Friday. The move followed the release of fourth-quarter results which showed a rise in book value despite lower...

Invesco Mortgage Capital Inc (IVR) Q4 2025 Earnings Call Highlights: Strong Economic Return and ...

Invesco Mortgage Capital Inc (IVR) Q4 2025 Earnings Call Highlights: Strong Economic Return and Portfolio Growth Amid Market Challenges

Q4 2025 Invesco Mortgage Capital Inc Earnings Call Transcript

Q4 2025 Invesco Mortgage Capital Inc Earnings Call Transcript

Invesco Mortgage Capital Inc. (IVR) Q4 2025 Earnings Call Transcript

Invesco Mortgage Capital Inc. (IVR) Q4 2025 Earnings Call January 30, 2026 9:00 AM ESTCompany ParticipantsGreg Seals - Investor RelationsJohn M.

Invesco Mortgage Capital Inc. 2025 Q4 - Results - Earnings Call Presentation

Invesco Mortgage Capital (IVR) Meets Q4 Earnings Expectations

Invesco Mortgage Capital (IVR) Meets Q4 Earnings Expectations

Invesco Mortgage Q4 earnings beat on Agency RMBS outperformance

Invesco Mortgage Capital Inc. Reports Fourth Quarter 2025 Financial Results

ATLANTA, Jan. 29, 2026 /PRNewswire/ -- Invesco Mortgage Capital Inc. (NYSE: IVR) (the "Company") today announced financial results for the quarter ended December 31, 2025. Net income per common share ...

Invesco Mortgage (IVR) Sees Active Options Trading Pre-Earnings

Invesco Mortgage (IVR) Sees Active Options Trading Pre-Earnings

Invesco Mortgage Capital: Double-Digit Yield Only Makes Sense If You Watch Book Value

Invesco Mortgage Capital has shifted to a pure agency RMBS/CMBS portfolio, eliminating credit risk but amplifying rate and funding sensitivity. IVR's high ~15–16% yield is now a direct pass-through of...

Price Over Earnings Overview: Invesco Mortgage Capital

In the current session, the stock is trading at $8.87, after a 0.23% spike. Over the past month, Invesco Mortgage Capital Inc. (NYSE: IVR) stock increased by 6.12% , and in the past year, by 8.59% . ...

Invesco Mortgage Capital Inc. To Announce Fourth Quarter 2025 Results

ATLANTA, Jan. 21, 2026 /PRNewswire/ -- Invesco Mortgage Capital Inc. (NYSE: IVR) will announce its fourth quarter 2025 results Thursday, January 29, 2026, after market close. A conference call and aud...

Invesco Mortgage Capital (IVR) Rises Higher Than Market: Key Facts

In the latest trading session, Invesco Mortgage Capital (IVR) closed at $9.3, marking a +2.31% move from the previous day.

Invesco Mortgage Capital (IVR) Declares Monthly Dividend with High Yield

Invesco Mortgage Capital (IVR) Declares Monthly Dividend with High Yield

Invesco Mortgage Capital (IVR) Book Value Rises, Stock Trades at Discount

Invesco Mortgage Capital (IVR) Book Value Rises, Stock Trades at Discount

Invesco Mortgage Capital declares $0.12 dividend

Invesco Mortgage Capital Inc. Announces Monthly Common Dividend and Provides Update on Book Value and Leverage

ATLANTA, Jan. 15, 2026 /PRNewswire/ -- Invesco Mortgage Capital Inc. (NYSE: IVR) (the "Company") today announced the declaration of a cash dividend of $0.12 per share of common stock for the month of ...

Wall Street's Most Accurate Analysts Weigh In On 3 Financial Stocks With Over 15% Dividend Yields

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high...

Bigger Dividends, Better Execution: Choosing Quality For The 2026 MBS Recovery

Agency mREITs are entering a powerful 2026 recovery as falling funding costs meet high asset coupons. By focusing on mortgages guaranteed by Fannie Mae and Freddie Mac, these companies avoid the defau...

Wall Street's Most Accurate Analysts Give Their Take On 3 Financial Stocks With Over 10% Dividend Yields

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high...

Wall Street's Most Accurate Analysts Give Their Take On 3 Financial Stocks With Over 10% Dividend Yields

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high...