T. Rowe Price Group, Inc. (LON:0KNY)

London · Delayed Price · Currency is GBP · Price in USD

London · Delayed Price · Currency is GBP · Price in USD | Market Cap | 15.03B -25.8% |

| Revenue (ttm) | 5.43B +3.1% |

| Net Income | 1.51B -0.6% |

| EPS | 6.87 +1.0% |

| Shares Out | n/a |

| PE Ratio | 9.93 |

| Forward PE | 9.34 |

| Dividend | 3.80 (4.04%) |

| Ex-Dividend Date | Dec 15, 2025 |

| Volume | 705 |

| Average Volume | 1,538 |

| Open | 94.86 |

| Previous Close | 94.38 |

| Day's Range | 92.98 - 96.12 |

| 52-Week Range | 77.92 - 117.94 |

| Beta | 1.54 |

| RSI | 38.83 |

| Earnings Date | Feb 4, 2026 |

About T. Rowe Price Group

T. Rowe Price Group, Inc. is a publicly owned investment manager. The firm provides its services to individuals, institutional investors, retirement plans, financial intermediaries, and institutions. It launches and manages equity and fixed income mutual funds. The firm invests in the public equity and fixed income markets across the globe. It employs fundamental and quantitative analysis with a bottom-up approach. The firm utilizes in-house and external research to make its investments. It employs socially responsible investing with a focus on... [Read more]

Financial Performance

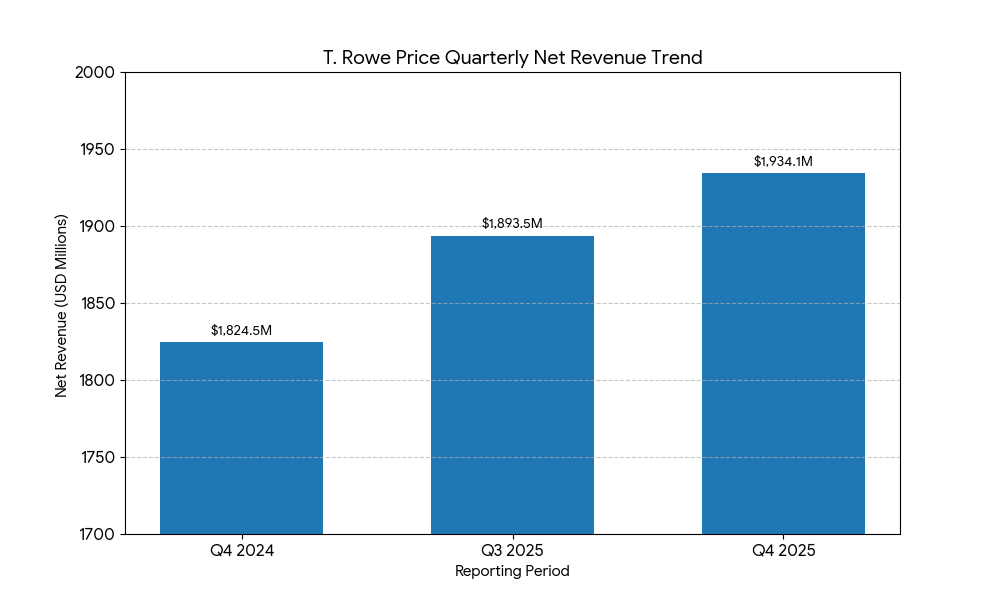

In 2025, T. Rowe Price Group's revenue was $7.31 billion, an increase of 3.12% compared to the previous year's $7.09 billion. Earnings were $2.04 billion, a decrease of -0.38%.

Financial numbers in USD Financial StatementsNews

Analyst Update: Morgan Stanley Adjusts Price Target for TROW | TROW Stock News

Analyst Update: Morgan Stanley Adjusts Price Target for TROW | TROW Stock News

T. ROWE PRICE SURVEY FINDS CHARITABLE GIVING PLANNING CAN STRENGTHEN ADVISOR AND CLIENT RELATIONSHIPS

Investors want more help from their advisors with charitable giving—and those who receive it report higher satisfaction, trust, and loyalty BALTIMORE, Feb. 10, 2026 /PRNewswire/ -- T. Rowe Price (NAS...

T. Rowe Price (TROW) Boosts Dividend Despite Earnings Miss

T. Rowe Price (TROW) Boosts Dividend Despite Earnings Miss

Best way to play AI race is digital semiconductor ecosystem: T. Rowe Price's Rizzo

CNBC’s “Closing Bell Overtime” team discusses how tech stocks are performing as AppLovin leads the S&P 500 and the AI trade continues with Dominic Rizzo of T. Rowe Price.

T. Rowe Price (TROW) Increases Quarterly Dividend for 40th Consecutive Year

T. Rowe Price (TROW) Increases Quarterly Dividend for 40th Consecutive Year

T. ROWE PRICE GROUP, INC., DECLARES QUARTERLY DIVIDEND

BALTIMORE, Feb. 9, 2026 /PRNewswire/ -- T. Rowe Price Group, Inc. (NASDAQ-GS: TROW), announced today that its Board of Directors has declared a quarterly dividend of $1.30 per share payable on March 3...

Systematic Value Fund Buys 7,054 Shares of T. Rowe Price Group Inc (TROW)

Systematic Value Fund Buys 7,054 Shares of T. Rowe Price Group Inc (TROW)

Stock Index Fund Sells 1,913 Shares of T. Rowe Price Group Inc (TROW)

Stock Index Fund Sells 1,913 Shares of T. Rowe Price Group Inc (TROW)

Private Wealth Partners, LLC Sells 3,100 Shares of T. Rowe Price Group Inc (TROW)

Private Wealth Partners, LLC Sells 3,100 Shares of T. Rowe Price Group Inc (TROW)

Checchi Capital Advisers, LLC Sells 2,044 Shares of T. Rowe Price Group Inc (TROW)

Checchi Capital Advisers, LLC Sells 2,044 Shares of T. Rowe Price Group Inc (TROW)

T. Rowe Price Group (TROW): JP Morgan Adjusts Price Target Lower | TROW Stock News

T. Rowe Price Group (TROW): JP Morgan Adjusts Price Target Lower | TROW Stock News

Analyst Lowers Price Target for T. Rowe Price Group (TROW), Maintains Hold Rating | TROW Stock News

Analyst Lowers Price Target for T. Rowe Price Group (TROW), Maintains Hold Rating | TROW Stock News

T. Rowe Price Group is Oversold

The DividendRank formula at Dividend Channel ranks a coverage universe of thousands of dividend stocks, according to a proprietary formula designed to identify those stocks that combine two important ...

T. Rowe Price Group Inc (TROW) Trading Down 0% on Feb 5

T. Rowe Price Group Inc (TROW) Trading Down 0% on Feb 5

Evercore ISI Group Lowers Price Target for T. Rowe Price Group (TROW) | TROW Stock News

Evercore ISI Group Lowers Price Target for T. Rowe Price Group (TROW) | TROW Stock News

T. Rowe Price: Goldman Sachs Partnership Helps This High-Yield Dividend Aristocrat

T. Rowe Price Group, Inc. is reiterated as a Strong Buy, supported by a pristine balance sheet, robust free cash flow, and a compelling >8% combined yield. TROW delivered record AUM of $1.78 trillion ...

Busey Bank Buys 2,000 Shares of T. Rowe Price Group Inc (TROW)

Busey Bank Buys 2,000 Shares of T. Rowe Price Group Inc (TROW)

T. Rowe Price Shares Decline Following Fourth-Quarter Earnings Miss

T. Rowe Price Group, Inc. (NASDAQ: TROW) saw its shares decline on Wednesday after reporting fourth-quarter 2025 financial results that fell short of analyst expectations. The stock was trading at $97...

T. Rowe Price Group Inc (TROW) Q4 2025 Earnings Call Highlights: Strong AUM Growth Amidst Net ...

T. Rowe Price Group Inc (TROW) Q4 2025 Earnings Call Highlights: Strong AUM Growth Amidst Net Outflows

Q4 2025 T Rowe Price Group Inc Earnings Call Transcript

Q4 2025 T Rowe Price Group Inc Earnings Call Transcript

T. Rowe Price Group Inc (TROW) Shares Down 5.87% on Feb 4

T. Rowe Price Group Inc (TROW) Shares Down 5.87% on Feb 4

T. Rowe Price (TROW) Achieves Over 10% Growth in AUM Despite Net Outflows

T. Rowe Price (TROW) Achieves Over 10% Growth in AUM Despite Net Outflows

T. Rowe Price Group, Inc. (TROW) Q4 2025 Earnings Call Transcript

T. Rowe Price Group, Inc.

T. Rowe Price (TROW) Misses Q4 2025 Earnings Expectations Amid Rising Outflows

T. Rowe Price (TROW) Misses Q4 2025 Earnings Expectations Amid Rising Outflows

T. Rowe (TROW) Q4 Earnings: How Key Metrics Compare to Wall Street Estimates

Although the revenue and EPS for T. Rowe (TROW) give a sense of how its business performed in the quarter ended December 2025, it might be worth considering how some key metrics compare with Wall Stre...