Compagnie Financière Tradition SA (LON:0QL7)

London · Delayed Price · Currency is GBP · Price in CHF

London · Delayed Price · Currency is GBP · Price in CHF | Market Cap | 2.01B +47.8% |

| Revenue (ttm) | 996.61M +8.7% |

| Net Income | 115.45M +21.7% |

| EPS | 14.36 +18.3% |

| Shares Out | n/a |

| PE Ratio | 17.43 |

| Forward PE | 15.82 |

| Dividend | 6.07 (2.17%) |

| Ex-Dividend Date | May 26, 2025 |

| Volume | 401 |

| Average Volume | 431 |

| Open | 274.00 |

| Previous Close | 279.52 |

| Day's Range | 268.00 - 277.00 |

| 52-Week Range | 185.00 - 313.00 |

| Beta | 0.14 |

| RSI | 36.82 |

| Earnings Date | Mar 20, 2026 |

About LON:0QL7

Compagnie Financière Tradition SA operates as an interdealer broker of financial and non-financial products worldwide. The company provides capital market products, including basis swaps, credit and currency derivatives, inflation products, Latin American derivatives, non-deliverable swaps, overnight index swaps, short dates, and Turkish fixed income and money market, as well as interest rate derivatives, options, and swaps. It offers energy and commodity products, such as coal, electricity, environmental products, natural gas, oil, precious me... [Read more]

Financial Performance

In 2024, LON:0QL7's revenue was 1.04 billion, an increase of 7.10% compared to the previous year's 974.71 million. Earnings were 115.60 million, an increase of 22.43%.

Financial numbers in CHF Financial StatementsNews

Richemont: One For The Investment Watchlist

Compagnie Financière Richemont SA (CFRUY) stock has surged, outperforming most peers, and reflecting the start of a luxury market recovery. Read the latest analysis on the stock here.

Compagnie Financière Richemont SA (CFRUY) Q2 2026 Earnings Call Transcript

Compagnie Financière Richemont SA 2026 Q2 - Results - Earnings Call Presentation

2025-11-14. The following slide deck was published by Compagnie Financière Richemont SA in conjunction with their 2026 Q2 earnings call.

Compagnie Financière Richemont SA GAAP EPS of Є3.05, revenue of Є10.62B

Compagnie Financière Tradition SA reports Q3 results

US Tariffs To Slow Down Swiss Economic Growth Further In 2026

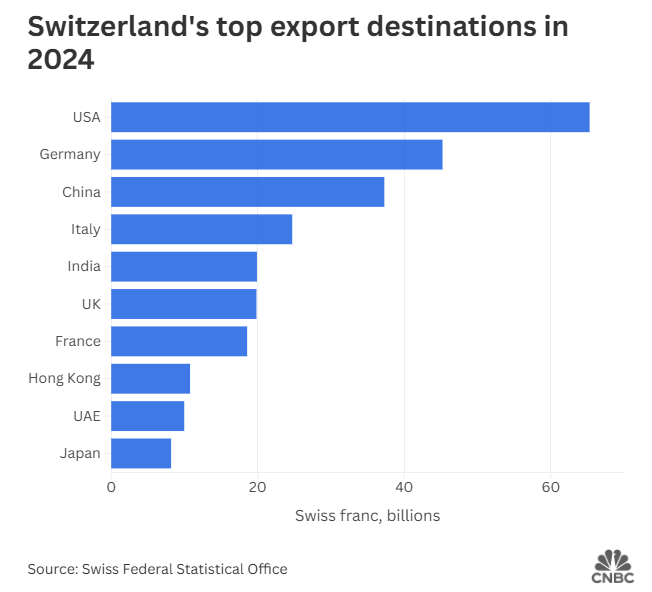

Swiss economic growth is expected to slow in 2026, following a "significantly below-average" performance this year, as higher US tariffs further cloud the country's outlook. The Swiss government proje...

Compagnie Financière Tradition SA reports 1H results

Compagnie Financière Richemont SA: No Catalyst To Drive A Near-Term Re-Rating

Richemont: Calmly Awaiting An Inflection Point

Compagnie Financière Richemont SA's focus on special-occasion luxury goods makes it more resilient than peers. Click here to find out why CFRHF stock is a Hold.

Compagnie Financière Richemont SA (CFRHF) Q4 2025 Earnings Call Transcript

Compagnie Financière Richemont SA (OTCPK:CFRHF) Q4 2025 Results Conference Call May 16, 2025 3:30 AM ETCompany ParticipantsAlessandra Girolami - Investor...

Compagnie Financière Tradition SA reports FY results

Compagnie Financière Tradition reports FY earnings per share of CHF 15.09 (+23.2%) & revenue growth of 11% to CHF 1,132.8M. Shares spike 9.4%.