Woodside Energy Group Ltd (WOPEF)

| Market Cap | 30.12B |

| Revenue (ttm) | 13.18B |

| Net Income (ttm) | 3.57B |

| Shares Out | n/a |

| EPS (ttm) | 1.87 |

| PE Ratio | 8.43 |

| Forward PE | 16.89 |

| Dividend | 1.22 (7.78%) |

| Ex-Dividend Date | Mar 6, 2025 |

| Volume | 100 |

| Average Volume | 48,732 |

| Open | 15.44 |

| Previous Close | 15.69 |

| Day's Range | 15.44 - 15.69 |

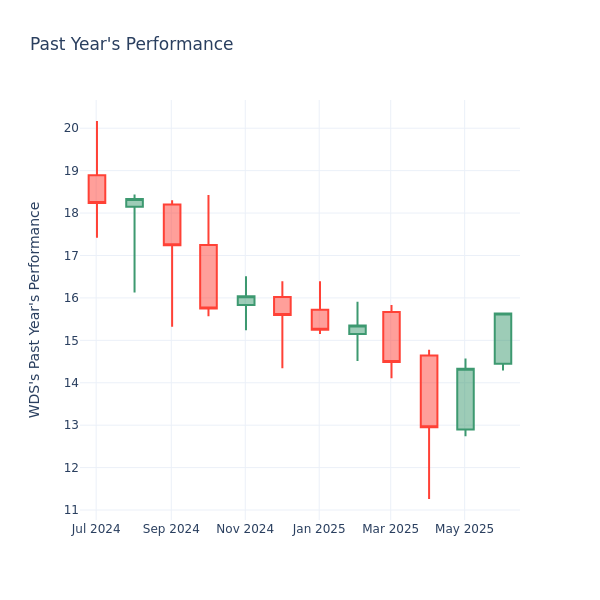

| 52-Week Range | 10.05 - 20.59 |

| Beta | 0.28 |

| RSI | 53.04 |

| Earnings Date | Jul 23, 2025 |

About Woodside Energy Group

Woodside Energy Group Ltd engages in the exploration, evaluation, development, production, marketing, and sale of hydrocarbons in the Asia Pacific, Africa, the Americas, and the Europe. The company produces liquefied natural gas, pipeline gas, crude oil and condensate, and natural gas liquids. It holds interests in the Pluto LNG, North West Shelf, Wheatstone and Julimar-Brunello, Bass Strait, Ngujima-Yin FPSO, Okha FPSO, Pyrenees FPSO, Macedon, Shenzi, Mad dog, Greater Angostura, as well as Scarborough, Sangomar, Trion, Calypso, Browse, Liard, ... [Read more]

Financial Performance

In 2024, Woodside Energy Group's revenue was $13.18 billion, a decrease of -5.82% compared to the previous year's $13.99 billion. Earnings were $3.57 billion, an increase of 115.24%.

Financial StatementsNews

Chevron hit by record pay claims as ‘same job’ laws hit oil and gas

The energy giant’s Gorgon LNG plant is facing “same job, same pay” claims upwards of $80,000 a year in a test case that could flow onto Shell, Woodside and Inpex.

Is selling off Santos to a foreign buyer in Australia’s national interest? First, define national interest | John Quiggin

The prospect of handing control of the energy company to overseas buyers has raised a series of concerns. But many of them are nebulous Amid the multifarious chaos of the past week, many of us might h...

ASX 200 LIVE UPDATES: ASX drops; CBA hits fresh record; Australian dollar at five-week low

ASX slides; Woodside to supply Japan with winter LNG; Adairs plunges; Good Guys penalised $13.7m; News Corp extends CEO’s contract by five years. Follow live.

Woodside Energy signs LNG supply deal with PETRONAS unit

Australia's Woodside energy on Wednesday said it has entered an agreement with a unit of Petroliam Nasional to supply of 1 million tonnes of liquefied natural gas annually to Malaysia starting in 2028...

Woodside Energy: The Jewel In The Calcasieu Parish

Environmentalists launch suit to quash North West Shelf approval

A rock art preservation group backed by the Holmes à Court family matriarch has launched a challenge to overturn WA approval of Woodside’s North West Shelf extension.

Energy giants Baker Hughes, Woodside shy away from making oil forecasts as Iran-Israel conflict escalates

"Never try and predict what the price of oil is going to be, because there's one sure thing: You're going to be wrong," says Baker Hughes CEO Lorenzo Simonelli.

'Closely' watching Israel-Iran to be able to help meet energy needs: Woodside CEO

Meg O'Neill, CEO of Woodside Energy, weighs in on the impact of the Israel-Iran conflict on energy prices and demand. She also adds that the Trump administrations efforts to reduce the trade deficit b...

Woodside accuses US government of ‘bad faith’ royalty grab

A lawsuit accuses department staff of sharing jokes on email about how they were going to make oil and gas companies pay more.

Oil prices rocket as Israel strikes unleash rally in energy stocks

Brent prices surged by the most since March 2022, rocketing shares in Woodside Energy 7 per cent higher amid fears of supply disruptions.

Woodside seeks more time on North West Shelf response

A deadline for the gas giant to respond to the government’s conditional approval of the mammoth North West Shelf gas facility is about to run out.

Monash staff say Woodside-backed climate conference highlights concerns about energy giant partnership

Senior lecturer says university staff and students have struggled to get answers from university leadership about arrangement Get our breaking news email , free app or daily news podcast Monash Univer...

A Look Into Woodside Energy Group Inc's Price Over Earnings

Looking into the current session, Woodside Energy Group Inc. (NYSE: WDS) shares are trading at $15.39, after a 1.18% increase. Moreover, over the past month, the stock went up by 9.41% , but in the p...

Woodside Energy files arbitration proceedings against Senegal

Australia's Woodside Energy , which operates Senegal's Sangomar oil and gas field, has filed a complaint with the World Bank's International Centre for Settlement of Investment Disputes, a filing seen...

Ballet Preljocaj’s Swan Lake review – dystopian twist sucks the breath out of you

QPAC, Brisbane; streaming online Property developers and industrial waste are the villains in this ‘Swan Lake for the ecocide era’, propelled by athletic choreography full of swagger Swan Lake isn’t o...

North West Shelf gas extension will deliver ‘almost nothing’ to Australia’s public purse

Experts say hugely profitable east coast LNG producers pay little in resources rent tax and Woodside project won’t help country’s energy shift Get our breaking news email , free app or daily news podc...

Why Labor could go all in on gas

The government’s sign-off on Woodside’s North West Shelf project is a signal it’s ready to take a more supportive approach to gas’ role in the energy transition.

Westpac shifts climate targets and eases path for more lending to gas

The bank, which lends to Woodside Energy, will change lending rules even as it demands better energy transition plan disclosures from borrowers.

Pocock says voters have ‘buyer’s remorse’ after Labor approves massive gas development’s 40-year extension

Fortescue CEO also says suggestion Australia can lock in fossil fuel projects and claim progress on net zero is ‘concerning’ Crossbenchers and environmental advocates are furious at the government’s d...

Woodside Energy Expands into U.S. LNG Market

Suppose you wanted to get into the LNG business in the U.S. to take advantage of the global low-cost of supply advantage held by America. So the desire and the rationale are there, but youd like to av...

Watt makes the only choice on Woodside

A new environment minister has finally granted a decades-long extension for operation of the vital North West Shelf project. But the fights over gas won’t stop.

North West Shelf approval is welcome dose of energy reality

The national conversation around gas has changed in the past year, Woodside boss Meg O’Neill says. Labor has listened – eventually.

Reunited Coalition reveals shadow cabinet; Labor approves contentious North West Shelf extension; and very expensive eggs

Want to get this in your inbox every weekday? Sign up for the Afternoon Update here , and start your day with our Morning Mail newsletter . Welcome, readers, to Afternoon Update. The Liberals and Nati...

Labor approves extension of Woodside’s contentious North West Shelf gas development

Murray Watt will approve the extension of one of the world’s biggest liquified natural gas projects from 2030 and 2070 Australia news live: latest politics updates Get our breaking news email , free a...

A major decision on a Woodside gas plant's future hinges on WA rock art – video

Unless something extraordinary happens, Labor's new environment minister, Murray Watt, looks set to extend the life of a huge Woodside gas plant in Western Australia. The decision hinges on the impact...