Micron Technology, Inc. (MU)

| Market Cap | 471.24B +353.7% |

| Revenue (ttm) | 42.31B +45.4% |

| Net Income | 11.91B +206.8% |

| EPS | 10.54 +204.5% |

| Shares Out | 1.13B |

| PE Ratio | 39.72 |

| Forward PE | 9.91 |

| Dividend | $0.46 (0.11%) |

| Ex-Dividend Date | Dec 29, 2025 |

| Volume | 30,189,826 |

| Open | 410.77 |

| Previous Close | 403.11 |

| Day's Range | 405.79 - 422.75 |

| 52-Week Range | 61.54 - 455.50 |

| Beta | 1.54 |

| Analysts | Strong Buy |

| Price Target | 359.45 (-14.15%) |

| Earnings Date | Mar 18, 2026 |

About MU

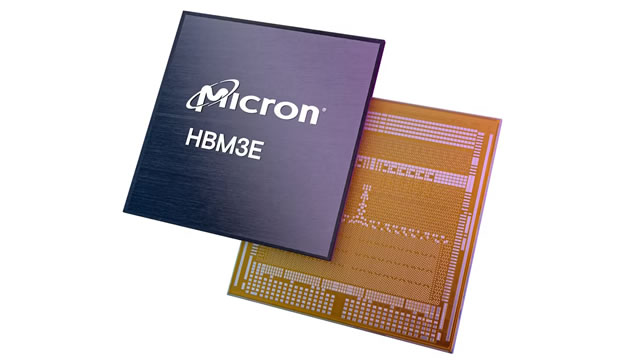

Micron Technology, Inc. designs, develops, manufactures, and sells memory and storage products in the United States, Taiwan, Japan, Mainland China, Hong Kong, Europe, and internationally. It operates through the Cloud Memory Business Unit; Core Data Center Business Unit; Mobile and Client Business Unit; and Automotive and Embedded Business Unit segments. The company provides memory products, including dynamic random access memory components and modules, CXL-based memory, LPDDR components and modules, graphics memory, high-bandwidth memory, and ... [Read more]

Financial Performance

In fiscal year 2025, Micron Technology's revenue was $37.38 billion, an increase of 48.85% compared to the previous year's $25.11 billion. Earnings were $8.54 billion, an increase of 997.56%.

Financial StatementsAnalyst Summary

According to 31 analysts, the average rating for MU stock is "Strong Buy." The 12-month stock price target is $359.45, which is a decrease of -14.15% from the latest price.

News

Micron Technology: HBM Sold Out For 2026, Wall Street Is Still Underpricing

Micron Technology, Inc. is rated Strong Buy, with a $500 price target, reflecting a structural shift from cyclical DRAM to AI-driven HBM dominance. MU's entire 2026 HBM production is sold out under bi...

The memory stock cycle of boom-bust-repeat is over, executives say

Memory stocks are soaring, and executives say that AI has upended the industry's old boom-bust cycle. Hyperscalers are more keen on signing long-term deals to lock in supply for years.

Why Micron stock is soaring nearly 5% today?

Micron stock (NASDAQ: MU) surged nearly 5% on Wednesday as investors digested a fresh round of analyst upgrades. The fresh rally came in the backdrop of the artificial intelligence sector pulling dema...

Micron: A Pound-The-Table Moment Ahead Of Q2

AI infrastructure is dramatically increasing memory intensity, with modern AI servers requiring multiple terabytes of DRAM and hundreds of gigabytes of HBM, a structural shift that is driving much str...

Buy Or Sell Micron Stock At $400?

Our multi-factor evaluation indicates that it might be prudent to lessen exposure to MU stock.

Micron stock soaring 6% today: should you buy before earnings?

Shares of Micron Technology climbed sharply at the start of the week as investors weighed bullish analyst commentary against reports of intensifying competition in the artificial intelligence memory m...

Micron Technology Will Hit Jackpot With This New Product

I doubled down on Micron in April 2025. That investment has generated ~460% returns in under a year. MU has recently started shipping samples of its new product, which I think will prove to be a catal...

Micron: Vera Rubin HBM4 Fears Mas A Bullish Earnings Setup

Micron Technology, Inc.'s HBM4 has allegedly been dropped from the supplier list for Nvidia's next-generation Vera Rubin accelerators based on Korean media outlet reports over the weekend (March 8). T...

Monday's Morning Movers: MU Price Target Hikes, ORCL Cuts & GEV Double Upgrade

GE Vernova's (GEV) double upgrade from Redburn to buy from sell offered a bright spot on a session that started lower. Other analysts also offered bullish views of Micron (MU) with price target hikes ...

Micron Continues Slide. Why Wall Street Likes the Stock Ahead of Earnings.

Analysts at Citi and Susquehanna boost their price targets for Micron stock.

Micron Is Likely To Beat Earnings Again And Rise (Preview)

Micron Technology, Inc. is set to report Q2 2026 earnings with high expectations for a double beat, supported by DRAM prices potentially surging 70% this quarter. AI-driven demand has exceeded global ...

Top Wall Street analysts are bullish on these 3 stocks despite ongoing volatility

TipRanks compiles some of the best stocks to own amid the current volatility, according to the Street's top analysts.

Micron stock falls as weakness hits global memory sector

Micron Technology shares fell on Friday as weakness in South Korean memory names weighed on sentiment and US investors awaited February jobs data. The moves come as US stocks remained in the red amid ...

Micron Bulls Are About To Meet Samsung's HBM4 Memory Chip (Rating Downgrade)

I am downgrading Micron Technology to hold ahead of the Q2 FY26 print. In my view, Samsung's HBM4 production ramp poses a downside catalyst that could pressure MU's market share and forward guidance e...

Micron's AI Supercycle Accelerates

Micron's HBM4 enters high-volume production in Q1-2026, earlier than expected, delivering speeds above 11Gb/s and strengthening hyperscaler demand. HBM3E memory offers roughly 30% lower power consumpt...

Is Micron Stock Primed For A Massive Breakout?

Micron Technology boasts a remarkable history of rapid price increases, with the stock rising over 50% in less than two months on multiple occasions, particularly in pivotal years such as 2013 and 202...

Paying Dividends: Steven Cress' 3 REITs For Inflationary, Heated Times

In a volatile, inflationary, and geopolitically tense market, Steven Cress talks barbell approach: strong dividend REITs and high-quality growth stocks on weakness. Getty (GTY), W.P.

Selling in the hottest semiconductor stocks was brutal, says Jim Cramer

'Mad Money' host Jim Cramer breaks down Tuesday's market action.

Micron and other memory stocks see outsized losses. What's behind the big moves?

Analysts don't see any negative shift in fundamentals for memory-chip stocks — and UBS offers a new highly upbeat earnings forecast for Micron specifically.

Micron: I'll Sell At $1000 (Or If This Happens)

Micron (MU) remains a top AI beneficiary, but everyone knows this now. So when do we sell Micron? I highlight three key scenarios. Based on valuation alone, $1000 seems to be in the cards for 2026.

Micron Sets New Benchmark With the World's First High-Capacity 256GB LPDRAM SOCAMM2 for Data Center Infrastructure

News highlights: 1/3 the power consumption and 1/3 smaller footprint versus standard RDIMMs — enabled by the industry's first monolithic 32Gb LPDDR5X die 2.3 times faster time to first token for long-...

2026 Memory Chip Bull Case: Why MU, SNDK & LRCX Will Rally

@MoneyFlowsCom's Lucas Downey says there's a lot "under the surface that has been working" outside the Mag 7. Among the stocks he sees continuing momentum: memory chips.

How Low Can Micron Stock Go?

Micron Technology (MU) stock has decreased by 5.3% over 21 trading days. This recent decline is driven by renewed worries about increasing HBM competition and the risks of cyclical oversupply.