Powell Industries, Inc. (POWL)

| Market Cap | 6.36B +151.6% |

| Revenue (ttm) | 1.11B +5.1% |

| Net Income | 187.37M +16.7% |

| EPS | 15.40 +16.9% |

| Shares Out | 12.14M |

| PE Ratio | 34.00 |

| Forward PE | 30.71 |

| Dividend | $1.08 (0.20%) |

| Ex-Dividend Date | Feb 18, 2026 |

| Volume | 193,536 |

| Open | 517.94 |

| Previous Close | 530.88 |

| Day's Range | 507.00 - 529.99 |

| 52-Week Range | 146.02 - 612.50 |

| Beta | 0.85 |

| Analysts | Buy |

| Price Target | 415.50 (-20.65%) |

| Earnings Date | Feb 3, 2026 |

About POWL

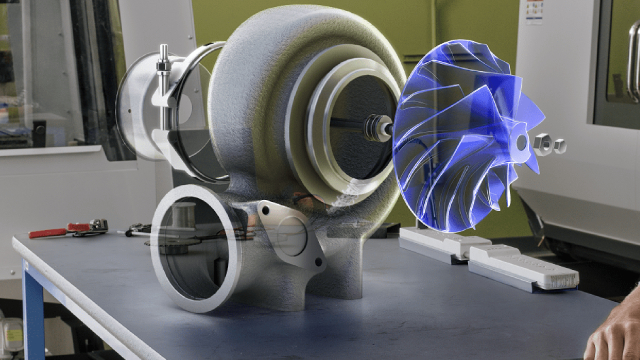

Powell Industries, Inc., together with its subsidiaries, designs, develops, manufactures, sells, and services custom-engineered equipment and systems. The company’s products portfolio includes integrated power control room substations, custom-engineered modules, and electrical houses; and traditional and arc-resistant distribution switchgears and control gears, medium-voltage circuit breakers, monitoring and control communications systems, motor control centers, switches, and bus duct systems. It also provides field service inspection, installa... [Read more]

Financial Performance

In fiscal year 2025, Powell Industries's revenue was $1.10 billion, an increase of 9.08% compared to the previous year's $1.01 billion. Earnings were $180.75 million, an increase of 20.62%.

Financial StatementsAnalyst Summary

According to 2 analysts, the average rating for POWL stock is "Buy." The 12-month stock price target is $415.5, which is a decrease of -20.65% from the latest price.

News

Powell Industries, Inc. (POWL) Q1 2026 Earnings Call Transcript

Powell Industries, Inc. (POWL) Q1 2026 Earnings Call Transcript

Powell Industries Announces First Quarter Fiscal 2026 Results

HOUSTON, Feb. 03, 2026 (GLOBE NEWSWIRE) -- Powell Industries, Inc. (NASDAQ: POWL), a leading supplier of custom-engineered solutions for the management, control and distribution of electrical energy, ...

Powell Industries Declares an Increase to the Quarterly Cash Dividend

HOUSTON, Feb. 03, 2026 (GLOBE NEWSWIRE) -- Powell Industries, Inc. (NASDAQ: POWL), a leading supplier of custom engineered solutions for the management, control and distribution of electrical energy, ...

Powell Industries: Profitability And Growth Justify The Premium - Still Bullish

Powell Industries: Profitability And Growth Justify The Premium - Still Bullish

Powell Industries: A Focus On Controlling Costs Helps Propel Growth

Powell Industries has delivered robust top and bottom-line growth since 2021, driven in part by systemic productivity improvements and strong execution. POWL's cost of revenue and SG&A as a percentage...

Powell Industries Announces Date and Conference Call for Fiscal 2026 First Quarter Results

HOUSTON, Jan. 20, 2026 (GLOBE NEWSWIRE) -- Powell Industries, Inc. (NASDAQ: POWL), a leading supplier of custom engineered solutions for the management, control and distribution of electrical energy, ...

Powell Industries: Record Margins And Strong Backlog Set Up A Solid FY2026

Powell Industries (POWL) delivered record FY2025 results, with revenue up 9% to $1.1B and EPS up 21% to $14.86. Growth slowed, but gross margin expanded to 29.4% for the year and 31.4% in Q4, driven b...

Powell Industries' Selloff Is Finally Here - Upgrade To Buy

POWL's much needed selloff is finally here, thanks to the deflating AI exuberance and the market's over reaction to the decelerating growth profile. I am of the opinion that the meltdown has triggered...

Powell Industries, Inc. (POWL) Q4 2025 Earnings Call Transcript

Powell Industries, Inc. ( POWL) Q4 2025 Earnings Call November 19, 2025 11:00 AM EST Company Participants Brett Cope - Chairman of the Board, President & CEO Michael Metcalf - Executive VP, CFO, Secr...

Powell Industries' Growth Slowed In 2025; Here's Why It May Pick Up Again In 2026

Powell Industries delivered another earnings beat, driven by improved margins despite slower revenue growth, and maintains a solid balance sheet. POWL's Electric Utility and Light Rail Power segments ...

Powell Industries Announces Fourth Quarter and Full Year Fiscal 2025 Results

HOUSTON, Nov. 18, 2025 (GLOBE NEWSWIRE) -- Powell Industries, Inc. (NASDAQ: POWL), a leading supplier of custom-engineered solutions for the management, control and distribution of electrical energy, ...

Powell Industries: Buy Before Another Strong Earnings

Powell Industries is rated a buy, with the recent price correction offering an attractive entry point ahead of FY 2025 Q4 results. POWL's strong backlog, robust demand in oil & gas and electric utilit...

Can POWL Stock Jump Once Again?

After a powerful run earlier this year, investors may be wondering whether Powell Industries (POWL) can climb higher. The company has been one of the standout performers in the industrial space, benef...

Carillon Eagle Small Cap Growth Fund Q3 2025 Portfolio Update

Small-cap stocks extended their momentum into the third quarter. We believe Rambus' evolution from a licensing and patent company into a full-fledged product company is progressing well. Shake Shack s...

Polen U.S. Small Cap Growth Q3 2025 Portfolio Performance And Attribution

During the third quarter of 2025, the U.S. Small Cap Growth Composite Portfolio returned 21.4% gross and 21.1% net of fees. Bloom Energy is a provider of solid oxide fuel cells that play a critical ro...

Powell Industries Announces Date and Conference Call for Fiscal 2025 Fourth Quarter and Full Year Results

HOUSTON, Nov. 04, 2025 (GLOBE NEWSWIRE) -- Powell Industries, Inc. (NASDAQ: POWL), a leading supplier of custom engineered solutions for the management, control and distribution of electrical energy, ...

Four Growth Stocks Powering The Fourth Industrial Revolution In 2025

I review four growth stocks—Argan, Inc., Power Solutions International, Inc., Powell Industries, Inc., and Sterling Infrastructure, Inc.—benefiting from the Fourth Industrial Revolution. STRL and PSIX...

Top 2 Industrials Stocks That May Collapse This Quarter

As of Oct. 17, 2025, two stocks in the industrials sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

Powell Industries: From Backlog Boom To Growth Bust

Powell Industries (POWL) is rated 'Hold' due to slowing backlog growth and a plateau in new orders after a significant multi-year rally. POWL's recent revenue and EPS growth benefited from temporary t...

Powell Industries: Order Momentum And Backlog Strength Outweigh Top Line Noise

Powell Industries reported Q3'25 revenue of $286.3 million, nearly flat year-over-year due to softness in key end markets. Healthy activity across utilities, commercial, and industrial markets, suppor...

Powell Industries Announces $12.4 Million Investment to Expand Production Capacity

Expansion of Jacintoport facility to support expectations of increased Oil & Gas order activity driven by LNG Expansion of Jacintoport facility to support expectations of increased Oil & Gas order act...

Powell Industries: New All-Time Highs Are Likely On The Horizon

I reiterate my 'buy' rating on Powell Industries, raising my price target to $381, reflecting a 50% upside potential from current levels. Despite a revenue miss, Electric Utility and Commercial segmen...

Powell Industries: Limited Upside As Growth Fizzles

POWL has had an amazing run, thanks to the robust historical top-line growth and the ongoing profit margin expansion, thanks to the strategic made-in-US offerings. The same has been observed in the gr...

Powell Industries: Strong Recent Results Reinforce Buy Rating

Powell Industries demonstrates robust growth together with solid financial performance and achieves a stock gain of approximately 900% during the last five years while showing potential for a +30% inc...

Powell Industries, Inc. (POWL) Q3 2025 Earnings Call Transcript

Powell Industries, Inc. (NASDAQ:POWL) Q3 2025 Earnings Conference Call August 6, 2025 11:00 AM ET Company Participants Brett A. Cope - Chairman of the Board, President & CEO Michael W.