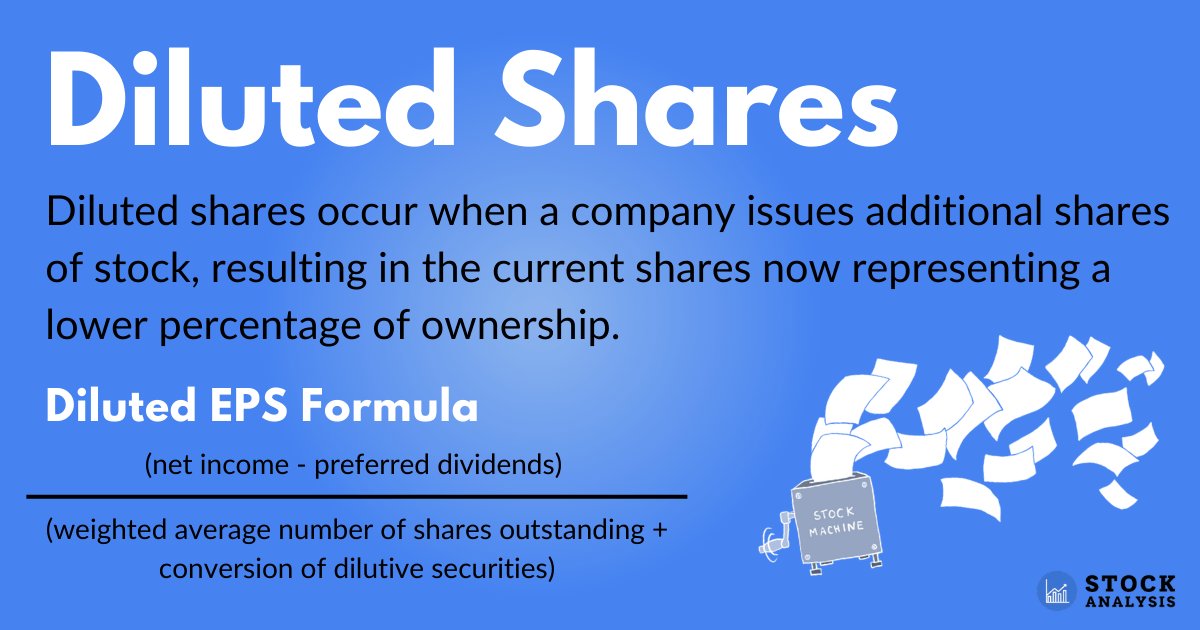

Diluted Shares

Diluted shares occur when a company issues additional shares of stock, resulting in the current shares now representing a lower percentage of ownership.

It can happen for several reasons, including additional stock offerings, conversions of optionable securities, or the issuance of employee stock options.

Dilution is an important risk for shareholders to consider and is often considered in a negative light, though it can also be a positive sign for the company.

Below is an overview of diluted shares including what they are, how to calculate diluted earnings per share (EPS), and what risks investors should consider.

What are diluted shares?

Diluted shares are those whose value has been reduced, or diluted. They occur when a company issues new shares in addition to those that already exist.

Since the ownership of the company is now divided into more shares, each one is worth a smaller portion of the overall company.

Dilution occurs in a few different cases where new shares are created, such as:

- The addition or sale of convertible securities

- More employee stock options are issued

- Secondary share issuance, such as to raise capital

- Optionable security conversions

- During an acquisition, if employees of the new company are offered equity

Share dilution affects the value of an investor's shareholding, so it's important to understand whether it's likely to occur and what it means for a company's profitability prospects — that is, if it's likely to adequately increase following the diluting event.

For investors, share dilution is considered a risk, though it can also be one that pays off in the long run.

To calculate this risk, you can compare earnings per share (EPS), which is used to calculate a company's profitability, to diluted EPS, which calculates earnings with dilutions factored in.

Diluted EPS accounts for currently issued convertible securities, employee stock options, and warrants.

SummaryDiluted shares occur after a company issues more shares, thus diluting the ownership stake the current shares represent. For investors dilution is a risk, though it can be one with reward.

Share dilution example

To see how share dilution plays out, it can be helpful to walk through an example.

Let's say a car manufacturer has 100 shareholders who each hold one share. Each shareholder is then entitled to 1% of the earnings the company distributes to shareholders.

And, if the shares were accompanied by voting rights, then each shareholder would have 1% control of how the company is run.

Now the company has decided to build a new car plant because it's seeing strong demand. To fund this venture, it issues another 100 shares.

There are now 200 shares, each with 0.5% rights to future earnings paid to shareholders. Voting rights are also diminished by half.

Share dilution could also happen if some convertible securities were actioned, such as employee stock options or convertible bonds. In this case, the new shares would be issued because of a previous commitment the company made.

SummaryWhen a company issues more stock or more stock is generated via convertible action, the current shareholders' stake becomes diluted.

Why do shares get diluted?

Companies can be faced with a choice between equity and debt when they need funding.

They may choose the equity option because it could be cheaper, they are not likely to be extended any further credit, or for other reasons.

Optional securities are issued to employees

Optional securities are often offered as part of a reward package for employees or directors.

This means the company may be able to offer less in salary and it also helps incentivize employees to increase share value through their contribution to the company's profits.

Optional securities may not be exercised for some time after they're issued, so investors need to know if they exist and how much they could impact shareholders in terms of value and voting rights.

Sometimes, optional securities may not be exercised at all, if, for example, the option exercise price is higher than the current market value.

However, investors should still consider the possibility that they could be.

Shares are issued to cover liabilities or growth

Companies may also issue more shares to provide capital for outstanding liabilities or growth.

Investors should be sure to get a clear picture of why the company needs this extra capital, so they can understand if the share dilution is likely to be of value to them.

Often, when secondary issues are being used to fund growth, there is a good chance that EPS will improve enough or more than enough to compensate for the extra shares it has to be split between. In this instance, the new issue will be good for current shareholders.

Of course, the opposite could end up being the case too.

Shares are issued during an acquisition

Finally, companies may issue more shares in exchange for acquisitions or services.

Once again, investors must consider whether the company is likely to be able to adequately increase its profitability by this decision — that is, whether the dilution will eventually produce more profit for their diminished portion of ownership.

These are not definitive answers, but value judgments.

SummaryShare dilution can occur because optional securities have been converted, the company needed to raise additional capital, or the company has exchanged shares for acquisitions or services.

Diluted EPS: formula and example calculation

Diluted earnings per share (EPS) is calculated to show what the EPS would be if all the possible dilutions were taken into account.

Here is the formula:

Diluted EPS = (net income - preferred dividends) / (weighted average number of shares outstanding + conversion of any in-the-money options, warrants, and other dilutive securities)

Diluted EPS takes account of any equity warrants, executive stock options, or convertible bonds being actioned, as well as secondary issues.

However, it's important to note that EPS is calculated net of the cash that is paid to preferred shareholders — that is, preferred shareholders are taken out of the equation.

Example calculation

Consider a company with the following numbers:

| Net income | $120M |

| Preferred dividends | $20M |

| Weighted av. number of shares outstanding | 800,000 |

| Conversions | 200,000 |

The conversions came about through a small secondary issue plus some employee options being actioned.

Diluted EPS can then be calculated like so:

($120 - $20 ) / (0.8 + 0.2) = $100M

For comparison, the EPS before dilution would be $125M.

From a shareholders' perspective, this is a significant reduction in profitability.

A shareholder would then need to determine if the employee incentive plus the use of the additional capital is likely to adequately boost future earnings enough to compensate for the current earnings being distributed to more shareholders.

SummaryInvestors can calculate diluted EPS to understand the impact dilution may have on future earnings. You can use this to decide whether or not the diluting event is likely to bolster future earnings enough to make up for the share dilution.

Are share dilutions good for investors?

When companies issue diluted shares, the portion of the company represented by each existing share is reduced.

This is obviously not ideal for shareholders when it comes to maximizing their return on investment since they will now have to share profits with more shareholders.

However, it's important to dig more into why a company is issuing new shares. It can often be for a positive reason that's likely to increase future profits.

For example, it may be because the company is expanding its operations and needs funds to do so. It could also be because the company wants to buy out a competitor, or even bring a new product to market.

The success of these activities is not guaranteed, but the company is prepared to take a risk because it believes the new venture will ultimately increase profits.

As a current shareholder, you have bought into the future of the company and are looking to grow its profits. So these activities can often be seen as positive developments.

However, it is important to understand the details of the dilution so that you can quantify how much of your portion of the company you will lose versus what you will gain from the company's investment using the extra capital.

Additionally, if the company decided to fund growth through debt, it could be a more expensive option in the long run. It could also mean the company may be weakened financially or be more vulnerable to takeover or collapse.

SummaryShare dilutions are a risk for investors, though they are one that may pay off later on. Overall, shareholders need to be aware of how dilutions could happen and how they would affect the value of the shareholding.

Frequently asked questions

Below are a few more things to know about diluted shares.

What do companies tell you about diluted shares?

Companies usually provide a variety of numbers around EPS and diluted EPS.

They may not always tell you about potential secondary issues, so it is important to consider whether these are likely.

Securities that could be exercised to dilute shares include executive stock options, employee stock options, convertible preferred stock, rights, equity warrants, and convertible bonds.

It is important to read the notes on what has been included or excluded in these calculations.

What signs should shareholders look out for regarding dilutions?

Shareholders need to be looking out for any emerging capital needs or growth opportunities.

Furthermore, if a company is granting employees a large amount of optional securities, then these are likely to be actioned at some point in the future and need to be considered in the evaluation.

How does dilution affect shareholder voting rights?

When diluted shares are issued, current shareholders' rights to vote are also diluted, since there will be more people with that right in the future.

This may or may not be that relevant for some investors, since they may not have a strong opinion on how the company should be run, preferring to leave this up to the company itself.

The takeaway

Current shares are diluted when more shares enter the overall pool.

Share dilutions occur for a number of reasons, including optional securities being actioned, capital requirements increasing, or in exchange for acquisitions or products.

The result of a share dilution is that current shareholders become entitled to a lower portion of the rights they previously held, both in terms of profits and voting.

However, in the long run, the shareholder may benefit from increased profitability if the company uses the extra funds wisely.

To weigh this risk, shareholders can calculate diluted EPS versus EPS to help them decide whether they think the company's future prospects are still a good investment.