The 7 Best Brokerage Accounts in 2026

Choosing a brokerage account isn't as simple as it used to be.

The good news is that commissions have dropped to zero, and nearly every platform gives you access to stocks, ETFs, options, and retirement accounts. The bad news? They all kind of blur together.

Some are better for long-term investors, others cater to active traders. A few are built for beginners, while some offer advanced features you won't find anywhere else.

Whatever you're looking for, we've got something for you.

Here's our list of the top seven online brokerages worth considering in 2026.

Summary of the best brokerage accounts

| Rating | Built for | Fees* | |

| Public | Long-term investing |

|

|

| Fidelity | Long-term investing |

|

|

| thinkorswim | Trading |

|

|

| Interactive Brokers | Trading |

|

|

| Robinhood | Long-term investing & Trading |

|

|

| Charles Schwab | Long-term investing |

|

|

| Moomoo | Trading |

|

*Fees on U.S. stock, ETF, and options trades.

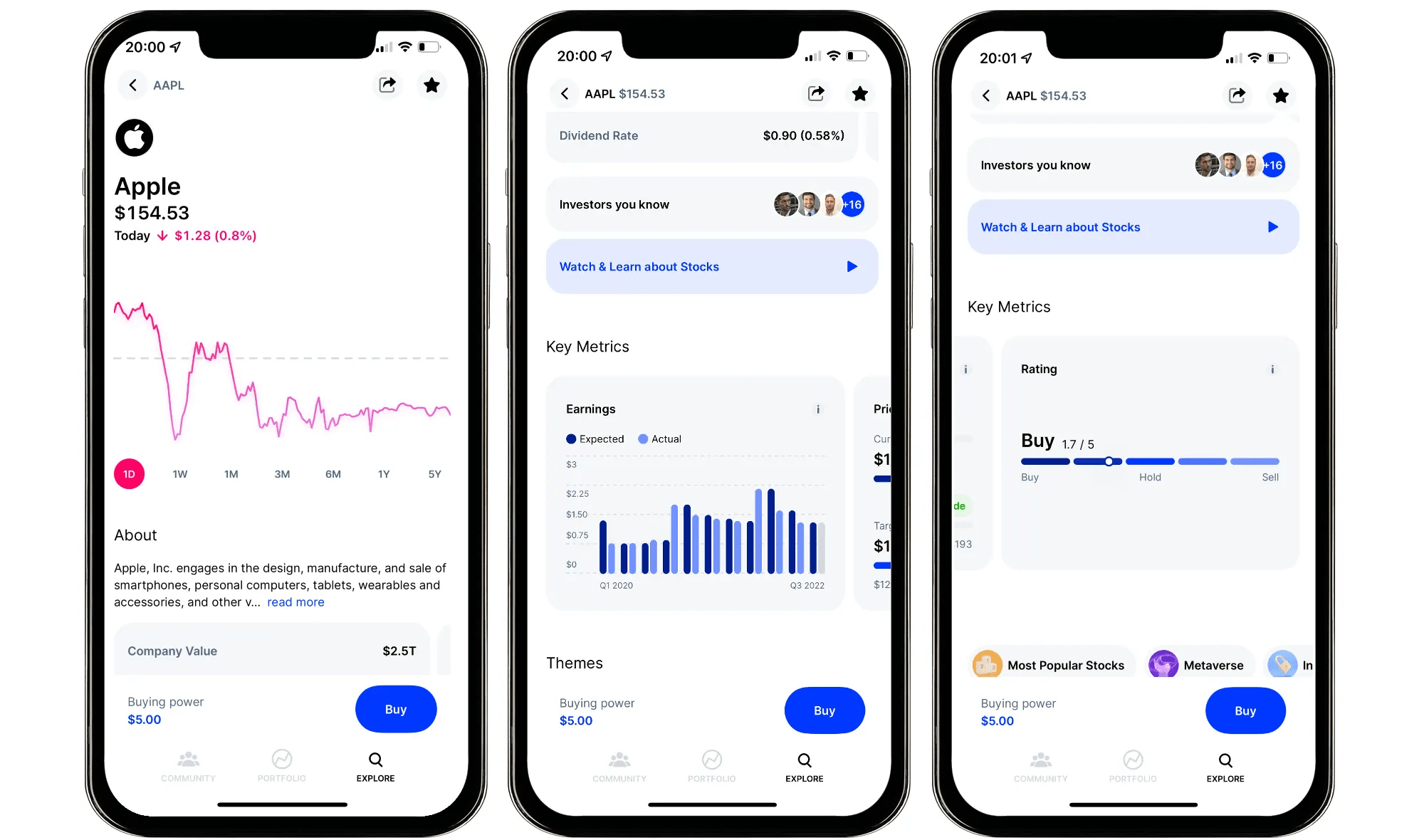

1. Best for new, long-term investors: Public

- Our rating:

- Assets: Stocks, ETFs, options, fixed income, and cryptocurrencies

- Fees: $0 per trade for stocks, ETFs, and options

If you're new to investing, Public delivers the right mix of simplicity and substance. It's clean, intuitive web and mobile apps make building your portfolio easy.

You get commission-free trades on stocks, ETFs, and options. There are no account minimums, and you can buy fractional shares.

Public also offers access to corporate bonds and Treasury bills — a rare feature for brokerages that aren't 20+ years old — plus a high-yield cash account that earns 3.3% interest.

You can open a standard brokerage account or invest through a traditional or Roth IRA.

For most investors in the 18–45 range, Public offers everything you need with no added complexity. That balance of simplicity and flexibility is what earns it the top spot on our list.

For more information, check out our full Public Review.

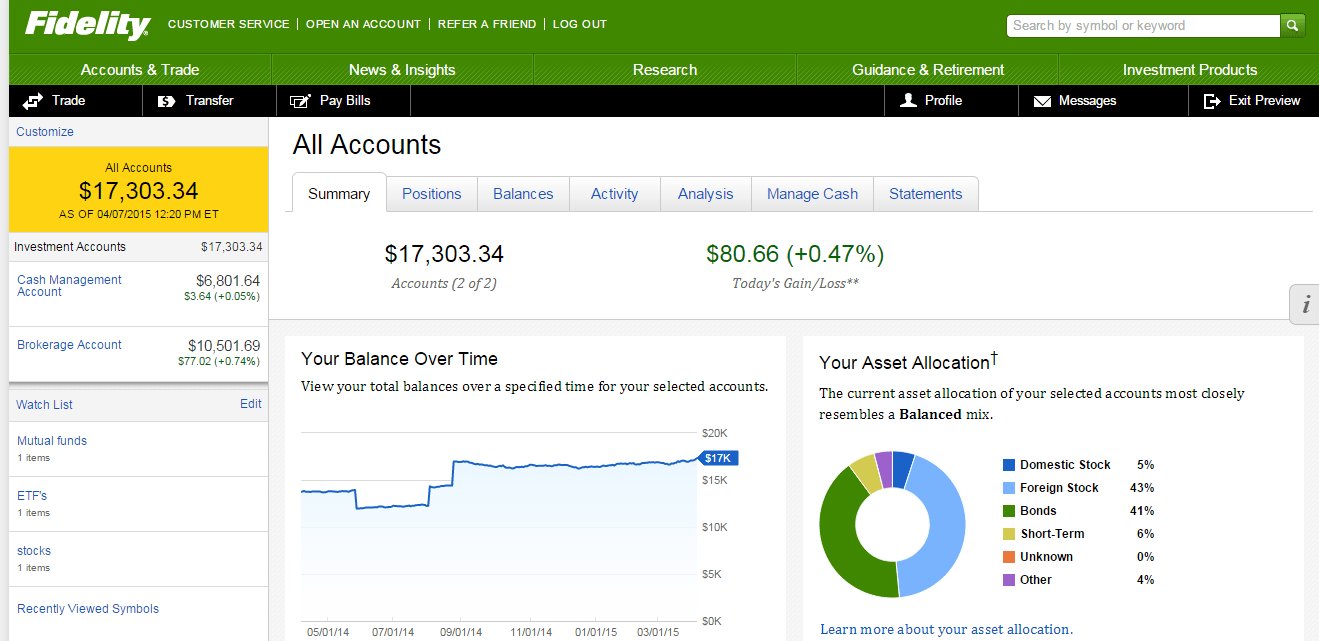

2. Runner-up for long-term investing: Fidelity

- Our rating:

- Assets: Stocks, ETFs, options, mutual funds, fixed income, cryptocurrencies, and more

- Fees: $0 per trade for stocks and ETFs, $0.65 per options contract

Generally speaking, there are two types of online brokerages: the legacy firms with decades of experience, retirement planning tools, and every account type imaginable, and the newer platforms built for simplicity, speed, and low costs.

In my opinion, Fidelity offers the best of both worlds.

Founded in 1946, Fidelity is one of the largest and most trusted brokerages in the world, with more than 50 million investors and over $15 trillion in assets. That kind of scale doesn't happen by accident.

You can invest in thousands of assets across global markets. Fidelity supports individual and joint brokerage accounts, traditional and Roth IRAs, HSAs, 401(k)s, and more.

The added flexibility comes with a bit more complexity, but the platform is still intuitive once you get used to it.

If you're looking for a legacy broker, you can't go wrong with Fidelity.

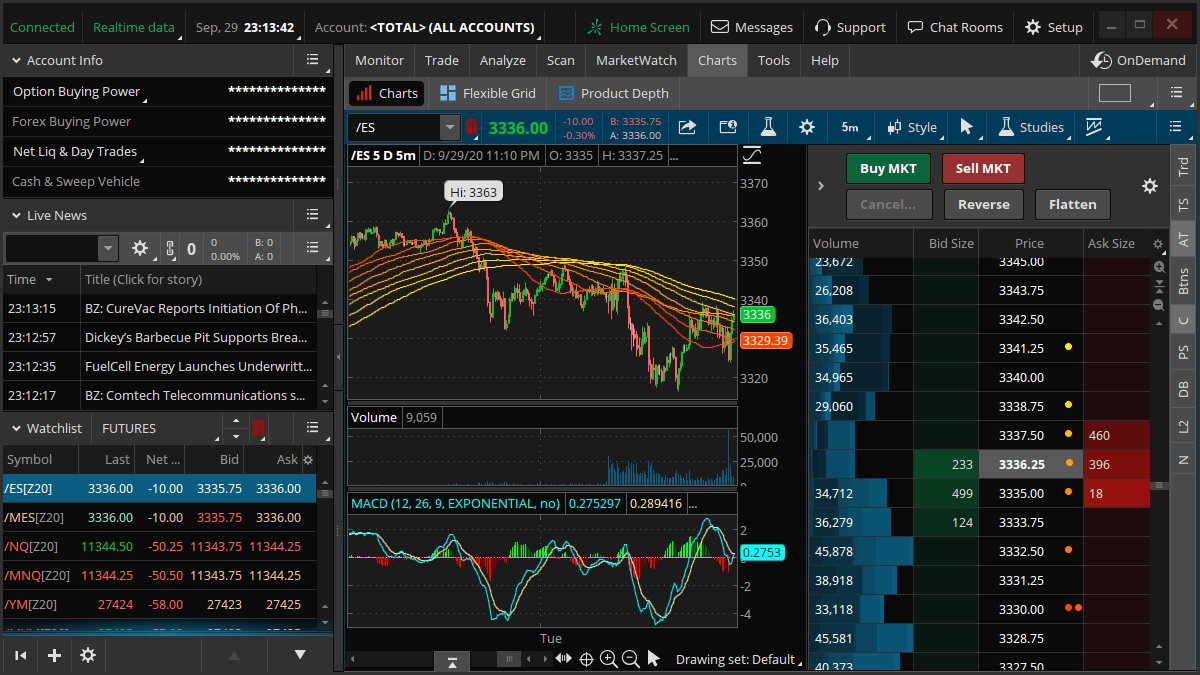

3. Best overall for trading: thinkorswim

- Our rating:

- Assets: Stocks, ETFs, options, mutual funds, futures, and forex

- Fees: $0 per trade for stocks and ETFs, $0.65 per options contract

If you're interested in day trading or swing trading, thinkorswim is my top pick. It's one of the most robust trading platforms available to individual investors, packed with tools for technical analysis, strategy testing, and real-time data.

The platform is available on desktop and mobile, and includes powerful features like paper trading, custom indicators, chart drawing tools, and multi-leg options trading.

You can also backtest your strategies using historical market data, so you can fine-tune your approach before putting real money on the line.

thinkorswim also offers built-in educational resources, including trading courses, video tutorials, and walkthroughs of specific trading strategies. It also has some of the best tools for analyzing options trades.

It may feel overwhelming at first, but once you get the hang of it, thinkorswim is an extremely capable and trader-friendly platform that's hard to outgrow.

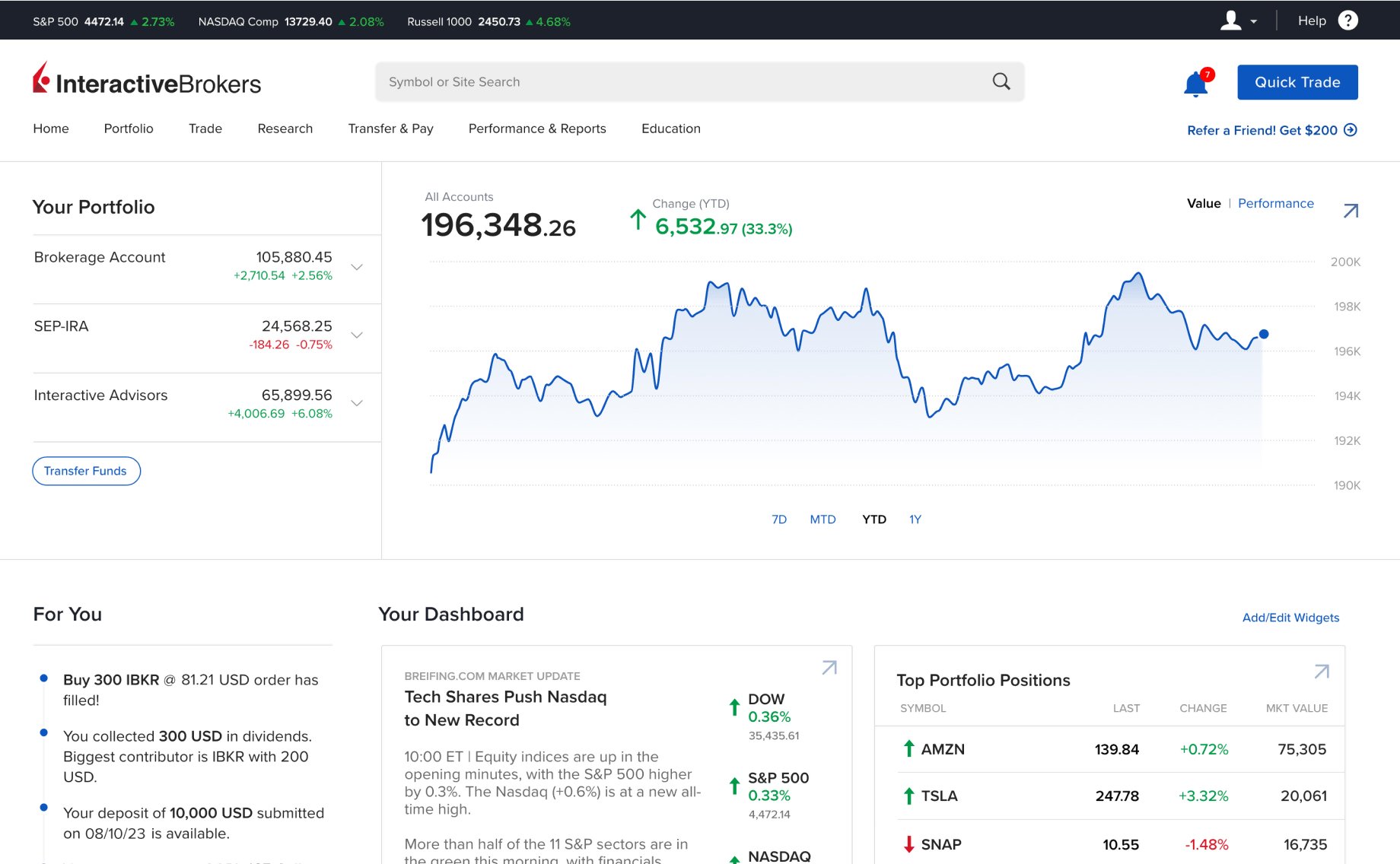

4. Best for advanced traders: Interactive Brokers

- Our rating:

- Assets: Stocks, ETFs, options, mutual funds, futures, currencies, bonds, funds, commodities, cryptocurrencies, and structured products

- Fees: $0 per trade for stocks and ETFs, $0.65 per options contract

If you're an advanced trader who needs enhanced research capabilities and access to international trading or more sophisticated products, you may prefer Interactive Brokers over thinkorswim.

IBKR has clients in over 200 countries and territories who can trade stocks, options, futures, currencies, bonds, funds, and more on 150 global markets. It also has hundreds of order types, advanced charting tools, real-time news, and more.

Also, for algorithmic traders, IBKR offers a suite of pre-built algorithms and a complete list of API languages. All of these tools are also available in its paper trading environment.

Clearly, IBKR is not for just anybody.

This is a serious trading platform built for serious traders. If you don't know whether or not you need IBKR's capabilities, you probably don't.

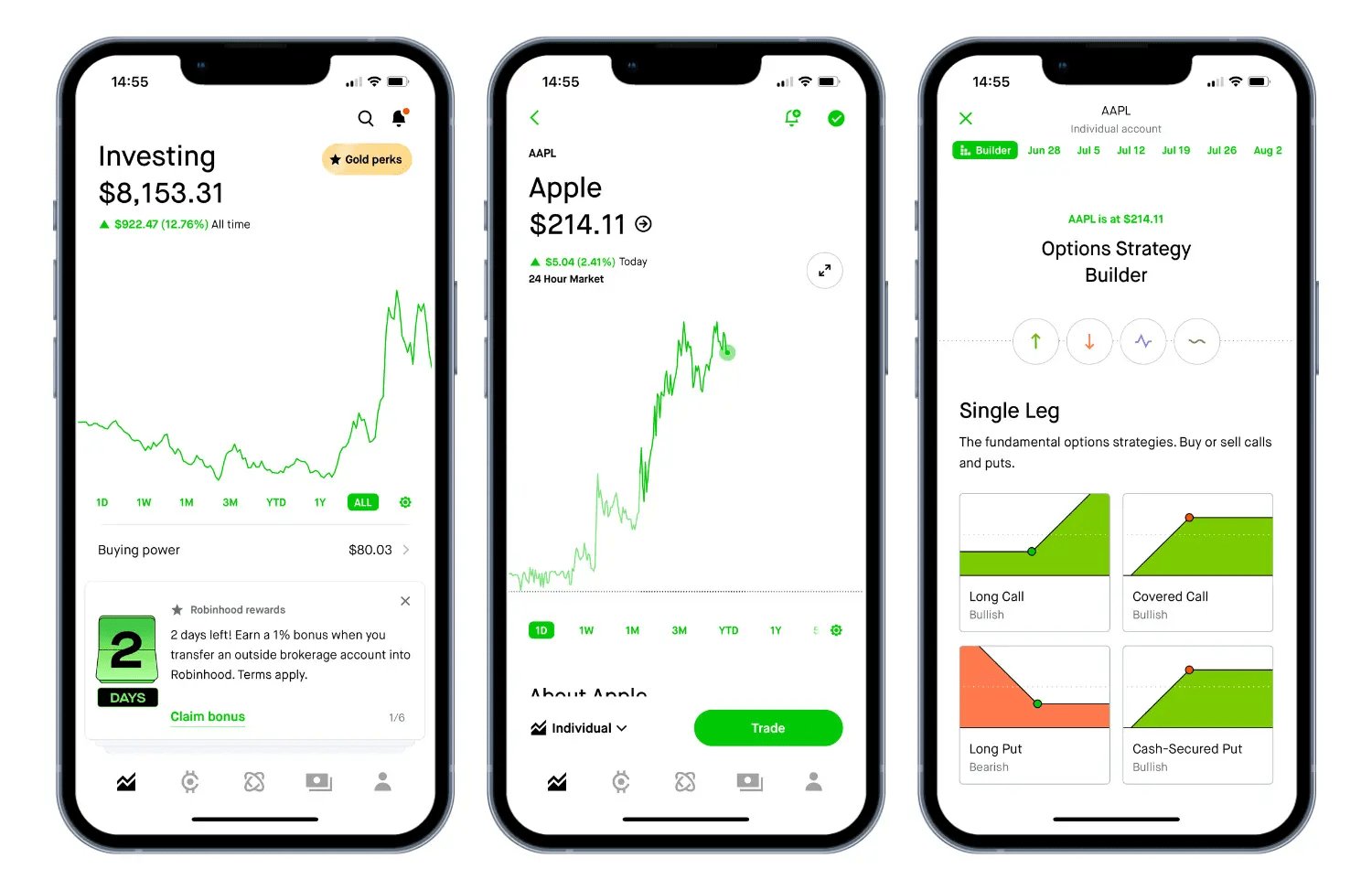

5. Best for young investors: Robinhood

- Our rating:

- Assets: Stocks, ETFs, options, and cryptocurrencies

- Fees: $0 per trade for stocks, ETFs, and options

Robinhood is still the easiest place for new investors to open a brokerage account and start buying stocks — especially if you're doing it from your phone.

While there's a web version, Robinhood is best known for its sleek, intuitive mobile app. The design is clean, the navigation is simple, and the onboarding process is fast.

That mobile-first approach is a big reason why it remains popular among younger investors.

You can invest in over 5,000 U.S. stocks and ETFs, along with more than 20 cryptocurrencies like Bitcoin, Ethereum, and Solana. Robinhood also supports options trading and lets you buy fractional shares with as little as $1.

It also has a few new features, including a 1% IRA match, a high-yield cash account (currently paying 5.00% APY with Robinhood Gold), and the ability to set up automatic investing schedules for recurring contributions.

New users can even claim a free share — worth between $5 and $200 — just for opening an account.

Robinhood isn't the most advanced platform, but for simplicity, speed, and ease of use, it's tough to beat.

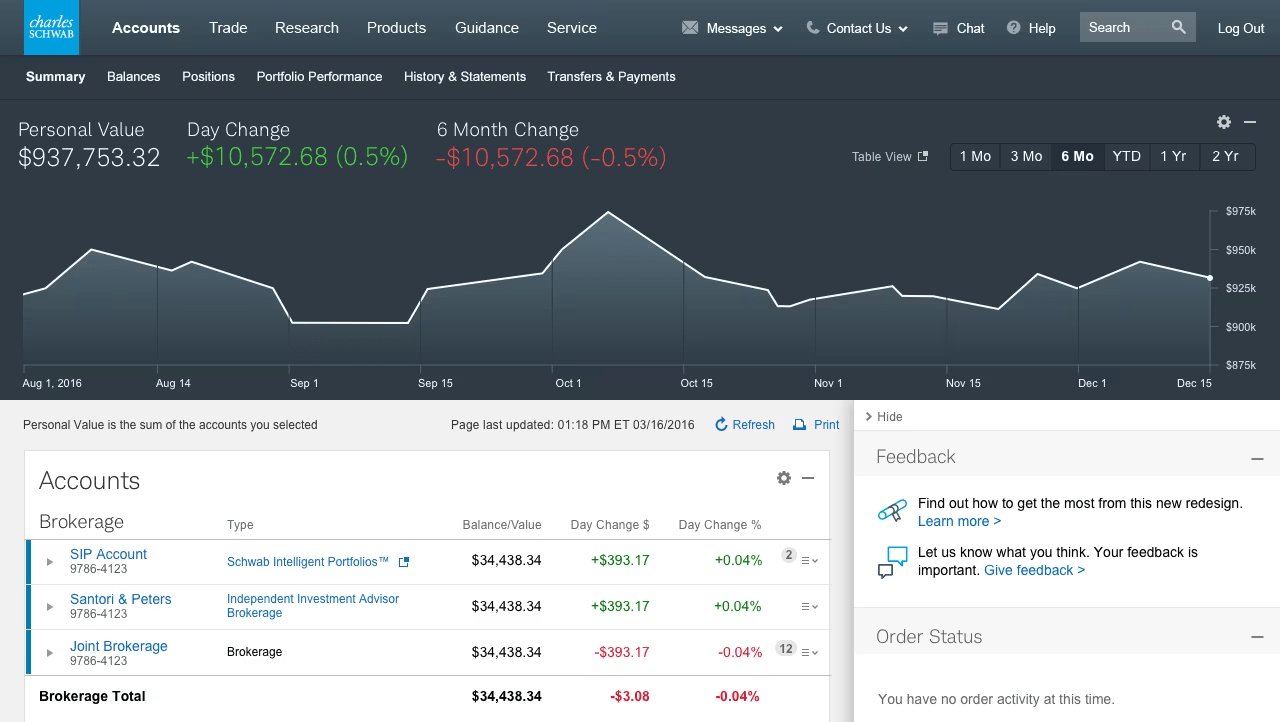

6. Best for retirees: Charles Schwab

- Our rating:

- Assets: Stocks, ETFs, options, mutual funds, fixed income, cryptocurrencies, and more

- Fees: $0 per trade for stocks and ETFs, $0.65 per options contract

Like Fidelity, Charles Schwab is a long-established brokerage that offers just about everything — taxable accounts, IRAs, 401(k)s, custodial accounts, HSAs, and access to global markets.

There are a couple of reasons you might choose Schwab over Fidelity.

First, some investors simply prefer Schwab's interface and platform design (personally, I prefer Fidelity's).

Second, Schwab is known for its deep suite of retirement planning tools. Its tools for goal tracking, income projection, and portfolio allocation are among the best in the industry.

Fidelity is strong here, too, but Schwab gets the slight edge if retirement is your primary focus.

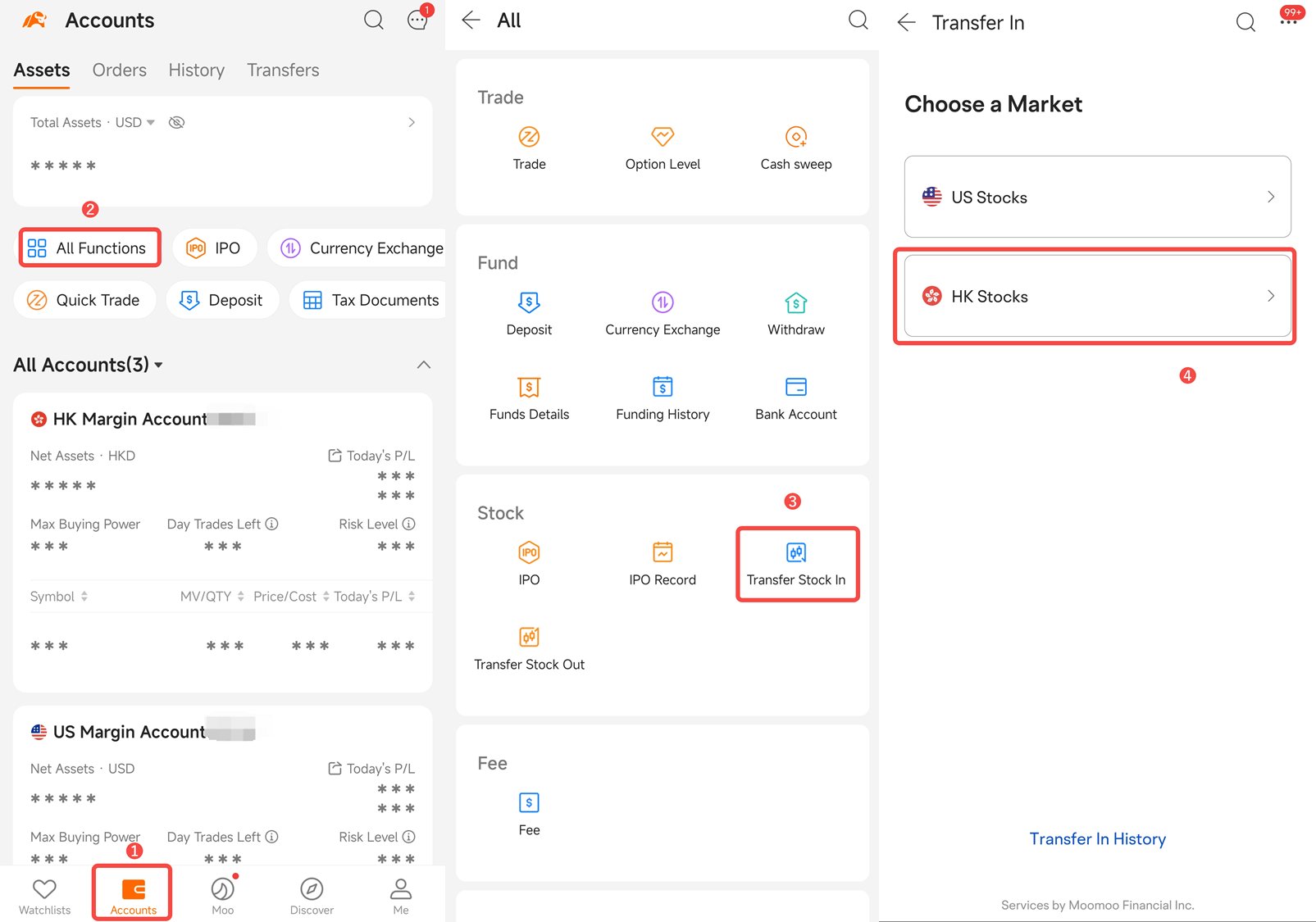

7. Best for new traders: Moomoo

- Our rating:

- Assets: Stocks, ETFs, options, Treasuries, and cryptocurrencies

- Fees: $0 per trade for stocks, ETFs, and options

Moomoo is an up-and-coming brokerage that caters to active traders.

Like Robinhood, Moomoo is popular among young, mobile-first users. That said, Moomoo's user base skews more heavily toward traders because of features like advanced charting, real-time news, and Level 2 data.

In addition to trading in U.S. markets, you can also invest in the Hong Kong and China-A-shares markets. Moomoo also has a paper trading feature that allows you to practice your strategies with virtual funds, all from the same login.

Plus, for opening a new account, you can get up to $1,000 in free NVIDIA stock* with the following deposit amounts:

- Deposit $100, get $20 of NVDA stock

- Deposit $2,000, get $50 of NVDA stock

- Deposit $10,000, get $300 of NVDA stock

- Deposit $50,000, get $1,000 of NVDA stock

*Because of this sign-up bonus, we ranked Moomoo as having the best free stock bonus program.

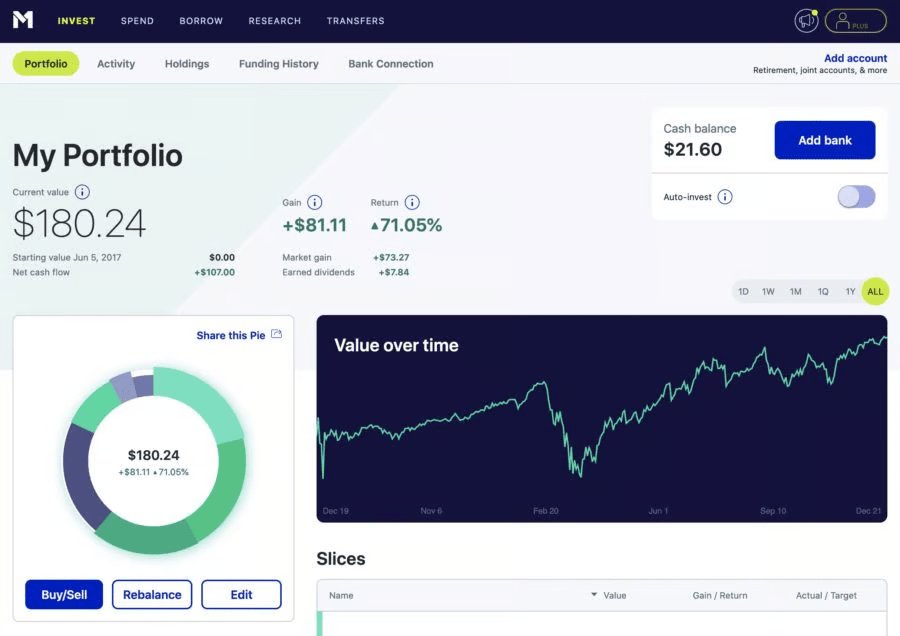

Bonus: M1 Finance

- Our rating:

- Assets: Stocks, ETFs, cryptocurrencies

- Fees: $0 per trade for stocks and ETFs

M1 Finance is a bit too unique to make the main list, but it's a great option for long-term investors who want to automate their portfolio and stick to a dollar-cost averaging strategy.

Instead of placing individual trades, you build a custom “pie” of stocks and ETFs, then set up recurring deposits.

M1 will automatically invest your money according to your targets, rebalance your portfolio over time, and let you stay hands-off. It's ideal for passive investors who want to grow wealth over time without managing trades day to day.

That said, M1 doesn't make the main list because it's only right for a specific type of investor. If you regularly want to change your portfolio, trade options, or react to short-term market moves, this isn't the platform for you.

But if you're building a long-term portfolio and value automation over flexibility, M1 is one of the best tools out there.

How to choose a brokerage account

Before choosing a brokerage, you need to get clear on what kind of investor or trader you plan to be. Are you a long-term investor or a short-term trader?

Next, consider what types of assets you want to invest in.

Nearly every platform offers access to U.S. stocks and ETFs. But if you plan to trade options, bonds, mutual funds, crypto, futures, or international stocks, double-check that your broker has what you need.

You'll also need to think about account types.

Any brokerage can open a regular taxable account, but if you're looking for a traditional or Roth IRA, HSA, custodial account, or 401(k) rollover, you'll want to go with a legacy broker like Fidelity or Schwab, which offer the widest selection.

Fees used to be a big differentiator, but these days, most online brokers offer commission-free trading. Unless you're using advanced features, pricing probably won't vary much.

How we chose the best brokerage accounts

When evaluating brokerage accounts, we take the following into consideration:

- Core offering: What can you actually do on the platform? We look at available investments (stocks, ETFs, options, crypto, etc.), account types (taxable, IRA, HSA, etc.), and standout features like research tools, automation, or advanced trading functionality.

- Fees and commissions: Most brokers are commission-free for stocks and ETFs, but we still review costs for options, margin, account, and other hidden fees.

- Usability: From mobile design to desktop functionality, we assess how intuitive and polished each platform feels, paying special attention to how new investors will feel navigating things for the first time.

- Credibility: We consider each brokerage's track record, reputation, number of users, and overall platform security.

- Target audience: Who is this platform actually built for? How broad are its uses and applications?

The takeaway

That's my list of the best brokerage accounts in 2026.

I've personally used every brokerage on this list (and many, many others) and ranked them based on my experience.

Every option here is largely commission-free, easy to get started with, and trusted by millions of investors. You don't need to overthink it — just choose the one you believe best fits your needs and get started.