The 7 Best Options Trading Courses

The draw toward trading options is obvious: when done well, you can generate far higher returns than you can trading stocks.

But it's not easy.

Options are complex instruments with strike prices, expiration dates, implied volatility, and Greeks all moving at once and affecting the "premium" of the contract. That complexity is largely why most new traders lose money.

I've been trading options — both buying and selling — for the last nine years.

I made a lot of mistakes in the beginning and learned the hard way what works and what doesn't. I paid my “ignorance tax” through trial and error, something I wouldn't recommend.

If you're just starting out, a good course can save you thousands in losses and months of frustration. That's why I made this list.

Below, I've reviewed the seven best options trading courses available today — so you can start smarter than I did.

A quick look at the best options courses

| Course | Our Rating | Takeaway | Cost |

| Benzinga Pattern Trader Pro | Best overall | $1,297/year | |

| Charles Schwab | Best free option | Free | |

| YouTube | Best for general info | Free | |

| Selling Options for Income | Best for learning how to sell options | $79 | |

| Option Alpha | Best free, curriculum-based training | Free | |

| Bullseye Trades | Best for swing trading | $147/year | |

| Udemy | Best paid course for beginners | ~$20 |

Disclaimer: Trading options is risky and complex. Be sure you know your max risk and understand all of the implications before placing a trade.

1. Benzinga Pattern Trader Pro: best options learning platform overall

- Our rating:

- Cost: $1,297/year

| Pros | Cons |

| Learn directly from a veteran options trader, Tom Gentile | Price (it's a membership, not a course) |

| Receive 1x real trade alert per week, not theory | |

| Education, analysis, and explanations for each trade |

If your goal is to learn how to make profitable options trades as quickly as possible, Benzinga Pattern Trader Pro is my top recommendation.

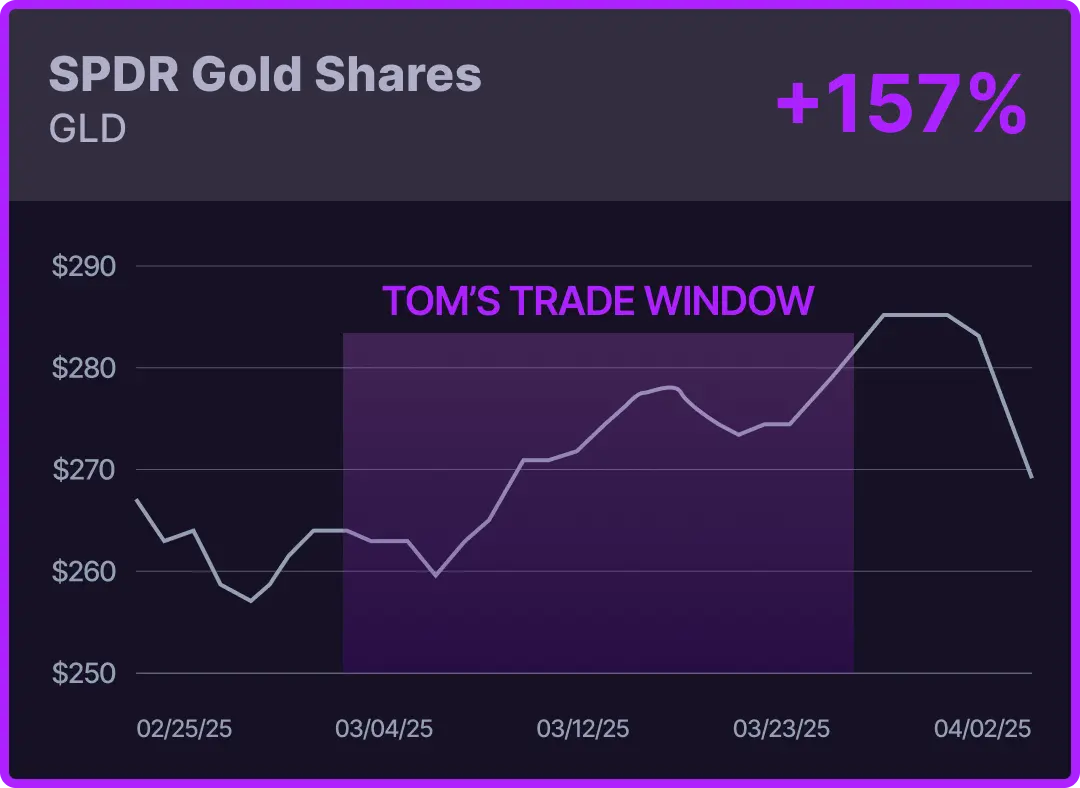

This isn't an e-course; it's an alert service produced by Tom Gentile, a veteran options trader. But unlike most alert services, Tom's goal is to help you become an independent options trader.

Along with each trade alert, Tom provides his full analysis (via video) and his reasons for taking the trade. This way, you can learn his exact process and eventually start taking trades on your own.

Additionally, members unlock Tom's premium library of training videos and guides. With it, you can learn how to capitalize on his "Power Patterns" and calendar-based strategies that turn timing into a trading edge.

If you're new to options, don't worry — the trades are easy to follow and implement, and most trades can be tailored to any account size. Plus, he only recommends one trade per week, so it's not too fast-paced to learn as you go.

The main downside is the price. At $1,297/year, this is a pretty serious commitment, and probably not worth it if you're just dabbling or testing the waters.

But, if you're serious about trading, this might be one of the fastest ways to become a profitable trader by learning a proven strategy from a veteran trader.

Benzinga's options service also ranks #3 on our list of the best options alert services.

2. Charles Schwab: best free options education

- Our rating:

- Cost: Free

| Pros | Cons |

| A complete library on options | Will teach you how options work, but not how to make winning trades |

| Free | The amount of information they provide can be overwhelming |

| The material is disorganized |

Charles Schwab has a massive library of high-quality investing resources available to its clients.

Resources include video walkthroughs, articles, podcasts, and in-person events on topics like market news, personal finance, investing, retirement planning, day trading, and more.

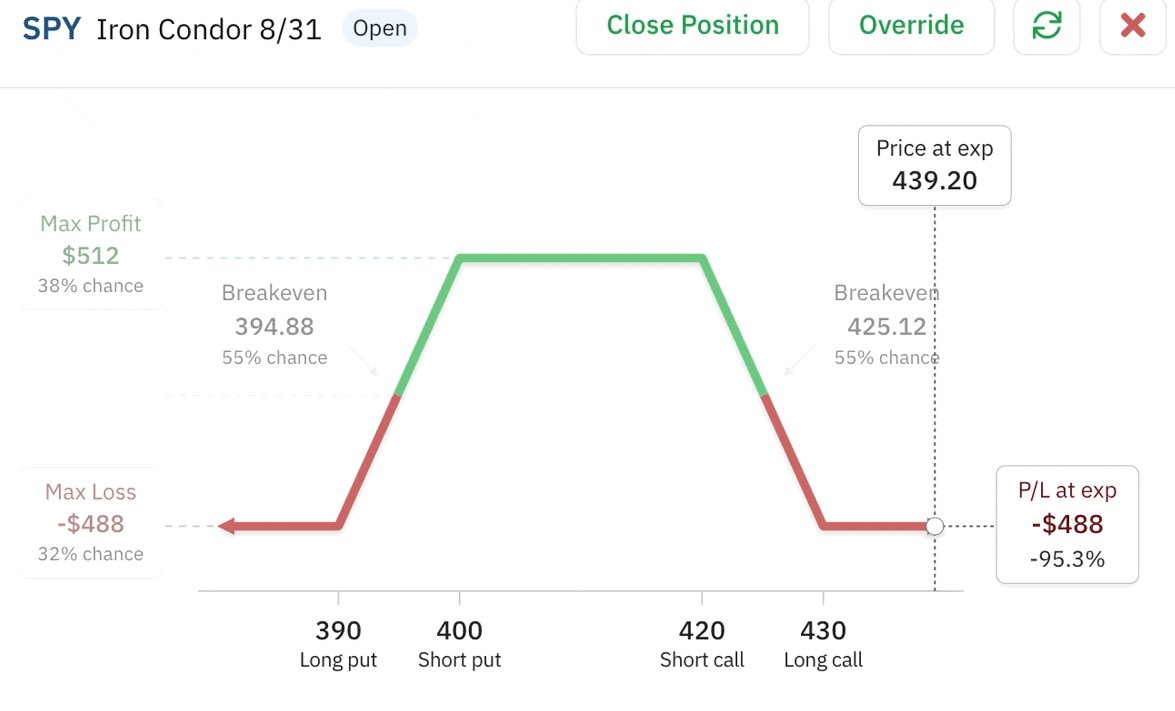

For options traders, Schwab has video and written guides covering everything from how to place your very first trade to advanced strategies like spreads, iron condors, and rolling positions.

To get started, you can browse the full options library or check out the first lesson in its Getting Started with Options series.

Unfortunately, its library isn't organized in any particular way. There's no structured curriculum or step-by-step learning path — just a long list of articles and videos ordered by publication date.

Still, if you don't mind digging a little, Schwab's library is one of the most underrated resources for investing and managing your money.

3. YouTube: best for general information

- Our rating:

- Cost: Free

| Pros | Cons |

| Endless resources | No curriculum or structure |

| Free | Too many choices and strategies |

| No way to know for sure if you're learning from someone with experience |

This isn't a specific course recommendation, but YouTube belongs on this list.

After completing one of the courses in this article or reading a few books on the topic, you're probably going to have some questions, and the answers to those questions will probably lead to more questions.

I would estimate you'll need to spend 10–20 hours studying options before you become somewhat familiar with them. For this, there's no better resource than YouTube.

There are hundreds of helpful videos on YouTube that will further your options education. That said, there are also some bad ones created by people who do not consistently trade options and/or don't fully understand what they're talking about.

As a beginner, it can be hard to distinguish between someone who really knows options and someone who doesn't, so be careful.

A few good channels for learning options are:

My recommendation: Pick one of these channels, watch a bunch of their videos in a row, and try to absorb as much information as you can.

4. Selling Options for Income: best for learning how to sell options

- Our rating:

- Cost: $79

| Pros | Cons |

| Simple strategies, with defined risk, for consistently profitable trades | You should have a basic understanding of options |

| Learn techniques so you never fear assignment | Best for accounts with $10,000+ |

| Cover the cost of the course on day one |

As mentioned in the introduction, I've been trading options for the last nine years. Over that time, I've tried countless strategies, taken 10+ courses, and read every book I could get my hands on.

After all of that experience, I've come back to two of the simplest options selling strategies out there: covered calls and cash-secured puts.

I came up with a unique system for selling them, which allows me to:

- Make simple, low-stress trades

- Never fear assignment or losing trades

- Make money from my existing portfolio without changing any asset allocations

After training a handful of people — including two financial advisors — on my approach, I was encouraged to create a course and share it with more people.

This is the result.

In my opinion, this is the right way to sell options. It just so happens to be quite simple, once you see the “Golden Rule” I teach.

Over the last four years, this strategy has averaged a 89.8% win rate and a 6.61% annualized return. And that's without changing anything about my underlying portfolio, so that return is in addition to what my portfolio would have done anyway.

5. Option Alpha: best free, curriculum-based trainings

- Our rating:

- Cost: Free

| Pros | Cons |

| Free | Pushes you to sign up for their bot-trading system |

| Excellent educational material | |

| Can take you from a beginner to a fairly advanced trader |

For the best free options trading course on intermediate selling strategies, head to Option Alpha.

Incidentally, I first learned about trading and selling options from the Option Alpha podcast back before it had an online curriculum.

The material was excellent, but it wasn't for beginners — I was often confused by the jargon and couldn't keep up with all of the different components of their strategies.

I would have to pause the podcast, scribble down notes, and look up words I didn't know.

Fortunately for you, you can just take their courses, which walk through many complex topics and strategies in simple ways.

Option Alpha offers beginner, intermediate, and advanced courses.

In total, it's about 15 hours of content. In addition to the courses, Option Alpha also has downloadable PDFs, simple explainers, and other helpful resources.

While the educational material is great, the reason Option Alpha isn't higher on this list is because they push you toward signing up for their automated, bot-based trading system.

And, once you get into the later courses, they start focusing more and more on the strategies they sell.

Still, the free courses are excellent and deserve a spot on this list.

6. Bullseye Trades: best options membership for swing trading

- Our rating:

- Cost: $147/year

| Pros | Cons |

| Learn from RagingBull's head of options trading, Jeff Bishop | Trade explanations aren't as detailed as those in Benzinga Pattern Trader Pro |

| Uses both fundamental and technical analysis | No real plan to help you become an independent trader |

| 1x real trade alert per week |

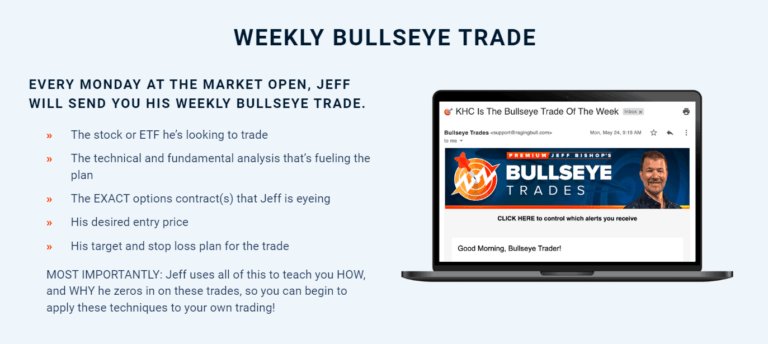

Similar to Benzinga Pattern Trader Pro, Bullseye Trades is another options alert service run by a very successful trader that also has an educational component.

Jeff Bishop is the co-founder of RagingBull and the author of Bullseye Trades. He has a degree in finance, a master's in economics, and has been trading options for over 20 years. A few years ago, he brought that experience to his subscribers.

Every Monday, subscribers receive an alert and accompanying analysis — including trading charts — of a trade he's putting on for that week. He also shares a trade update in the middle of each week.

In addition to the alerts and analysis, there is a “Launchpad Training” video series to help beginners understand options and how Bishop approaches trades.

While there's less educational material than Benzinga Options offers, this is still one of my favorite ways to learn. You can pick up and apply a ton of practical information from being in a service like this and being able to learn from a very profitable trader.

7. Udemy: best paid options course for beginners

- Our rating:

- Cost: ~$20

| Pros | Cons |

| Affordable | You'll have mastered the basics of options trading but will need other materials for real strategies once you're done |

| Choose your own courses |

More than 65,000 people have taken the Options Trading Basics courses on Udemy, and it has racked up 4.6 stars from 9,700+ ratings.

As its name suggests, this course bundle was created to help you “master the nuts and bolts of options trading.”

You'll learn about how options are different from stocks, the factors that affect options pricing, the theory and mathematics behind options, and a handful of simple strategies.

The course is a monster. It includes 11.5 hours of video and 7 downloadable resources. If you're looking for one course to learn everything you need to know about how options work, this is it.

That said, it would be better with more real-life applications — most students mention they needed to buy additional courses before they could start trading options on their own.

Know before you go: a word of caution

Trading options is risky. Regardless of which options trading course you choose, I cannot emphasize this enough: start slowly.

This is especially true when it comes to selling options, which can result in “naked” positions and lead to nearly unlimited losses, similar to shorting stocks.

Before you place any options trade, either buying or selling, be sure you know the max risk of the trade and understand all of the implications.

If you don't know what your max risk is or how to calculate it, keep studying.

Helpful tipThis is something Kirk from Option Alpha explains very well in his Beginner Courses.

How we chose the best option trading courses

When evaluating investing products and services, we take the following into consideration:

- Core offering: How good the product or service is.

- Cost: The overall price, value for money, average cost per month, and any hidden fees.

- Usability: How well the course is designed, whether it's easily digestible and easy to navigate, and how responsive the support is.

- Credibility: The quality of information and data, as well as brand reputation.

- Audience: Who the product is for, the range of uses and applications, whether it actually works for its target audience, if it's the best option available, and any limitations therein.

- Offers: Whether there is a special offer for signing up or any discounts.

Final verdict

Trading options is extremely complex — there are a lot of moving parts — and it's easy to get in over your head. The resources I listed above are some of the best ways to learn about options.

If I were starting from scratch, these are the materials I'd choose from to save myself time, money, and a lot of frustration.

Here's one last piece of advice:

There are hundreds of options trading strategies out there, so don't fall into the trap of bouncing from strategy to strategy and then get frustrated because none of them “worked.”

You've got a better chance of getting good results by finding one strategy that fits your personality and then taking the time to master it.

.png)