How to Invest $1 Million in 2024

Whether you came into an inheritance, sold a company, or built a nest egg over time, it can be hard to figure out how you should invest your money.

While one million dollars might not be the fortune it once was, it can still go a long way if prudently invested.

When investing, your objectives should be to both protect your capital and increase its value.

Here's how to invest $1,000,000 in 2024 to make your money work for you and to achieve your financial goals.

Before you invest

Before you start investing, you should answer a few key questions that will form the foundation of your financial plan and investment strategy.

What are your financial goals?

Every good financial plan starts with your goals in mind — the goals drive the plan.

Are you:

- Investing for retirement?

- Investing to increase your net worth?

- Investing for your child's or grandchild's education?

- Investing to fund the charities that are most important to you?

Write down what your goals are and be specific. Then, assess how much money will you need to fund these goals.

From there, you'll have a better sense of the annual returns you'll need to generate and which investments to include in your plan.

What is your time horizon?

Now that you know your goals, it's time to factor in your current age and when you'll start drawing from your investments.

Here's a general rule of thumb: The longer your time horizon, the greater your allocation to more volatile investments — like stocks — can be.

So if you're 20 years away from retirement, you're still in your “wealth accumulation” phase and have ample time to ride through the stock market's inevitable volatility in pursuit of higher returns.

Shorter timelines, on the other hand, should have a higher allocation toward lower-risk, fixed-income investments — like bonds.

If you're two years away from retirement, you'll likely be in “wealth preservation” mode and want to own assets that have a very high likelihood of maintaining their value.

What is your risk tolerance?

Your risk tolerance and time horizon are linked — the longer your time horizon, the more risk you can take on. As you get older, your risk tolerance should decline because there is less time to recover from a downturn in the market.

Additionally, your temperament should influence your investment mix.

If you're very conservative and know you can't stomach volatility, you may want to allocate more of your portfolio to bonds than someone who is more comfortable with market fluctuations.

Your goals, time horizon, and risk tolerance should guide your asset allocation, which is the amount of money you invest in different assets.

Do you have any debt?

Oftentimes, the highest ROI investment you can make is paying off your high-interest debt.

If you have personal loans, credit card debt, or car loans with interest rates over ~6%, you should probably pay off the balances before investing.

By paying these debts off, you're guaranteeing a 6% (or higher) ROI, which most investments will have a hard time matching.

Do you have an emergency fund?

Regardless of your income level or net worth, you should have an emergency fund.

Your emergency fund should have enough money to cover at least six months' worth of living expenses in case of a job loss or other emergency.

To earn income from your emergency fund, place it in a high-yield savings account (check out Raisin for options) or invest it in individual Treasury bills or an ETF like SGOV.

You'll need a brokerage account to invest in Treasury bills, ETFs, stocks, and more. I like Public.

The 6 best ways to invest $1 million

Here are the top 6 ways to invest $1 million. Read on for more info about each.

- Stocks and ETFs

- Bonds

- Real estate

- Cash equivalents

- Alternative investments

- Hire a financial advisor

1. Stocks and ETFs

Almost every financial advisor constructs their clients' portfolios with two asset classes as the bedrock: stocks and bonds.

Stocks, while more volatile, offer the opportunity for higher long-term returns than bonds.

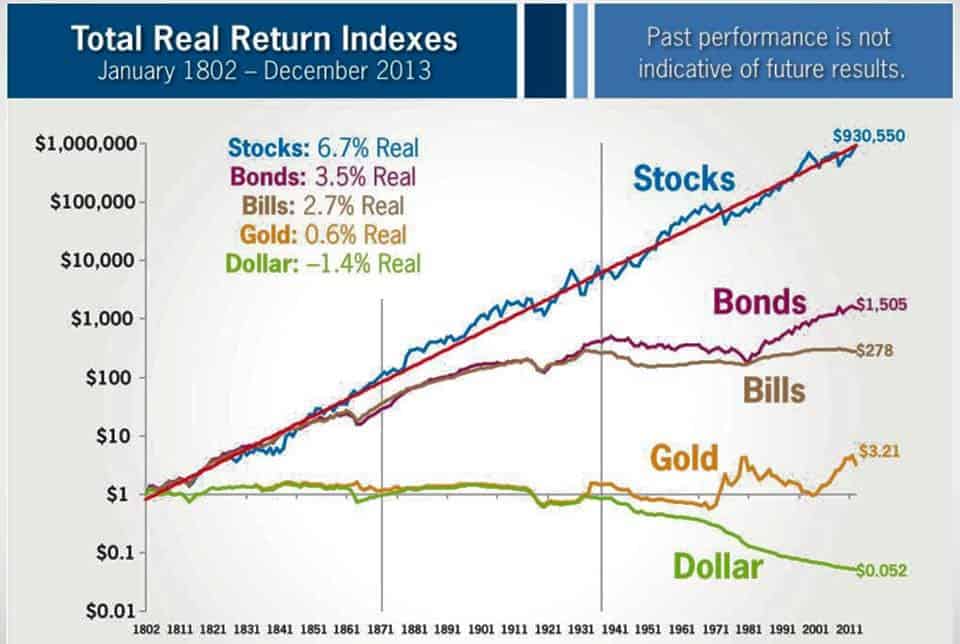

From 1802 to 2013, stocks returned 6.7% (net of inflation), which is almost double the return of bonds, at 3.5%, and more than double the return of Treasury bills:

Source: Wealth Capitalist

While 3.2% outperformance might not seem like much, look at the effects of that outperformance on the chart above: $1 invested for those 212 years resulted in $930,550 in stocks versus just $1,505 in bonds.

For this reason, stocks are used as the main driver of growth in most portfolios.

While you can invest in individual stocks (like AAPL, TSLA, and GOOGL), many financial advisors recommend ETFs. An ETF (exchange-traded fund) is an investment vehicle that holds a basket of stocks at once, making for easy diversification.

Because of this diversification, ETFs are generally less risky than buying individual stocks. A few of my favorite ETFs are VOO, VT, and QQQ.

Kris (the founder of StockAnalysis) and I both invest in ETFs and individual stocks, following what we call the Barbell Strategy. This approach gives us diversification and the opportunity to earn outsized returns.

We share our exact portfolios, which stocks we own, how we manage our money, and financial education in our investing newsletter, The Barbell Investor.

How much of your portfolio should be allocated to stocks depends on your goals, time horizon, and risk tolerance. A 25-year-old may have a portfolio with 100% stocks, while a 65-year-old may have an allocation closer to 45%.

2. Bonds

While stocks are the main drivers of growth in a portfolio, bonds provide stability.

Governments and companies issue bonds to borrow money. In return for lending the borrower money, investors receive interest payments plus the original principal when the bond matures.

Unlike stock investments, the borrower is legally obligated to repay the loan.

For this reason, while stock investments may swing dramatically, bonds tend to be less volatile. Investors choose bonds because of their cash flow, stability, capital preservation, and diversification.

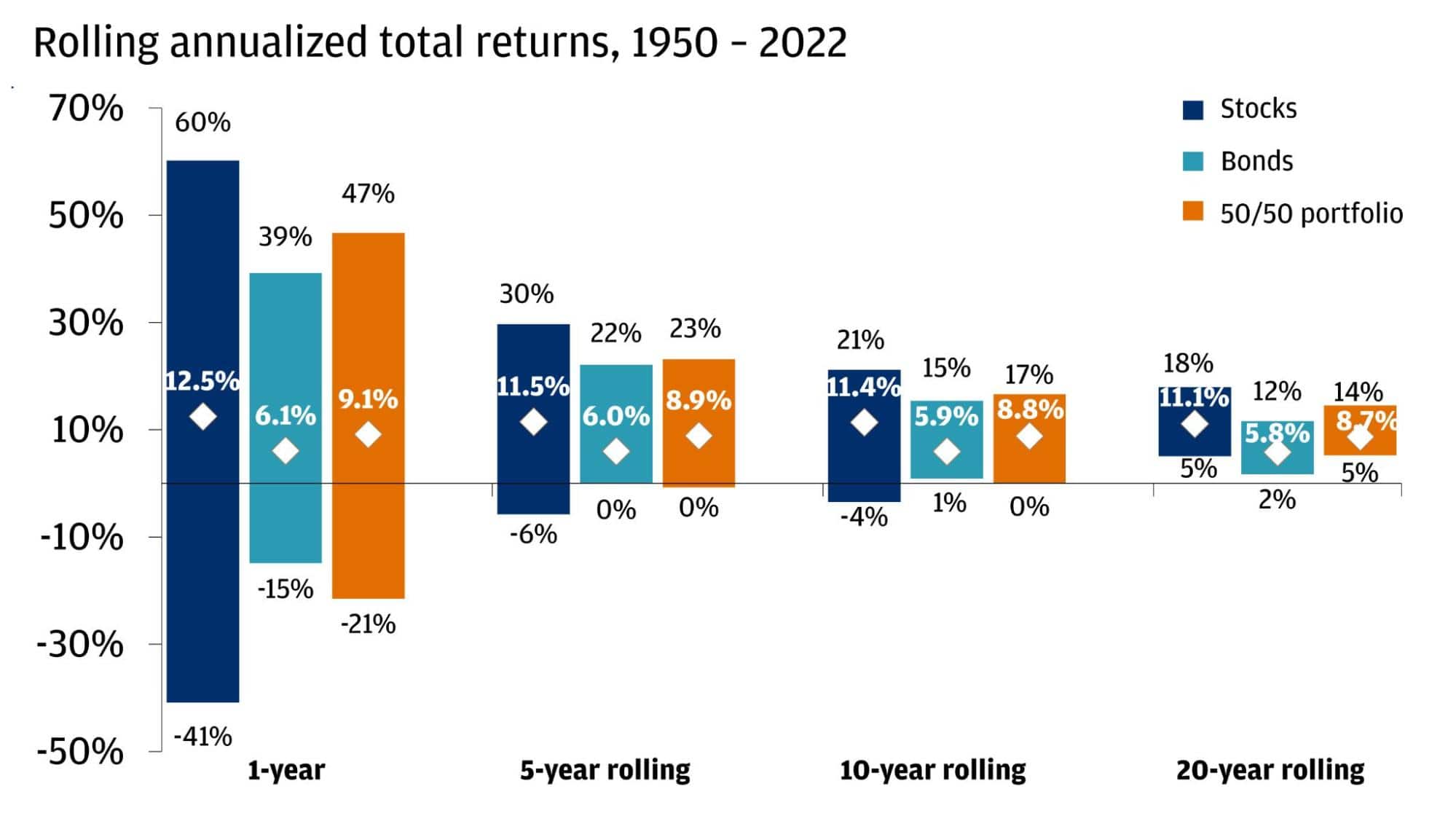

By combining stocks and bonds, you can smooth your returns:

Source: J.P. Morgan Private Bank

How to read this chart

The diamond is the average return over the rolling period, while the best-performing and worst-performing periods are marked at either end. So, for example, the worst-performing rolling 5-year period for stocks generated cumulative -6% returns.

There are many types of bonds, but the three primary categories (based on their issuer) are government, corporate, and private companies.

Government

Government bonds are issued and backed by the U.S. government, which is considered the safest issuer in the world.

If the U.S. government ever didn't have enough tax revenue to cover its debt obligations, it could print more money and pay back its creditors.

The government issues short-term debt (known as Treasury bills) and long-term debt (known as Treasury bonds).

Any debt with a maturity date of two or fewer years is considered a Treasury bill (or “T-bill”), while anything longer-term is considered a Treasury bond.

It's worth noting, however, that longer maturity bonds have a heightened risk of volatility and may lose money if they're sold before they mature.

Instead of buying individual government bonds, you can also buy a government bond ETF. These are easier to manage than individual bonds, pay a monthly income, and have lower minimum investments.

You can buy government bond ETFs, like SPTL or VGLT, in your brokerage account (such as Public).

Corporate

Corporate bonds are debt instruments issued by publicly traded companies.

The primary risk of corporate bonds is “default risk,” or the company failing to pay its debt obligations — usually in the case of bankruptcy.

Since the government does not have a default risk, interest rates on corporate bonds are typically higher than on government bonds.

Right now, for instance, 10-year Treasury bonds are yielding 3.98% while 10-year, high-yield corporate bonds are yielding 4.75%.

Corporate bonds are assigned credit ratings, which signal how likely the issuing company is to default on their loans. Conservative investors usually opt for “investment grade” bonds while risk-on investors may choose “junk” bonds.

Again, instead of buying individual corporate bonds, you can buy a bond ETF which will hold many bonds with varying issuers, maturity dates, and interest rates.

These ETFs typically make monthly distributions, as opposed to semiannual interest payments like most individual bonds.

Two examples of corporate bond ETFs to look into are SCHI and SPBO.

Private credit

Private companies, which don't have access to the public markets, must turn to private markets for financing. This money is used for growth or funding current operations.

Because private financing is harder to come by, these companies must offer investors better terms. These terms often include shorter durations and higher yields than public bonds.

Additionally, the private credit market is largely uncorrelated with the public equity and bond markets.

Historically, the $1.9 trillion private credit market has only been available to institutional investors, but Percent has opened the door to private credit deals for income-seeking, accredited investors (like you).

The private credit market is more risky than government and corporate bonds, but it may be worth allocating a small percentage of a portfolio to it. 89% of investors on Percent re-invest after their first deal, which is why it ranks third on our list of the best investments for accredited investors.

3. Real estate

You may not think of yourself as a real estate investor but, if you own a home, then you are one.

In fact, most people have a considerable portion of their net worth in real estate. If you have a net worth of $1.5 million and you've paid off your mortgage on your $500,000 house, 1/3rd of your net worth is in real estate.

Still, if you want to allocate even more of your net worth to real estate or become a “real estate investor,” it's a great option. Real estate has created more millionaires than any other asset class.

Real estate investors have three ways to win:

- Rental income

- Price appreciation

- Tax advantages

Historically, real estate has also served as an excellent hedge against inflation.

While real estate investing can be lucrative, it does take substantially more work. As a real estate investor, you'll have to perform due diligence, handle the paperwork, manage renovations, obtain permits, do maintenance, interview tenants, and more.

You could hire a management company to take care of some of this, but it will reduce your returns.

If you want to get into real estate investing but don't want all the headaches that come with it, consider using a real estate crowdfunding platform like Yieldstreet, EquityMultiple, or Arrived.

These platforms take care of everything — you just provide the capital.

Yieldstreet has invested more than $4 billion since its inception and its real estate deals have earned a 9.7% net realized annual return due to its unparalleled access to developers.

EquityMultiple's Ascent Income Fund is also a great way to gain exposure to U.S. commercial real estate loans with a target annual return of 11–13%.

4. Cash equivalents (CDs, MMFs, HYSAs)

Most financial advisors will recommend having a few months' worth of cash on hand in addition to your emergency fund. This money is set aside for upcoming bills, any pre-planned purchases, and to stabilize your investment portfolio.

But you don't need to let this money just sit in a bank account — you can still invest it.

To make sure you have quick access to this money, however, you will want to invest it in a “cash equivalent,” an investment that won't lose value and is easily convertible to cash.

These include short-term Treasury bills, certificates of deposit (CDs), money market funds (MMFs), and high-yield savings accounts (HYSAs).

You can compare CDs, MMFs, HYSAs, and other banking options on Raisin.

My favorite place to park cash is in Treasury bills. Instead of constantly buying and managing individual Treasury bills, you can make things much simpler by buying an ETF, like SGOV.

5. Alternatives (private companies, art, cryptocurrency, collectibles, venture capital, and hedge funds)

Alternative investments (known simply as “alternatives”) are any investments outside of stocks, bonds, and cash.

Alternative investments have exploded in popularity in the last 10 years. Alternatives offer diversification outside of public stock and bond markets, may be good hedges against inflation, and may generate higher returns.

These benefits have led investment managers like BlackRock to recommend supplementing a stock/bond portfolio with up to 20% in private market alternatives.

While I personally find this to be a little high, I do believe there is a place for alternatives in a modern portfolio, especially one with a million dollars in it.

A few of my favorite platforms for buying alternative assets are:

- Yieldstreet: Real estate, venture capital, private equity, short-term notes, and more

- Equitybee: Private companies (like Stripe, OpenAI/ChatGPT, and Plaid)

- Masterworks: Fine art

- Public: Cryptocurrency and collectibles (like sports cards, shoes, bags, and NFTs)

- Percent: Private credit

Equitybee Disclaimer: Subject to availability. Investments involve risk; Equitybee Securities, member FINRA.

If you want to allocate a portion of your portfolio to alternatives but don't know what to invest in, Yieldstreet's Multi-Asset Class Fund has you covered.

It is a professionally managed, income-generating portfolio with a current distribution rate of 8%.

6. Hire a financial advisor

If all of this seems like a lot to you, you're not alone. There is a lot that goes into financial planning and creating an investment strategy perfectly suited to you.

If you'd rather not handle investing and managing your money yourself, consider hiring a financial advisor. Financial advisors are well-prepared to offer advice on an investment strategy, taxes, insurance, real estate, and more.

If you're interested in hiring a financial advisor, I would recommend interviewing with a few different local advisors and choosing your favorite. Be sure they're a fee-only “fiduciary,” which means they are obligated to work in your best interest and will not receive kickbacks for putting your money in certain investments.

For more information on how to find a good financial advisor, check out my Fisher Investments Review.

Frequently asked questions

Below are a few more questions commonly asked about investing $1,000,000.

Where should I invest $1,000,000 right now?

The best way to invest $1 million right now depends on your age, financial goals, income and spending habits, and risk tolerance.

There is not one right answer to this question, as it's different for everybody.

Most people will choose to spread their money between stocks, bonds, cash, and real estate (via home ownership).

If you're risk-averse or are in or near retirement, you may want to have a higher allocation to bonds and other fixed income than someone who is younger and more comfortable with risk.

A popular rule of thumb to determine a good stock/bond split is to take your age and subtract 10, then allocate that percentage of your money to bonds. Using this rule, a 65-year-old would invest ~55% of their portfolio in bonds.

What is the safest investment for $1 million?

The safest way to invest $1 million is to buy Treasury bills. A Treasury bill (or T-bill) is a short-term debt obligation backed by the “full faith and credit” of the U.S. government.

The U.S. government is the least risky borrower because of its tax revenue.

In fiscal year 2023, the U.S. government collected $3.97 trillion. That money is nearly guaranteed unless everybody moves out of the United States or stops paying their taxes.

Additionally, if the U.S. was ever at risk of defaulting on its debt, it could print more money to repay its obligations.

2-year T-bills are currently paying about 4%, meaning an investment of $1 million would generate $40,000 in interest per year.

How much can you make if you invest $1 million?

How much you will earn from any investment depends on which assets you buy, and how long your money is invested.

If you invest $1,000,000 in treasury bills that pay 4%, you will earn $40,000 per year in interest. Investing in other securities, like stocks, can generate higher returns but also comes with more risk.

For instance, the stock market has averaged about 8% per year over the last 100 years. If you invest $1,000,000 and it earns 8% per year, you will have $4,660,957 after 20 years.

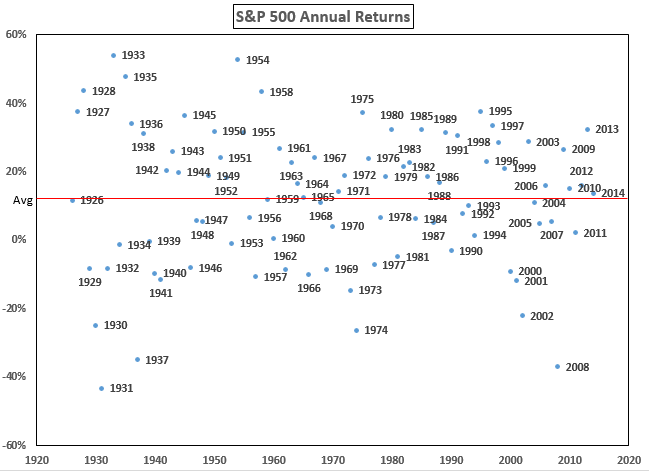

That said, if your investment time horizon is just one year, stock market returns are sporadic:

Source: A Wealth of Common Sense

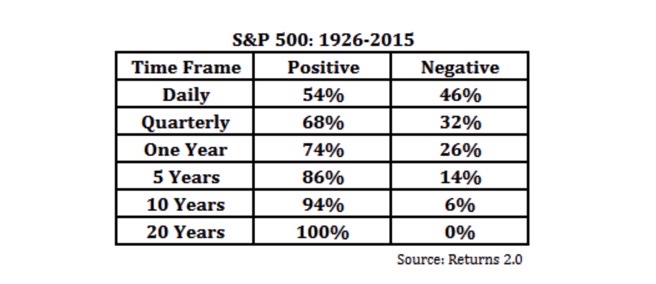

But when you extend your time horizon, the historical probabilities become heavily stacked in your favor:

Source: A Wealth of Common Sense

So, if you were to invest $1 million in the stock market, on average you might earn $80,000 per year. But, because of volatility, history tells us you could lose up to $431,000 or make as much as $542,000 in a single year.

How to invest $1 million to live off the interest?

You can live off the interest of $1 million by investing in assets that will generate more interest income than you spend in a year.

For example, 2-year Treasury bills are currently paying 4% interest, so an investment of $1,000,000 would generate $40,000 in interest income per year.

If you need more than $40,000 in income, you could increase this amount by buying slightly more risky assets, such as corporate bonds or private credit (via Percent).

How we chose the best ways to invest $1,000,000

When evaluating investments, we consider the following:

- Popularity: How popular is the asset among investors? Has the asset class been around for a long time or is it relatively new? How likely is a financial advisor to recommend it?

- Returns: How has the investment performed historically? How is it expected to perform in the future? How stable/reliable are those returns expected to be?

- Risk: How much volatility should be expected? How much confidence can we place in the expected returns? How much downside is possible? How stable is the investment?

- Duration: How long should the investment timeline be? Should the investment be held for weeks, months, or years?

- Accessibility: How easy is the investment to buy and sell? How simple is it to create an account and start investing? Are the recommended platforms easy to navigate?

Putting it all together

You may be wondering now how to put all this information into action.

As an example, consider the following hypothetical. Let's assume I'm a 50-year-old who's saving for retirement and I have:

- $1,000,000 to invest

- A $500,000 home with a $50,000 mortgage balance

Let's also assume that I have a job that covers all my expenses, I'm slightly risk averse, and I plan to retire in 15 years.

My portfolio might look something like this:

- 50% stocks (primarily VOO)

- 35% bonds (primarily SPTL)

- 10% alternatives (spread across Yieldstreet's Multi-Asset Fund, Equitybee, Masterworks, and Percent)

- 5% cash (primarily SGOV)

That's my quick, back-of-the-napkin example of how I would invest $1,000,000 in 2024.

Obviously, this is a very rough, simple example, but I think it's helpful to show how I might go about constructing a portfolio. I hope it helps you.

My best advice is to take your time, educate yourself, and write down your financial goals, time horizon, and risk tolerance. After that, you'll be able to back into the investment strategy and financial plan that is best suited to you.

.png)