How to Buy Alef Aeronautics Stock

Alef Aeronautics is developing the world's first legal flying car. Yes, seriously.

What's maybe even more exciting: the U.S. Federal Aviation Administration (FAA) approved Alef's Model A for test flights. The company now has legal clearance to fly.

Alef is a California-based company founded in 2015 and expects the $300,000 car to start being delivered to customers before the end of 2025.

While no IPO date has officially been set, I would expect the company will turn to the public market for funding in the near future — development and production will not be cheap.

Still, as private equity investors know, the real money is made before a company's IPO, not after.

Fortunately, there's a way to invest in private companies before they become public. I'll cover exactly how below.

If you're wondering how to buy Alef Aeronautics stock today, here are a few ideas to gain exposure.

Can you buy Alef stock? Is Alef Aeronautics publicly traded?

Unfortunately, Alef is not yet publicly traded. There is no Alef Aeronautics stock symbol, and there's no way to buy it in your regular brokerage account.

The company won't become public until the Alef Aeronautics IPO, which has yet to be scheduled. Until then, there's no way for retail investors to buy its stock.

As mentioned above, I fully expect Alef to IPO in the near future given its aggressive timeline for deliveries, which management anticipates will be by the end of 2025.

The company will need to spend a lot of money on research, development, and production before that date, and the public market seems like the best place to get that funding.

It's impossible for retail investors to buy Alef Aeronautics stock before its IPO, but there may be a way for accredited investors to invest alongside the private equity firms getting in before everyone else.

How to buy Alef Aeronautics stock in 2024

If you're an accredited investor, you can sign up to Equitybee and get notified if Alef stock becomes available.

Accredited investors are those with an annual income of more than $200,000 or a net worth exceeding $1,000,000, excluding their primary residence.

If you aren't an accredited investor, skip to the retail investor section below to learn how you may still be able to participate in Alef Aeronautics's upside.

How to invest in pre-IPO stocks as an accredited investor

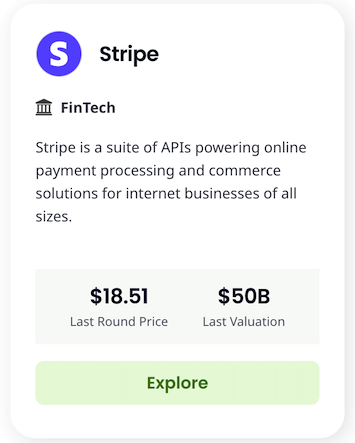

Equitybee is an investment platform that gives accredited investors access to high-growth, VC-backed startups and private companies like Discord, Instacart, and Stripe:

By funding employee stock options, accredited investors can gain investment exposure to private companies at past valuations (meaning you can buy in at the same valuation as private equity firms paid at the last funding round).

In exchange for funding the options, you will receive a percentage of future proceeds from any successful liquidity events.

View the current offerings on Equitybee.

Disclaimer: Subject to availability. Investments involve risk; Equitybee Securities, member FINRA.

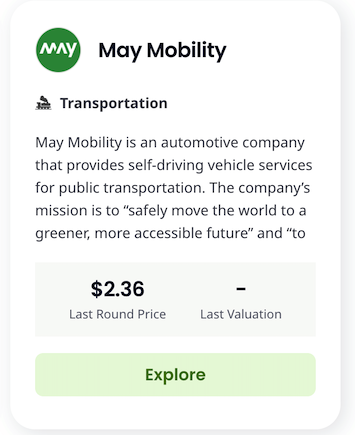

You may also be interested in May Mobility, an automotive company that provides self-driving vehicle services for public transportation:

Alef Aeronautics isn't currently available on Equitybee, but you can sign up and get notified if it becomes available.

How to invest as a retail investor

If you're not an accredited investor, there may still be a way to get exposure to Alef before its IPO.

According to Crunchbase, Alef Aeronautics has raised money in 12 different rounds. It has received about $44.5 million — not a huge sum given it was founded back in 2015.

Its investors include Draper Associates Fund V (Tim Draper was an early investor in Tesla), Tata Capital, Redwood Venture Partners, Redwood Technology Ventures, and Select Venture Partners.

To date, there have been no public companies that have invested in Alef, meaning there's no way to gain indirect exposure by buying a publicly traded company that is a part owner of Alef.

Again, given the future capital requirements, I expect this to change in the near future. If you're a retail investor and want exposure to Alef Aeronautics before its IPO, keep an eye out for public companies participating in its funding rounds.

Additionally, there may be venture capital funds that decide to invest in Alef's funding rounds, such as the ARK Venture Fund, which owns Zipline. The minimum investment is just $500 and all U.S.-based investors are eligible to invest.

If you decide to invest in the Ark Venture Fund, be sure you're comfortable investing in all of the companies the fund also owns and be prepared for extreme volatility.

How to buy the Alef Aeronautics IPO

The Alef Aeronautics IPO date has not yet been set, but after its initial public offering, you will be able to look up its stock symbol and buy it in your brokerage account.

If you don't have a brokerage account, we recommend Public. Invest in stocks, ETFs, bonds, and cryptocurrencies all from the same account.

Who owns Alef Aeronautics?

As mentioned above, Alef Aeronautics' list of investors includes Draper Associates Fund V, Tata Capital, Redwood Venture Partners, Redwood Technology Ventures, and Select Venture Partners.

While we don't know how much of the company each of these investors owns, I would guess the company's founding team still owns the vast majority, given the total funding received is just $44.5 million.

Frequently asked questions

Below are a few more questions often asked about Alef.

How to buy Alef Aeronautics stock?

Alef stock has not been made available to the public via an IPO or SPAC, and is not currently listed on Equitybee, our recommended pre-IPO investing platform.

How much is Alef Aeronautics stock?

Alef stock is not yet publicly traded and has no publicly available price per share.

What is the Alef Aeronautics stock symbol?

Alef is still a privately held company so there is no stock symbol.

Who owns Alef Aeronautics?

Alef Aeronautics is partially owned by Jim Dukhovny, Dr. Constantine Kisly, Pavel Markin, Oleg Petrov, and 7 other investors and investment firms.