How to Buy Canva Stock Before Its IPO

Canva is an online design platform built for non-designers — and it's become indispensable for individuals and businesses alike.

And in the past year, it's only gotten better. Canva has rolled out a suite of AI-powered tools — from Magic Design and Magic Write to AI-generated video and presentations — that have made it even easier to create professional-looking content in seconds.

Canva is now used by over 260 million people each month. More than 30 billion designs have been created on the platform. And over 95% of the Fortune 500 are customers.

As of October 2025, Canva had 29 million paid users and surpassed more than $3.5 billion in annualized revenue.

Despite all this momentum, Canva remains private — though that may change in 2026 (more on that below).

Still, there are a few ways to invest in it right now, while it's still a private company.

Can you buy Canva stock?

Canva is a private company, which means there is no Canva stock symbol and you can't buy it in your brokerage account.

However, there are two ways to invest in Canva, even before it becomes publicly traded.

Two ways to buy Canva stock in 2026

The best way for you to invest in Canva depends on whether you qualify as an accredited investor or a retail investor.

Are you an accredited or retail investor?

You qualify as an accredited investor if you meet one of the following criteria:

- You have an annual income of $200,000 individually or $300,000 jointly

- Your net worth exceeds $1,000,000 (excluding your primary residence)

If you're an accredited investor, the first section is for you. If you don't qualify as an accredited investor, skip to the second section, which is for retail investors.

1. For accredited investors

Hiive is a marketplace where accredited investors can buy shares of high-growth, VC-backed startups and private companies, including Stripe, OpenAI, and Canva:

At the time of this writing, there are 7 listings of Canva stock available on Hiive.

On Hiive, sellers (including employees, venture capitalists, and angel investors) list their shares and set their own asking prices. Buyers can either accept the asking prices or place bids and negotiate directly with the sellers.

After a successful transaction, the seller pays the fees (there are no fees for buying), and the shares are transferred to the buyer.

Register for Hiive and start investing in private companies today:

2. For retail investors

While only accredited investors can invest directly in Canva, there is also a good way for retail investors to get exposure.

Fundrise's Innovation Fund is a venture capital fund that is open to all investors. The fund buys stakes in private, high-growth technology companies.

It has positions in Anthropic, OpenAI, Anduril, Databricks, Roblox, and, as of September 2023, Canva.

The Innovation Fund invested $6.2 million in Canva, most likely at a valuation of $40 billion.

The fund has a minimum investment of $10, has an annual management fee of 1.85%, and is open to all U.S. residents. You can find more information and learn how to invest on Fundrise's website.

How to buy the Canva IPO

Canva has not made any IPO filings with the SEC and there are no estimates of the Canva IPO date at this time.

In an interview in November 2025, Canva COO Cliff Obrecht said the company's IPO is "imminent in the next couple of years."

This echoed comments made 7 months earlier by CEO Melanie Perkins, who said Canva's public offering is still “on the horizon,” but there's “no news” to report.

Canva has completed three secondary transactions (which give employees and investors an opportunity to sell their shares) since April 2024, the most recent of which was completed in August 2025.

While transactions like this often signal an IPO is at least a year away, Canva is in a unique position.

In early 2025, the Australian company set up a U.S.-based parent entity — a move that laid the groundwork for a future IPO. But it also created a surprise tax liability for shareholders, many of whom are employees.

As part of the restructuring, shareholders were given new shares of equal value in the new U.S. entity.

However, the Australian Tax Office (ATO) treated this as a taxable event — essentially viewing it as a sale of the old shares and a purchase of the new ones.

That triggered a capital gains tax bill that many employees assumed wouldn't hit until the company went public. Now, that bill is due later this year.

By providing a secondary share sale, Canva is giving employees a way to sell some of their shares and cover their tax bills.

When it does go public, the stock symbol might be something like CNVA or CANV, and you'll need a brokerage account to buy shares.

If you don't have a brokerage account, we recommend Public. On Public, you can invest in stocks, ETFs, Treasuries, and cryptocurrencies, all on one of the most well-designed investing platforms.

Who owns the company?

CEO Melanie Perkins and COO Cliff Obrecht, the married co-founders of Canva, are estimated to own about 18% each. Cameron Adams, a third founder, owns 7-9%.

The other ~55% is owned by early employees, angel investors (including Bob Iger and Bill Tai), and private equity firms such as Blackbird Ventures, Square Peg Capital, Franklin Templeton, Sequoia Capital, T. Rowe Price, and others.

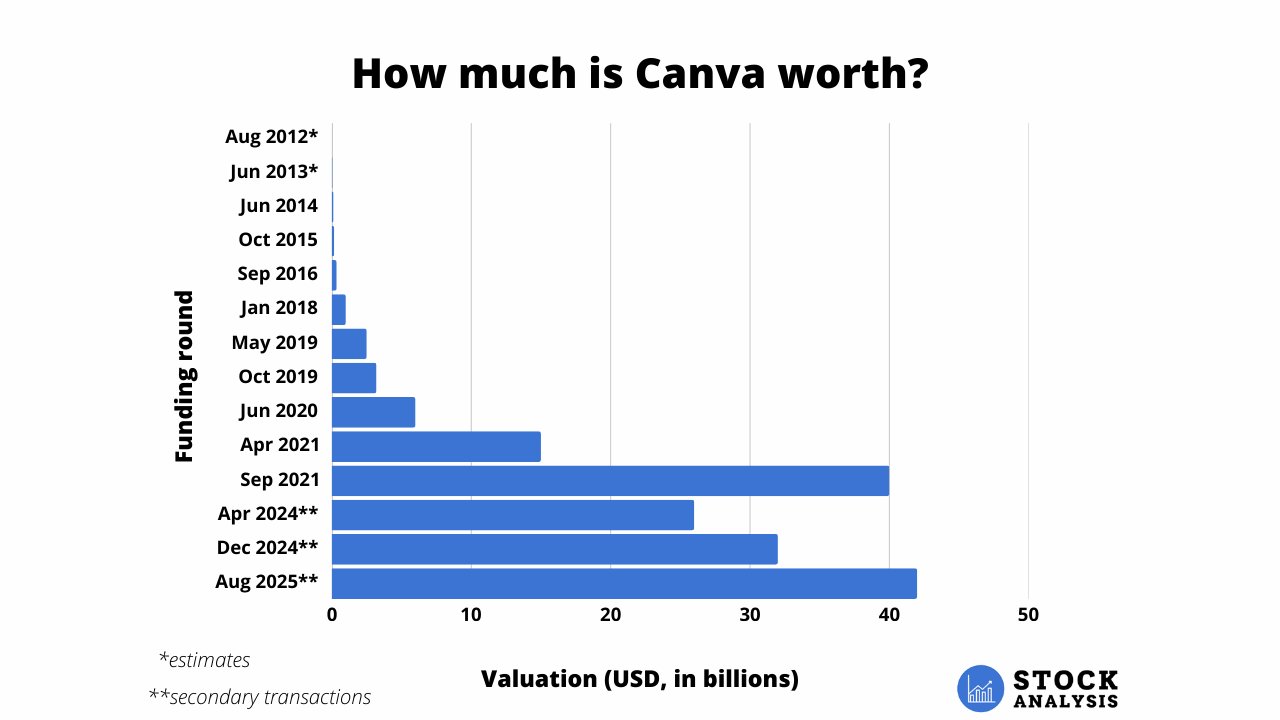

Canva valuation chart

Canva has not raised funding since September 2021. In that round, the company raised $200 million at a $40 billion valuation.

Since then, Canva has conducted three secondary transactions, which have been completed at different valuations:

- April 2024: $26 billion valuation (35% lower than its peak)

- December 2024: $32 billion valuation

- August 2025: $42 billion

Including these secondary transactions, here's a look at how its valuation has changed since the company was founded in 2012:

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.

.png)