How to Buy Miso Robotics Stock in 2026

Robots aren't far from taking over the fast food industry. The company at the forefront of the charge: Miso Robotics.

Miso's flagship product, Flippy 2, is engineered to fry anything — french fries, onion rings, fish, wings, you name it.

Miso also created:

- Sippy: a point-of-sales beverage dispenser

- Chippy: the robot behind Chipotle's tortilla chips

- CookRight: a grilling robot that can tell when food is ready

What this all means is that busy kitchens can produce higher-quality meals faster, cheaper, and more consistently than ever before. Plus, robots never get tired.

Miso Robotics is in a prime position to become an integral part of the $675 billion global fast food industry. And even though it's not yet public, there is a way for you to invest in it right now.

Here's how you can buy Miso Robotics stock before its IPO.

Can you buy Miso Robotics in your brokerage?

Miso Robotics is not a public company, which means you can't purchase shares of it in your regular brokerage account. At this point, the company has not made a clear indication of when it plans to go public and has not made its initial IPO filing.

To date, the company has raised $96.3 million from the private markets.

The number of private investors who want to get in — the last funding round closed in 9 days — coupled with the company's $3 million in annual revenue means it is in no rush to go public.

It likely won't go public until the IPO market warms up again, which could be more than a few years away. But that doesn't mean you can't invest in it today.

How to buy Miso Robotics stock in 2026

1. Invest via its investor's website

Miso Robotics is raising capital from individual investors in what's known as a Regulation CF (Reg CF) offering, a crowdfunding campaign which can raise up to $5 million.

In a Reg CF, a company can raise funds from the public without becoming a public company by filing a Form C with the SEC then offering shares via a registered funding portal.

Shares of Miso Robotics are being sold for $4.97 each on its investor website. More than 37,000 investors have participated in the funding.

There is a minimum investment of $1,003.94. There is also a transaction fee of 3.5%.

I'm not sure of the legal structure behind these offerings — it's very atypical for a private company to offer its shares to retail investors — so be sure to do your due diligence and read the disclosures if you're going to participate. That said, it has been registered and approved by the SEC.

2. Invest via Hiive

Accredited investors can purchase shares of Miso Robotics on Hiive, a secondary marketplace where private, VC-backed companies and shareholders can sell stock.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional.

There are 3 listings of Miso Robotics stock on Hiive right now:

Each listing on Hiive is made by a unique seller who sets their own asking price and quantity of shares for sale. Buyers can accept the asking price or place bids and negotiate directly with the sellers.

See the listings for Miso Robotics with the button below:

3. Other ways to invest

Invest in Miso Robotics' partners

Miso Robotics' current list of partners includes Chipotle (CMG), Jack in the Box (JACK), Buffalo Wild Wings (which was purchased and taken private by Arby's in 2017), and White Castle.

Much of the fast food industry is likely to follow the same path and begin automating more of the food preparation and service with robotics.

Companies like McDonald's (MCD), Domino's (DPZ), Wendy's (WEN), Starbucks (SBUX), Papa John's (PZZA), Wingstop (WING), and more will all benefit from significant reductions in cost by implementing similar technology.

I wouldn't be surprised if a handful of these companies built their own equipment, but I expect many more will become customers of Miso Robotics.

In May 2023, the company formed a partnership with Ecolab (ECL) — a water, hygiene, and infection prevention company — to provide food safety solutions to the food service industry. Ecolab joined as both an investor and strategic partner.

Invest in Miso Robotics' competitors

A handful of the company's competitors are:

- Neura Robotics

- Covariant

- Treeswift

- Magazino

- RightHand Robotics

- KeenOn Robotics

- Chef Robotics

However, all of these are private companies, though some are likely available on Hiive.

The machines produced by Miso Robotics will make food preparation and service much cheaper and have the potential to create a boon for the entire industry.

If you want to gain broad-market exposure to this industry, consider these ETFs:

- First Trust Nasdaq Food & Beverage ETF (FTXG)

- Invesco Dynamic Food and Beverage ETF (PBJ)

- Fidelity MSCI Consumer Staples ETF (FSTA)

There are also a few robotics-focused ETFs you may be interested in:

- iShares Robotics and Artificial Intelligence Multisector ETF (IRBO)

- First Trust Nasdaq Artificial Intelligence & Robotics ETF (ROBT)

- ARK Autonomous Technology & Robotics ETF (ARKQ)

More about Miso Robotics

As mentioned above, Miso Robotics generated $3 million in revenue in 2022, a 10x increase since 2020.

The company makes money via a RaaS (Robots-as-a-Service) monthly pricing model. Fees include hardware, software updates, routine maintenance, service calls, training, and live support.

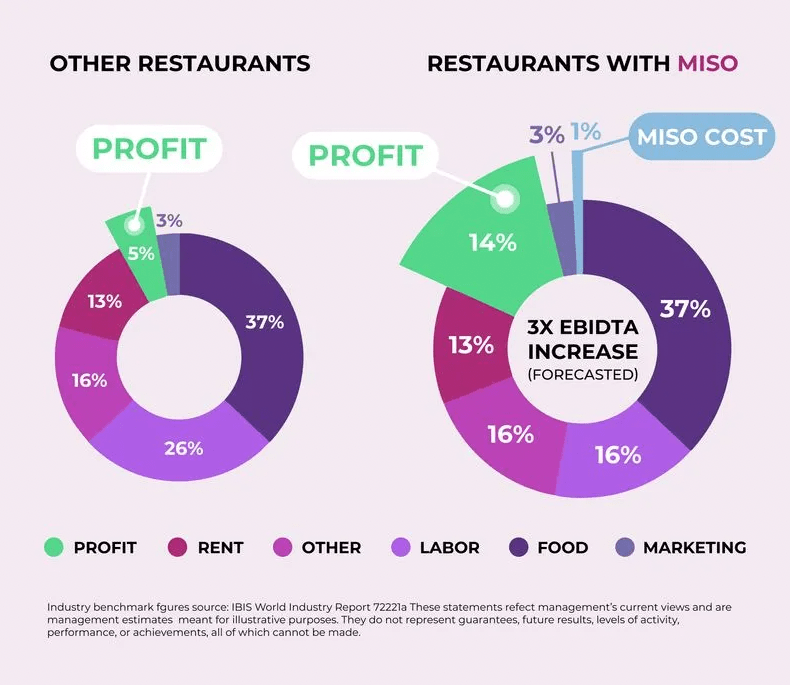

By slashing labor costs, Miso projects restaurants will be 3x more profitable with its AI-powered robots:

Image source: Miso Robotics

According to the company's website, Flippy has fried over 3,000,000 baskets for restaurants like Chipotle, Jack in the Box, Panera, Buffalo Wild Wings, White Castle, and more.

Who owns Miso Robotics?

Miso Robotics was founded in 2016 by Buck Jordan, Rob Anderson, and Ryan Sinnet. Miso is currently led by CEO Rich Hull.

Beyond the management team and founders, early employees and investors are all partial owners of Miso Robotics.

The current list of investors includes private equity and venture capital firms Crowdcube, Seedinvest, Levy Restaurants, MAG Ventures, and Acacia Research, as well as individual investors like Hanson Wong, Adam Morley, and Erhan Bilic.

Does Chipotle own Miso Robotics?

No, Chipotle does not own Miso Robotics. Chipotle is one of Miso Robotics' biggest customers, however, and the two companies have formed a partnership to develop products.

For instance, Miso's “Chippy” was primarily designed for Chipotle's restaurants (it's a robotic tortilla chip maker), though many other restaurants will also become customers.

Additionally, Chipotle is expected to start testing “CookRight” in several locations soon.

How to buy the Miso Robotics IPO

As mentioned above, the company has not made its initial IPO filings with the SEC. This indicates it has no plans to go public in the near future.

When it does go public, the Miso Robotics stock symbol might be MISO, MROB, or MRBT (my ideas). When it does finally have a ticker, you'll need a brokerage account to buy its shares.

If you don't have a brokerage account, we recommend Public.

On Public, you can Invest in stocks, ETFs, Treasuries, and cryptocurrencies all on one of the most well-designed investing platforms.

Miso Robotics valuation chart

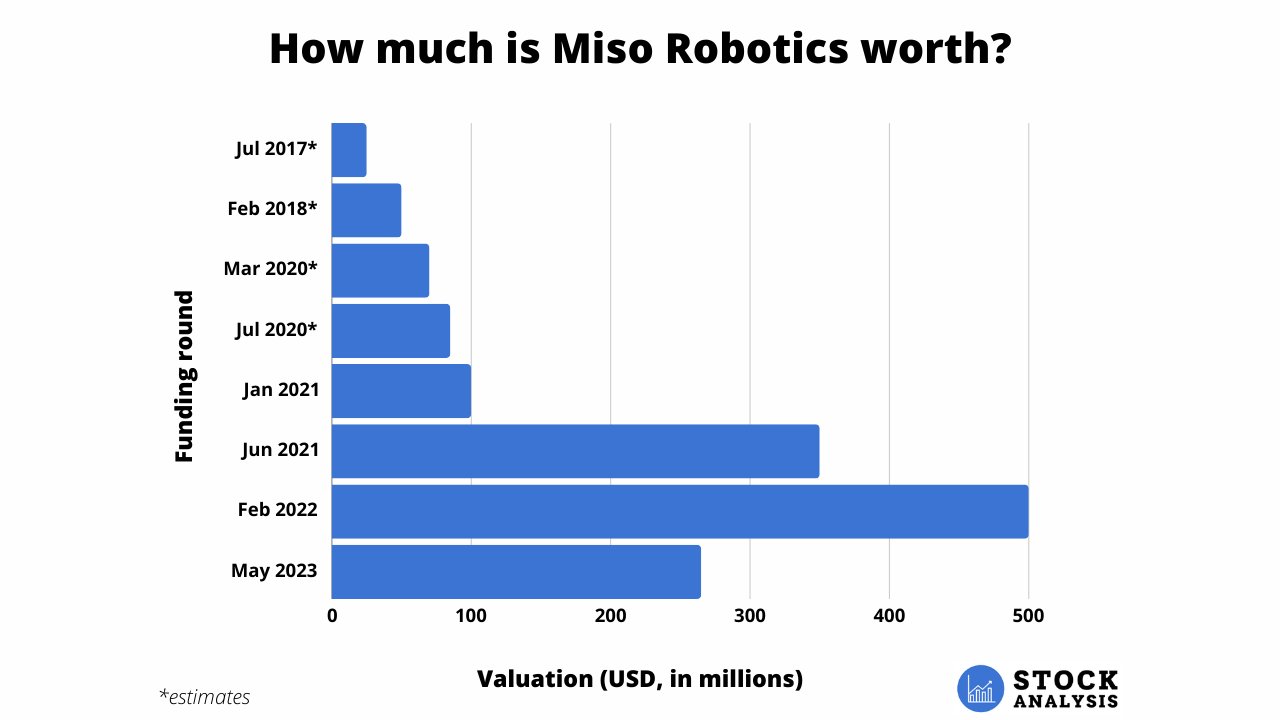

In February 2022, Miso Robotics raised its Series E at a $500 million valuation, up from the $333 million it earned in its Series D in June 2021. This was its highest valuation yet.

However, in May 2023, Ecolab joined as an investor and strategic partner.

While no valuation was announced at the time, I found a comment by Miso's investor relations department that said Ecolab invested at a $265 million pre-money valuation. Shares were purchased at a price of $4.97, the same price being offered on the company's website in October 2024.

Here's a look at how Miso Robotics has changed in valuation over time:

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.

.png)

.png)