How to Buy Miso Robotics Stock in 2024

Robots aren't far from taking over the fast food industry. The company at the forefront of the charge: Miso Robotics.

Miso's flagship product, Flippy 2, is engineered to fry anything — french fries, onion rings, fish, wings, you name it.

Miso also created:

- Sippy: a point-of-sales beverage dispenser

- Chippy: the robot behind Chipotle's tortilla chips

- CookRight: a grilling robot that can tell when food is ready

What this all means is that busy kitchens can produce higher-quality meals faster, cheaper, and more consistently than ever before. Plus, robots never get tired.

Miso Robotics is in a prime position to disrupt the $675 billion global fast food industry. And even though it's not yet public, you can still invest in it right now.

Here's how you can buy Miso Robotics stock before its IPO.

Can you buy Miso Robotics in your brokerage?

Miso Robotics is not a public company, which means you can't purchase shares of it in your regular brokerage account. At this point, the company has not made a clear indication of when it plans to go public and has not made its initial IPO filing.

To date, the company has raised about $100 million from the private markets.

The number of private investors who want to get in — the last funding round closed in 9 days — coupled with the company's $3 million in annual revenue means it is in no rush to go public.

It likely won't go public until the IPO market warms up again, which could be more than a few years away. But that doesn't mean you can't invest in it today.

How to buy Miso Robotics stock in 2024

If you are an accredited investor, the first section below is for you. If you don't qualify as an accredited investor, skip ahead to the second section.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional.

1. How to buy Miso Robotics stock as an accredited investor

Accredited investors can purchase shares of Miso Robotics on Hiive, a secondary marketplace where private, VC-backed companies and shareholders can sell stock.

There is one listing of Miso Robotics stock on Hiive right now:

Each listing on Hiive is made by a unique seller who sets their own asking price and quantity of shares for sale. Buyers can accept the asking price or place bids and negotiate directly with the sellers.

Additionally, there are no fees for buyers.

See the listings for Miso Robotics with the button below:

2. How to invest in Miso Robotics as a retail investor

While there's no way for retail investors to invest directly in Miso Robotics right now, below are a few ideas for gaining indirect exposure.

Invest in Miso Robotics' partners

Miso Robotics' current list of partners includes Chipotle (CMG), Jack in the Box (JACK), Buffalo Wild Wings (which was purchased and taken private by Arby's in 2017), and White Castle.

Much of the fast food industry is likely to follow the same path and begin automating more of the food preparation and service with robotics.

Companies like McDonald's (MCD), Domino's (DPZ), Wendy's (WEN), Starbucks (SBUX), Papa John's (PZZA), Wingstop (WING), and more will all benefit from significant reductions in cost by implementing similar technology.

I wouldn't be surprised if a handful of these companies built their own equipment, but I expect many more will become customers of Miso Robotics.

In May 2023, the company formed a partnership with Ecolab (ECL) — a water, hygiene, and infection prevention company — to provide food safety solutions to the food service industry. Ecolab joined as both an investor and strategic partner.

Invest in Miso Robotics' competitors

A handful of the company's competitors are:

- Neura Robotics

- Covariant

- Treeswift

- Magazino

- RightHand Robotics

- KeenOn Robotics

- Chef Robotics

However, all of these are private companies, though some are likely available on Hiive.

The machines produced by Miso Robotics will make food preparation and service much cheaper and have the potential to create a boon for the entire industry.

If you want to gain broad-market exposure to this industry, consider these ETFs:

- First Trust Nasdaq Food & Beverage ETF (FTXG)

- Invesco Dynamic Food and Beverage ETF (PBJ)

- Fidelity MSCI Consumer Staples ETF (FSTA)

There are also a few robotics-focused ETFs you may be interested in:

- iShares Robotics and Artificial Intelligence Multisector ETF (IRBO)

- First Trust Nasdaq Artificial Intelligence & Robotics ETF (ROBT)

- ARK Autonomous Technology & Robotics ETF (ARKQ)

More about Miso Robotics

As mentioned above, Miso Robotics generated $3 million in revenue in 2022, a 10x increase since 2020.

The company makes money via a RaaS (Robots-as-a-Service) monthly pricing model. Fees include hardware, software updates, routine maintenance, service calls, training, and live support.

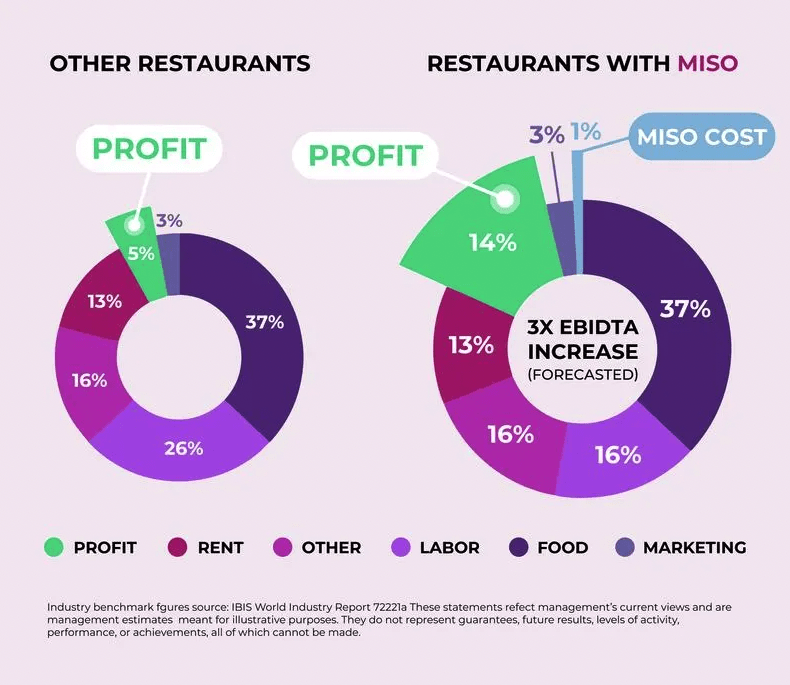

By slashing labor costs, Miso projects restaurants will be 3x more profitable with its AI-powered robots:

Image source: Miso Robotics

According to the company's website, Flippy 2 is on pace to cook over 1,000,000 baskets in 2023 for restaurants like Chipotle, Jack in the Box, Panera, Buffalo Wild Wings, White Castle, and more.

Who owns Miso Robotics?

Miso Robotics was founded in 2016 by Buck Jordan, Rob Anderson, and Ryan Sinnet. Miso is currently led by CEO Rich Hull.

Beyond the management team and founders, early employees and investors are all partial owners of Miso Robotics.

The current list of investors includes private equity and venture capital firms Crowdcube, Seedinvest, Levy Restaurants, MAG Ventures, and Acacia Research, as well as individual investors like Hanson Wong, Adam Morley, and Erhan Bilic.

Does Chipotle own Miso Robotics?

No, Chipotle does not own Miso Robotics. Chipotle is one of Miso Robotics' biggest customers, however, and the two companies have formed a partnership to develop products.

For instance, Miso's “Chippy” was primarily designed for Chipotle's restaurants (it's a robotic tortilla chip maker), though many other restaurants will also become customers.

Additionally, Chipotle is expected to start testing “CookRight” in several locations soon.

How to buy the Miso Robotics IPO

As mentioned above, the company has not made its initial IPO filings with the SEC. This indicates it has no plans to go public in the near future.

When it does go public, the Miso Robotics stock symbol might be MISO, MROB, or MRBT (my ideas). When it does finally have a ticker, you'll need a brokerage account to buy its shares.

If you don't have a brokerage account, we recommend Public.

On Public, you can Invest in stocks, ETFs, Treasuries, and cryptocurrencies all on one of the most well-designed investing platforms.

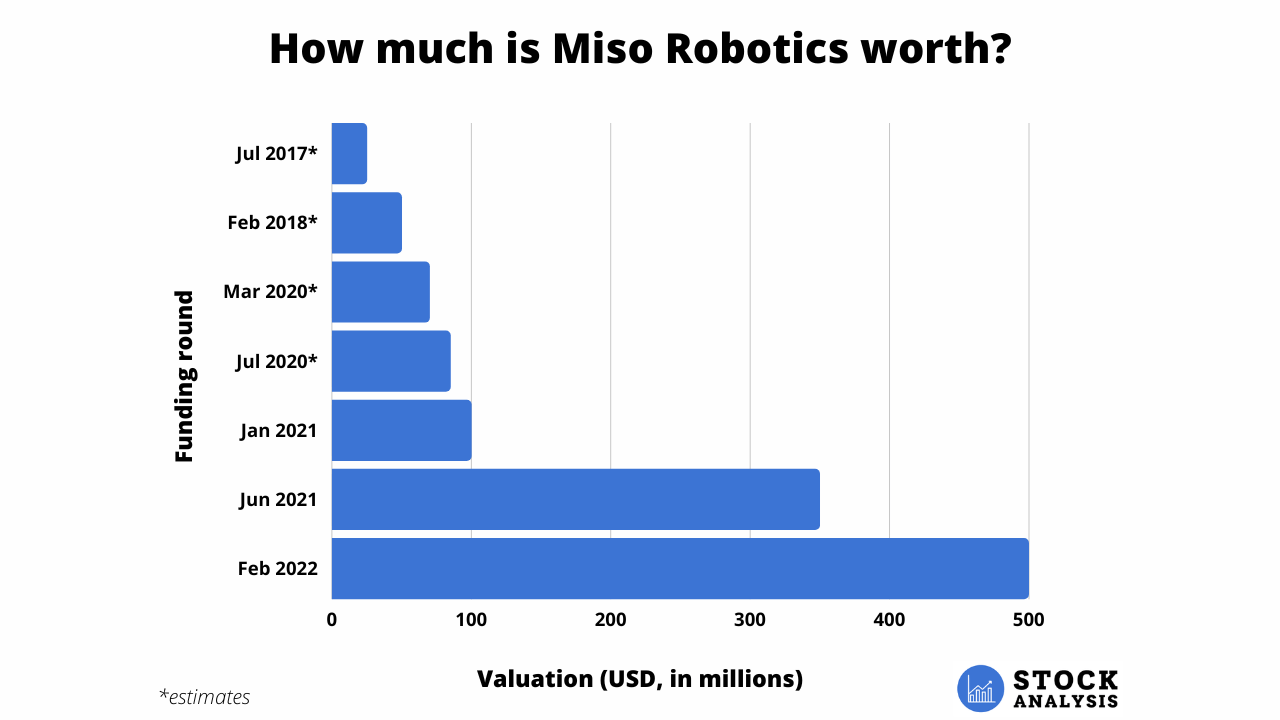

Miso Robotics valuation chart

Here's how Miso Robotics has changed in valuation over time at each funding round:

.png)

.png)