How to Buy Ripple Stock Before Its IPO

Ripple Labs provides financial services via blockchain technology.

The company is best known for creating XRP (aka "Ripple"), the 4th largest cryptocurrency in the world.

XRP was created as an alternative to SWIFT, a system that banks and other financial institutions use to facilitate international money transfers.

Leveraging blockchain technology, XRP acts as a bridge currency and can facilitate real-time transactions at a fraction of the cost of traditional methods.

More recently, Ripple has expanded beyond payments into areas like digital asset custody, liquidity and prime brokerage for institutions, and corporate treasury management — positioning itself as a broader financial infrastructure provider.

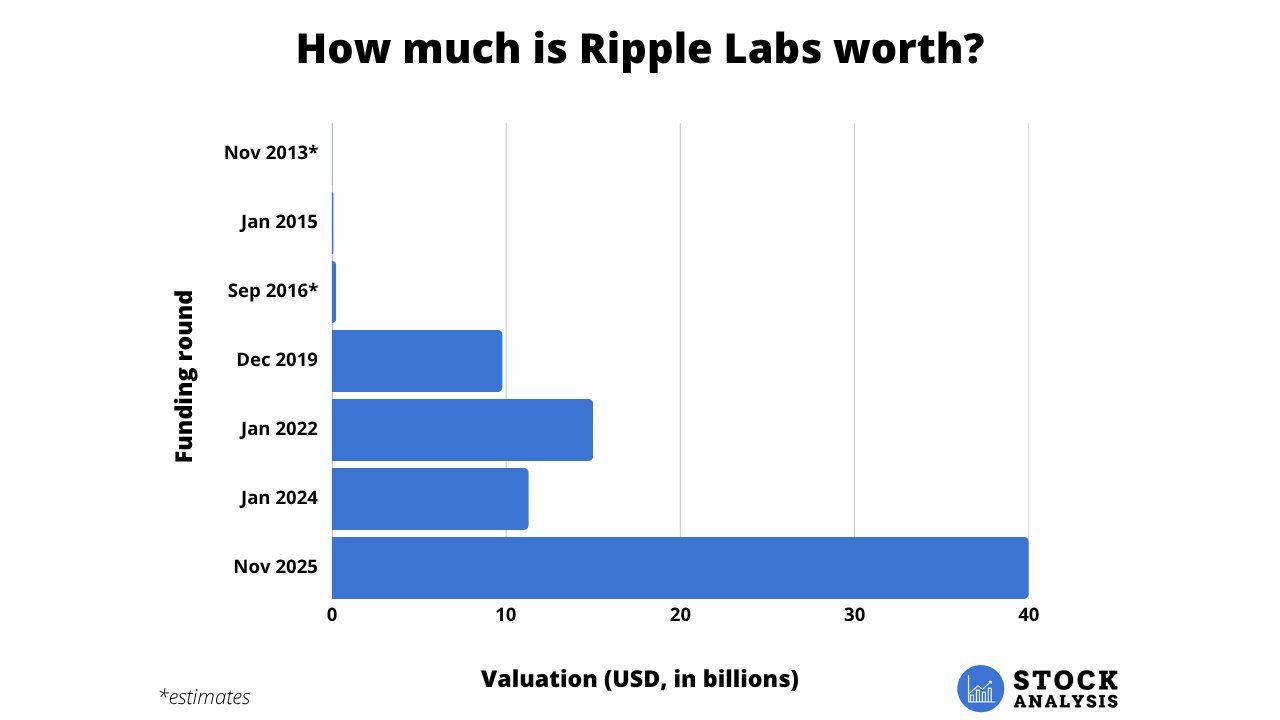

The strategy appears to be paying off. Ripple described 2025 as a record year of growth, and investors have taken notice. In November, the company raised $500 million at a $40 billion valuation — nearly quadrupling its valuation from January 2024.

Still, an IPO isn't expected before 2027 (more on that below).

But for those who don't want to wait, there is a way to invest in Ripple Labs before it goes public, if you qualify.

How to buy Ripple stock in 2026

If you're an accredited investor, you can buy shares of Ripple Labs on the secondary market.

To qualify as an accredited investor, you need to either a) have an annual income of $200,000 as an individual or $300,000 as a married couple or b) have a net worth exceeding $1,000,000 (excluding your primary residence).

If you don't qualify as an accredited investor, you can skip down to the section for retail investors below.

1. How to buy Ripple stock as an accredited investor

Hiive is a secondary marketplace where accredited investors can buy shares of private companies before they go public.

As of the time of writing, there are 93 live orders for Ripple Labs on Hiive, making it one of the most actively traded stocks on the platform:

On Hiive, investors can buy shares directly from employees, venture capital or hedge funds, angel investors, or anybody else with shares to sell.

Investors can accept a seller's asking price as listed or place bids and negotiate with sellers. They can also add companies to their watchlist and get notified of any new transactions or listings.

See the current bids and asks for Ripple Labs on Hiive:

2. Can you invest in Ripple stock as a retail investor?

There is currently no way for retail investors to invest directly in Ripple Labs.

If you're wondering how to invest in XRP, you can do so on most major crypto exchanges (Binance, Kraken, Coinbase, Robinhood, eToro, and Bitstamp) — but buying XRP is not the same as investing in Ripple Labs.

Technically, individual investors can get indirect exposure to Ripple Labs by investing in Alphabet (GOOGL), Google's parent company. Google Ventures, Alphabet's venture capital arm, invested in Ripple Labs back in 2015.

However, Google likely invested about $10 million. Although its stake has roughly 40x'd in value, that $400 million stake is still just a fraction of Alphabet's $3 trillion market capitalization.

As a retail investor, you may be best off waiting for Ripple Labs' IPO.

How to buy the Ripple IPO

While several crypto companies — including Circle (CRCL) — have gone public, Ripple doesn't appear to be in any rush.

Monica Long, president of Ripple, said an IPO “is not on the radar” for now, noting that the company's strong balance sheet and liquidity give it room to expand without raising public capital.

Though not a current focus, an IPO remains the logical next step in Ripple's long-term trajectory.

When it does go public, the Ripple stock symbol might be something like RLAB or RIPL.

When it does finally have a ticker, you'll need a brokerage account to buy shares. If you don't have a brokerage account, we recommend Public.

On Public, you can invest in stocks, ETFs, Treasuries, and cryptocurrencies, all on one of the most well-designed investing platforms.

Who owns Ripple?

Ripple has raised $893.9 million from 71 investors, including Pantera Capital, Andreessen Horowitz, Blockchain Capital, Seagate Technology, Google Ventures, Siam Commercial Bank, Westpac Banking Corporation, and others.

In addition to its private equity investors, Chris Larsen, an angel investor and co-founder of Ripple, owns roughly 18% of the company. Brad Garlinghouse, the current CEO, also owns 6.3%.

Larsen and Garlinghouse also own large amounts of XRP.

Ripple valuation chart

Ripple most recently raised $500 million at a $40 billion valuation in November 2025, almost four times the $11.3 billion valuation it received during a secondary share sale in January 2024.

Including its two share buybacks (January 2022 and January 2024), here's a look at how Ripple Labs' valuation has changed over time:

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.

.png)