How to Buy Ripple Stock Before Its IPO

Ripple Labs provides financial services via blockchain technology.

Its solutions are faster, more transparent, and more cost-effective than traditional financial services.

Ripple's customers use these solutions to source crypto assets, make instant payments, engage new audiences, reduce capital requirements, and drive new revenue.

It also has its own cryptocurrency, Ripple (XRP). Like its parent company, XRP is very unique. It has a demonstrated use case tied to financial settlement, faster and lower-energy transactions than Bitcoin, and a fixed supply (no mining).

Ripple Labs has had no issue garnering attention. In addition to its enterprise-technology products and having its own cryptocurrency, the company has been engaged in a highly publicized lawsuit brought by the SEC.

In 2020, the SEC accused Ripple and its founders of violating securities laws by selling $1.3 billion of its native cryptocurrency, XRP, without registering it first.

In July 2023, the court issued a summary judgment wherein both parties secured a partial victory, though the case is still dragging on.

With the lawsuit almost behind it, many investors are wondering how to invest in Ripple Labs. Here's how to buy Ripple stock before its IPO.

Can you buy Ripple stock?

Ripple Labs is a private company, which means it doesn't trade on any public exchange and you can't purchase shares of it in your regular brokerage account.

At this point, the company has not made a clear indication of when it plans to go public and has not made its initial IPO filing.

To date, the company has raised about $295 million from the private markets, and there's already been plenty of interest in future funding rounds.

Plus, based on the continued interest from venture capital investors, Ripple Labs has no need to go public until it's ready.

But that doesn't mean you can't invest in it today.

How to buy Ripple stock in 2024

If you have an annual income of $200,000 as an individual or $300,000 as a married couple, or if you have a net worth exceeding $1,000,000 (excluding your primary residence), then you qualify as an accredited investor.

The first section below is for you.

If you don't qualify as an accredited investor, you can skip down to the section for retail investors below.

1. How to buy Ripple stock as an accredited investor

Hiive is a secondary marketplace where accredited investors can buy shares of private companies before they go public.

As of the time of writing, there are 11 unique listings (sellers offering shares) for Ripple Labs:

On Hiive, investors can buy shares directly from employees, venture capital or hedge funds, angel investors, or anybody else with shares to sell.

Investors can place bids and negotiate with sellers or accept their asking prices.

Plus, on Hiive, only the sellers pay fees.

See the current bids and asks for Ripple Labs on Hiive:

2. Can you invest in Ripple stock as a retail investor?

There is currently no way for retail investors to invest directly in Ripple Labs. However, you can invest in its cryptocurrency called XRP.

Keep in mind that cryptocurrencies are extremely risky and that an investment in XRP is not an investment in Ripple Labs.

That said, the pending lawsuit against Ripple has made it more difficult to buy XRP, as several U.S.-based exchanges have delisted the cryptocurrency (most notably Coinbase). You can still buy it on Binance and several other brokerages, like eToro.

Alphabet's (GOOGL) venture capital arm Google Ventures also invested in Ripple Labs back in 2015, though the amount invested was less than $30 million, which is just a fraction of Alphabet's $1.75 trillion market capitalization.

As a retail investor, you may be best off waiting for Ripple Labs' IPO.

How to buy the Ripple IPO

Ripple Labs has not made any IPO filings with the SEC.

The company's CEO, Brad Garlinghouse, mentioned an IPO back in 2020, though the SEC lawsuit has delayed those plans.

When it does go public, the Ripple stock symbol might be something like RLAB, RIPL, or XRP. When it does finally have a ticker, you'll need a brokerage account to buy shares.

If you don't have a brokerage account, we recommend Public.

On Public, you can Invest in stocks, ETFs, Treasuries, and cryptocurrencies, all on one of the most well-designed investing platforms.

Who owns Ripple?

Ripple has been funded by 43 investors including Pantera Capital, Andreessen Horowitz, Blockchain Capital, Seagate Technology, Google Ventures, Siam Commercial Bank, Westpac Banking Corporation, and others.

In addition to its private equity investors, Chris Larse, an angel investor and co-founder of Ripple, owns 17% of the company. Brad Garlinghouse, the current CEO, also owns 6.3%. Larsen and Garlinghouse also own large amounts of XRP.

Ripple Labs is a private company, so it isn't required to disclose its ownership.

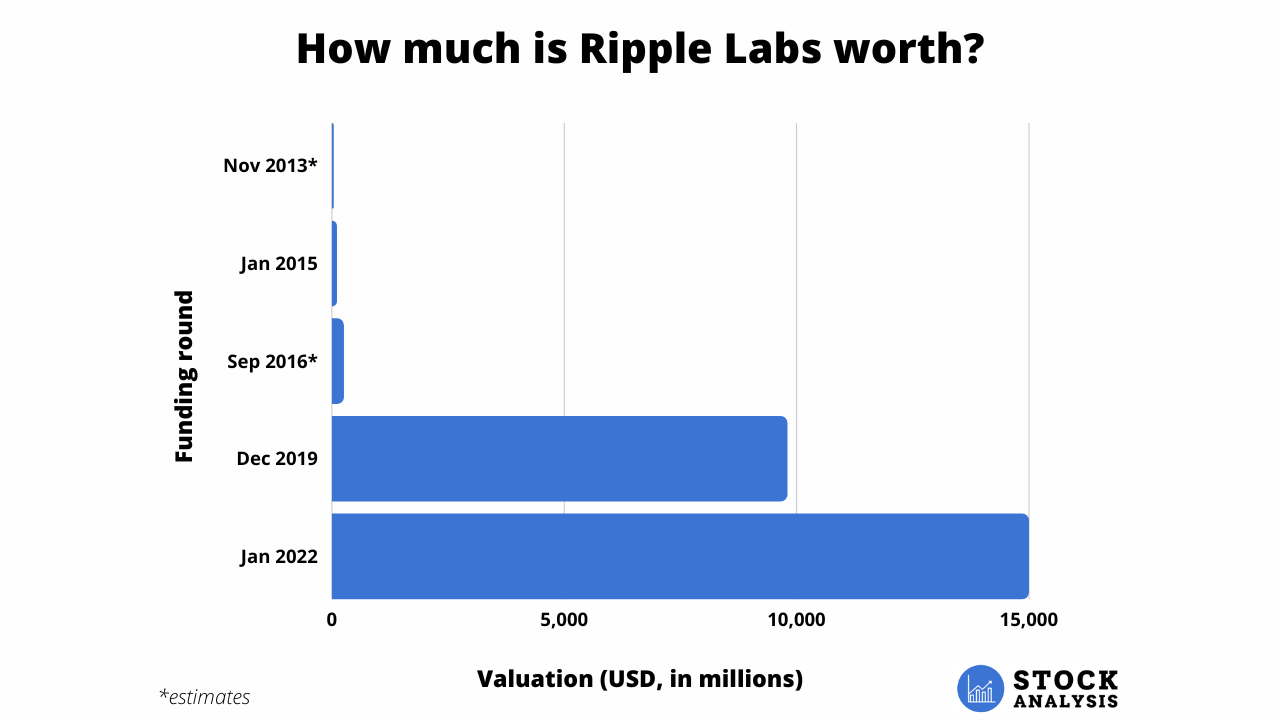

Ripple valuation chart

Here's how Ripple has changed in valuation over time at each funding round:

In January 2022, while the lawsuit was in full swing, Ripple Labs bought out its Series C investors at a valuation of $15 billion after its payments business doubled in 2021.

This buyback indicates the company is very bullish on its own prospects.

.png)