How to Invest in Anduril Stock in 2025

The Department of Defense has deep pockets.

In 2024, the DoD had a budget of $841.4 billion.

A lot of this budget is sent to defense contractors, fueling multi-billion dollar corporations like Boeing, Lockheed Martin, and Northrop Grumman. While there are many smaller players in the industry, no company has had the technology to compete with the legacy contractors.

Until Anduril.

Anduril Industries is a defense technology company that specializes in autonomous vehicles, machine learning, and artificial intelligence. It builds surveillance towers, counter-drone technology, unmanned systems, and more.

It's not an overstatement to say that its technology could change the future of war, a fact not lost on investors.

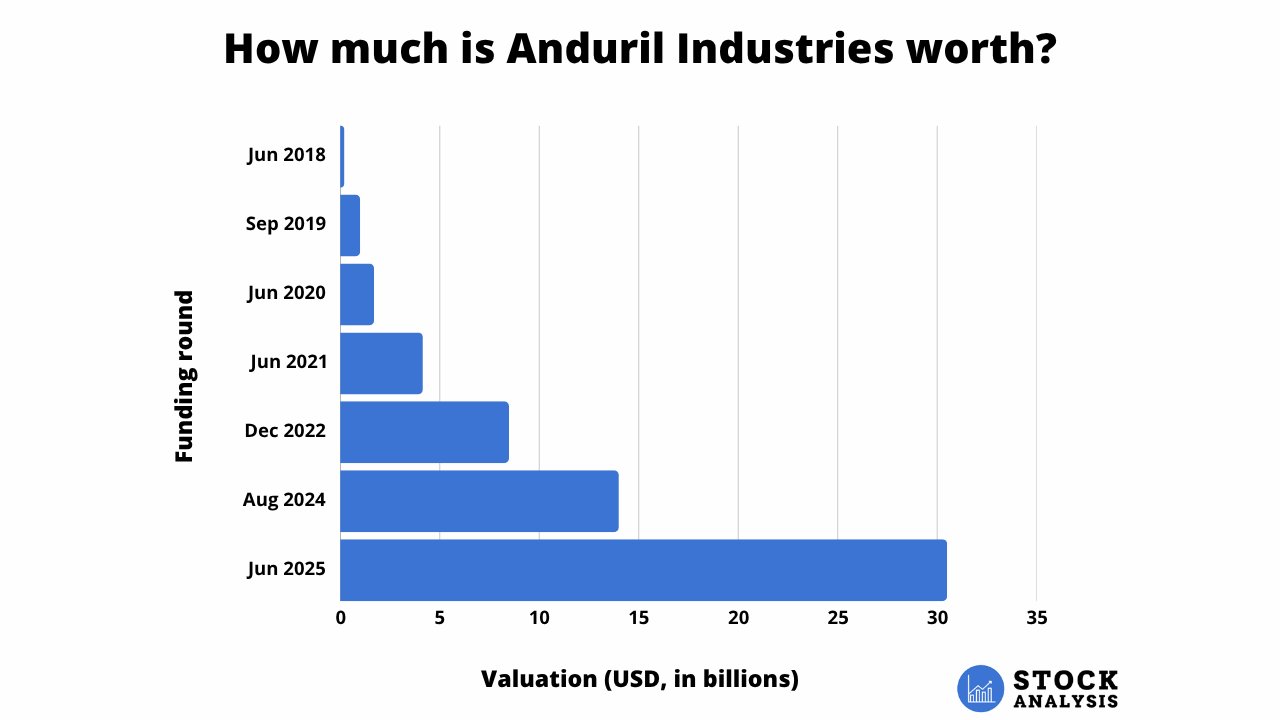

In June, Anduril closed one of the largest funding rounds of 2025 — $2.5 billion at a $30.5 billion valuation (up from $14 billion in August 2024). The round was 8x oversubscribed, and comes after the company more than doubled its annual revenue in 2024 to about $1 billion.

Notably, Anduril just won a contract for developing new AR/VR headsets for the U.S. Army. The contract, which has a total budget of $22 billion, was originally granted to Microsoft but was reassigned to both Microsoft and Anduril in February.

And, even though it's still a private company, there's a way for you to invest in it, too.

How to invest in Anduril in 2025

Anduril Industries is a private company, meaning there is no stock symbol and no way for you to buy it in your traditional brokerage account. This will continue to be the case until it becomes publicly traded, either through an IPO or a direct listing.

While a future IPO is the goal, Luckey indicated in an interview in September 2023 that it would likely be at least three years before they took the company public.

Still, although it's not a public company, there is a way for accredited investors to buy Anduril stock today — via Hiive.

Accredited investors

Hiive is a marketplace which gives accredited investors access to high-growth, VC-backed startups.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly

- Have a net worth that exceeds $1,000,000, excluding your primary residence

- Be a qualifying financial professional

There are over 2,000 private companies available for investment on Hiive, including Anduril:

There are 62 listings of Anduril stock available on Hiive (as of the time of this writing).

Each of these listings was created by a unique seller. Sellers may be current or former employees, venture capitalists, or angel investors.

After a seller creates a listing, buyers can either accept their asking price as listed or place bids and negotiate directly with the sellers. Buyers can also add a company to their watchlist and get notified of any new listings or successful transactions.

If you qualify as an accredited investor, you can see the complete order book (all bids, asks, and transactions) for every company on Hiive. You can create an account for free with the button below:

Retail investors

Unfortunately for retail investors, Hiive is only available to accredited investors. However, there is a way for retail investors to gain exposure.

The Fundrise Innovation Fund is a venture capital fund that is open to all investors. The fund invests in private, high-growth technology companies. It has invested in 20 pre-IPO companies including OpenAI, Anthropic, Canva, and Anduril:

The Innovation Fund's investment team believes Anduril will help transform the military complex and has the potential to save taxpayers hundreds of billions of dollars, and may be one of the most important companies of our generation.

The fund has an annual management fee of 1.85% and a minimum investment of $10.

Alternatives to investing in Anduril Industries

1. Wait for its IPO

The simplest way for retail investors to invest directly in Anduril is to simply wait for its IPO. Unfortunately, this might take some time.

As referenced above, Luckey gave an interview in September 2023 in which he indicated it was unlikely the company would have its IPO before late 2026. He's waiting until 1) the IPO market warms up again and 2) his company is in shape for Wall Street.

When Anduril does have its initial public offering, you'll need a brokerage account to buy shares. If you need a brokerage account, we recommend Public.

On the platform, you can invest in stocks, ETFs, Treasuries, corporate bonds, cryptocurrencies, and collectibles, all from one account.

2. Invest in other defense contractors

Though Anduril has a unique team of founders with expertise in VR, tech, and defense contracts, it's not the only company making autonomous vehicles and tech.

Here are a few other investment opportunities you may be interested in:

- Boeing (BA) produces unmanned vehicles that operate on land, sea, air, and in space. The company is worth $127 billion and generated $73.3 billion in revenue in the last 12 months.

- Lockheed Martin (LMT) also produces autonomous products like UAVs and software for piloting unmanned aircraft. Lockheed Martin brought in $71.3 billion in revenue in the last year and is valued at $116.5 billion.

- Northrop Grumman (NOC) has its own line of autonomous systems, which includes helicopters, aircraft, and submarines. The company is valued at $70 billion and earned $41 billion in revenue in the last 12 months.

- Raytheon (RTX) also has a number of autonomous defense solutions. The company has TTM sales of $79 billion and a market capitalization of $160 billion.

While it may not be as exciting as investing in a startup, each of these companies has a long history of developing and selling defense solutions to the U.S. government.

They also have very deep pockets, which is a massive advantage when developing new technologies.

What is Anduril Industries?

Anduril Industries was founded on the thesis that the future of military tech relies more on advances in computer and software engineering, and less on hardware.

In simple terms, Anduril is where Silicon Valley meets the Pentagon.

With that thesis in mind, everything the company builds is capable of functioning autonomously. Each of its products are integrated with and operated by an AI-powered operating system called Lattice OS.

Anduril has contracts with the governments of the U.S., the U.K., Australia, and more. Below are a few examples of how they're using its technology:

- Surveillance towers: In March 2018, Anduril launched a test program with four of its Sentry Towers to detect human trafficking and drug smuggling at the Mexican border. According to the U.S. Customs and Border Protection, 200 additional towers were purchased following the pilot.

- Warfare software: In 2020, Anduril received a contract from the Air Force to work on the Advanced Battle Management System (ABMS), which allows forces to operate together via a secure network, allowing quick, real-time decision making.

- Counter-drone tech: In 2022, Anduril won an almost $1 billion, decade-long contract with Special Operations Command to provide counter-drone capabilities through its Lattice AI platform.

- Unmanned systems: In 2023, the U.K.'s Ministry of Defence (MoD) awarded Anduril a $21.4 million (initial), 31-month contract to explore the use of unmanned aerial systems in the Royal Air Force.

In early 2024, Anduril beat out Lockheed, Northrop, and Boeing in a program to develop and test small unmanned fighter jet prototypes.

And in December 2024, Archer Aviation (ARCH) announced a partnership with Anduril to develop hybrid aircraft for urban and defense applications, sending Archer's stock up nearly 15%.

Who founded Anduril?

Anduril was founded by Palmer Luckey, who also founded Oculus, a virtual reality headset company acquired by Meta (META) for $2 billion.

In June 2017, Luckey partnered with former Palantir (PLTR) executives Matt Grimm, Trae Stephens, and Brian Schimpf, along with Oculus' former hardware lead, Joe Chen, to form Anduril.

Together, the team believes its unique set of experiences in virtual reality, hardware, technology, and defense contracting will help it disrupt the defense industry.

More about Anduril

1. Revenue

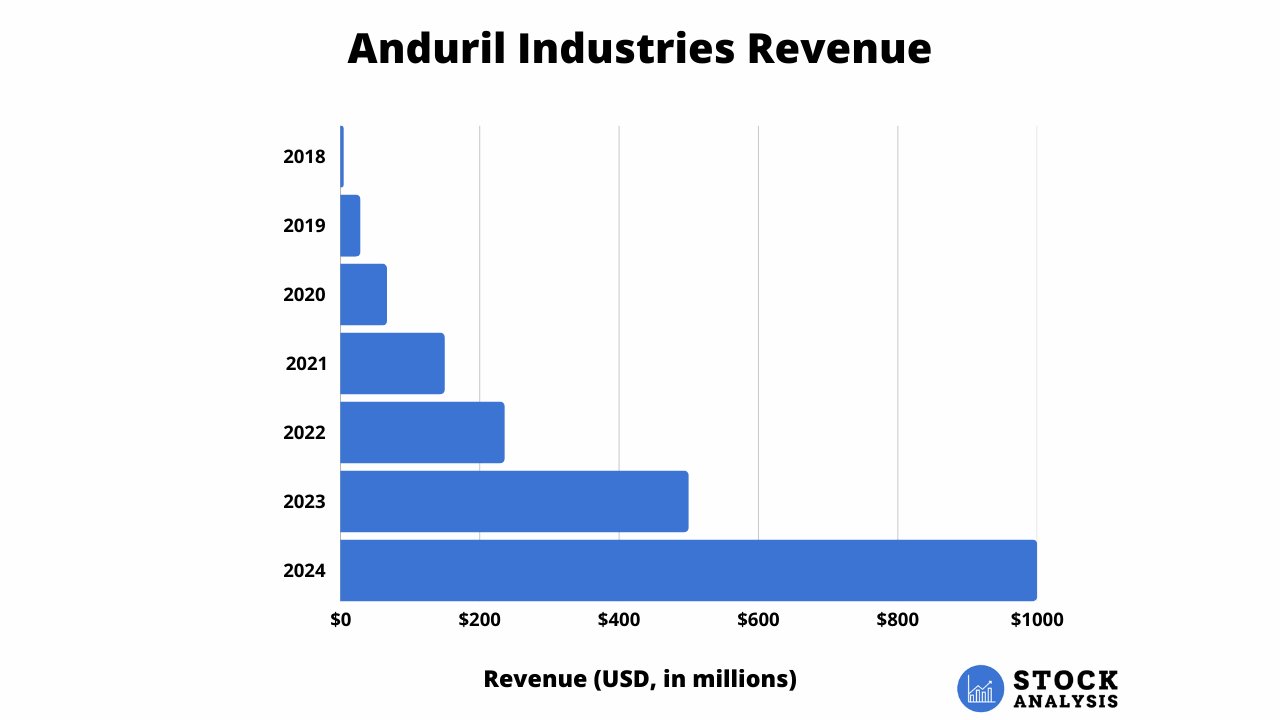

Anduril's revenue has grown at an impressive clip as it continues to land more and more contracts.

After doubling its revenue in 2023 to $500 million, Anduril doubled its revenue again in 2024 to $1 billion.

Here's a quick look at its revenue over the last few years, according to Sacra:

While the bulk of its revenue has come from the U.S. government, Anduril also has contracts with the governments of Australia and the U.K.

2. Products

The company's flagship product is Lattice, which combines data from drones, cameras, and satellites to create a real-time situational awareness platform for military personnel. They can then use this information to make crucial decisions.

In addition to the command and control software, Anduril produces autonomous vehicles and systems to complete the network.

A few of its other products are:

- Anvil, an unmanned aerial vehicle that rams other drones using computer vision.

- Ghost 4, an autonomous tactical drone that is incredibly quiet and hard to track.

- ALTIUS, a series of tube-launched, unmanned aerial vehicles designed to accept modular payloads that can be operated in a mesh network.

- Dust, a ground-based sensor intended to detect people and objects with a limited line of sight.

- Dive-LD, an autonomous underwater vehicle used for surveillance and inspection.

- Fury, a long-range, subsonic military drone for surveillance and combat operations.

- Roadrunner, a turbojet-powered aircraft used for surveillance and to intercept cruise missiles and manned aircraft.

- Sentry Tower, a solar-powered surveillance tower operating autonomously with radar and thermal imaging.

- Rocket motors, which are used for defense and space launch systems.

3. What does the name “Anduril” mean?

Anduril is a reference to The Lord of the Rings book series written by J.R.R. Tolkien. Anduril is the sword of Aragon, one of the primary protagonists.

The name means “the flame of the West.”

Who owns Anduril?

Anduril was founded by Palmer Luckey, Matt Grimm, Trae Stephens, Brian Schimpf, and Joe Chen. In addition to the co-founders, current and former employees also own some portion of the company via stock options.

Anduril also has 49 investors including Andreessen Horowitz, Sands Capital, Counterpoint Global, Baillie Gifford, Thrive Capital, Valor Equity Partners, and Peter Thiel's Founders Fund. The company has raised more than $6.2 billion in funding.

The exact ownership split is not publicly available.

Anduril Industries valuation chart

In June 2025, Anduril closed an enormous $2.5 billion round that valued the company at $30.5 billion*, more than double the $14 billion valuation it received at its last round in August 2024.

*The round was led by Founders Fund, which committed $1 billion, and was 8x oversubscribed (meaning the amount of capital offered by investors was eight times higher than the target amount the company was aiming to raise).

Here's a look at how Anduril's valuation has changed over time:

Source: Crunchbase

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.