6 Ways to Invest in Anthropic

While ChatGPT dominated the early headlines, another AI chatbot has been rapidly gaining ground: Claude.

Claude is an AI system that can analyze large volumes of information, generate and edit text, write code, and help automate complex workflows. It's built by Anthropic, an AI safety and research company founded in 2021 by former OpenAI executives.

Anthropic's growth has been explosive. In early 2026, the company reached a $14 billion annual revenue run rate, more than 10x what it was generating just a year earlier. Management is also projecting up to $26 billion in annualized revenue by the end of 2026.

Unsurprisingly, investors have been pouring in.

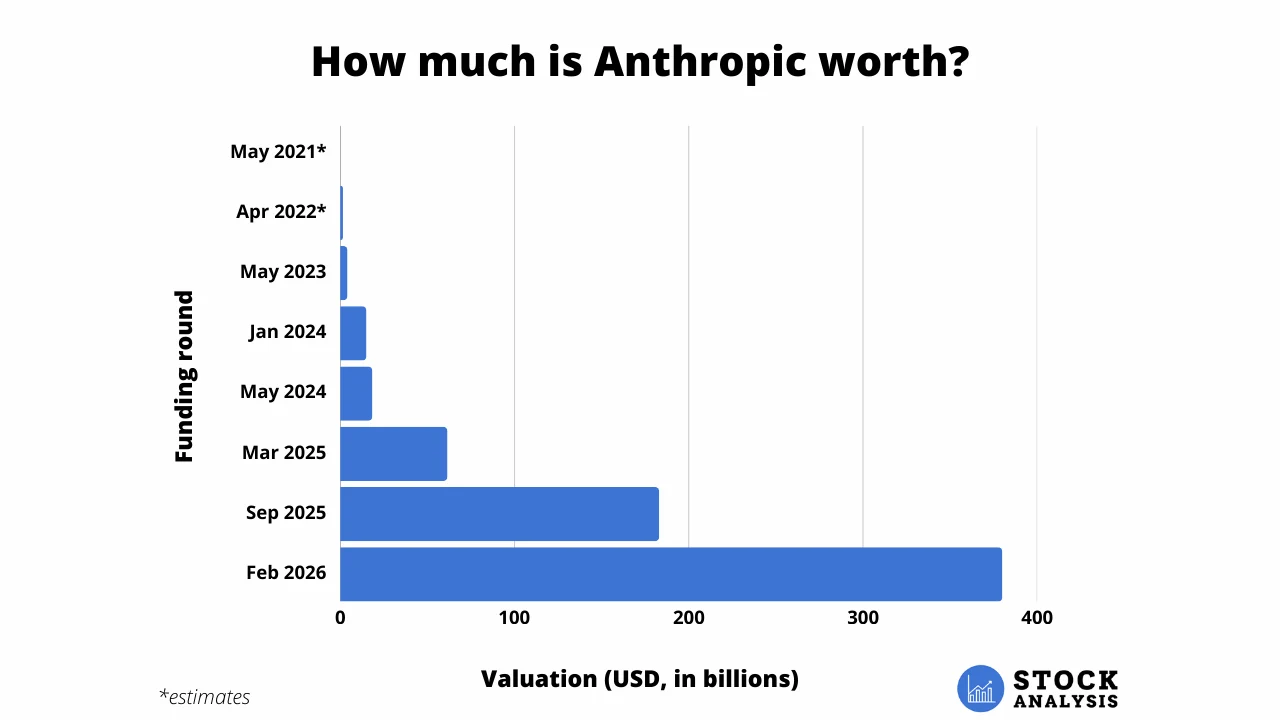

In February 2026, Anthropic raised $30 billion at a $380 billion valuation, more than doubling its valuation in just five months. Initially seeking just $10 billion, the round was 6x oversubscribed, prompting Anthropic to triple the size of the raise.*

*Nvidia ($10 billion) and Microsoft ($5 billion) are major participants in the round, joining existing investors Google and Amazon on the cap table.

The raise came just two months after reports suggested Anthropic was exploring a potential IPO in the first half of 2026, although the company later clarified that discussions were informal and that no final decisions had been made.

While an IPO may be coming in 2026, Anthropic is still a private company for now. But you don't have to wait for it to go public to get exposure.

Here are six ways to invest in Anthropic stock before the IPO.

1. Buy shares directly from current shareholders

Despite Anthropic being a private company, it is possible to buy shares of its stock through a secondary marketplace called Hiive.

Hiive is a pre-IPO marketplace platform that allows accredited investors to buy and sell shares in private companies and startups.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional.

There are over 3,000 pre-IPO companies on Hiive, including Databricks, Figure AI, and Anthropic:

Anthropic is one of the most active companies on Hiive. There are 46 orders of its stock available as of the time of writing.

Listings are created by existing shareholders who are typically current or former employees, venture capitalists, or angel investors.

Every seller sets their own asking price and quantity of shares. Buyers can either accept the asking prices or place bids.

After creating an account, both buyers and sellers can see the full order book of bids and asks and see the exact prices at which Anthropic's shares are trading.

Hit the button below to create your free account:

Forge is another pre-IPO marketplace where accredited investors can find Anthropic shares. Because secondary pricing and availability vary by platform, it can be worth comparing listings on both Forge and Hiive to make sure you're getting the best price.

2. Invest in the Fundrise Innovation Fund

Fundrise's Innovation Fund is a venture capital fund that is open to all investors.

The fund invests in privately held technology companies across multiple verticals, including artificial intelligence, machine learning, and big data. It has invested in 20 pre-IPO companies and has stakes in OpenAI, Anduril Industries, and Anthropic.

The Innovation Fund has a minimum investment of just $10 and a 1.85% annual management fee.

As is the case with the ARK Venture Fund (which I cover next), Anthropic is just one of the Innovation Fund's holdings.

If you do invest in either of these funds, remember that you're buying a stake in the entire portfolio. You can learn more about the Innovation Fund here.

3. Invest in the ARK Venture Fund

Another way to gain exposure to Anthropic is to invest in Cathie Wood's ARK Venture Fund.

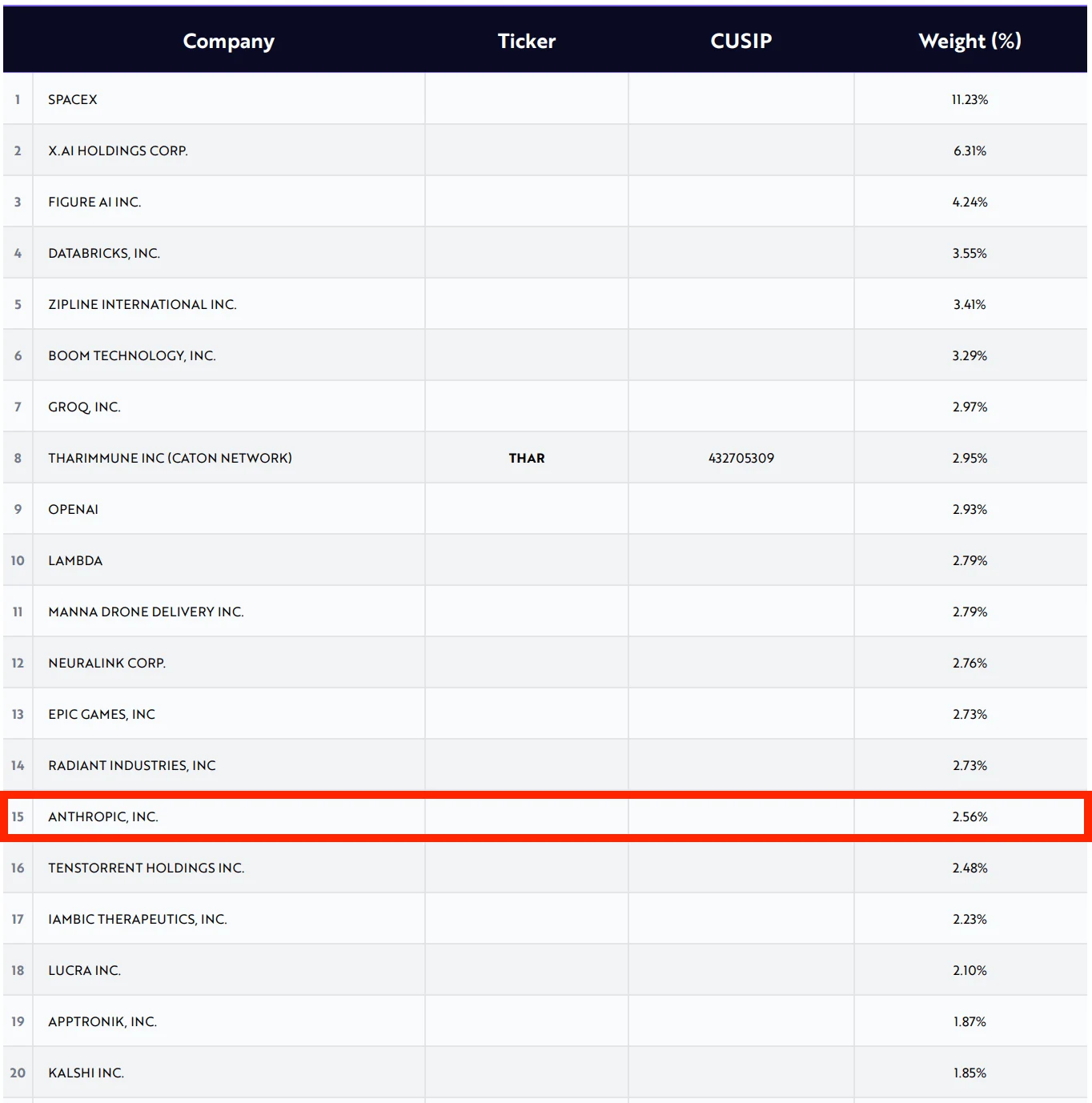

At the end of January, Anthropic made up 2.56% of the fund, its 15th largest position:

The fund invested in Anthropic in July 2023. It likely invested at a valuation of between $2–4 billion, which would mean the stake has at least 95x'd in value.

The ARK Venture Fund invests in what it considers to be the world's most innovative companies, public or private. That said, 9 of its top 10 positions (which include SpaceX, xAI, Figure AI, and OpenAI) are all private companies.

The fund has total annual fees of 2.90%. You can go to ARK's website for more information and to learn how to invest in the fund.

4. Invest in Anthropic's stakeholders

As mentioned above, Anthropic has received investments from all four of the major tech companies — Google, Microsoft, Nvidia, and Amazon.

In April 2023, Google (GOOGL) invested $300 million in Anthropic, giving it a 10% stake in the AI lab. Shortly thereafter, Anthropic announced it would also be using Google's cloud computing services.

Google invested an additional $2 billion in October 2023 and another $1 billion in January 2025, bringing its total investment to $3.3 billion.

In total, Google owns ~14% of Anthropic. But even that stake is overshadowed by Amazon's.

In September 2023, Amazon (AMZN) invested $1.25 billion in Anthropic and struck a deal to invest as much as $4 billion in the company. In May 2024, Amazon wrote a check for the remaining $2.75 billion.

In November 2024, Amazon invested an additional $4 billion*, bringing its total funding to $8 billion. As part of the deal, AWS became Anthropic's primary cloud and training partner.

*This $4 billion was raised as a convertible note, a type of debt that can be converted to equity (at a pre-determined valuation) at a later date. The valuation was not disclosed.

In all, Amazon is estimated to own somewhere around 15–19% of Anthropic.

In November 2025, Nvidia (NVDA) and Microsoft (MSFT) committed to joining the cap table with investments of $10 billion and $5 billion, respectively. According to Anthropic, the February 2026 round included "a portion" of those investments. If these investments were made at a $380 billion valuation, the two would have ownership stakes of ~2.8% and ~1.4%.

Alongside the funding, Anthropic purchased $30 billion of compute capacity from Microsoft Azure running on Nvidia systems.

5. Invest in other AI companies and funds

While it's not the same as investing directly in Anthropic, there are other ways to gain exposure to the generative AI ecosystem.

All of the companies listed in the previous section — Microsoft, Amazon, Nvidia, and Google — play critical roles in today's AI stack, whether through model development, cloud infrastructure, or AI-specific hardware.

Google (GOOGL), in particular, is worth highlighting because it operates its own frontier model.

Gemini is consistently ranked among the top large language models, competing directly with ChatGPT and Claude across reasoning, coding, and multimodal benchmarks.

Meta Platforms (META) is another alternative. Meta has invested heavily in AI for more than a decade, with its research efforts spanning large language models, computer vision, and speech processing.

If you'd rather own a basket of AI companies and gain diversified exposure to the space, you can buy an ETF. A few options are:

- Roundhill Generative AI & Technology ETF (CHAT)

- Themes Generative Artificial Intelligence ETF (WISE)

These funds provide broad exposure to companies building models, chips, and infrastructure that power generative AI, without requiring you to pick which lab ultimately comes out on top.

6. Wait for the Anthropic IPO

If none of the above options fit what you're looking for, your final option is to wait for Anthropic to go public.

In December 2025, news broke that Anthropic had engaged with multiple banks to discuss an IPO. According to sources, the lab was considering going public as early as the first half of 2026.

If true, this could position Anthropic in a race to go public with OpenAI, which is also laying the groundwork for a public offering.

When it does go public, you'll need a brokerage account to buy it. And if you happen to be in the market, we recommend Public.

How much is Anthropic worth?

In January 2026, news broke that Anthropic was targeting $10 billion at a $350 billion valuation. The round swelled to $30 billion raised and a $380 billion valuation by the time it closed in February 2026, primarily due to excess investor interest.

Prior to this round, the lab raised $13 billion at a $183 billion valuation in September 2025, which was nearly triple the $61.5 billion valuation it had received just 6 months earlier in March 2025.

Here's a look at Anthropic's valuation history since it was founded in 2021:

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.