How to Invest in Databricks in 2024

Databricks is a cloud-based platform for big data analytics and machine learning.

The platform helps businesses by providing one place for managing data, working on data science projects, developing AI and machine learning tools, and analyzing data.

This makes it easier for companies to make quick, informed decisions, work more efficiently, and create new, smart technologies.

While 2023 was a tough year for cloud software stocks and many other private software companies (like Canva and Stripe), Databricks has reached new heights.

Thanks to a surge in revenue growth, Databricks recently raised an additional $500 million at its highest valuation ever.

Databricks has not made any firm plans to IPO, but there are still ways to invest.

Can you buy Databricks stock in your brokerage account?

Databricks is still a private company.

You can only buy shares of publicly traded companies in your brokerage account. Until its IPO, there will be no Databricks stock symbol and no way for retail investors to directly buy its stock.

However, there is a way for accredited investors to invest in Databricks directly, and there are a handful of ways for retail investors to gain some exposure.

More on that below.

Will Databricks have an IPO?

In late 2022, The Information reported that Databricks told its investors it was planning on an IPO by the summer of 2023.

In June 2023, however, CEO Ali Ghodsi told Bloomberg those plans would be postponed due to the weak market.

That wasn't the first time the company had mentioned an IPO.

It was also on track to IPO in 2021 after raising $1.6 billion at a valuation of $36.4 billion, but it decided to wait until a later date.

When Databricks does go public, you'll be able to look up its stock symbol and buy it in your brokerage account. If you're looking for a new broker, you may want to check out Public.

But, if you don't want to wait for its IPO, read on for how to invest now.

How to invest in Databricks

There are two separate ways to invest in Databricks, depending on whether or not you qualify as an accredited investor.

Are you an accredited investor?

You can qualify as an accredited investor if:

- You have an annual income of $200,000 individually or $300,000 jointly

- Your net worth exceeds $1,000,000, excluding your primary residence

- You are a qualifying financial professional

If you meet one of these requirements, the SEC considers you an accredited investor and allows you to invest in what it considers to be “riskier” assets. This includes investing in private companies.

If you don't qualify as an accredited investor, you're a retail investor — skip ahead to section two below.

1. How to invest in Databricks as an accredited investor

As mentioned above, being an accredited investor gives you access to privileged asset classes like venture capital, hedge funds, and private equity.

This includes investing in private startups.

Hiive is a marketplace platform for investing in high-growth, VC-backed startups and private companies like OpenAI and Databricks:

Databricks is one of the most actively-traded companies on Hiive. As of the time of this writing, there are 35 unique listings.

Sellers may be employees, venture capitalists, or angel investors. Buyers can either accept the listing price and volume as offered or place bids and negotiate directly with the sellers.

Plus, there are no fees for buyers on Hiive.

Hit the button below to view current offerings for Databricks:

2. How to invest in Databricks as a retail investor

While SEC regulations prevent retail investors from directly buying private companies, there are other ways to gain exposure to Databricks.

Invest in the Fundrise Innovation Fund

The Fundrise Innovation Fund is a venture capital fund that is open to all investors. The fund targets private, high-growth technology companies for its portfolio.

It invested $25 million in Databricks in July 2023 and is the fund's largest holding, comprising over 22% of its total assets ($112 million). The fund has also invested in Canva, Roblox (RBLX), Twilio (TWLO), Block (SQ), and others.

This is the most direct way for retail investors to invest in Databricks, and the fund has a minimum investment of just $10.

Invest in Databricks' publicly traded investors

In all, Databricks has raised over $4 billion from 53 investors over 12 rounds, according to Crunchbase.

While the vast majority of these investors are private equity firms and venture capitalists, there are a handful of publicly traded companies that own stakes in Databricks.

Here's a quick breakdown:

- Microsoft (MSFT) participated in the Series E round in February 2019, which raised $250 million at a valuation of $2.8 billion.

- Microsoft and BlackRock (BLK) both invested in the Series F round in October 2019. The round raised $400 million at a $6.2 billion valuation.

- Amazon (AMZN), Salesforce (CRM), and Franklin Templeton (BEN) participated in the Series G round in February 2021, which raised $1 billion at a $27 billion valuation.

- Morgan Stanley (MS), BlackRock, Franklin Templeton, and T. Rowe Price (TROW) all invested in the Series H round in August 2021. $1.6 billion was raised at a $36.4 billion valuation.

- Nvidia (NVDA), Franklin Templeton, Capital One (COF), and T. Rowe Price all invested in the latest funding round in September 2023, which raised $685 million at a $43 billion valuation.

As you can see, there are plenty of companies with at least some exposure to Databricks.

The problem, however, is that all of these companies' stakes are likely very inconsequential investments in relation to the total size of their primary businesses.

Invest in its competitors

If you're not happy with any of the above options, you may decide investing in one of Databricks' competitors is a better opportunity.

- Snowflake (SNOW): Snowflake is a direct competitor to Databricks. Its platform enables enterprise clients to consolidate data and uncover meaningful business insights. It generated $2.62 billion in revenue in the 12 months and has a market capitalization of $65.5 billion.

- Splunk (SPLK): Splunk provides a “data-to-everything” platform that powers IT operations, DevOps, and security teams. The company drove $3.98 billion in revenue over the last year and has a valuation of $25.6 billion.

If you're bullish on data analytics and database provider industries in general, both of these companies should be on your radar.

About Databricks

How it's used

Databricks is a platform for building, sharing, and maintaining enterprise-level data, analytics, and AI solutions at scale.

It also deploys cloud infrastructure on behalf of its clients.

The Databricks workspace provides a unified workspace for a variety of data tasks, including:

- Data processing

- Generating dashboards and visualizations

- Managing security, governance, and disaster recovery

- Machine learning modeling, tracking, and generative AI solutions

These solutions save companies both time and money.

Products

Databricks offers a handful of products, which all integrate.

- Spark: The company's core offering, a web-based portal for data scientists to write queries in SQL, Python, and other languages for running data analysis.

- MosaicML: Acquired in June 2023 for $1.3 billion, MosaicML is used to train large language models (LLMs) and image generation models.

- MLFlow: Here, data scientists can build machine learning (ML) models, track their experiments, deploy them to production, and monitor their performance.

- Delta Lake: Delta Lake speeds up data queries and is the company's primary initiative to move into the data analytics category.

- Databricks SQL: This is a data warehouse that allows users to run SQL on top of Delta Lake, create visualizations, build and share dashboards, and more tools for improving the usefulness of SQL.

Revenue

In the quarter that ended in July, Databricks reached a $1.5 billion annual revenue run rate, with sales growth of 50% year-over-year.

Based on its current trajectory, I estimate it will end 2023 at a nearly $2 billion annual run rate.

Additionally, the company ended the quarter with more than 10,000 customers worldwide, including 300 customers paying more than $1 million per year.

Profitability

While its revenue has grown substantially over the last few years, it's unlikely the company is profitable.

In the last two years, Databricks has increased its number of employees from 3,500 to 6,000, creating a significant drag on reaching profitability.

We can also use its main competitor and their net income (Snowflake, at -$873.9 million TTM) to help estimate Databricks' bottom line.

These figures do not guarantee Databricks is unprofitable, but we can reasonably draw that conclusion given that most pre-IPO technology companies with outside funding operate at a short-term loss in order to maximize growth.

Who owns Databricks?

In addition to the public companies listed above, there are a number of private equity firms that have invested in Databricks.

Notable investors include Andreessen Horowitz (a16z), Tiger Global Management, Founders Future, Green Bay Ventures, Alkeon Capital, Greenoaks Capital Partners, ClearBridge Investments, and more.

Co-founder and CEO Ali Ghodsi and other co-founders (Reynold Xin, Matei Zaharia, Ion Stoica), as well as other executives and employees, all likely own portions of the company.

The exact ownership breakdown, however, is not publicly available.

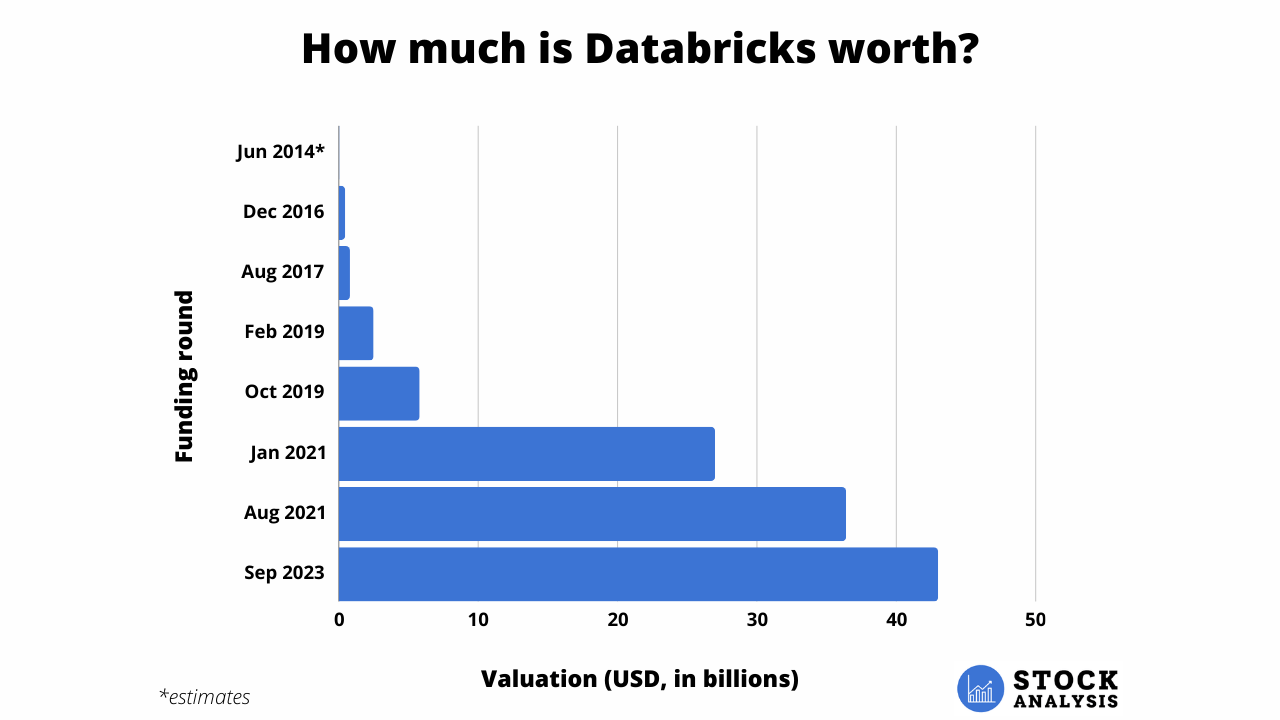

Databricks valuation chart

Here's a look at how Databricks' valuation has grown over time:

Source: Crunchbase

Databricks' most recent funding round, in September 2023, raised ~$685 million at a valuation of $43 billion, up from its $36.4 billion valuation set in August 2021.