How to Invest in Cedar Stock in 2026

More than 100 million Americans are struggling with healthcare debt, leaving healthcare providers with billions of dollars of delayed or unclaimed revenue.

The current billing system is fragmented and overly complicated, leaving everyone — patients, providers, and insurance companies — confused and frustrated.

Cedar is aiming to solve this problem.

Cedar is an enterprise platform for healthcare providers that reduces administrative and billing friction. More importantly, it makes it easier for patients to clearly see what they owe and create custom payment plans that work for them.

As a testament to the platform's effectiveness, one of the nation's largest health systems saw a 43% drop in days to collect and 90% patient satisfaction after implementing Cedar.

This is a valuable problem to solve, and Cedar's platform seems to be a viable solution. It's no surprise that the company was valued at $3.2 billion back in March 2021.

Is there a way for you to buy its stock in 2026? Yes, if you qualify. Here's how.

Can you buy Cedar stock?

Cedar is still a private company. There is no Cedar stock symbol, it doesn't trade on the NYSE or Nasdaq, and there's no way to buy it in your traditional brokerage account.

However, accredited investors may be able to buy its shares on the pre-IPO market.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional.

Hiive is a pre-IPO marketplace.

On Hiive, accredited investors can buy shares of privately held, venture-backed startups such as SpaceX, OpenAI, Databricks, and Cerebras Systems.

Hiive also has 16 listings of Cedar stock available:

Each listing is created by a unique seller who inputs their quantity of shares for sale and asking price. Most sellers are current or former employees, venture capitalists, or angel investors.

From there, buyers can view all of the available listings and can accept a seller's asking price as listed, place bids on specific listings, or add a company to their watchlist and get notified of any new listings or transactions.

Buyers can view the order books of all 2,000+ private companies listed on Hiive after creating an account.

At the time of this writing, Cedar shares are trading for $46.07 per share. You can check the current price by registering for Hiive with the button below:

Can retail investors buy Cedar stock?

Retail investors cannot buy Cedar stock while it's a private company — they will need to wait for the company to go public before they can invest (more on the company's potential IPO in the next section).

However, Cedar isn't the only company working on fixing the billing ecosystem in healthcare. Here are a few publicly traded competitors you may be interested in:

-

Waystar (WAY) offers revenue cycle management solutions, helping providers manage billing, payments, claims, analytics, reporting, and other financial processes. Waystar is the closest publicly traded alternative to Cedar. It also partnered with Cedar to provide pricing estimates through the Cedar platform.

-

Optum, a technology platform that includes revenue cycle management (RCM) services, is a subsidiary of UnitedHealth Group (UNH) and is a large player in the space.

-

HCA Healthcare (HCA) also has a subsidiary, Parallon, which offers comprehensive RCM services tailored for hospitals and health systems.

Additionally, if you're bullish on the impact this technology will have on the healthcare system in general, you may want to own a healthcare ETF such as XLV or FHLC.

When will Cedar have its IPO?

Cedar has made no indication that it plans to go public via an IPO or a SPAC. It likely won't become a publicly traded company in the near future.

However, if it maintains its position as the market-leading platform in the space, it's hard to imagine it won't become a public company at some point.

If it makes healthcare providers more money and saves patients time and frustration, it could be an extremely valuable company.

It could also be acquired. Big healthcare companies are massive — UnitedHealth Group generated over $400 billion in revenue in 2024 — and could easily afford to buy Cedar if it was an attractive deal.

If Cedar does go public, you'll need a brokerage account to buy it. We recommend Public, which is at the top of our list of the best brokerages in 2026.

Who founded Cedar?

Cedar was founded in 2016 by Florian Otto and Arel Lidow.

Otto, a former physician and executive at Zocdoc, came up with the idea for Cedar after his own nightmarish journey through the healthcare system. He was left feeling confused, frustrated, and disappointed by the entire experience.

The goal for Cedar became clear: to make healthcare more affordable and accessible via a consumer-friendly platform.

Otto started Cedar with Arel Lidow, his technical co-founder. Lidow started his career as a technology associate at Bridgewater Associates and was VP of product at AppNexus before joining Otto.

Cedar is based in New York and has over 700 employees. As of December 2023, Cedar was engaging with 25 million patients on an annualized basis.

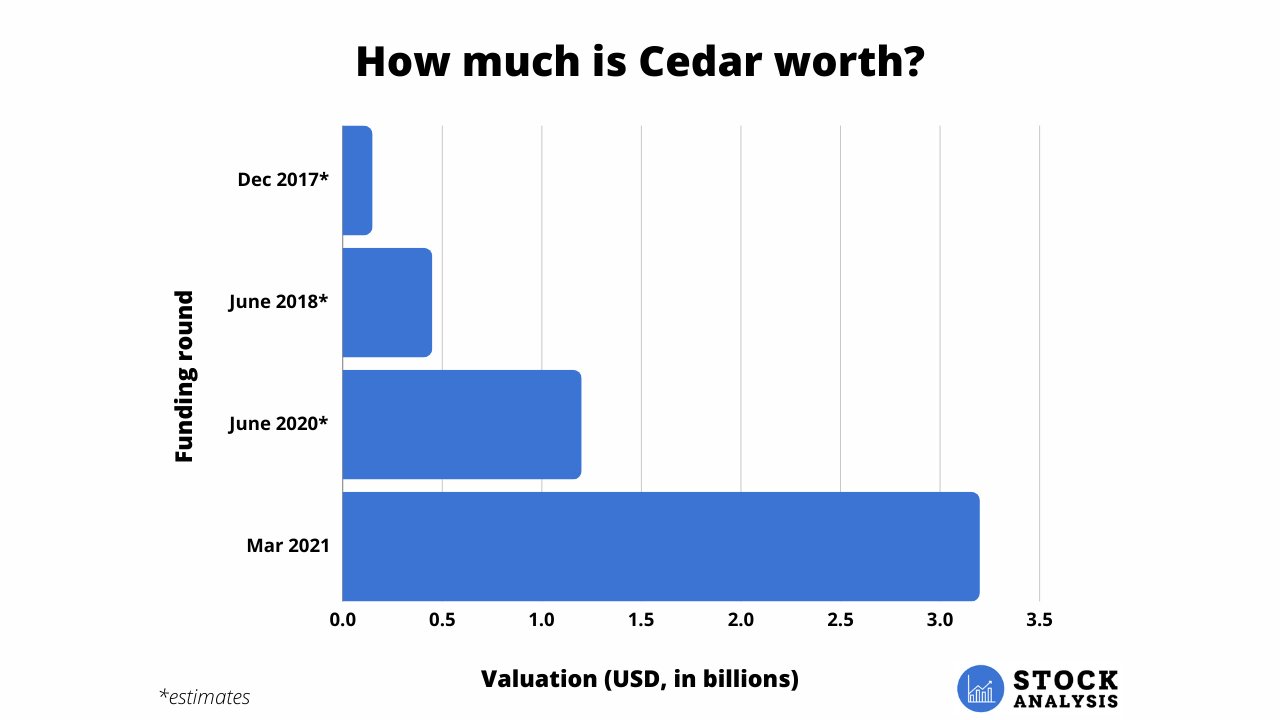

How much is Cedar worth?

Cedar's most recent funding round came in March 2021. The company raised $200 million at a valuation of $3.2 billion in its Series D.

Tiger Global Management led the round. Andreessen Horowitz (a16z) and Concord Health Partners also participated in the round.

Including this round, the company has raised over $350 million to date. Previous rounds included investors such as Kinnevik, Thrive Capital, Lakestar, Founders Fund, and Jeff Vacirca (CEO of New York Cancer and Blood Specialists).

Here's a look at how the company's valuation has changed over time (estimates mine):

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.