How to Invest in Cerebras Systems Stock in 2026

As the demand for AI compute skyrockets, Cerebras Systems is positioning itself as a serious alternative to Nvidia.

Best known for building the world's largest computer chip, Cerebras designs hardware specifically optimized for training and running massive AI workloads.

It's already deployed AI supercomputers for governments, biotech firms, and national labs, and its shift to cloud services is bringing in even more demand. It also signed a $10 billion agreement with OpenAI.

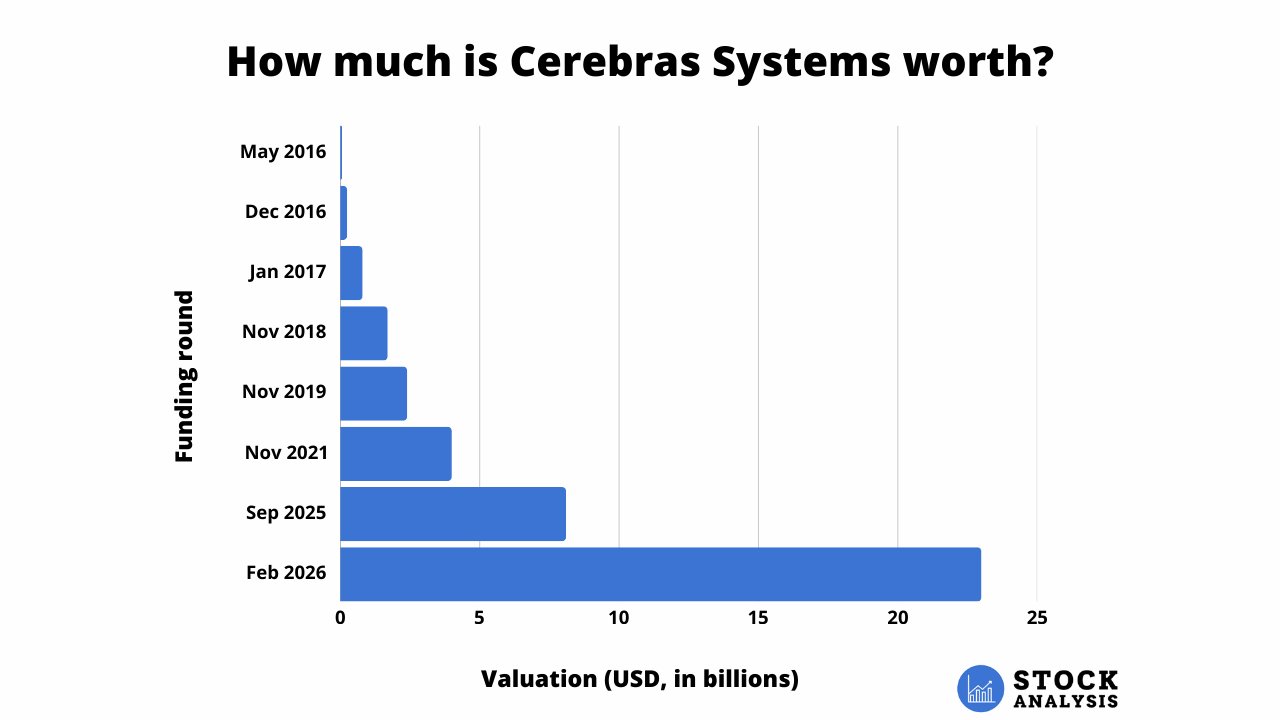

The company had originally planned to go public in 2025 under the ticker symbol “CBRS,” but instead raised rounds of $1.1 billion and $1 billion in September 2025 and February 2026, respectively.

These rounds are likely to delay its IPO until at least late 2026.

Still, Cerebras looks destined to hit the public markets eventually.

And if you're looking to invest before that happens, this article will show you how to buy Cerebras Systems stock before its IPO.

How accredited investors can buy Cerebras Systems stock

Hiive is a secondary marketplace platform that allows accredited investors to buy shares of private, VC-backed companies.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional.

Out of over 3,000 private companies listed on Hiive, Cerebras Systems is one of the most active:

There are 125 orders of Cerebras stock as of the time of writing. Shares are trading for $110.55.

Every listing is created by a different seller who sets their own asking price and number of shares available. Sellers often include current or former employees, venture capitalists, and angel investors.

Buyers can add stocks to their watchlist, place bids, or accept a seller's asking price as listed.

After registering, buyers are able to see the complete order book for every listing on Hiive. This includes the prevailing bid, all asking prices, shares available, and recent transaction data.

See the order book for Cerebras after registering with the button below:

Can retail investors buy Cerebras Systems stock?

Unfortunately, there is no way for retail investors to invest directly in Cerebras Systems, though there are two publicly traded companies that may benefit from Cerebras' success.

1. Qualcomm

Given its background in designing smartphone chips, Qualcomm (QCOM) is well-positioned to be a key player when generative AI comes to smartphones, PCs, and automobiles.

However, the company needed a partner with the infrastructure to train large-scale models at speed. So it teamed up with Cerebras.

Cerebras specializes in building AI supercomputers designed specifically for training massive generative models. Qualcomm, on the other hand, is an expert in deploying those models efficiently on edge devices like smartphones and cars.

Together, the two companies believe they can optimize the entire pipeline — from model training to low-power inference — better than either could alone.

2. Taiwan Semiconductor

Cerebras uses Taiwan Semiconductor (TSM) 5nm chips for all of its Wafer Scale Engine 3 (WSE-3) processors. If there is increasing demand for Cerebras' products, its suppliers (including TSMC) will also profit.

That said, Qualcomm and TSMC are very large companies ($147 billion and $1.4 trillion, respectively), so investing in either of these companies is a very indirect way to gain exposure to Cerebras.

Retail investors are probably better off waiting for the company's IPO.

When will Cerebras IPO?

Cerebras Systems filed paperwork for an IPO in September 2024, with the plan of listing on the Nasdaq under the ticker symbol "CBRS" in early 2025.

It ran into regulatory delays shortly thereafter.

The company's IPO was initially delayed in early March by the Committee on Foreign Investment in the United States, which flagged a $335 million investment made by G42, an Abu Dhabi-based cloud and AI company.*

*In addition to its investment stake, more than 85% of Cerebras' revenue in the first half of 2024 also came from G42. This combination of factors is likely what prompted the investigation.

A few weeks later, the IPO was further delayed due to unfilled positions at CFIUS.

In May 2025, CEO Andrew Feldman said the company had obtained clearance from CFIUS in March regarding G42's interests, and he hoped Cerebras would go public in 2025.

However, at the end of September, Cerebras raised $1.1 billion in a new funding round. It officially withdrew its IPO designation a few days later.

At the time of the round, CEO Andrew Feldman said they still intended to take the company public but wouldn't share any further details.

Then, in February 2026, Cerebras raised an additional $1 billion in its Series H.

The round came just weeks after Cerebras and OpenAI announced a partnership, which will involve OpenAI deploying 750 megawatts of Cerebras-built computing power through 2028 in a deal worth over $10 billion.

Although a public offering still seems to be the long-term objective, its Series H likely pushes the IPO back to late-2026 at the earliest.

When it does go Public, you'll need a brokerage account to buy its stock. If you need one, we recommend Public.

What does Cerebras Systems do?

In July 2023, Cerebras Systems completed its first $100 million supercomputer — one of nine being built to offer an alternative to Nvidia (NVDA)'s GPU-based infrastructure.

These supercomputers are powered by Cerebras' custom Wafer Scale Engine (WSE) — the largest chip ever built. While traditional chips are about the size of a postage stamp, the WSE-3 is the size of a dinner plate and contains 900,000 AI-optimized cores.

It's purpose-built to train and run large-scale artificial intelligence models faster and more efficiently than traditional GPUs.

While Cerebras' systems lack the range of applications and flexibility of Nvidia's offerings, it's a real threat in certain use cases, such as training foundation models, LLMs, and other compute-heavy workloads that strain distributed GPU clusters.

In late 2024, Cerebras pivoted from selling chips and systems to delivering cloud-based AI compute.

Through its own data centers, customers can now access Cerebras hardware directly via the cloud without needing to buy or maintain any of their own physical infrastructure.

Today, Cerebras is used by enterprises, governments, and individual developers for code generation, reasoning, and agentic work. Customers include Hugging Face, Meta Platforms (META), Perplexity AI, Mistral AI, and Amazon (AMZN).

Cerebras posted revenue of $78.7 million in 2023, which is more than triple the $24.6 million it generated in 2022. That pace accelerated in early 2024, with $136.4 million coming in the first half of the year alone.

In January 2026, Cerebras scored a $10 billion contract with OpenAI to provide the AI lab with 750 megawatts of computing power through 2028.

Who founded Cerebras Systems?

Andrew Feldman, Gary Lauterback, Michael James, Sean Lie, and Jean-Philippe Fricker founded Cerebras Systems in 2015.

All five of these co-founders worked together at SeaMicro, a company specializing in computer servers, which was sold to AMD in 2012 for $334 million.

All five remain at the company:

- Andrew Feldman is the CEO

- Jean-Philippe Fricker is the Chief System Architect

- Michael James is the Chief Architect, Advanced Technologies

- Gary Lauterack and Sean Lie serve as co-CTOs

The exact ownership structure of Cerebras is not publicly available, but each of these co-founders still likely owns a healthy stake in the company.

How much is Cerebras Systems worth?

Cerebras Systems most recently raised $1 billion at a $23 billion valuation in February 2026, nearly triple the $8.1 billion valuation it received just five months earlier.

Cerebras has now raised over $2.8 billion in total funding.

Here's a look at how its valuation has changed over time:

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.