How to Invest in Gusto Stock in 2026

Gusto is a cloud-based payroll, benefits, and human resource management platform.

With it, companies can add and track employee hours, overtime pay, bonuses, and more, as well as insurance, retirement savings, and other benefits. It also automatically calculates and files payroll taxes to federal and state governments.

If you nearly fell asleep reading that, you're not alone.

But that's exactly what Gusto wants.

While the smartest, most talented, and hardest-working entrepreneurs are all racing against each other to build the next greatest artificial intelligence or renewable energy startup, Gusto is solving a boring but persistent problem. And it's working.

Gusto has 300,000 customers and generated more than $500 million in revenue in 2023. It's also profitable.

Unfortunately, the company is privately owned, and it hasn't made any indication of a potential IPO.

However, there's a way to invest in Gusto right now, while it's still a private company.

Can you buy Gusto stock?

Gusto is still a private so there's no way to look up its stock symbol and buy it in your regular brokerage account.

However, accredited investors can buy shares on Hiive. Hiive is an investment platform where accredited investors can buy shares of pre-IPO companies.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional.

Thousands of the world's most valuable startups — including SpaceX, Databricks, OpenAI, and Twitter — have shares available on Hiive.

And so does Gusto:

At the time of writing, there are 28 live orders of Gusto stock on the platform.

How Hiive works

- Existing shareholders (employees, venture capitalists, angel investors, etc.) create a listing by setting an asking price and quantity of shares available.

- Once a listing is live, buyers can accept the asking price or place a bid.

- After a buyer and seller have agreed on a price, Hiive handles the legal side and helps facilitate the transaction.

- The seller gets paid, and the shares are transferred to the buyer.

After registering on the site, buyers can see all bids, asks, and recent transactions for every company listed on Hiive.

Buyers can also add companies to their watchlist and get notified of any new listings or transactions.

You can create an account on Hiive with the button below:

Can retail investors buy Gusto stock?

As mentioned above, Gusto is a private company. Unfortunately, retail investors cannot buy stock until it goes public.

However, Gusto is not the only company providing payroll, benefits, and HR services, and it's not the only one focused on serving small businesses.

Here are a few of its publicly traded competitors that you may be interested in.

- Automatic Data Processing (ADP), more commonly known as ADP, is a global leader in payroll, HR, and benefits services and offers solutions for businesses of all sizes. It has a market capitalization of $117 billion.

- Paychex (PAYX), like Gusto, provides payroll, HR, and benefits services tailored to small and medium-sized businesses (SMBs).

- Intuit (INTU) is best known for its QuickBooks suite, an extremely popular accounting software used by small businesses that also offers some payroll and HR tools. Intuit has a market cap of $172 billion.

- Workday (WDAY) specializes in enterprise HR and payroll solutions.

- Paycom (PAYC) is another direct competitor to Gusto best known for its set of employee self-service options, which allow for more hands-off management.

As you can see, Gusto is far from the only player in this space, and each of these competitors is generating at least $1 billion in annual revenue. ADP and Intuit are each doing more than $15 billion.

Because of their easy-to-use platforms and focus on SMBs, the two closest competitors to Gusto are Paychex and Paycom.

Who founded Gusto?

Gusto (which was known as ZenPayroll until 2015) was founded by Joshua Reeves, Tomer London, and Edward Kim in November 2011.

As former business owners themselves, they'd experienced firsthand the lack of good options for SMBs to handle their payroll and benefits.

In 2012, the founders applied for and were accepted into Y Combinator, a prolific startup accelerator and venture capital firm. The company went on to raise the second largest seed round in Y Combinator's history.

The service officially launched in December 2012.

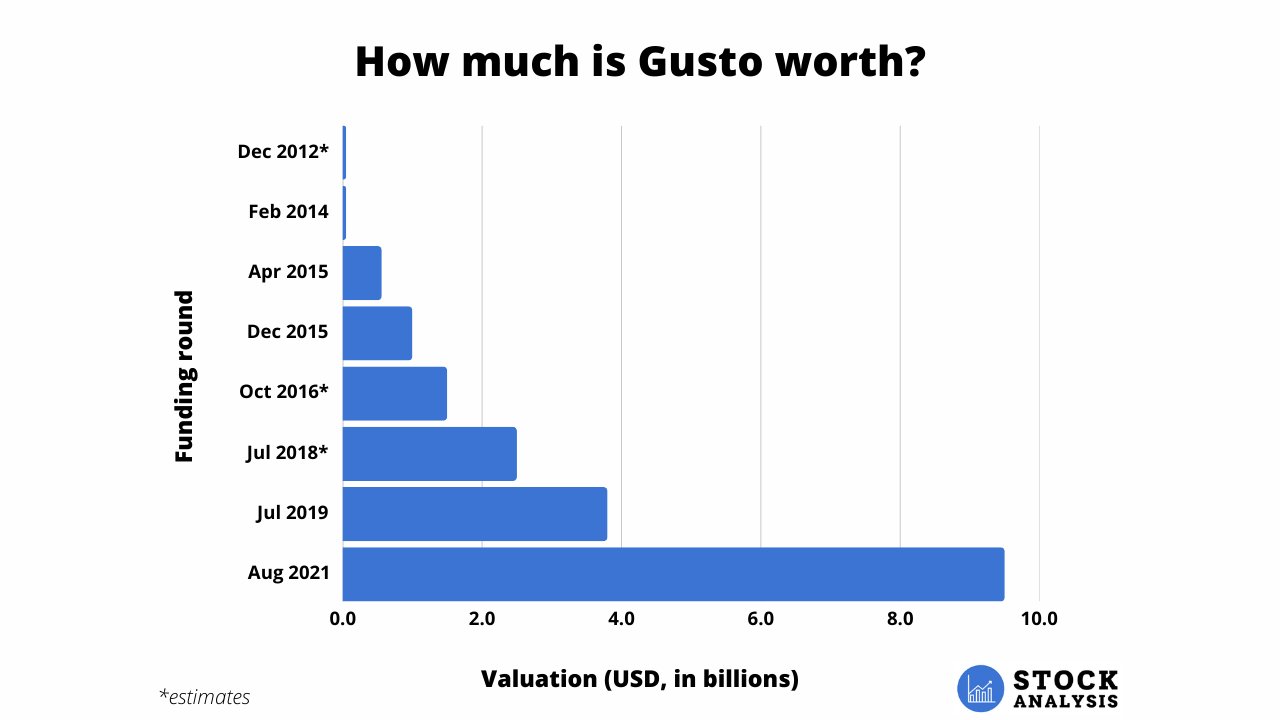

Just three years later, in December 2015, Gusto raised $50 million at a valuation of $1 billion, making it a unicorn.

Today, the company is now doing more than $500 million in annual revenue, has 2,800 employees, and is cash flow positive. Its most recent funding round, in August 2021, valued the company at $9.5 billion.

Notably, all three co-founders are still leading Gusto — Reeves as CEO, Kim as CTO, and London as CPO (Chief Product Officer).

How much is Gusto worth?

To date, Gusto has raised $718 million over nine rounds from a total of 82 investors.

Some of its investors include T. Rowe Price, Fidelity Investments, Google Ventures, and venture capital firms General Catalyst, 137 Ventures, and Dragoneer Investment Group.

Gusto's most recent funding round was its Series E in August 2021. In it, the company raised $175 million at a valuation of $9.5 billion.

Here's a look at how its valuation has changed over time:

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.