How to Buy Harness Stock in 2026

Harness provides software that enables development teams to innovate more quickly and reliably. More specifically, it is an AI-driven software development platform that simplifies the deployment of software in the cloud.

It works by using machine learning to detect faulty updates and technical issues before updates are made, preventing bugs and other errors.

This makes every development team much more efficient, as they spend less time doing mundane tasks and searching for errors.

Harness also offers cloud cost optimization and security services, among other tools.

Harness is trusted by developers at more than 500 companies, many of which are publicly traded. The company passed $100 million in ARR (annual recurring revenue) in 2023 and has continued to grow beyond that.

While all signs point to a future IPO, the team has yet to file for one. So you're probably wondering if there's a way to invest in Harness stock right now, before its IPO.

The short answer is yes. Here's how.

Can you buy Harness stock?

While Harness is still a private company, which means it doesn't have a stock symbol and isn't publicly traded, there is a way for accredited investors to buy its shares.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional.

Hiive is a pre-IPO marketplace where accredited investors can buy shares of privately held, venture-backed startups. Many of the world's most valuable private companies have shares available for purchase on Hiive, including OpenAI, SpaceX, and Figure AI.

There are currently 34 live orders of Harness stock, which are currently trading for $25.11 per share:

Hiive functions similarly to a regular stock exchange.

Current shareholders — who may be employees, venture capitalists, or angel investors — can create a listing by setting their asking price and number of shares for sale.

From there, buyers can accept a seller's asking price as listed or place bids and negotiate directly with the sellers.

Hiive's watchlist feature allows buyers to follow companies and receive notifications of any new listings or successful transactions.

You can see the current order book for Harness, and over 2,000 other pre-IPO companies, by creating an account on Hiive with the button below:

Can retail investors buy Harness stock?

No, retail investors cannot buy Harness stock while it's still a private company.

That said, it seems likely that the company will have an IPO once the opportunity presents itself. While management hasn't given any indication of a potential timeline, all of the pieces are in place. More on its potential IPO below.

In the meantime, you may be interested in a few of Harness's publicly traded competitors in the DevOps and CI/CD space:

- GitLab (GTLB) is a leading DevOps platform that provides a suite of CI/CD tools, source code management, and collaboration features.

- Atlassian (TEAM) offers several DevOps tools including Jira (project management), Bitbucket (source code management), and Bamboo (CI/CD).

- HashiCorp (HCP) sells Terraform, Vault, and Consul, which are infrastructure automation tools that are critical for DevOps workflows.

- JFrog (FROG) provides a platform that focuses on CI/CD pipelines, artifact management, and other software release tools.

- IBM (IBM) offers a range of DevOps solutions, its most popular being the UrbanCode product suite, which supports CI/CD and release automation.

- Microsoft (MSFT) provides Azure DevOps, a comprehensive suite that provides tools for CI/CD, version control, and project management. As an added benefit, it also integrates with the broader Azure cloud platform.

It's worth noting that IBM's and Microsoft's DevOps offerings represent a tiny fraction of their total revenue.

While none of these are exact replacements for investing in Harness, each of these companies is targeting the same market.

Who founded Harness?

Harness was founded by Jyoti Bansal in 2017.

Born in India, Bansal moved to the U.S. and worked as a software engineer for a number of Silicon Valley startups from 2000–2007.

Then, in April 2008, Bansal founded AppDynamics, an application performance management company. Bansal served as the company's CEO for eight years and grew it to over 900 employees. In 2017, AppDynamics was acquired by Cisco for $3.7 billion.

Following the sale of AppDynamics, Bansal launched BIG Labs (a start-up studio) and Harness (BIG Lab's first startup) in October 2017.

Traceable, a cybersecurity company, was launched from the studio in July 2020.

Today, Harness employs over 700 people out of its headquarters in San Francisco. It has more than 500 enterprise customers and generates over $100 million in annual recurring revenue.

When will Harness have its IPO?

As mentioned above, Bansal's previous company, AppDynamics, was sold to Cisco for $3.7 billion. Interestingly, this transaction happened the same week that AppDynamics was scheduled to go public.

With Harness, the company's recent decision to raise debt financing instead of equity financing — which prevents current shareholders from being diluted — may be an indication of its readiness to become a public company.

In Bansal's own words,

“We've been looking at what is the best way to raise capital, and if you look at a public company, most of the public companies have access to debt — and that's what they would be raising as a very healthy business… We think we can take this loan all the way to an IPO. We don't need to raise any more equity. Who knows, we may end up doing it, but we don't need to, and we can go from here to an IPO without additional investment.”

Harness surpassed $100 million in ARR in 2023, a number which Bansal says has continued to accelerate. All signs are pointing to a public offering.

When it does go public, you'll need a brokerage account to buy it. We recommend Public, which ranked #1 in our list of the best brokerages in 2026.

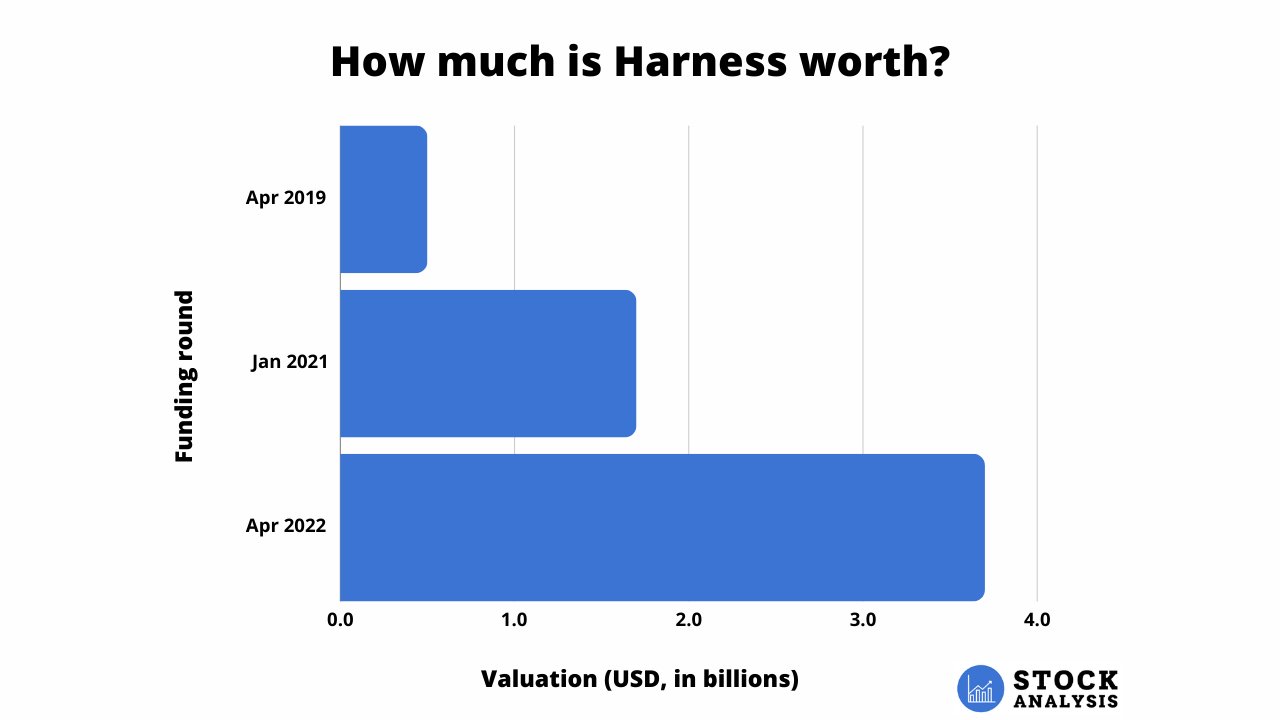

How much is Harness worth?

Harness's latest funding round was back in April 2022, when it raised $230 million at a valuation of $3.7 billion.

This round more than doubled the valuation it received in its previous round in January 2021.

Investors in the April 2022 round included:

- Norwest Venture Partners

- JP Morgan (JPM)

- Capital One Ventures (COF)

- Splunk Ventures

- Adage Capital Partners

- ServiceNow (NOW)

- Google Ventures (GOOGL)

- Sorenson Capital

The company has not raised another round of equity financing since then, but it did get access to a $150 million line of credit in May 2024.

Here's a look at how the company's valuation has changed over time:

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.