How to Buy PsiQuantum Stock in 2026

PsiQuantum is a quantum computing startup that's aiming to build a 1-million-quantum-bit machine.

While most competitors are focused on building small-scale prototypes, PsiQuantum is taking a bold, all-or-nothing approach by aiming directly for a large-scale, fault-tolerant quantum computer, which should be ready in two years.

Quantum technology has the potential to perform calculations that would stump even the most powerful supercomputers (more on this in the next section).

While no company is particularly close to making the technology a reality, PsiQuantum's progress has investors taking notice. In September 2025, the company raised $1 billion at a $7 billion valuation.

Notably, it also announced a partnership with Nvidia (which also participated in the round) to help with the development of its quantum computers.

The announcement of this collaboration came just a few months after Nvidia CEO Jensen Huang predicted quantum computing technology wouldn't be viable for another 20+ years.

You can skip ahead to learn more about how to invest in the company, or you can read the next section first to learn more about quantum computing.

What is quantum computing?

Quantum computing uses the principles of quantum mechanics to process information in a fundamentally different way than traditional computers.

Instead of using bits that represent either 0 or 1, quantum computers use qubits, which can be 0, 1, or both at the same time (known as superposition). Qubits can also be entangled, meaning the state of one qubit is linked to another.

These properties allow quantum computers to perform complex calculations at speeds that are impossible for even the fastest supercomputers today.

The potential applications are limitless. Quantum computers could revolutionize fields like:

- Drug discovery, helping to design new medicines faster by accurately simulating how molecules interact.

- Climate modeling, improving climate forecasts by analyzing complex weather and environmental data in more detail.

- Materials science, creating stronger, lighter, or more efficient materials.

- Financial analysis, optimizing supply chain shipping and logistics by quickly analyzing vast amounts of financial scenarios.

- Cybersecurity, breaking current encryption methods and helping develop new, more secure ones.

- Generative AI, speeding up model training, enhancing accuracy, allowing for more complex simulations and data sets, and more.

Why are quantum computers necessary? Why can't we just use faster computers?

Speed alone isn't the issue. Some problems — like modeling quantum physics or optimizing large systems — grow exponentially harder as they get bigger.

Traditional computers hit a wall, but quantum computers can scale more naturally with increasing complexity.

However, the technology is still emerging, and current quantum machines are error-prone.

Companies like IBM, Google, Microsoft, and PsiQuantum are racing to build fault-tolerant, utility-scale quantum machines that can actually solve real-world problems.

Can you buy PsiQuantum stock?

PsiQuantum is a private company without a publicly traded stock symbol.

While you can't buy shares in your traditional brokerage account, they do trade on Hiive.

Hiive is an investment platform where accredited investors can buy shares of pre-IPO companies from existing shareholders.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional.

There are over 2,000 companies with shares available on Hiive, including PsiQuantum, which is one of the most active:

Each listing on Hiive is created by an existing shareholder who sets their own asking price and quantity of shares available. Sellers are typically employees, VC firms, or angel investors.

After a listing is created, buyers can accept a seller's asking price as listed or place bids on the shares. Buyers can also add companies to their watchlists to get notified of any new listings or completed transactions.

As of the time of writing, the aggregate price of PsiQuantum's shares is $32.37.

To see all of the active bids and asks of PsiQuantum, and every other company listed on Hiive, you can create an account for free with the button below:

Can retail investors buy PsiQuantum?

Because PsiQuantum is still a private company and Hiive is only available to accredited investors, there's no way for retail investors to invest in its stock.

At this point, retail investors' best course of action is to wait for the company's IPO.

Although it has not made any indication of plans to become publicly traded, PsiQuantum's $2 billion in funding and current trajectory suggest it's aiming for an eventual public offering.

However, PsiQuantum is not the only company working on quantum computing.

If you're bullish on the industry, here are a few publicly traded companies you may be interested in investing in:

- IonQ (IONQ) is a quantum computing company developing trapped-ion quantum systems. As one of the first pure-play quantum firms to go public, IonQ offers cloud-accessible quantum computing and is focused on building scalable, general-purpose quantum machines.

- Rigetti Computing (RGTI) is a quantum hardware company that uses superconducting qubits to power its hybrid quantum-classical computing platform. The company serves both commercial and government clients and is actively competing to bring practical quantum applications to market.

- D-Wave Quantum (QBTS) is known for its quantum annealing technology, which is well-suited for solving optimization problems. While D-Wave's systems differ from PsiQuantum's fault-tolerant photonic approach, it has established real-world use cases across logistics, finance, and AI.

And here are a few other well-known companies with forays into the field:

- IBM (IBM) is a global tech giant with one of the most advanced quantum research programs, offering access to its superconducting quantum computers via the IBM Quantum cloud. IBM is investing heavily in quantum hardware, software, and ecosystem development.

- Alphabet (GOOGL), the parent company of Google, operates a leading quantum computing research division. Google's quantum team made headlines with its 2019 “quantum supremacy” experiment and is actively developing scalable, error-corrected quantum systems.

- Microsoft (MSFT) is pursuing quantum computing through its Azure Quantum platform and is developing topological qubits, a novel approach aimed at creating more stable and error-resistant quantum systems for the cloud.

- Amazon (AMZN) offers cloud-based quantum computing services through Amazon Braket, a platform that allows developers to access quantum hardware from multiple providers. It recently unveiled its own quantum computing chip.

You could also invest in ETFs like the following:

- Defiance Quantum ETF (QTUM), a pure-play quantum computing ETF.

- Global X Future Analytics Tech ETF (AIQ), which, while not strictly quantum-focused, invests in companies that are involved in quantum computing development.

You can invest in stocks and ETFs from your regular brokerage account. If you don't have a brokerage account, we recommend Public.

Who founded PsiQuantum?

PsiQuantum was co-founded in 2016 by Jeremy O'Brien, Terry Rudolph, Peter Shadbolt, and Mark Thompson, who are current and former university professors and researchers.

After uncovering a viable path to build large-scale, fault-tolerant systems using photonics, the founders began manufacturing.

Today, the company is producing thousands of quantum chip wafers and designing error-resistant algorithms, among other projects, all of which are essential for launching its initial systems.

Its headquarters are in Palo Alto, California.

PsiQuantum has partnered with and received a number of contracts from U.S. government agencies — such as the Air Force Research Laboratories, DARPA, the U.S. Department of Energy, and the Los Alamos National Laboratory — as well as Australia.

PsiQuantum is backed by BlackRock, Baillie Gifford, Founders Fund, Redpoint, M12 (Microsoft's venture fund), NVentures (Nvidia's venture capital arm), and others.

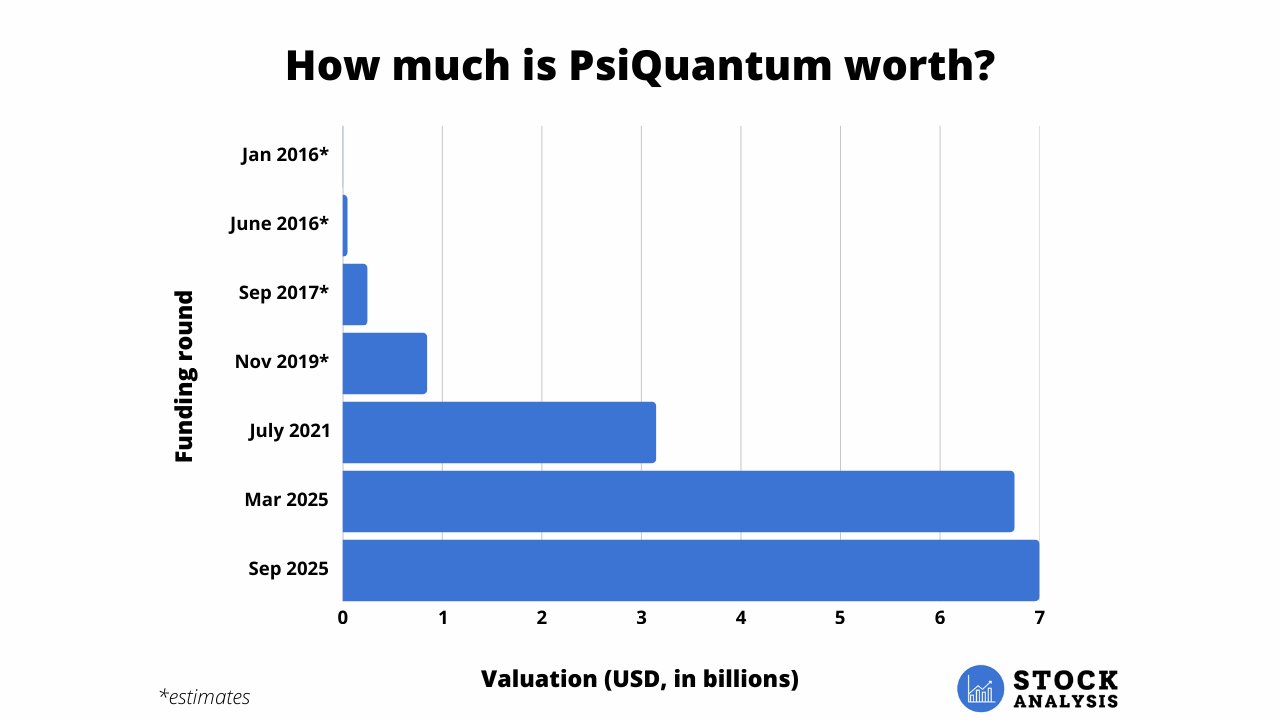

How much is PsiQuantum worth?

PsiQuantum has raised a total of $2.4 billion over six primary rounds, plus some money from grants and prizes.

Here is a summary of its six funding rounds:

| Round | Date | Raised | Valuation (if known) |

| Seed | January 2016 | $1.5 million | |

| Series A | June 2016 | $13.5 million | |

| Series B | September 2017 | $50 million | |

| Series C | November 2019 | $150 million | |

| Series D | July 2021 | $450 million | $3.15 billion |

| (extension) | March 2025 | $750 million | $6.75 billion |

| Series E | September 2025 | $1 billion | $7 billion |

Here's a look at how PsiQuantum's valuation has changed over time (estimates mine):

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.