Can You Buy Revolut Stock in 2025?

Revolut is once again making headlines.

In 2023 — on the back of strong user growth and interest-related income — the British fintech company nearly doubled its revenue to $2.27 billion and generated a pretax profit of $553 million.

Revolut has signaled its aim to become publicly traded, but a few snags have delayed its plans.

First, the company has faced problems reporting its financial results clearly and on time. It also has yet to secure its banking license, which it originally applied for in 2021.

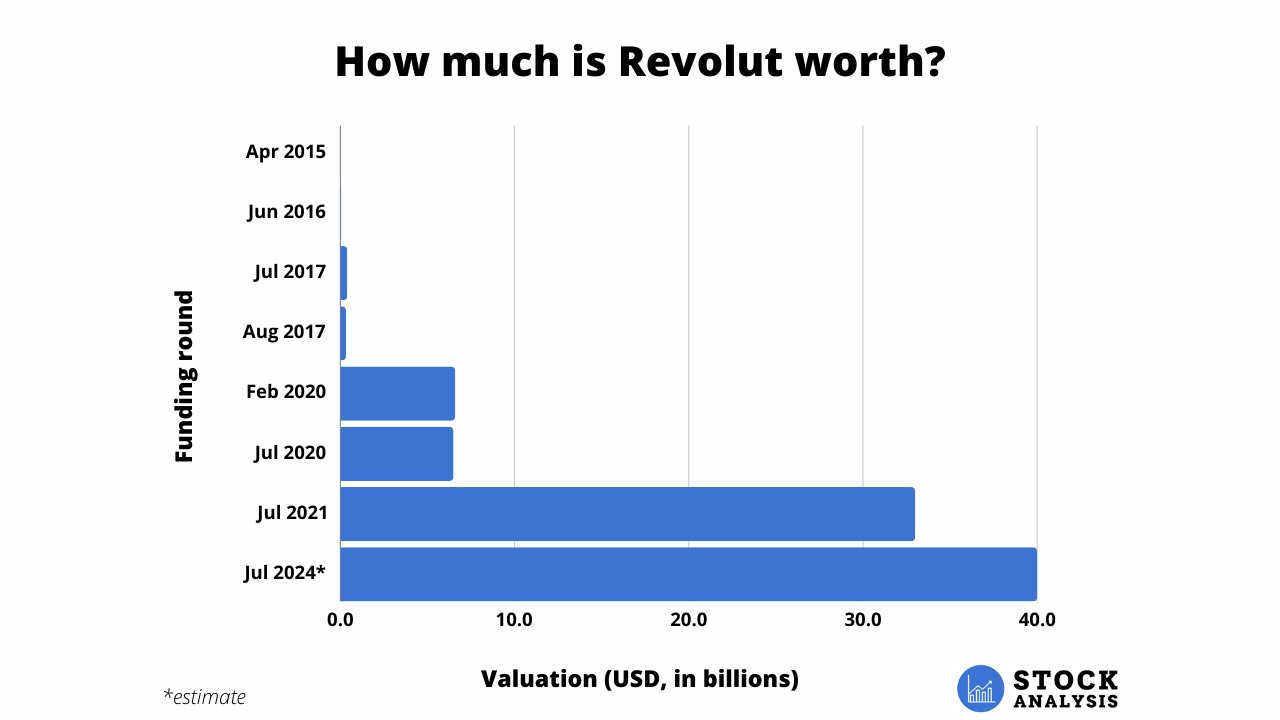

Still, these issues aren't stopping the company from working on a $500 million secondary offering, which would value it at more than $40 billion, up from the $33 billion valuation it received in 2021.

If you qualify, there may be a way for you to buy Revolut shares before its IPO.

Can you buy Revolut stock?

For the time being, Revolut is still a private company. It does not trade on a public exchange and does not have a stock symbol.

That said, accredited investors can buy shares on Hiive, an investment marketplace for pre-IPO companies.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional.

There are over 2,000 companies available on Hiive. As of the time of this writing, there are two listings of Revolut stock available:

Each of these live orders was created by a unique seller who may be a current or former employee, a venture capitalist, or an angel investor. Each sets their own asking price and number of shares for sale.

After a listing is created, buyers can see the listing's asking price and the quantity of shares offered. Buyers can accept the asking price or place bids and negotiate directly with sellers.

They can also add companies to their watchlist and get notified of any new listings or transactions.

See what price shares of Revolut are trading for on Hiive with the button below:

Can retail investors buy Revolut stock?

Unfortunately, until Revolut becomes publicly traded, there's no way for retail investors to buy shares.

And while it seems intent on becoming a public company — likely on the London Stock Exchange — the company's interim CFO Victor Stinga declined to suggest a potential timeline for its public debut.

This is likely due to a couple of factors, which I will explain in more detail in the next section.

If you're looking to invest in the fintech or banking industry, however, you may be interested in the following public companies:

-

Wise PLC (WIZEY) provides cross-border and domestic payments for individuals and businesses. The company is best known for its low fees and hassle-free international money transfers.

-

SoFi Technologies (SOFI) is an all-in-one banking and investing app that allows its members to save, borrow, spend, invest, and protect their money.

-

Block (SQ) builds and maintains the Square commerce platform as well as related financial products and services. It also owns the Cash App, which is primarily used to send money between friends.

-

PayPal (PYPL) enables digital payments between merchants and consumers, as well as between friends, via its namesake app and Venmo. It also offers credit and debit cards, BNPL plans, and other personal loans and services.

-

Affirm (AFRM) operates a digital platform that includes a point-of-sale solution that connects merchants and their customers with originating banks, allowing customers to pay for a purchase over time with BNPL installment loans.

You may also be interested in investing in a fintech ETF such as the Global X FinTech ETF (FINX) or the ARK Fintech Innovation ETF (ARKF).

When will Revolut IPO?

It's unclear when Revolut will become publicly traded. There are a few things that are holding up its public listing.

The first problem has to do with the company's financial reporting. Revolut's most recent financial results were reported on time, but its 2021 and 2022 results were published after the deadline.

Furthermore, the company has drawn scrutiny from regulators after independent auditors were initially unable to verify the bulk of its revenue, and some of its results may have been “materially misstated.”

Revolut will need to shore up its internal accounting systems before becoming a public company.

The above accounting concerns have also delayed its application for a local banking license, which it first applied for in 2021. Back then, CFO Mikko Salovaara told reporters that the company was “at the very last stage of the process” of securing it.

As of July 2024, the company is still “continuing to work very closely with the PRA (Prudential Regulation Authority) on our U.K. bank license application.”

Without the license, Revolut is unable to offer lending products such as credit cards, personal loans, or mortgages in the U.K.

It is also deprived of access to the Bank of England, which pays the highest interest rate on deposits. More lending and higher rates would lead to greater profitability.

Who founded Revolut?

Revolut was founded in 2015 by Nikolay Storonsky and Vlad Yatsenko.

Prior to Revolut, Storonsky (CEO) worked as a trader at Lehman Brothers and Credit Suisse, and Yatsenko (CTO) worked as a software engineer for Credit Suisse, Deutsche Bank, UBS, and other companies.

The pair wanted to eliminate the hidden costs and fees charged by traditional solutions, which made spending across Europe and overseas unnecessarily expensive.

The business started as a way for customers to spend in over 90 countries using debit cards with no foreign transaction fees and a “real” exchange rate, with no further fees.

Today, Revolut offers banking services, currency exchange, debit and credit cards (in some countries), virtual cards, Apple Pay, personal loans (in some countries), and stock, crypto, and commodity trading.

The company has more than 40 million customers globally.

Two of its U.K.-based rivals, Starling and Monzo, each have fewer than 10 million customers, despite also being founded in 2014 and 2015, respectively.

How much is Revolut worth?

Since its first seed round in April 2015, Revolut has raised more than $2.1 billion over 13 rounds.

Its list of investors includes Balderton Capital, Index Ventures, Seedcamp, TriplePoint Capital, DST Global, Visa (V), Tiger Global Management, SoftBank (SFTBY), Ribbit Capital, Molten Ventures, and Schroders.

Here's a look at how its valuation has changed over time:

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.