How to Invest in Scale AI Stock in 2024

Data is the foundation of artificial intelligence (AI).

All AI systems draw insights from the datasets they're trained on. The accuracy and completeness of those datasets is of paramount importance. The better the data you feed it, the better the results the AI system will produce.

Scale AI is a startup that specializes in labeling and curating data for AI applications. Its customers include companies such as OpenAI, Meta, Microsoft, Nvidia, and Toyota, as well as government agencies like the U.S. Department of Defense.

On March 28, 2024, it was reported that Scale was in talks to raise hundreds of millions of dollars at a valuation as high as $13 billion, which is 80% higher than its most recent round.

While the company is still privately owned, there is a way for you to invest in its now — if you qualify as an accredited investor. Here's how you can invest in Scale AI today.

Buy Scale AI stock from existing shareholders

Hiive is a secondary marketplace where accredited investors can buy shares of private, VC-backed startups from current shareholders.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional.

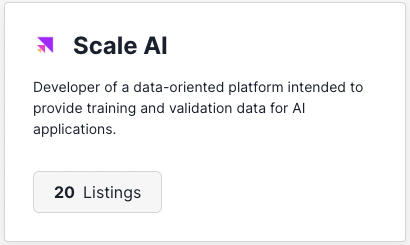

Some of the most active companies on Hiive are SpaceX, Databricks, and Scale AI:

As of the time of writing, there are 20 unique listings of Scale AI stock on Hiive.

Each listing is made by a different seller who sets their own asking price and quantity of shares. Sellers may be current or former employees, venture capitalists, or angel investors.

Buyers can either accept a seller's asking price as listed or place their own bid and negotiate directly with sellers.

After registering for Hiive, you'll be able to see the complete order book of bids and asks for every company, as well as all of the recent transaction prices.

See the order book for Scale AI with the button below:

Alternatives to investing in Scale AI

Unfortunately, if you're not an accredited investor, there's no way for you to gain exposure to Scale AI at this time.

However, you could invest in the company's publicly traded customers, which include:

- Microsoft (MSFT)

- Nvidia (NVDA)

- Meta Platforms (META)

- PayPal (PYPL)

- Toyota (TM)

- General Motors (GM)

- SAP SE (SAP)

- Chegg (CHGG)

Although this is an indirect way to invest, if Scale AI's solutions substantially improve the AI systems these companies are working on, they will also benefit.

Since Scale's primary competitors — which include Sama, Labelbox, and Cloudfactory — are all private companies, there's no way for retail investors to invest directly in any company offering data labeling or model accuracy services.

You can also invest in various exchange-traded funds (ETFs), which have different objectives within the robotics and artificial intelligence industries.

ETFs you may be interested in include:

- Global X Artificial Intelligence & Technology ETF (AIQ)

- First Trust Nasdaq Artificial Intelligence & Robotics ETF (ROBT)

- WisdomTree Artificial Intelligence and Innovation Fund (WTAI)

- ROBO Global Artificial Intelligence ETF (THNQ)

- Themes Generative Artificial Intelligence ETF (WISE)

Be sure to keep in mind, though, that these ETFs will only give you general exposure to AI, generative AI, LLMs, and robotics. It's not the same as investing directly in Scale AI.

And, since, that's not possible for retail investors at this time, you may be better off waiting for Scale AI's IPO.

Wait for the Scale AI IPO

Scale AI has not made any indication that it plans to go public in the near future.

Given the state of venture capital, which continues to pour billions of dollars into any promising AI startup, Scale has had no trouble raising capital.

Unfortunately for retail investors, this also means the company has no need to turn to the public market for funding.

Couple that with the company's 2023 revenue of $760 million, and we can reasonably assume it won't go public in the next couple of years.

But when it does go public, or if you've decided to buy one of the publicly traded companies above, you'll need a brokerage account. We recommend Public.

On Public, you can invest in stocks, ETFs, Treasuries, options, and cryptocurrencies on what I think is the most user-friendly brokerage available.

Who owns Scale AI?

Alexandr Wang founded Scale AI in 2016 at 19 years old. By age 24, thanks to his 15% stake in Scale, he became the world's youngest self-made billionaire.

In addition to Wang, who likely still owns more than 10% of the company, some members of the company's board of directors, executive team, and strategic advisors, along with current and former employees, all likely own some percentage.

However, the exact ownership structure is not publicly available.

Additionally, there are 29 external investors, which include private equity firms, venture capitalists, and angel investors.

A few of Scale's most well-known investors are Accel, Thrive Capital, Tiger Global Management, Founders Fund, and Drew Houston (the co-founder and CEO of Dropbox).

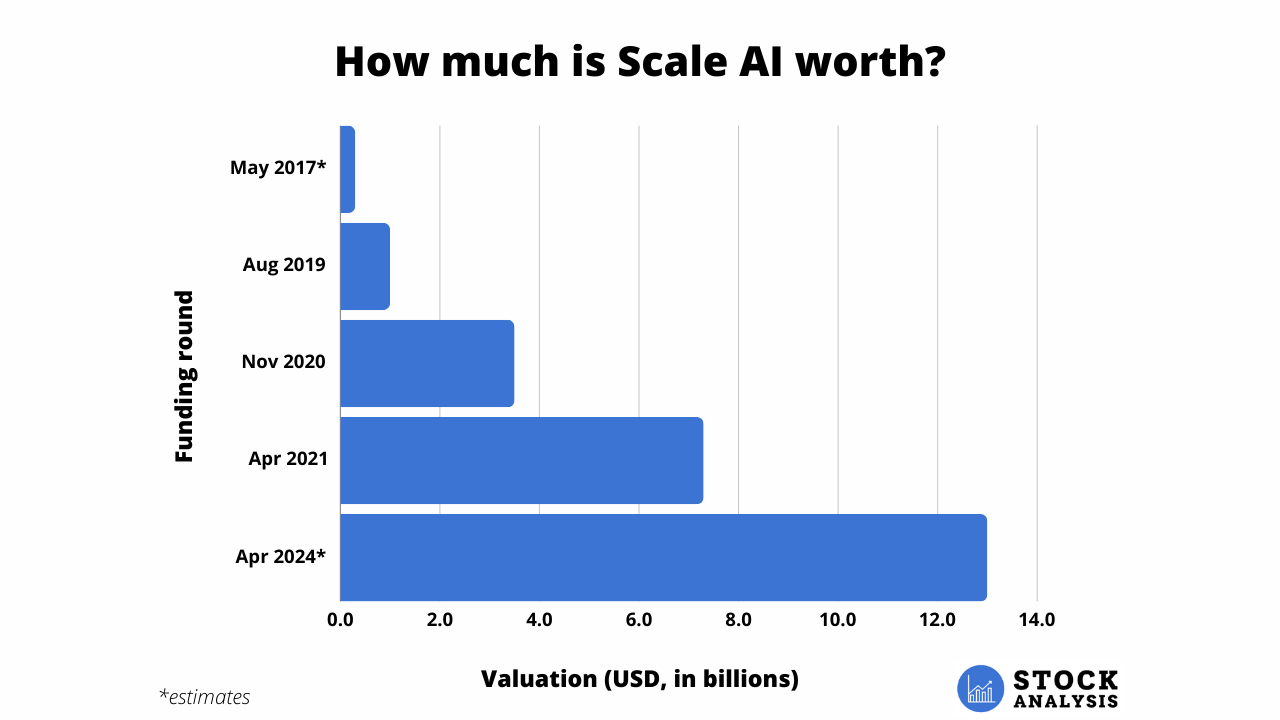

How much is Scale AI worth?

As mentioned above, Scale is in the middle of raising capital, which is likely to value the company at $13 billion.

This is up from its previous round in April 2021, which raised $325 million at a $7.3 billion valuation.

Here's a look at how its valuation has changed since the company was founded in 2016: