4 Ways to Invest in SpaceX Stock in 2026

SpaceX is a company unlike any other. It:

- Designs, manufactures, and launches reusable rockets and spacecraft;

- Serves high-speed satellite internet (via Starlink);

- Operates a global satellite network for government entities (called Starshield); and

- Shuttles astronauts to and from the International Space Station.

And now, it's getting into AI.

In February 2026, SpaceX acquired xAI, Musk's artificial intelligence lab. xAI — which itself acquired X (Twitter) in March 2025 — is best known for Grok, a generative AI chatbot similar to ChatGPT, Claude, and Gemini.

But Grok isn't the reason for the acquisition. More on that below.

The SpaceX–xAI deal valued SpaceX and xAI at $1 trillion and $250 billion, respectively, creating a combined entity valued at roughly $1.25 trillion.

The acquisition comes just months before SpaceX's proposed IPO, where the company was planning to raise up to $50 billion at a valuation as high as $1.5 trillion. It's unclear whether the xAI acquisition will change the structure of that offering.

For now, SpaceX remains private, which means you can't buy its shares through a traditional brokerage account.

Fortunately, there are other ways to gain exposure.

Here are four ways to buy SpaceX stock today, while it's still a private company.

1. Buy shares directly (from existing shareholders)

You can invest in shares of SpaceX through Hiive, an investment platform where accredited investors can buy shares of private, pre-IPO companies.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional.

As of the time of this writing, there are 58 unique listings for SpaceX on Hiive:

Each of these listings was created by a unique seller who may be a current or former employee, a venture capital fund, or an angel investor. Each seller sets their own asking price and quantity of shares available.

Buyers can accept a seller's asking price as listed or place bids and negotiate directly with sellers. Buyers can also add companies to their watchlist and receive notifications of any new listings or transactions.

You can see the current price of SpaceX shares by creating a free account with the button below:

Unfortunately, Hiive is only available for accredited investors — retail investors can't directly invest in SpaceX. However, there are other ways to gain exposure.

Note: SpaceX shares trade on secondary markets, so pricing and availability can vary by platform. Outside of Hiive, Forge is another large secondary exchange that may have different sellers, order blocks, or pricing at any given time. If you're serious about investing in SpaceX, it may make sense to check both platforms before investing.

2. Invest in the ARK Venture Fund

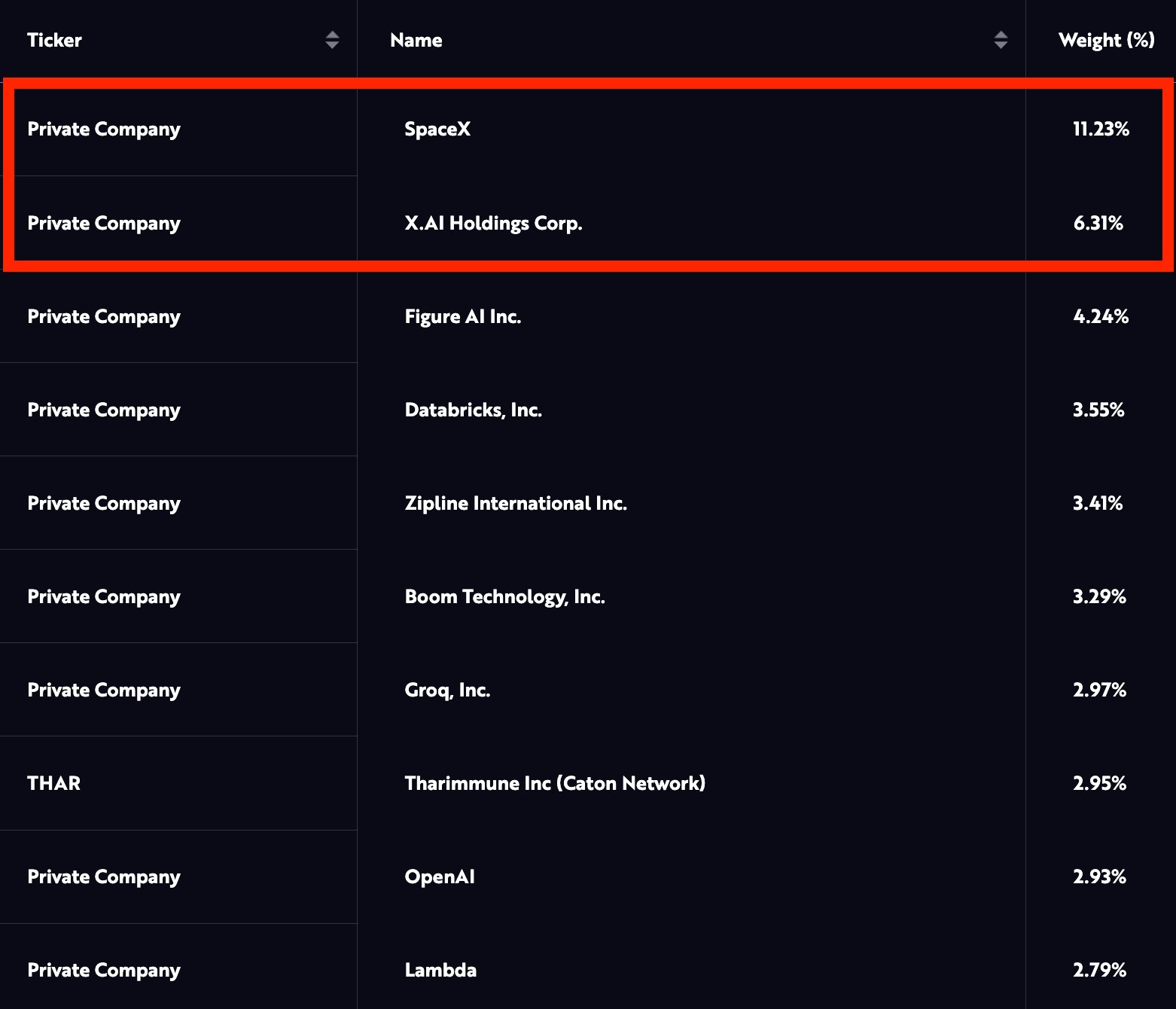

Cathie Wood's ARK Venture Fund invests in the "most innovative companies" in the world.

As of the end of January, SpaceX and xAI were the fund's two largest holdings, making up 17.54% of the fund:

This is the most direct way for retail investors to gain exposure to SpaceX.

That said, if you do invest, ~83.5% of your capital will be invested in other companies, but they may be companies you'd like to invest in anyway.

The fund has a 2.90% annual management fee and is available to both accredited and retail investors. You can learn more about how to invest here.

3. Invest indirectly via public companies

Another option is to buy shares of a public company that has invested in SpaceX.

So far, only two public companies have invested in one of its funding rounds: Alphabet (the parent company of Google) and Bank of America.

Alphabet's (GOOGL) first investment came in January 2015 when it invested $900 million at a valuation of $12 billion. It also participated in another funding round in December 2021, which increased its total stake to about 7%.

Given SpaceX's current valuation of $1.25 trillion, Alphabet's stake may be worth ~$60 billion.

Bank of America (BAC) invested $250 million in its November 2018 round at a valuation of ~$30 billion. This stake is likely worth about ~$10 billion.

You can buy shares of Alphabet or Bank of America in your brokerage account. If you don't have a brokerage account, I recommend checking out Public.

The downside to investing in Alphabet or Bank of America to gain exposure to SpaceX is that each of these companies' stakes represents a tiny fraction of their businesses.

Alphabet is a $4.1 trillion company, so its ~$60 billion stake in SpaceX is about 1.4% of its total business. Bank of America's market capitalization is $390 billion, so its ~$10 billion stake in SpaceX is just 2.6% of its total business.

Still, if you like either of these companies and want to own them anyway, getting exposure to SpaceX as well is an added bonus.

4. Invest in competitors and partners

If none of the above methods interest you (or if you can't stomach SpaceX's nearly 26x P/S ratio — more on that below), you may be interested in investing in its competitors.

Here are a few options:

- Boeing (BA): Competes with SpaceX through the United Launch Alliance joint venture and builds spacecraft for NASA.

- Raytheon (RTX): Produces satellites and defense systems that compete for the same government contracts SpaceX targets.

- Lockheed Martin (LMT): Another ULA partner and a key player in defense, satellite, and space systems.

- Rocket Lab Corporation (RKLB): Public launch company with reusable rockets competing directly in the mid-lift market.

- HEICO Corporation (HEI): Supplies mission-critical aerospace parts used across rockets and satellites.

- Virgin Galactic (SPCE): Richard Branson's suborbital space tourism company, which is pioneering commercial human spaceflight.

- Astra Space (ASTR): Small-launch competitor targeting low-cost payload delivery.

SpaceX builds most of its components in-house, but several outside suppliers stand to gain directly if the company continues to grow:

- Velo3D (VLD): Provides advanced metal 3D-printing systems used by SpaceX to manufacture rocket engines and complex components.

- Tesla (TSLA): While technically a separate Musk-run enterprise, there's overlap in talent, battery development, and autonomous systems between Tesla and SpaceX.

- Redwire Corporation (RDW): Supplies space infrastructure and satellite components used in missions launched aboard SpaceX rockets.

You can buy any of these stocks in your regular brokerage account.

Wait for the SpaceX IPO

If you want to invest in SpaceX but prefer the simplicity and transparency of the public markets, your chance may be coming soon.

After kicking off a secondary share sale that values the company at $800 billion, SpaceX is reportedly exploring a public listing as early as the second half of 2026. If that timeline holds, investors may not have to wait much longer.

Reports indicate SpaceX will be raising $50 billion at a valuation of up to $1.5 trillion in its public offering in what would be the largest IPO ever.

When SpaceX does go public, you'll be able to buy shares through any standard brokerage account — just like you would with Tesla, Amazon, or any other publicly traded company. If you need a brokerage account, we recommend Public.

Why did SpaceX acquire xAI?

xAI has spent billions of dollars building its own compute infrastructure. Its flagship system, Colossus, is the world's largest AI supercomputer.

Current advances in AI depend on data centers that require enormous amounts of power and cooling. As models scale, those constraints are becoming one of the biggest bottlenecks to progress.

For this reason, some have considered building data centers in space, where solar energy is abundant, cooling is effectively free, and environmental and permitting constraints largely disappear.

In that vision, orbit becomes a new layer of global infrastructure, not just a transportation domain.

Elon Musk is one of the most outspoken proponents of this idea. He has repeatedly argued that truly large-scale AI will eventually require moving compute off Earth altogether. That belief is where SpaceX and xAI converge.

The acquisition isn't about Grok.

It's about aligning launch systems, orbital infrastructure, and AI compute under one roof, positioning Musk's companies for a future where solar-powered satellites are operating as orbital data centers.

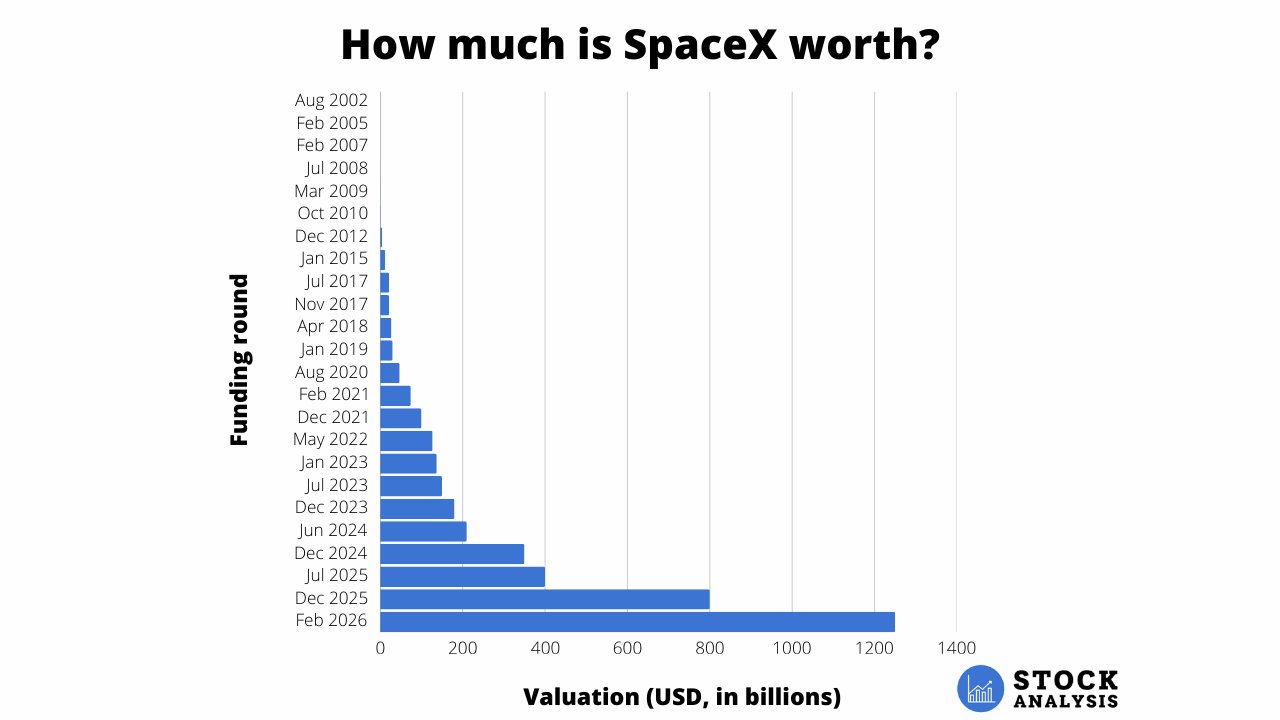

How much is SpaceX worth?

Following its acquisition of xAI in February 2026, the combined SpaceX entity is valued at $1.25 billion. In the transaction, SpaceX and xAI were given values of $1 trillion and $250 billion, respectively.

Prior to the acquisition, SpaceX was valued at $800 billion in a secondary share sale in December 2025, double the valuation it received in a similar transaction six months earlier.

SpaceX is cash flow positive and, as such, has not needed to raise outside capital in years. Its most recent external funding round came at the beginning of 2023, when it raised $750 million at a $137 billion valuation.

xAI was most recently valued at $230 billion in January 2026.

Here's a look at how SpaceX's valuation has changed over time:

A $1.25 trillion valuation makes SpaceX the most valuable private company in the world. It would also make it the 10th-largest company in the S&P 500 if it were publicly traded.

Not only would an $800 billion valuation make it the most valuable private company in the world, but it would be the 14th-largest company in the S&P 500 if it were publicly traded.*

*A $1.5 trillion valuation would make it #9.

SpaceX was projected to generate $15.5 billion ($11.8 billion from Starlink) in revenue in 2025, up from the estimated $13.3 billion it generated in 2024.

At a $1 trillion valuation, the company is trading at over 64x revenue.

For the sake of comparison, Raytheon (RTX) generated $89 billion in revenue last year and has a market capitalization of $272 billion (~3x revenue).

Frequently asked questions

Below are a few more questions people often ask about investing in SpaceX stock.

How to buy SpaceX stock?

SpaceX has not been made available to the public via an IPO or SPAC, but it is available on Hiive, our recommended pre-IPO investing platform. You can also invest in it via the ARK Venture Fund or by buying shares of Alphabet or Bank of America.

How much is SpaceX stock?

At a $1.25 billion valuation, SpaceX stock is currently trading for ~$526.59/share.

What is the SpaceX stock symbol?

SpaceX is still a privately held company. There is no stock symbol yet.

Who owns SpaceX?

SpaceX is partially owned by Elon Musk (its founder and CEO, who is estimated to own 42% of the company) and a host of other private equity firms, a few publicly traded companies, and other investment firms.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.

.png)