How to Invest in Tanium Stock in 2026

Tanium is a cybersecurity company with an impressive customer list.

The company counts 70% of the Fortune 100, 8 of the top 10 global financial institutions, and 7 of the top 10 global retailers as its clients. Additionally, it serves five branches of the U.S. Armed Forces.

What does it have that all these organizations want?

Tanium provides a cybersecurity platform that offers real-time visibility and control over millions of endpoints (think individual computers and mobile phones) across an entire organization's network.

Unlike traditional cybersecurity solutions, which use centralized databases, Tanium uses a decentralized approach. Its technology is known as Converged Endpoint Management (XEM), and Tanium is the only company in the industry to offer it.

This allows for nearly instantaneous scanning and modification of endpoints, making it possible to identify and prevent cyber threats in real time.

In other words, the company provides very effective and very necessary technology to ensure the security of computers and networks.

Founded back in 2007, Tanium is a mature business. It hit a revenue run rate of $700 million per year in 2024, up 59% since 2019 ($440 million), and has free cash flow margins of over 10%.

If you're wondering how you can buy Tanium stock, you're not alone. It's been the acquisition target of more than one company (more on this below), and investors have been waiting for its IPO for years.

But, if you qualify, there's a way to invest in it today.

Investing in Tanium as an accredited investor

Despite Tanium being a private company with no stock symbol, it is possible to buy its stock through a secondary marketplace called Hiive.

This is a platform for accredited investors to buy and sell shares in private companies and startups, and they currently have 38 listings of Tanium stock available.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional.

Importantly, you don't need a certificate to be an accredited investor, Hiive will simply ask whether you fit the criteria when you register for an account.

Of the more than 2,000 companies on Hiive, Tanium is currently one of the most actively traded:

Each listing is made by a separate seller who sets their own asking price and order size. Sellers may be employees, venture capital firms, or angel investors.

Buyers can either accept the asking price as listed, place bids and negotiate with a seller, or add the company to their watchlist and get notified of any new activity.

After registering, buyers can see the complete order book for every company on Hiive. This includes all recent transaction prices, all bids (prices and volume), and all asks (prices and volume).

Register for Hiive and see the shares available and asking prices below:

Can retail investors buy Tanium stock?

Unfortunately, retail investors cannot buy Tanium stock at this time.

The company is privately owned and there is no way to buy it in a brokerage account. If you're not an accredited investor, your only option for investing in Tanium is to wait for its IPO (more on this below).

Alternatively, you may be interested in investing in one of its publicly-traded competitors.

CrowdStrike

CrowdStrike (CRWD), like Tanium, specializes in cloud-delivered endpoint protection.

It's best known for Falcon, its AI-driven security platform that combines antivirus protection, endpoint detection and response (EDR), and a 24/7 managed hunting service that proactively disrupts threats in real time.

Because of its real-time threat detection and protection, CrowdStrike is the most similar public company to Tanium.

CrowdStrike has a market capitalization of $69.5 billion on $3.5 billion in annual revenue.

Palo Alto Networks

Palo Alto Networks (PANW), which tried to acquire Tanium in 2015, is best known for its next-generation firewall solutions.

Relative to Tanium, Palo Alto offers a broader range of cybersecurity solutions, including network security, cloud security, and threat detection and prevention.

Its Cortex XDR platform competes with Tanium's on endpoint threat detection, investigation, and response.

The company reported $8 billion in TTM revenue last year and has a market valuation of $109.4 billion.

Microsoft

Microsoft (MSFT) has a number of cybersecurity solutions, such as Azure Security Center, and Microsoft Defender for Endpoint (its Tanium-like offering).

Microsoft is also a customer of Tanium, using it to provide more comprehensive cybersecurity and IT management solutions, especially in endpoint visibility.

Microsoft is worth $3.1 trillion on TTM revenue of $245.1 billion.

While these are competitors of Tanium, none of them offer the same technology (converged endpoint management). Tanium's solutions are in a class of their own.

When will Tanium IPO?

In late 2015, Palo Alto Networks placed at least one bid in excess of $3 billion for Tanium. This followed a bid by VMware (which was acquired by Broadcom (AVGO) in November 2023), which would have valued Tanium at $3.5 billion.

Both bids were rejected.

When asked about the acquisition offers, CEO Orion Hindawi said:

“We have had partnership talks with a lot of companies, and a lot of them veer into wanting to acquire Tanium. We've been really clear with Tanium that acquisition is not part of our strategy. It's just not something that we're interested in at all.”

It was clear that Tanium only had eyes for the public market.

These intentions were reinforced in 2017, when Hindawi said in an interview, “I think our path is to go public,” and later added that they planned to list their shares in the next 18 months.

That was seven years ago, and the company has not made any indication of an upcoming IPO.

However, given its valuation, revenue growth, and an IPO market that seems to be warming up, Tanium could be an IPO candidate in the not-too-distant future.

When it does go public, you'll need a brokerage account to buy it. If you're in the market for a brokerage, check out our article on the best brokerage accounts.

Who founded Tanium?

Tanium was founded in 2007 by David and Orion Hindawi and isn't the first venture the father-son duo have worked on together.

The pair co-founded BigFix, also an endpoint management platform, which was sold to IBM in 2010. Orion Hindawi described this experience as “brutal,” which may explain his aversion to acquisitions.

Tanium was founded in San Francisco but moved its headquarters to Kirkland, Washington, in 2020.

Both David and Orion Hindawi currently sit on Tanium's board of directors, the former as Chairman Emeritus and the latter as Executive Chairman.

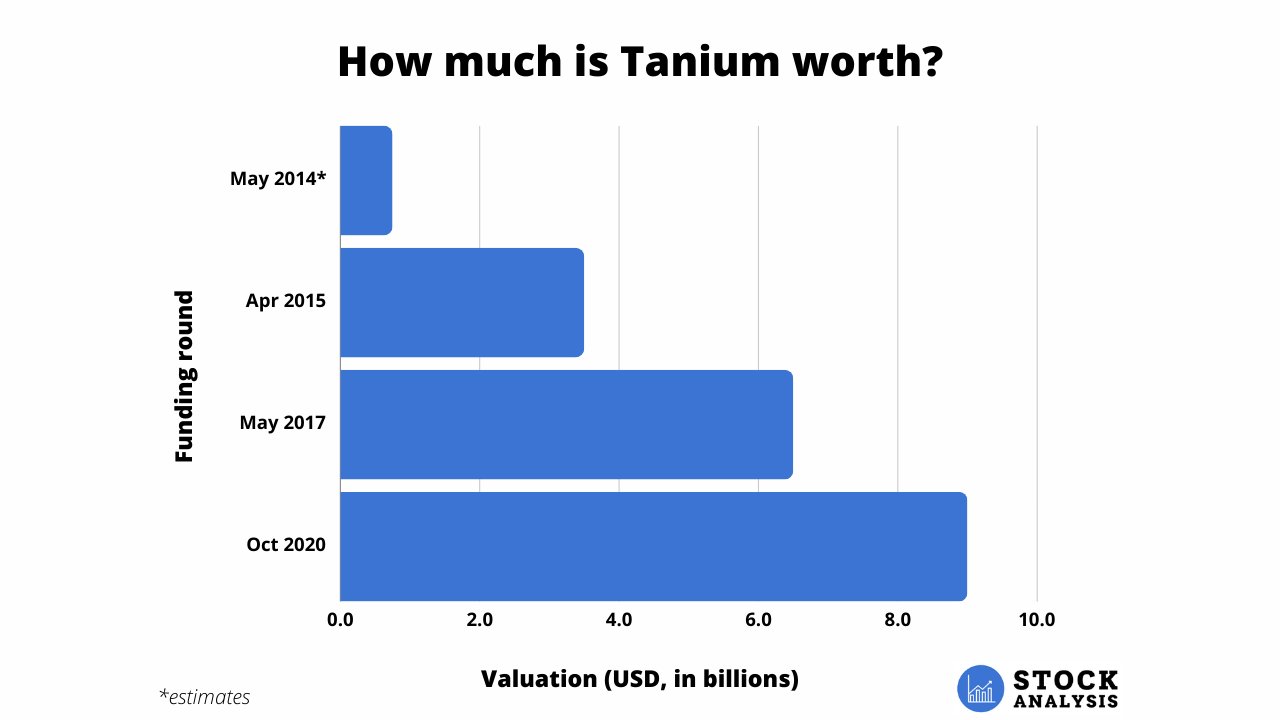

How much is Tanium worth?

Tanium most recently raised money at a valuation of $9 billion in October 2020, up from the $6.5 billion valuation it received in May 2017. The round raised $150 million, bringing the total amount raised to more than $900 million.

Here's how Tanium's valuation has changed over time:

The May 2017 fundraising round came after Tanium had generated just over $430 million in revenue in 2019.

Assuming it commanded a similar multiple, Tanium would be worth about $14.5 billion based on its current annual revenue run rate of $700 million.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.

.png)