How to Invest in ThoughtSpot Stock

Data is the new gold.

Over the last 10 years, companies across the world have begun collecting as much data as possible.

Data is information, and holds valuable insights into why customers buy or don't buy, what they value, what they'd pay more for, and so on.

The more data that's collected and the better it's analyzed, the faster a company can innovate and make more money.

But how are companies supposed to analyze all of this data and transform it into actionable insights?

ThoughtSpot's answer: artificial intelligence.

What does ThoughtSpot do?

ThoughtSpot provides AI-powered data analytics software.

It primarily focuses on two things:

- Search: Instead of relying on data analysts querying massive databases, ThoughtSpot allows any employee to draw insights from their company's data with its user-friendly search interface.

- Visualization: After finding the data, ThoughtSpot's Liveboards help you transform and visualize important business metrics in real time. Of note, this solution replaces business analytics dashboard software.

Altogether, ThoughtSpot significantly reduces the costs and time involved in using data to make decisions.

Plus, since a computer is performing the analysis, this software also helps lower the risks of human biases leading to inaccurate conclusions.

Add it all up, and you get more accurate, faster, and cheaper data analysis.

It's not hard to imagine why this is valuable, and you may be wondering how you can buy ThoughtSpot stock.

Is ThoughtSpot publicly traded?

ThoughtSpot is still a private company.

There is no ThoughtSpot stock symbol and no direct way for retail investors to buy it, though there are a few indirect ways to get exposure, which will be discussed later on.

And although the management team has been mentioning it for years (more on this below), they have yet to set an IPO date.

Fortunately, if you're an accredited investor, you don't need to wait for its IPO. You can buy ThoughtSpot today.

Accreditation requirements

You can qualify as an accredited investor if:

- You have an annual income of $200,000 individually or $300,000 jointly.

- Your net worth exceeds $1,000,000, excluding your primary residence.

- You are a qualifying financial professional.

How to invest in ThoughtSpot before its IPO

Hiive is a secondary marketplace for private, VC-backed companies and their shareholders.

Accredited investors can register for Hiive and gain access to hundreds of private companies, including ThoughtSpot:

As of the time of this writing, ThoughtSpot is one of the most actively traded securities on Hiive. There are 46 live orders of ThoughtSpot stock on Hiive.

Every listing is created by a different sellers with varying asking prices and volume. These sellers may be employees, venture capital firms, or angel investors.

Buyers can either accept the asking price as listed or place a bid and negotiate directly with sellers.

Register and check out the ThoughtSpot listings available on Hiive:

How to access ThoughtSpot as a regular investor

If you don't qualify as an accredited investor, there's no way for you to invest directly in ThoughtSpot before its IPO. However, there is a roundabout way to get some exposure.

Snowflake (SNOW), after having been a partner of ThoughtSpot since 2019, made a $20 million investment in the company in March 2021 at an undisclosed valuation.

It also participated in the Series F funding round in November 2021, which raised $100 million at a $4.2 billion valuation.

So, by buying Snowflake stock, you could get indirect exposure to ThoughtSpot.

That said, its total stake is probably worth around $40 million. Given Snowflake's market capitalization of $38 billion, this stake represents just 0.1% of its total value.

Additionally, Hewlett Packard (HPE) participated in the company's Series C round, which raised $50 million in 2016.

Assuming HP invested $10 million at a $450 million valuation, its stake may now be worth around $95 million, or 0.35% of its market capitalization.

In either case, buying Snowflake or HP is a very indirect means of getting exposure to ThoughtSpot. If you're a regular investor, you're likely better off waiting for its IPO.

ThoughtSpot IPO

Initial discussions of the ThoughtSpot IPO go back to at least September 2020, when it was reported that the company was “positioning itself to go public in fall 2021.”

To make itself more attractive to the public market, management changed its core business from providing on-premises services to cloud-based services.

As of September 2021, ThoughtSpot Cloud represented half of the company's annual recurring revenue. Furthermore, the company had 100 SaaS enterprise clients.

Still, it was not ready to go public, as management wanted to show a few more quarters of consistent revenue growth and improving margins.

Today, more than 3 years later, there has been little news about its eventual IPO.

ThoughtSpot acquired business analytics provider Mode Analytics for $200 million in June 2023. The acquisition increased ThoughtSpot's annual recurring revenue by 50% to $150 million. It also surpassed 1,000 customers.

Given management's earlier comments about waiting to go public until it showed consistent revenue growth, I would not expect it to IPO within the next year.

This is based on the assumption that the team will want several quarters to demonstrate the value of the Mode Analytics acquisition before becoming publicly traded.

My guess would be that ThoughtSpot's IPO will happen in 2026 or later.

When it finally does have its IPO, you'll need a brokerage account to buy its shares. If you're in the market, we recommend Public, where you can open an account for free.

On the platform, you can invest in stocks, ETFs, Treasuries, corporate bonds, cryptocurrencies, and collectibles, all from the same account.

Who owns ThoughtSpot?

ThoughtSpot was co-founded by Ajeet Singh and Amit Prakash.

Singh previously co-founded Nutanix, a cloud computing company that he took public in 2016. Prakash came from Google, where he built machine learning systems for Google Ads. Both co-founders likely still own large stakes in the company.

The company has raised $663.7 million over 12 rounds from 32 external investors, the vast majority of which are venture capital firms. Some of its notable investors include MicroVentures, Lightspeed Venture Partners, and Silver Lake Partners.

Additionally, current and former employees and executives also likely own some portion of the company via stock options and other incentives.

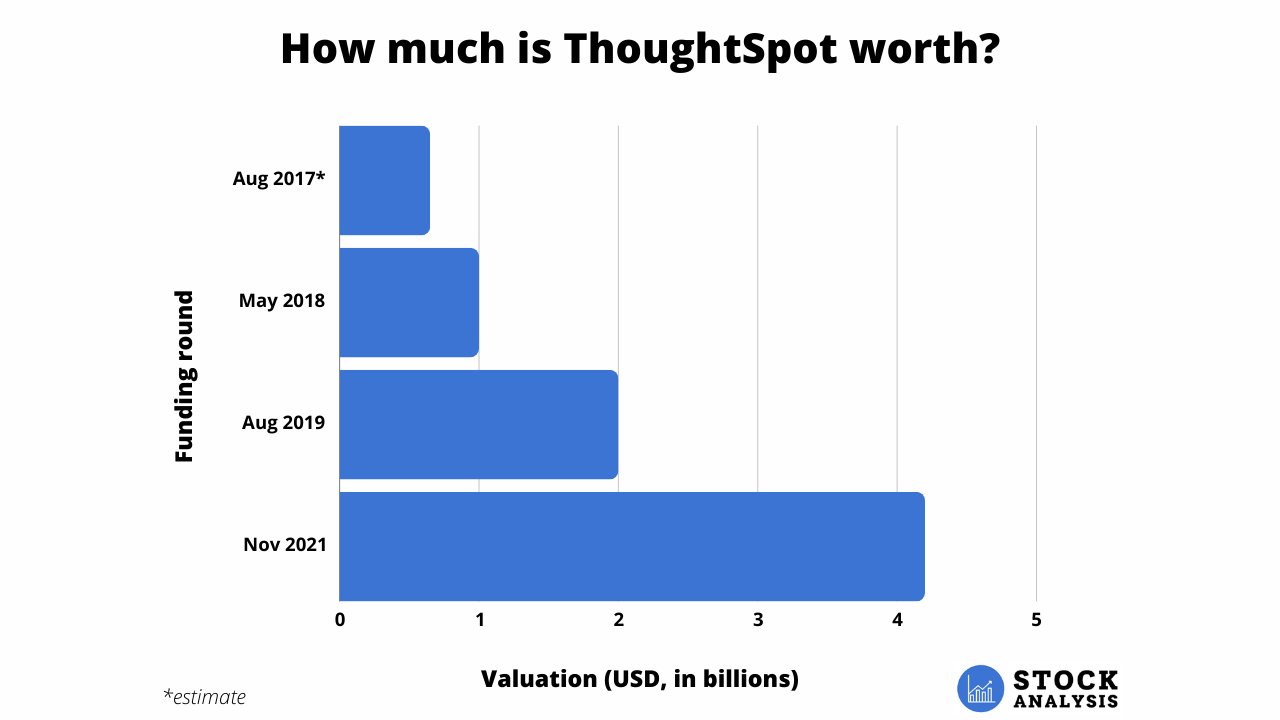

ThoughtSpot valuation chart

ThoughtSpot's most recent funding round was in November 2021.

It raised $100 million at a $4.2 billion valuation, up from the $2 billion valuation it received in its August 2019 round.

Here's a look at the valuation history:

Source: Crunchbase

While its revenue has grown significantly since it was last valued in 2021, a $4.2 billion valuation still implies a staggering 28x revenue multiple on its $150 million in ARR.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.