Moby Review: Track Record, Features, Pricing, and More

What if you could outsource your investment research to a team of professional analysts? Enter: Moby.

The Moby team researches companies, recommends stocks, analyzes the latest market developments, and writes reports that are available on the app or website.

They also track politician stock trades and provide a suite of research tools.

But none of that really matters. What does matter? How Moby's stock picks have performed. And that's what I'm going to focus on in this review.

Here's everything you need to know about Moby so you can decide whether it's the right service for you.

Moby review summary

- Overall rating:

- Service type: Stock picking, investment research

- Best for: Long-term investors

- Cost: $199/year (new members can get their first year for $99)

Bottom line

Based on the results of its stock picks so far — beating the market by 10.86% on average — Moby Premium is worth the cost, in my opinion. However, it should be noted that the product is only a few years old.

The team's research is also straightforward and easy to read, and the features in the app are easy to use. That said, I find the app's UI and UX to be a bit cluttered.

Additionally, Moby makes three new stock picks per week, which can be a bit overwhelming. But, more importantly, those picks have performed well.

What is Moby?

Moby is a stock-picking and investment research service founded in 2020 by Dan Remstein and Justin Kramer, a former analyst at Morgan Stanley.

Moby has a web-based version, but the product was built to be mobile-first and the app is the best way to use it.

In addition to Kramer, Moby recruited another analyst from Morgan Stanley. Together, these two lead the investment team.

Everything on Moby — all of its stock recommendations, economic analysis, and educational content — is produced by this team of professionals.

In my opinion, this is what separates Moby from many of its competitors.

Moby's performance and track record

Whether Moby Premium is worth it or not comes down to one thing: how its stock picks perform.

The goal of the service is to outperform the market. If it does, the $199/year cost is probably worth it. If it doesn't, it's probably not.

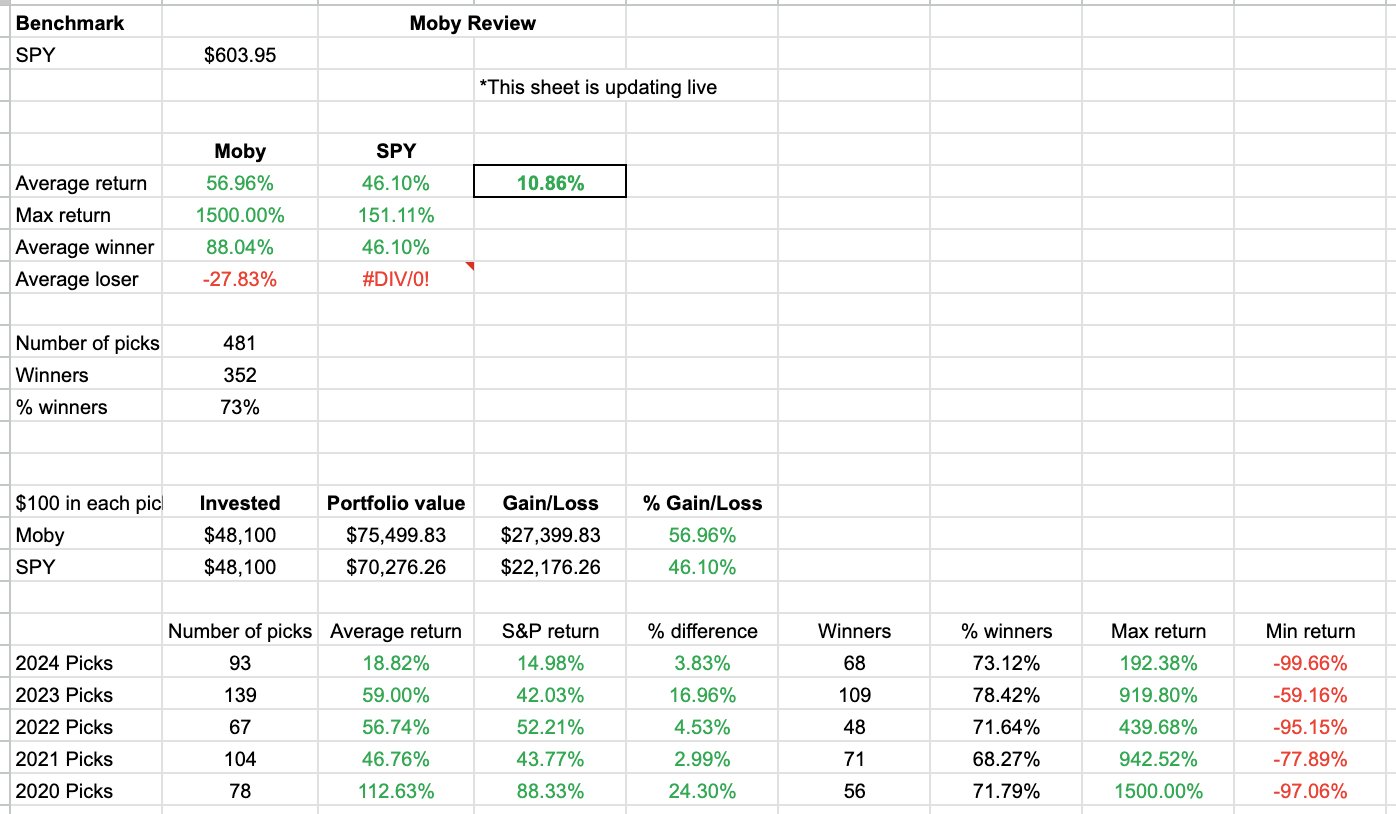

I put all of Moby's picks into a spreadsheet and compared the performance of those picks to if you had bought SPY every time Moby made a new recommendation.

Here are the results, as of December 10, 2024:

Here are the key figures:

- Its stock picks have an average return of 56.96%

- Its average stock pick is outperforming the S&P by 10.86%

- 73% of its picks are profitable

Yes, the results have been good.

As you can see from the Max return column, the team has picked some big winners. Some of its biggest winners are:

- Nvidia (NVDA), first picked in May 2020

- Eli Lilly (LLY), selected in January 2021

- e.l.f. Beauty (ELF), recommended in February 2022

- Palantir (PLTR), added in January 2023

- CAVA Group (CAVA), selected in January 2024

Each of these stocks has gained at least 100%.

While Moby's average pick has outperformed the market, this isn't a huge sample size or timeframe. And Moby has only made recommendations during a bull market — I'm curious to see how it would do in different market conditions.

With the data we have, though, the performance has been strong.

Moby's features: stock picks, analysis, and more

Moby offers a wide variety of features, including stock picks, model portfolios, expert analysis, a politician trade tracker, and information about upcoming products.

Here are detailed overviews of what those features are and how they work. Some of these features are free, while others require a Premium subscription.

1. Stock picks

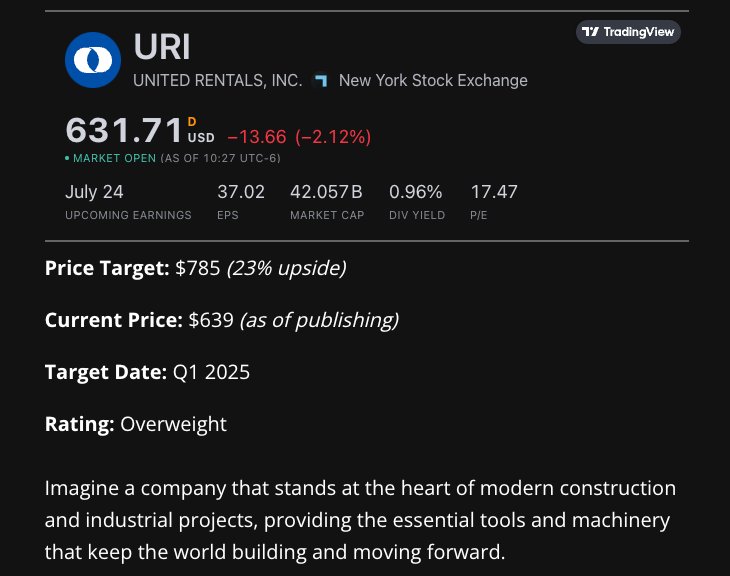

Moby's team makes three new stock recommendations per week for its Premium subscribers.

Each recommendation is posted with a short, easily digestible write-up on why the team made the recommendation and their price target for the stock.

The team uses a combination of fundamental and technical analysis for their stock picks. They focus on finding stocks with strong growth potential that they think are underpriced and poised for a move higher.

Most of their picks have a target date — the amount of time they expect it will take for the stock to reach their price target — of one year or less, though they usually continue to hold a stock past this date if it hasn't yet reached their price target.

Reports include a brief overview of the company, financial projections, and an outlook for the stock covered. Each report takes about five minutes to read.

Moby also makes each report available in an audio format so you have the option to listen to it on your commute.

2. Model portfolios

In addition to stock picks, Moby also provides Premium subscribers with four model portfolios, which can be used to build a portfolio without needing to wait for new stock picks to come out.

Each of the four model portfolios has its own investment strategy:

- Flagship Portfolio: Invests in undervalued technology companies.

- Offshore Portfolio: Invests in growth businesses in emerging markets like China, Brazil, South Korea, and Taiwan.

- ESG Portfolio: Invests in companies that aim to have a sustainable and societal impact in the world.

- Dividend Portfolio: Owns 10 companies with reliable earnings and sizable dividends.

You can use any of these portfolios, or some combination of their components, to form the base of your own portfolio.

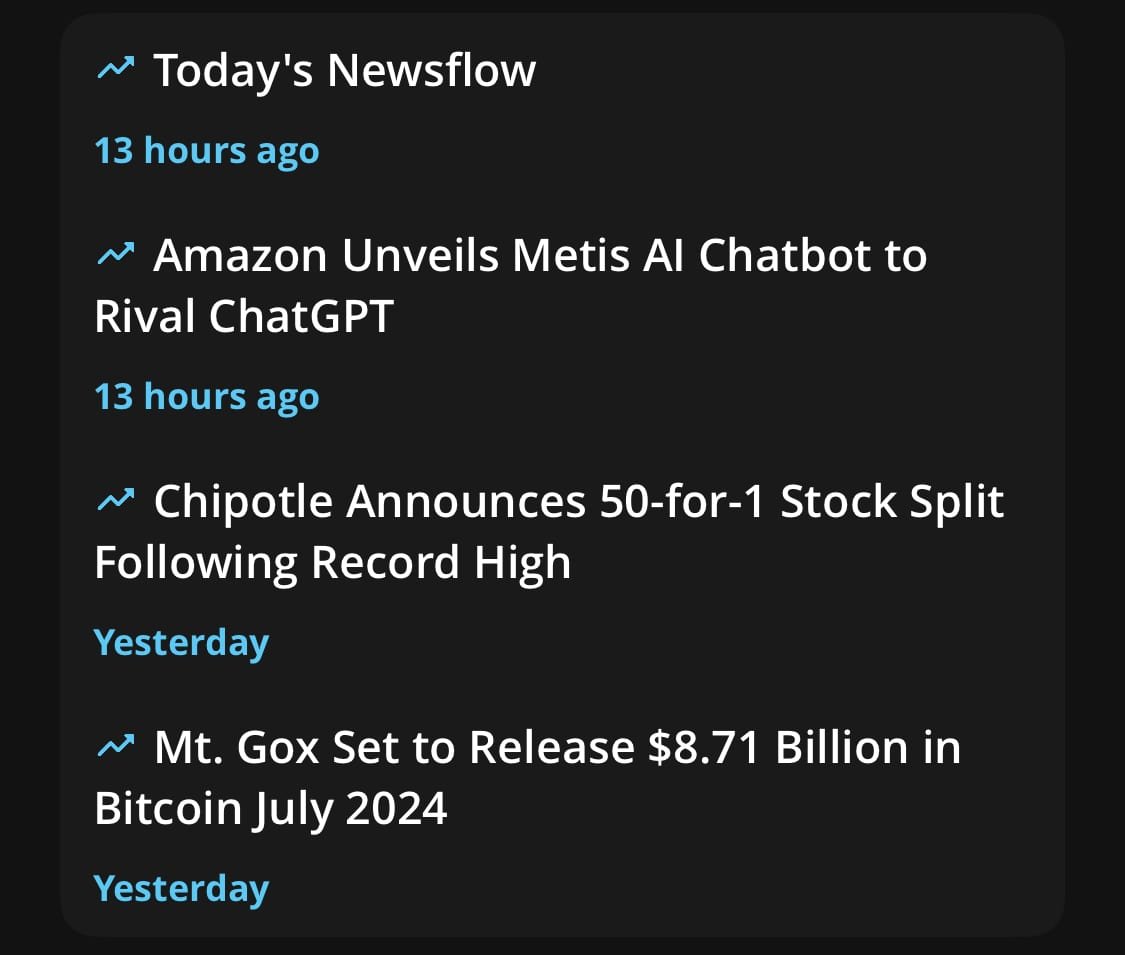

3. Market updates & analysis

Moby's team also writes recaps of any news that's moving the markets.

This often includes company-specific information, earnings reports, new economic data, or anything else the team finds noteworthy.

These updates are brief and easily digestible, using only a handful of sentences to cover the highlights of each story. The updates are available on the app or website through the newsfeed section.

If you're short on time, they also produce a section titled “Here's Everything You Need to Know Today,” where they write about just a few stories but in more detail.

Each story in this section comes with analysis on “Why It Matters” which will tell you what impact the news will have on the underlying stock.

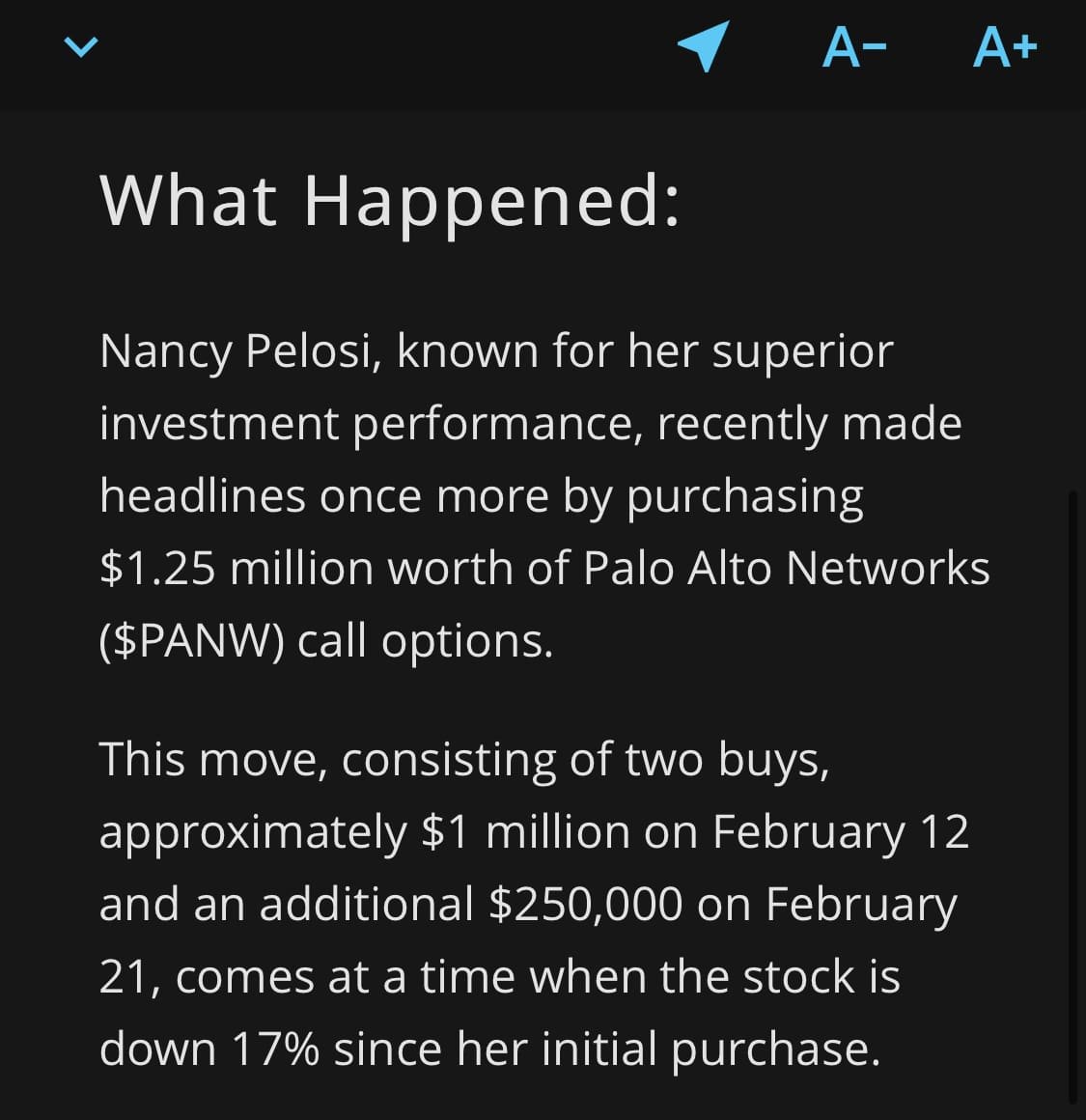

4. Politician trade tracker

Over the last few years, politicians have come under more scrutiny after repeatedly making well-timed stock and option trades.

Politicians are often privy to non-publicly available information, which can have material impacts on certain companies or sectors.

Today, politicians are required to disclose all of their trading activity, and Moby's political trades tool tracks that activity.

The tool houses short reports about the politician who made the trade and what they bought or sold.

5. Other tools

Moby also has five other tools, besides the policial trades feature, that you can use for further investment research and to stay on top of what's going on in the markets.

Here's a synopsis of what each of these other tools does:

- Market data: This section shows the daily, monthly, and yearly performance of the most common stock indices, futures, bonds, and forex markets.

- Asset lookup: This tool allows you to check a stock's or crypto's current price and also links to any research reports produced by Moby about that asset.

- Daily movers: This section shows the best and worst-performing stocks each day.

- Crypto screener: The screener gives you the ability to filter and sort through almost 500 cryptocurrencies by criteria such as market cap and trading volume.

- Economic calendar: The calendar contains information on upcoming Federal Reserve meetings, inflation reports, jobless claims, and other data that moves the markets.

I find that all of these tools help round out the product offering, but the bulk of the value is in the team's research, analysis, and stock picks.

6. Upcoming product improvements

Moby is currently developing a handful of features to improve its app and web platform.

Some of its upcoming features are:

- In-app trading: This will allow you to connect to your brokerage and place trades without leaving the Moby app.

- Portfolio linking: With this feature, you can track your investment performance and receive personalized notifications based on your positions.

While these aren't necessary features, they will be nice to have.

Moby Premium pricing

The majority of tools and research on Moby's mobile app are free.

However, its stock picks and model portfolios, which I'd argue are the bulk of its value, are only available to Premium subscribers.

Moby Premium costs $199 per year, but you can get the first year for $99 with this link.

It also comes with a 30-day money-back guarantee.

Pros and cons

| Pros | Cons |

| All research is produced by a team of ex-Wall Street analysts | The UI and UX of the app and web platform feel cluttered and could be improved |

| Strong historical performance | A lot of stock picks* |

| Beginner-friendly research reports, investment analysis, and market summaries | |

| A lot of stock picks* |

*The Moby team recommends three new stocks each week, which is a lot. This can be a pro or a con, depending on whether you want a lot of stock picks or have a hard time keeping up with this volume.

Is Moby right for you?

If you're new to investing and/or want to invest in individual stocks, but want some help with research and recommendations, Moby may be for you.

While it's only been around since 2020, the team's track record of winning stock picks justifies the cost of Premium — their picks have outperformed the S&P 500 by 10.86%.

While past performance does not guarantee future results, it's a good indication of the quality of Moby's team.

All the other tools and features, plus the market analysis and commentary, are just bonuses.

You can get your first year for just $99 with the button below. Plus, you can try it for 30 days and if you decide you don't like it you can get your money back.

Final verdict

When you're considering subscribing to a stock picking service, what really matters is the performance you can expect.

To that end, Moby has performed well, having outpaced the S&P by an average of 10.86% per stock pick since it started in 2020. If the team can continue generating these results, Premium is well worth the cost.

However, picking stocks that outperform the market is very difficult, and you shouldn't expect the team to pick winners every time. Right now, about 73% of their stock picks are winners, and 27% are losers.

If you aren't comfortable taking that risk, this service isn't for you.