Motley Fool Stock Advisor Review: Is It Worth the Money?

There are hundreds of stock-picking services out there, and they all promise the same thing: outperformance.

The Motley Fool is no different, except that it has been around for much longer and has more subscribers than almost all of its competitors.

Therefore, it was high time for me to become a subscriber myself and see what it was like. Most importantly, I wanted to see how their stock picks performed.

Below, I cover everything you need to know about The Motley Fool's Stock Advisor service, including performance, who it's right for, and what to expect as a member.

Stock Advisor review summary

- Overall rating:

- Service type: Stock-picking newsletter

- Best for: Long-term investors

- Cost: $199/year (new members can get their first year for $89)

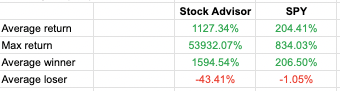

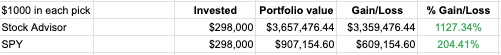

According to my own calculations, the service has outperformed the S&P 500 by 4.4x since 2002.

- Lifetime return: 663.05% (vs the S&P's 149.86%)

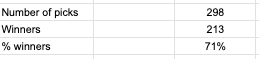

- Percent winners: 71%

I break down these results in significantly more detail in the sections below.

What is Stock Advisor?

Stock Advisor is a stock-picking newsletter that was launched in 2002 by The Motley Fool.

The Motley Fool (which I'll abbreviate as TMF) was founded by brothers Tom and David Gardner in 1993. The pair started with a blog and other content about investing.

Fast forward about 31 years, and the company now reaches millions of people every month and aims to help them get smarter with their money.

TMF does this through financial education, stock market news, online communities, and its premium investing services.

Stock Advisor is TMF's most popular product. According to their website, more than 500,000 investors are subscribed to the service.

Stock Advisor performance and returns

Disclaimer: Past performance does not guarantee future results.

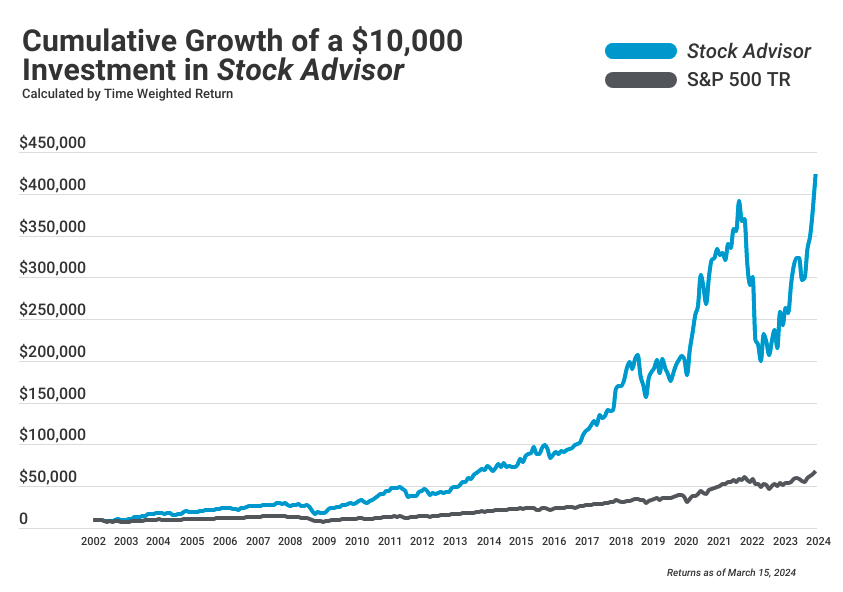

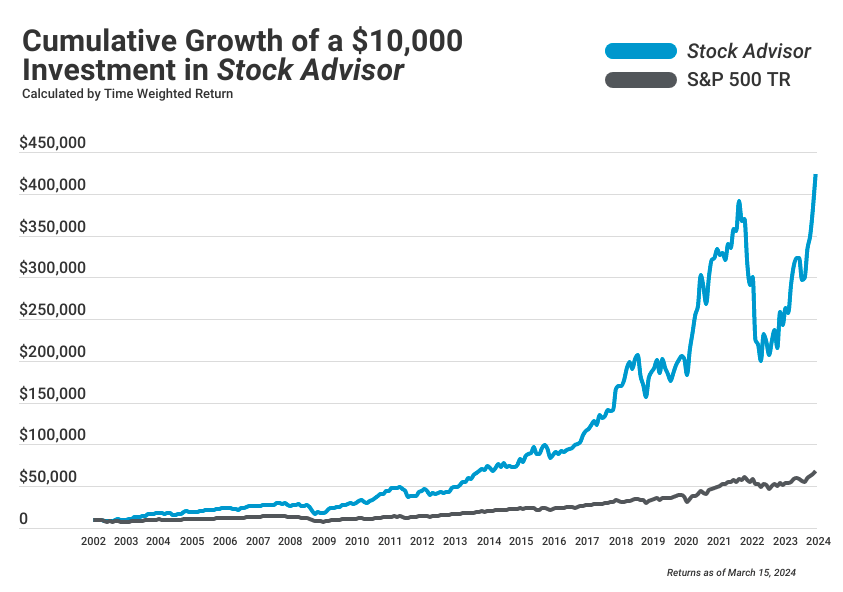

If you landed on this article, you've likely already seen this chart comparing the performance of Stock Advisor to the S&P 500:

But what you haven't seen is what the performance looks like from inside the service, and how these returns have been generated.

But what you haven't seen is what the performance looks like from inside the service, and how these returns have been generated.

All figures below are current as of April 15, 2024.

I went back and tracked all of Stock Advisor's recommendations since its inception in 2002. Here's how the service has performed since then:

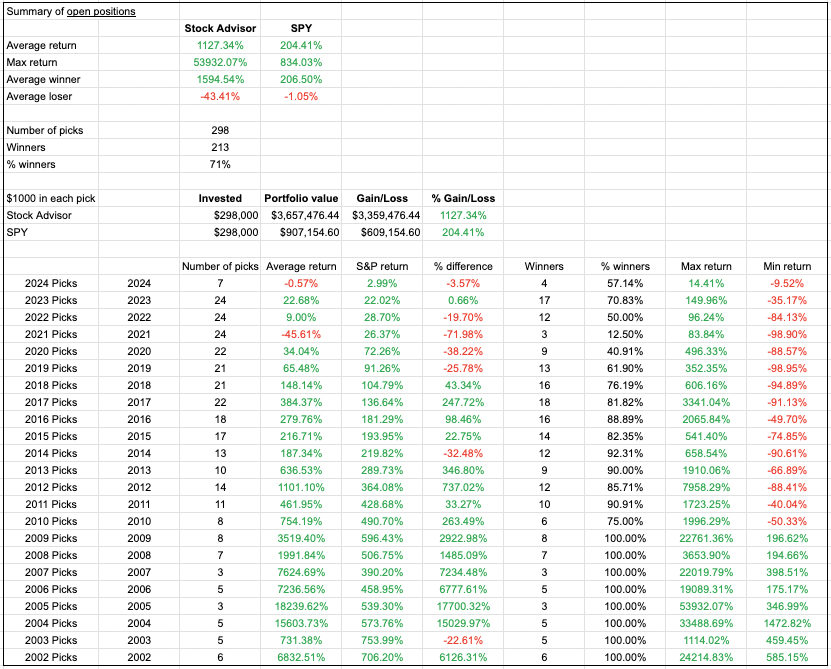

I was able to do an even deeper analysis of Stock Advisor's open positions, breaking down their picks by year. Here are the results for its 298 open positions:

You can see these results for yourself with the link above, but of the 298 open positions:

The average return has been excellent:

71% (213) are winners:

A $1,000 investment in each of these stocks would be doing quite well:

As you'll read in the next section, the team is aiming for a holding period of at least 5 years.

You'll notice that the number of open positions falls off considerably after 2015, a holding period of about 9 years. Any stocks held longer than that are most likely big winners, since the team has not found a reason to sell them.

How does Stock Advisor work?

1. Investment selection process

Stock Advisor only recommends stable, well-established companies with 1) growth potential and 2) robust competitive advantages.

There are two teams within Stock Advisor. Each team provides one stock pick per month.

The first team is led by Tom Gardner. Tom's team focuses on fundamental analysis and deploys many value investing principles to spot companies that are trading at less than they're worth.

The other team, led by David Gardner, uses both fundamental and quantitative analysis. Not only are they looking for stocks with strong underlying businesses, but they want the stock to be showing some signs of momentum.

While the two teams have almost perfect overlap on which type of stocks they might recommend, the timing of their recommendations is different.

Tom's team recommends stocks when they're undervalued, usually after a pullback in the stock price. David's team recommends stocks that are in demand, which is most often seen by an increasing price.

This blended approach makes for a more balanced portfolio.

2. The Motley Fool's investing philosophy

All professional investors have a set of rules that guide how they invest.

When considering subscribing to a service, you should be sure the service's investment philosophy lines up with your own style of investing.

There are 6 components to investing “The Motley Fool Way:”

- Diversify: Diversification, or spreading your money among a range of investments, can reduce your risk. TMF recommends owning a portfolio of at least 25–30 stocks. Although that may not sound like enough, this lines up with other research.

- Have a long-term outlook: There are many causes of short-term fluctuations in the stock market, but good businesses tend to win out in the long run. TMF recommends planning to hold each of its recommendations for 5 years or more.

- Invest regularly: TMF suggests investing new money regularly so you never have to sell current positions to fund new positions.

- Hold through volatility: The stock market declines by 10–30% on somewhat regular occasions. You should be ready for these downturns and not sell out of fear or panic.

- Don't sell winners: A common mistake among investors is selling their winners. Instead, TMF has found that their winning stocks tend to keep winning, and they can increase their portfolio's returns by holding on to these winners.

- Focus on long-term returns: Just like you should have a long-term outlook with the individual businesses in your portfolio (#4), TMF recommends you have a long-term outlook with your portfolio — a 5- to 25-year period, not shorter.

In summary, TMF recommends you buy at least 25 great stocks, commit to holding them for at least 5 years, make regular contributions to your portfolio, and be patient through good times and bad.

What else is included with Stock Advisor?

The main service Stock Advisor provides is its new stock recommendations, which are released every two weeks. But here's what else you get:

- Starter stock list: For new subscribers, the Stock Advisor team actively updates its list of their “Top 10 Starter Stocks” to buy now. This way, you can get started building your portfolio on day one.

- Educational material: You'll also gain access to a library of expert guidance on financial markets, personal finance, and individual stocks. This material comes in multiple formats, including written articles, eBooks, videos, and podcasts.

- Online community: Finally, you can talk to other Motley Fool subscribers in the online community.

How much does Stock Advisor cost?

Stock Advisor costs $199/year.

For that price, you get two new stock picks per month, so 24 per year, investment research reports, portfolio commentary, educational content, and access to a private community.

New members can get their first year of Stock Advisor for just $89.

Every Motley Fool product comes with a 30-day membership fee-back guarantee. So, if you're not happy with the service for any reason, you can cancel your subscription and get a refund.

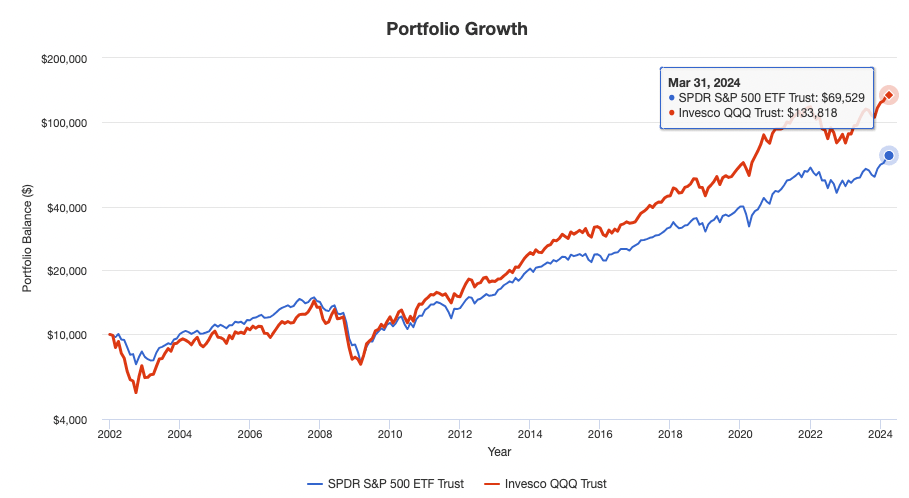

Should Stock Advisor's benchmark be the Nasdaq?

One note about Stock Advisor that is frequently mentioned on discussion forums like Reddit is that since the service mainly recommends technology stocks, its benchmark should probably be the Nasdaq, not the S&P 500.

This was also something I had thought about before writing this review, so I put together this section to compare Stock Advisor against the Nasdaq 100.

As a refresher, here's the typical chart TMF uses to market Stock Advisor:

While I can't re-make this chart using the Nasdaq instead of the S&P, I can compare the performance of the Nasdaq 100 and the S&P 500.

Here's the cumulative growth of $10,000 of these two indexes since 2002:

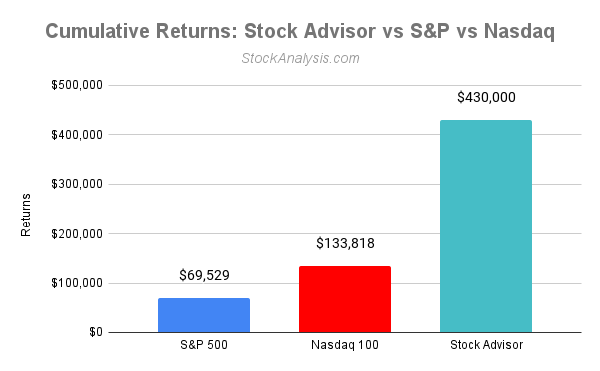

Since 2002,

- The Nasdaq 100 has returned 12.36% per year, or cumulative growth of $133,818

- The S&P 500 has returned 9.11% per year, or cumulative growth of $69,529

Based on the chart above, the cumulative balance of a $10,000 investment in Stock Advisor since 2002 would be worth around $430,000 today, a return of 18.64% per year.

With compounding, this outperformance leads to significant differences in cumulative returns:

Despite having returns roughly 3.2% per year higher than the S&P, the Nasdaq's returns are still lower than the results earned by Stock Advisor.

Stock Advisor pro and con summary

| Pros | Cons |

| Outperforming the S&P and Nasdaq | For long-term investors only |

| 1 new stock pick every 2 weeks | Frequent promotional emails |

| Simple, beginner-friendly service | |

| A long track record | |

| $89 introductory offer |

Final verdict

To recap this Stock Advisor review:

- Stock Advisor has cumulatively outperformed the S&P by 4.4x. Past performance does not guarantee future results, but the team's track record dates back to 2002.

- The service is $89 for new members. This isn't expensive for this type of product, but you will want to have at least a few thousand dollars to invest and be able to make regular deposits to your brokerage each month to invest in new stock picks.

- Don't expect this to be a perfectly smooth ride. As the team's investing philosophy makes clear, the stock market is volatile, and your investments may go down for long periods of time. If you aren't comfortable with that risk, this probably isn't the service for you.

If all of that sounds good to you, then yes, Stock Advisor is worth the money.