Motley Fool Stock Advisor Review: Is It Worth the Money?

There are hundreds of stock-picking services out there, and they all have the same goal: outperformance.

But few (if any) have delivered on that goal with the same consistency and success as Stock Advisor.

As of July 2025, Stock Advisor's average pick has outperformed the S&P 500 by more than 5.7x (+1,034% vs +180%).

That's why the service has gained more than 500,000 subscribers (including me) since being launched by The Motley Fool in 2002.

Here's everything you need to know about The Motley Fool's Stock Advisor service, including performance details, its investing strategy, who it's right for, and what you can expect if you become a member.

Stock Advisor review summary

- Overall rating:

- Service type: Stock recommendation service

- Best for: Long-term investors

- Cost: $199/year (new members can get their first year for $99)

I've subscribed to and tracked the performance of the most popular stock picking services, and in terms of performance, consistency, ease of use, and brand reputation, Stock Advisor is in a category all by itself.

Over the last 23 years, its stock picks have outperformed the market by over 5.7x.

The service is suited for a wide variety of investors — from complete beginners to more advanced investors looking for new stock ideas — though The Motley Fool recommends having a portfolio size of at least $25,000.

What is Stock Advisor?

Stock Advisor is an investing newsletter that provides two new stock recommendations per month. It was launched in 2002 by The Motley Fool.

The Motley Fool (which I'll abbreviate as TMF) was founded by brothers Tom and David Gardner in 1993. The pair wrote blog content and had a talk show about investing.

Fast forward 32 years, and the company now reaches millions of people every month, and it aims to help each of them get smarter with their money.

TMF does this through financial education, stock market news, online communities, and its premium investing services.

Stock Advisor is TMF's most popular product. According to its website, more than 500,000 investors are subscribed to the service.

Stock Advisor performance and returns

Disclaimer: Past performance does not guarantee future results.

As of July 2025, Stock Advisor's average pick has returned +1,034% vs +180% for the S&P 500 since the service was launched in 2002.

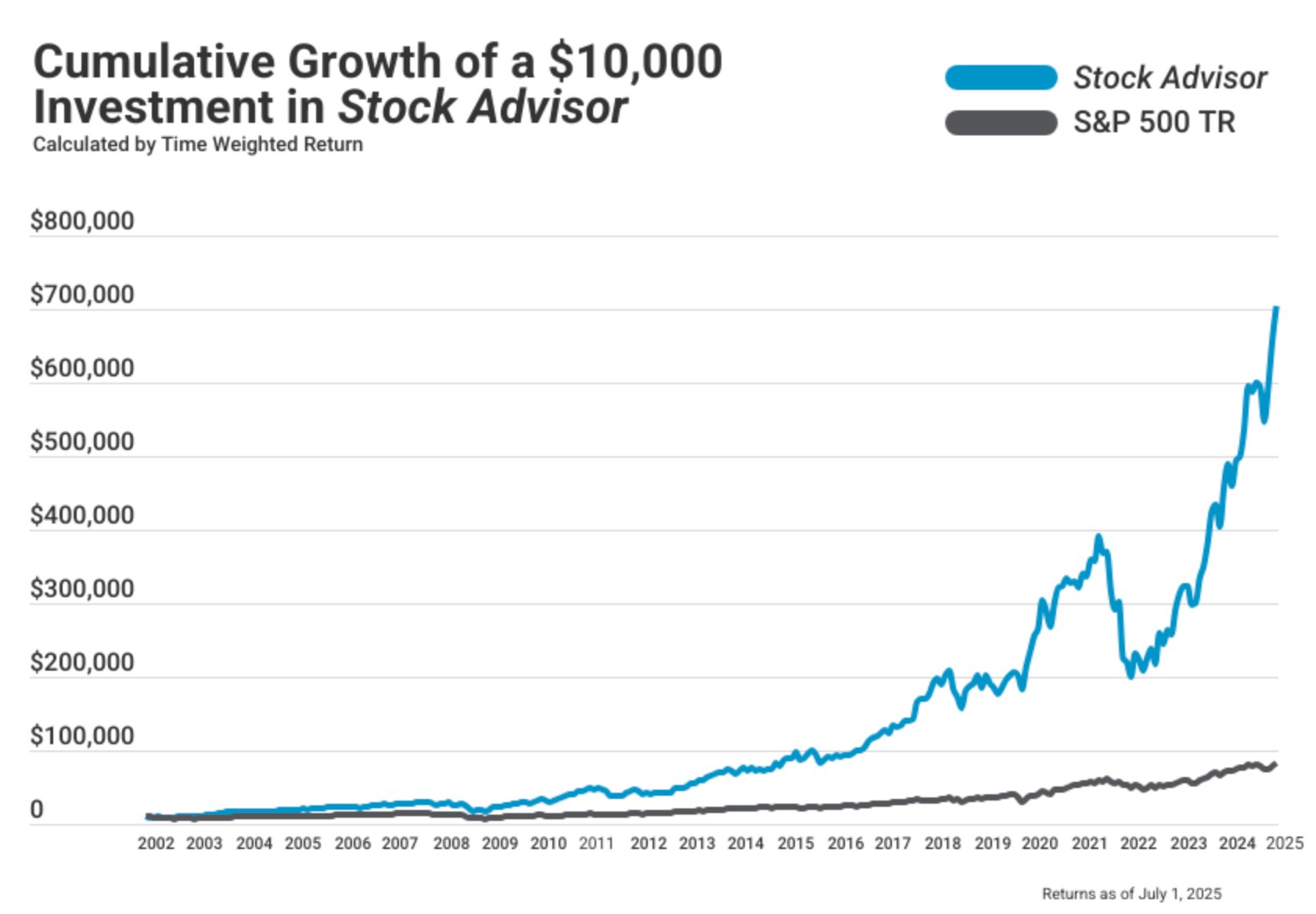

If you landed on this article, you've likely already seen this chart comparing the performance of Stock Advisor to the S&P 500:

Source: The Motley Fool

You can read more about the team's investment process below, but its primary focus is on buying growth-oriented companies that can be bought and held for at least five years.

They also believe in holding their winners. When they find a good company, they like to hold it for as long as possible.

For example, some of its best-performing recommendations include:

- Nvidia (NVDA), +80,430% since March 2005

- Netflix (NFLX), +75,308% since November 2004

- Shopify (SHOP), +3,843% since July 2016

Sign up to see their most recent recommendations.

But its gains aren't limited to just a few big winners. In all, Stock Advisor has recommended more than 120 stocks that have returned over +100%.

Subscribers can see its full list of recommendations (and performance) at any time via the website.

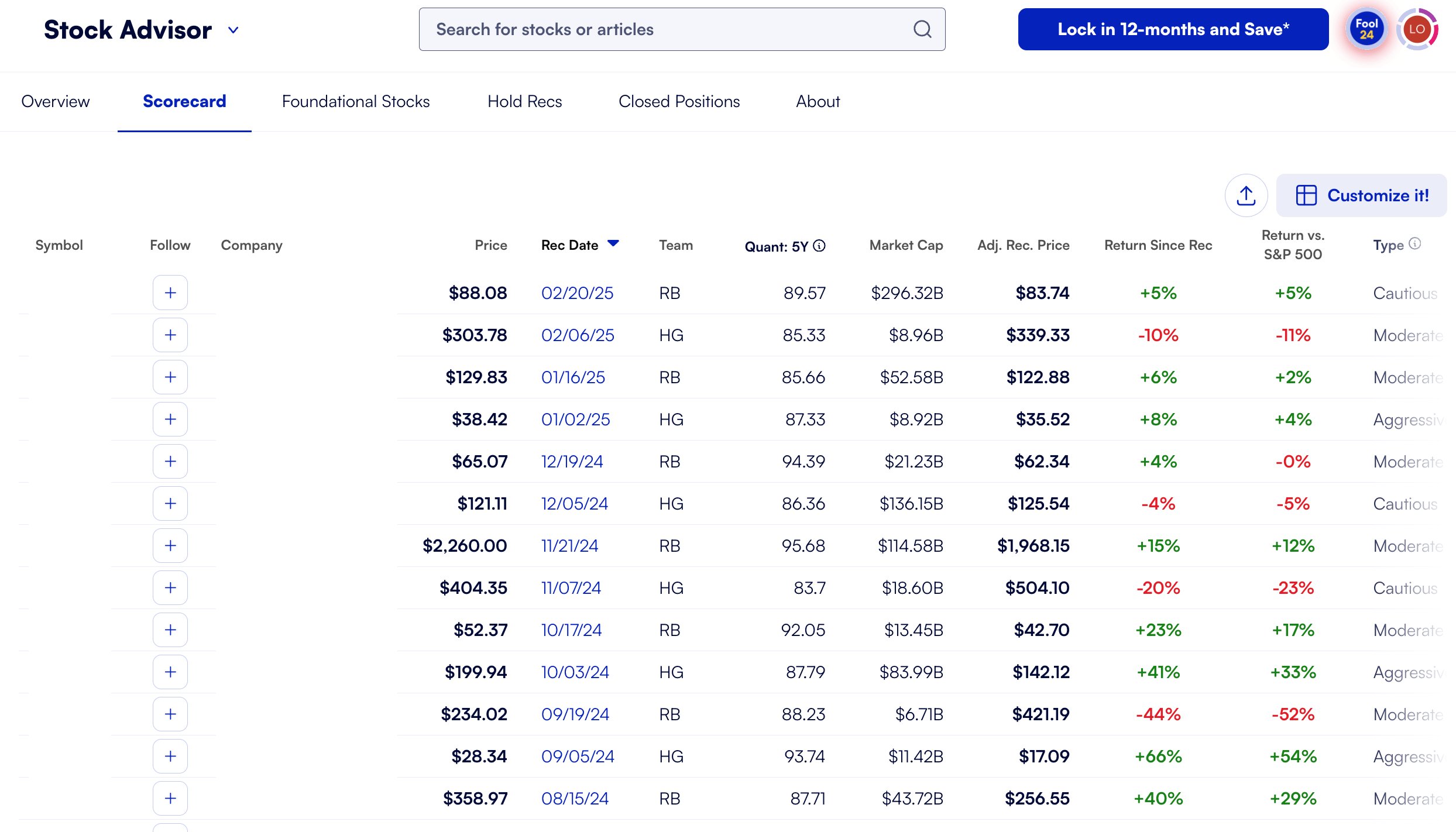

Here's what the main dashboard looks like (I've hidden the company names and tickers):

Source: The Motley Fool

If you're wondering how the Stock Advisor decides which stocks to recommend and what investing rules they follow, that's what I cover next.

How does Stock Advisor work?

1. Investment selection process

The Stock Advisor team recommends stable, well-established companies with 1) growth potential and 2) robust competitive advantages.

Each company is evaluated based on its management team, financial history, and business prospects.

The team frequently re-recommends stocks if their fundamentals are still strong and they're trading at good prices.

Members can also view "Rankings," a list of the team's favorite investment opportunities from the hundreds of companies they've previously recommended.

2. The Motley Fool's investing philosophy

All professional investors have a set of rules that guide how they invest.

When considering subscribing to any service, you should be sure its investment philosophy lines up with your own style of investing.

There are 6 components to investing “The Motley Fool Way:”

- Diversify: Diversification, or spreading your money among a range of investments, can reduce your risk. TMF recommends owning a portfolio of at least 25–30 stocks. Although that may not sound like enough, this lines up with other research.

- Have a long-term outlook: There are many causes of short-term fluctuations in the stock market, but good businesses tend to win out in the long run. TMF recommends planning to hold each of its recommendations for 5 years or more.

- Invest regularly: TMF suggests investing new money regularly so you never have to make the decision to sell current positions to fund new positions.

- Hold through volatility: The stock market declines by 10–30% on a somewhat regular basis. You should be ready for these downturns and not sell out of fear or panic.

- Don't sell winners: A common mistake among investors is selling their winners. Instead, TMF has found that their winning stocks tend to keep winning, and they can increase their portfolio's returns by holding on to these winners.

- Focus on long-term returns: Just like you should have a long-term outlook with the individual businesses in your portfolio (#4), TMF recommends you have a long-term outlook with your portfolio — a 5- to 25-year period, not shorter.

In summary, TMF recommends you buy at least 25 great stocks, commit to holding them for at least 5 years, make regular contributions to your portfolio, and be patient through good times and bad.

What else is included with Stock Advisor?

The main service Stock Advisor provides is its new stock recommendations, which are released every two weeks. But here's what else you get:

- Starter stock list: For new subscribers, the Stock Advisor team actively updates its list of 10 “Foundational Stocks” to buy now. This way, you can get started building your portfolio on day one.

- Educational material: You'll also gain access to a library of expert guidance on financial markets, personal finance, and individual stocks. This material comes in multiple formats, including written articles, eBooks, videos, and podcasts.

- Online community: Finally, you can talk to other Motley Fool subscribers in the online community.

How much does Stock Advisor cost?

Stock Advisor costs $199/year (new members can get their first year of Stock Advisor for just $99).

For that price, you get two new stock recs per month, so 24 per year, investment research reports, portfolio commentary, educational content, and access to a private community.

Stock Advisor comes with a 30-day membership fee-back guarantee. So, if you're not happy with the service for any reason, you can cancel your subscription and get a refund.

Should Stock Advisor's benchmark be the Nasdaq?

One note about Stock Advisor that is frequently mentioned on discussion forums like Reddit is that since the service mainly recommends technology stocks, its benchmark should probably be the Nasdaq, not the S&P 500.

This was also something I had thought about before writing this review, so I put together this section to compare Stock Advisor to the Nasdaq 100.

As a refresher, here's the typical chart TMF uses to market Stock Advisor:

Source: The Motley Fool

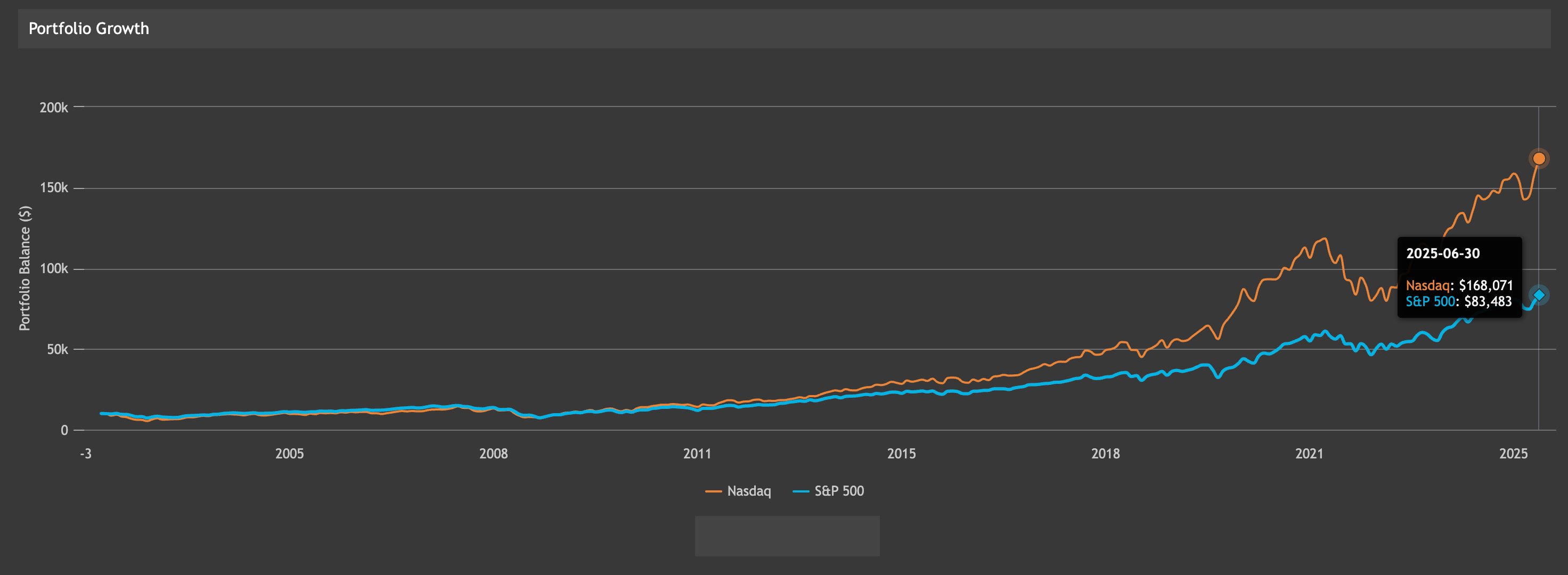

While I can't remake this chart using the Nasdaq instead of the S&P, I can compare the performance of the Nasdaq 100 and the S&P 500.

Here's the cumulative growth of $10,000 of these two indexes since January 2002 (QQQ in orange, SPY in blue):

Since January 2002,

- The Nasdaq 100 has returned 12.76% per year, or a cumulative growth of $168,071

- The S&P 500 has returned 9.45% per year, or a cumulative growth of $83,483

The Nasdaq has outperformed the S&P by around 3.3% per year, which has led to a pretty big difference in cumulative returns.

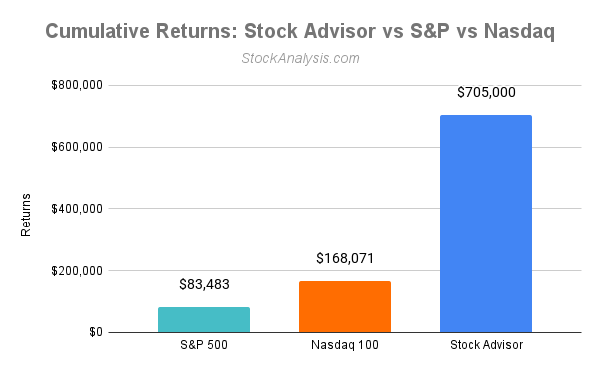

However, the Nasdaq's outperformance is completely overshadowed by Stock Advisor's returns.

Based on the chart above, an initial investment of $10,000 in Stock Advisor since 2002 would be worth around $705,000 today, a return of 22.24% per year.

Here's a look at the difference in cumulative gains:

Despite having returns over 3.3% per year higher than the S&P, the Nasdaq's returns are still much lower than the results earned by Stock Advisor.

Stock Advisor pro and con summary

| Pros | Cons |

| Has historically outperformed the S&P and Nasdaq | For long-term investors only |

| 1 new stock rec every 2 weeks | Frequent promotional emails |

| Simple, beginner-friendly service | |

| A long track record | |

| $99 introductory offer |

You may be interested in our Seeking Alpha vs The Motley Fool vs Morningstar vs Zacks article.

Final verdict

To recap this Stock Advisor review:

- As of July 2025, Stock Advisor has outperformed the S&P by 5.7x. Past performance does not guarantee future results, but the team's track record dates back to 2002.

- The service is $99 for new members. This isn't expensive for this type of product, but you will want to have at least a few thousand dollars to invest and be able to make regular deposits to your brokerage each month to invest in new stock recs.

- Don't expect this to be a perfectly smooth ride. As the team's investing philosophy makes clear, the stock market is volatile, and your investments may go down for long periods of time. If you aren't comfortable with that risk, this probably isn't the service for you.

If all of that sounds good to you, then yes, Stock Advisor is worth the money.