The 9 Best Stock Research Websites

There are hundreds of stock research websites and investing tools on the internet.

The best one for you depends on what kind of investor you are, what information you need, and whether you're willing to pay for a subscription.

You might be looking for:

- Financial data

- A stock screener

- News and information

- Wall Street analyst ratings

- Charting and tools for technical analysis

Or more likely, some combination of all of them.

With those use cases in mind, here's my list of the best stock websites in 2026.

A quick look at the best stock research websites

| Our pick | Best for | Pricing |

| Stock Analysis | Best overall | Free |

| Seeking Alpha | Opinionated stock research & analysis | Paid |

| TradingView | Charts and technical analysis | Primarily paid |

| Motley Fool | Stock recommendations | Paid |

| Morningstar | Mutual funds | Primarily free |

| Fiscal.ai | Investment research terminal | Primarily paid |

| Stock Market Guides | Day & swing trading setups | Paid |

| Finviz | Standalone stock screener | Free |

| Yahoo Finance | Stock market news | Free |

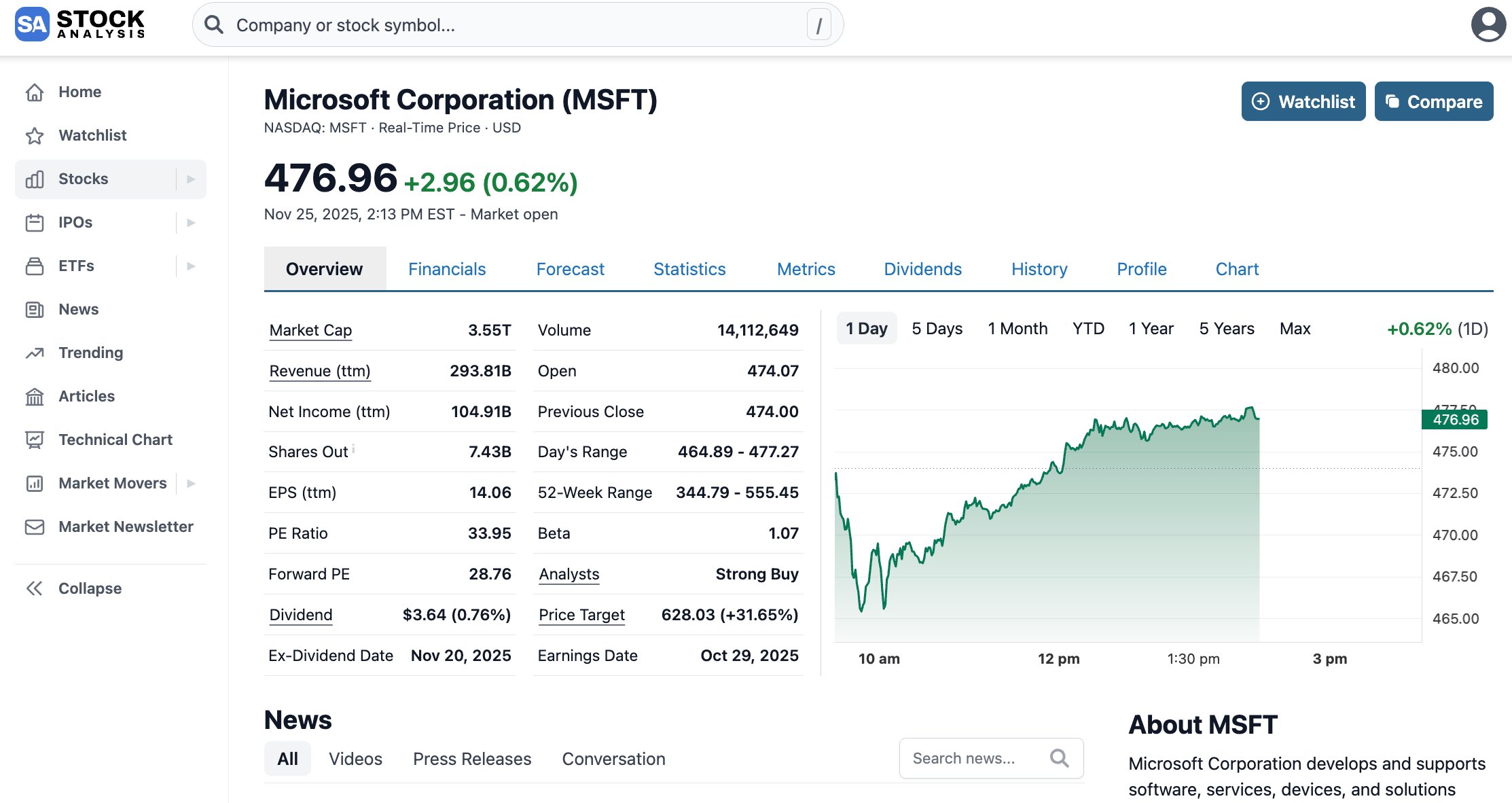

1. Best website for researching stocks: Stock Analysis

- Pricing: Free

Stock Analysis is the best website for free stock information for regular investors.

You can think of it like Yahoo Finance, but better — it's faster, has more comprehensive and accurate data, and has a more user-friendly interface.

We take our data very seriously. We pay a premium for connections to institutional-grade data sources, so you can be confident in the quality of our data.

These sources also give us deep coverage. We have comprehensive financial data for 5,500+ stocks and 4,600+ ETFs across the U.S., and over 120,000+ stocks and funds total (including international markets).

For stocks, this includes financials (income statements, balance sheets, and cash flow statements), statistics and financial ratios, dividend information, and a company profile. But that's not all.

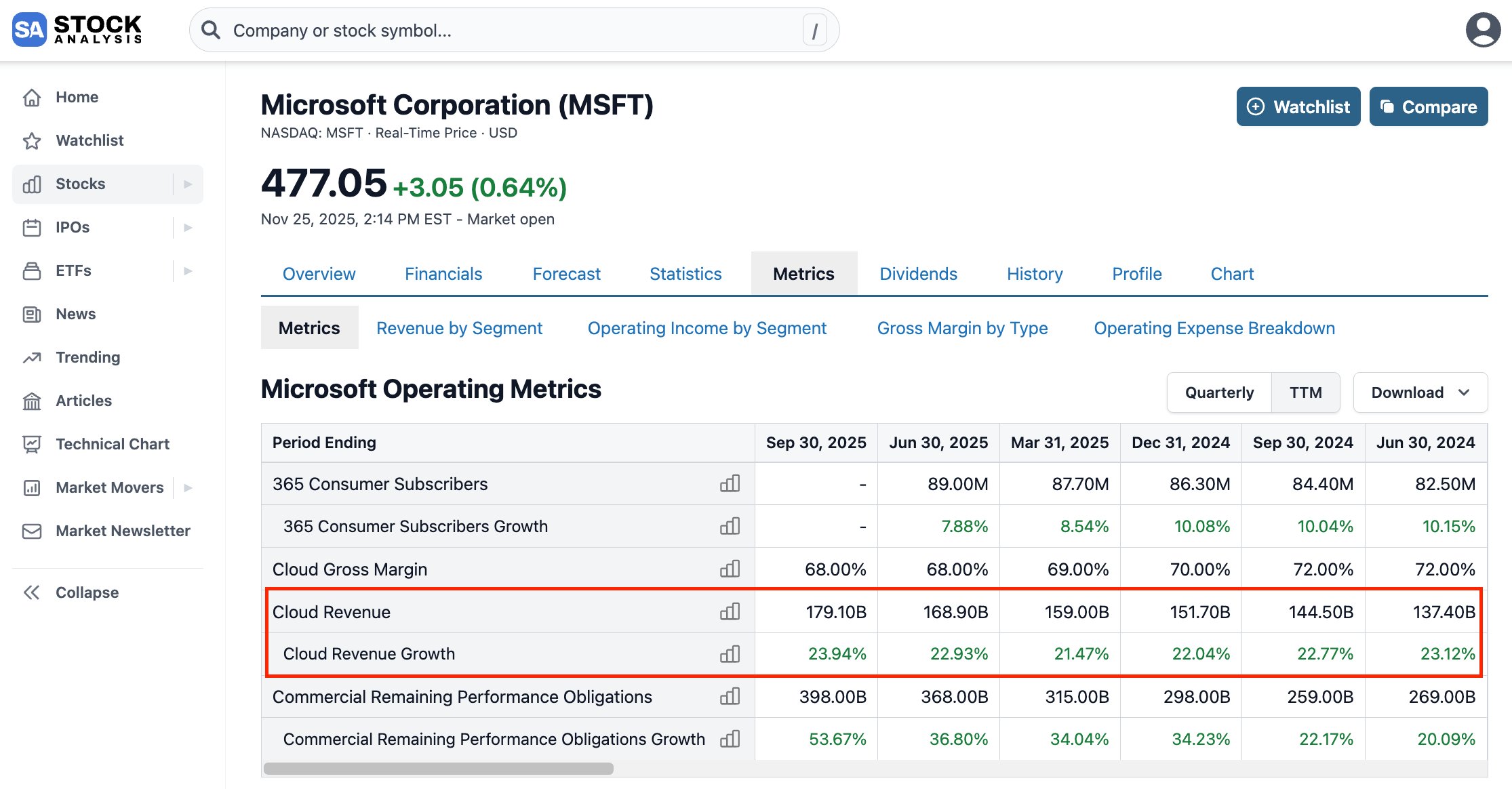

We also provide key operating metrics — company-reported KPIs that typically aren't found in financial statements but offer critical insight into business performance. For example, Microsoft's cloud revenue:

Beyond company-specific data, you can see analyst ratings, price targets, and financial forecasts, as well as perform technical analysis with our advanced charts.

Another popular feature is the stock screener. There are 272 screener filters covering a broad range of qualitative and quantitative data points, so you can uncover new stock ideas with a few clicks.

We also have stock lists, an ETF screener, an IPO calendar, an earnings calendar, a corporate actions history, and a newsfeed. All of this is completely free — no sign-up required.

You can also create up to 5 customizable watchlists with 25 symbols per watchlist with a free account.

Additionally, we produce Market Bullets, a free stock market newsletter read by over 200,000 investors. You can use it to keep up with financial markets in just a few minutes per day.

While almost everything on the site is free, you can upgrade to Stock Analysis Pro to unlock export capabilities and unlimited access to all of our data and tools. It costs just $79/year.

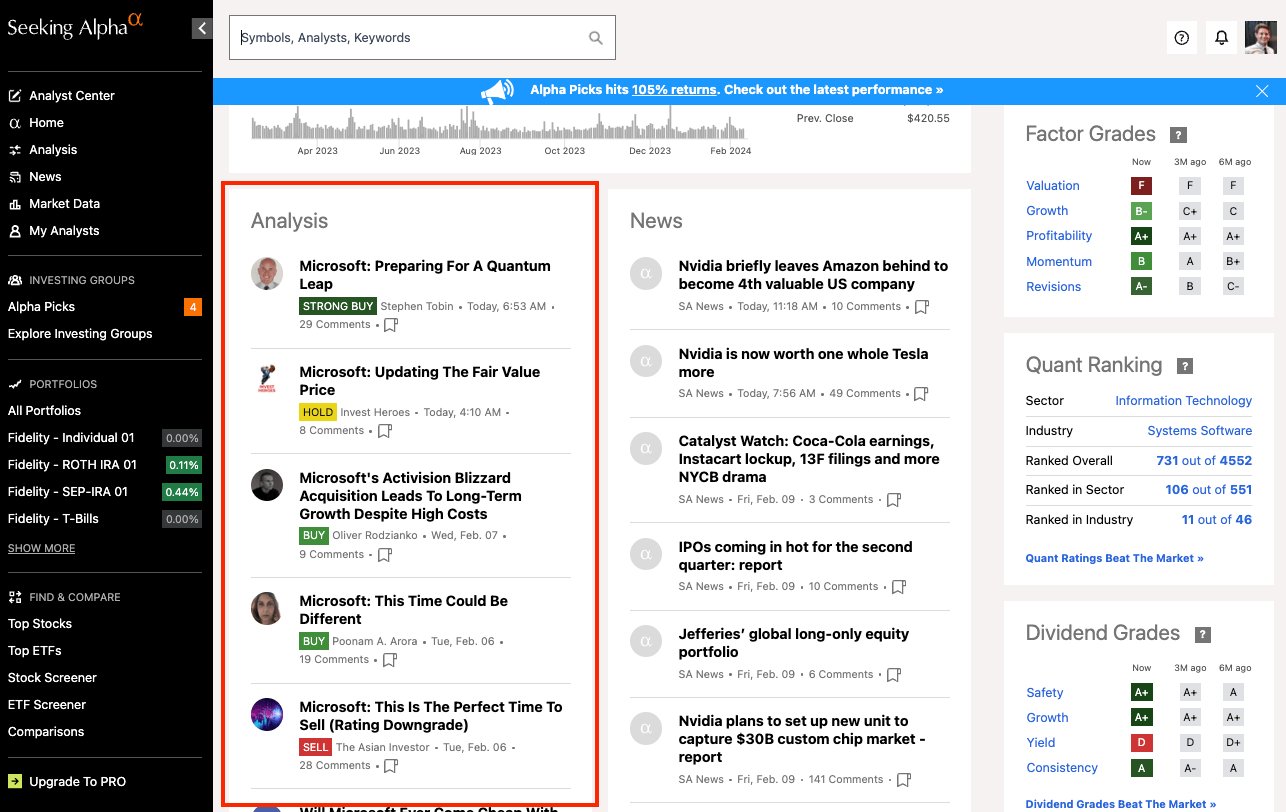

2. Best for opinionated stock research & analysis: Seeking Alpha

- Pricing:

$299/year($269/year after a 7-day free trial)

On Stock Analysis, you're the lead analyst. We provide the data and information; you perform the analysis and come to your own conclusions.

On Seeking Alpha, you can browse through complete investment research reports produced by thousands of contributors — making it seem like you have your own team of analysts.

These contributors are individual investors or teams of analysts who scrutinize investments and make buy/sell/hold recommendations based on their research.

Each article is submitted to Seeking Alpha's editors, who check it for accuracy, thoroughness, and quality. Once it passes review, it gets published on the site.

Altogether, Seeking Alpha publishes over 1,000 new articles per week.

In addition to its contributors' research reports, Seeking Alpha provides financial data, a stock screener, news, and Wall Street analyst ratings.

It also publishes a number of quantitative measurements that feed its Quant Ratings system, which measures stocks based on their fundamentals, analyst expectations, and recent price performance.

I'm a subscriber to Seeking Alpha Premium because of these Quant Ratings and the contributor analysis. I find it to be well worth the $299/year for Premium.

Our readers can get Seeking Alpha Premium for $269 after a 7-day free trial.

I also pay for Alpha Picks, Seeking Alpha's paid stock-picking newsletter. If you're interested in my take on it, check out our Alpha Picks Review.

3. Best for charts and technical analysis: TradingView

- Pricing: $14.95/month (after a 30-day free trial)

TradingView is the best website for traders to perform charting and technical analysis.

Every time I use it, I'm blown away by the user interface and experience. The site is both easy to use and remarkably feature-rich, making it a great charting platform for beginner and advanced traders alike.

And I'm not alone in this sentiment. TradingView has more than 100 million users from 190+ countries around the globe.

TradingView is fast, powerful, and easy to use — an excellent combination for traders. It has a free tier, but active traders will quickly hit the limits and run into a paywall.

I recommend the Essential ($14.95/month) or Plus ($33.95/month) plan, both of which you can try free for 30 days.

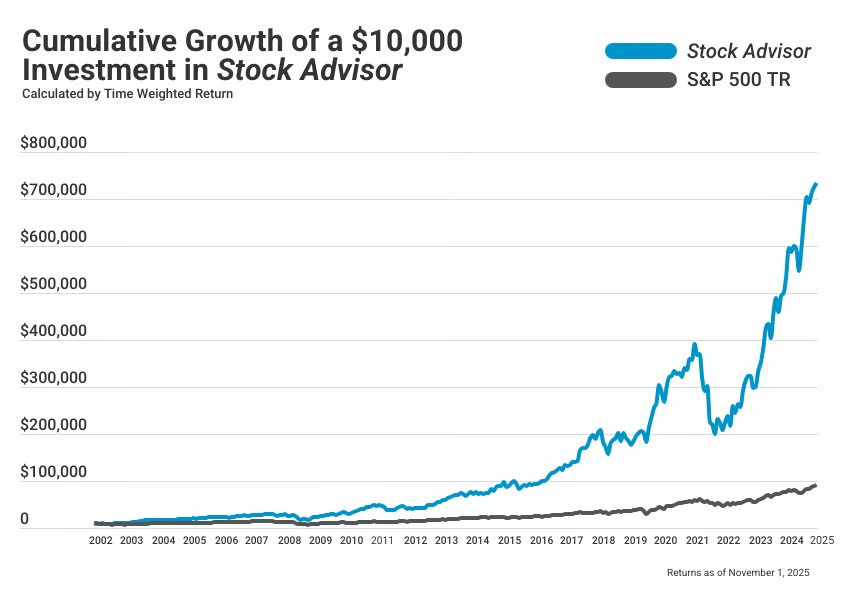

4. Best for stock recommendations: Motley Fool

- Pricing:

$199/year($99/year for new members)

While Stock Analysis provides you with the data and leaves the investment decisions up to you, The Motley Fool just tells you exactly which stocks to buy and when to sell.

Stock Advisor is The Motley Fool's most popular product. It is a stock-picking service that focuses on buying high-quality businesses and owning them for long periods.

According to the company's site, it has returned more than 5.2x the S&P over the last 23 years (total average returns of +1,002% vs +190%):

The Stock Advisor team sends out two stock picks per month. Each pick comes with a summary of the team's analysis and why they expect it to be a long-term winner.

The service also comes with a list of 10 “Starter Stocks,” all previous picks, community access, and additional educational resources.

If you don't want to do your own stock research and would rather outsource it to a team that has performed exceptionally well over the past two decades, then Motley Fool's Stock Advisor is worth looking into.

New members can get their first year for $99, which comes with a 30-day membership fee-back guarantee.

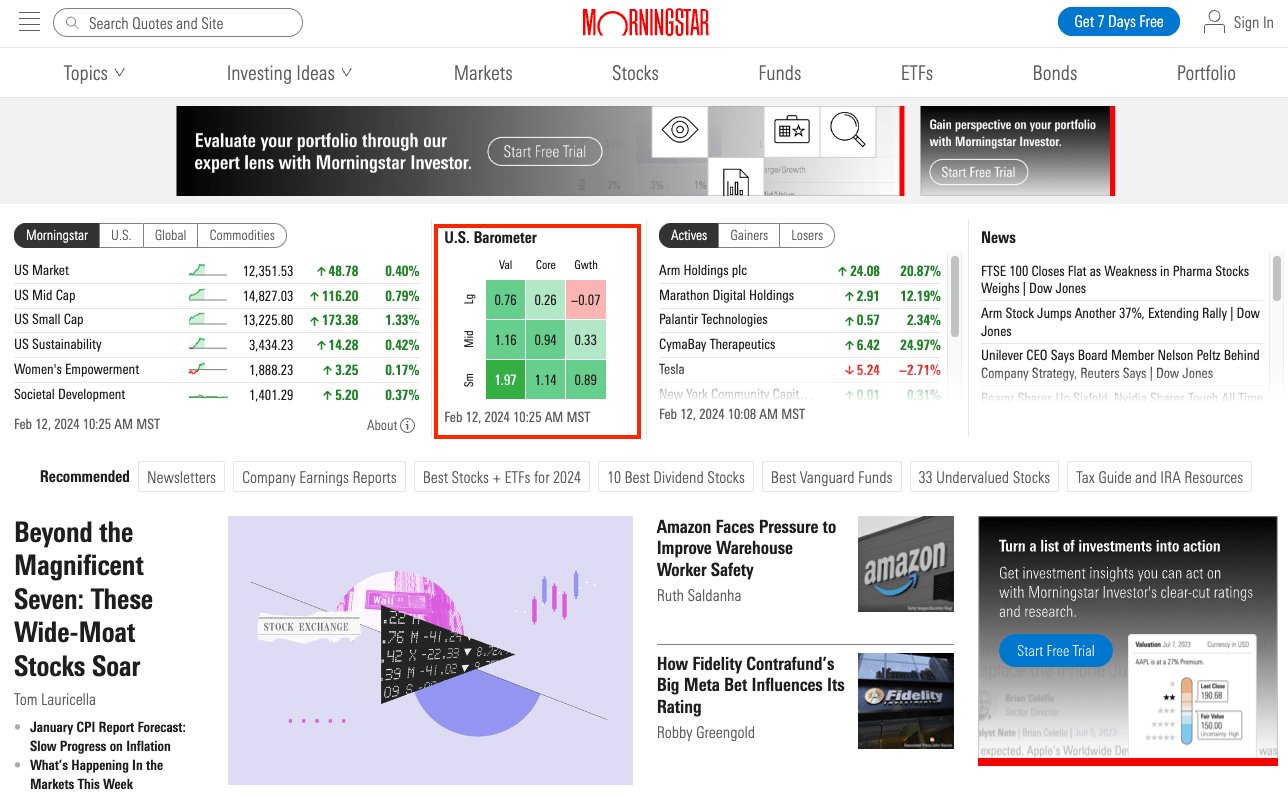

5. Best for mutual funds: Morningstar

- Pricing: Primarily free

Morningstar is an often-overlooked website for financial research, but it shouldn't be. It's a go-to resource for financial advisors and other professionals.

I check the “Barometer” on its homepage (pictured below) every day to get a pulse on how different sections of the market are performing.

If you're a mutual fund investor, you should know about Morningstar. In my opinion, it is the best free source on the internet for aggregating information about mutual funds.

You can find the basic quote information (NAV, investment style, expense ratio, yield, turnover, etc.), performance data, risk assessments, and information on the fund's parent company.

It also grades every fund out of five stars based on its performance relative to peers.

Additionally, Morningstar is a great resource for high-quality economic and business news.

Morningstar Investor is the site's premium service and gives you access to more in-depth research, investment ratings, and a suite of portfolio management tools. It costs $34.95/month after a 7-day free trial.

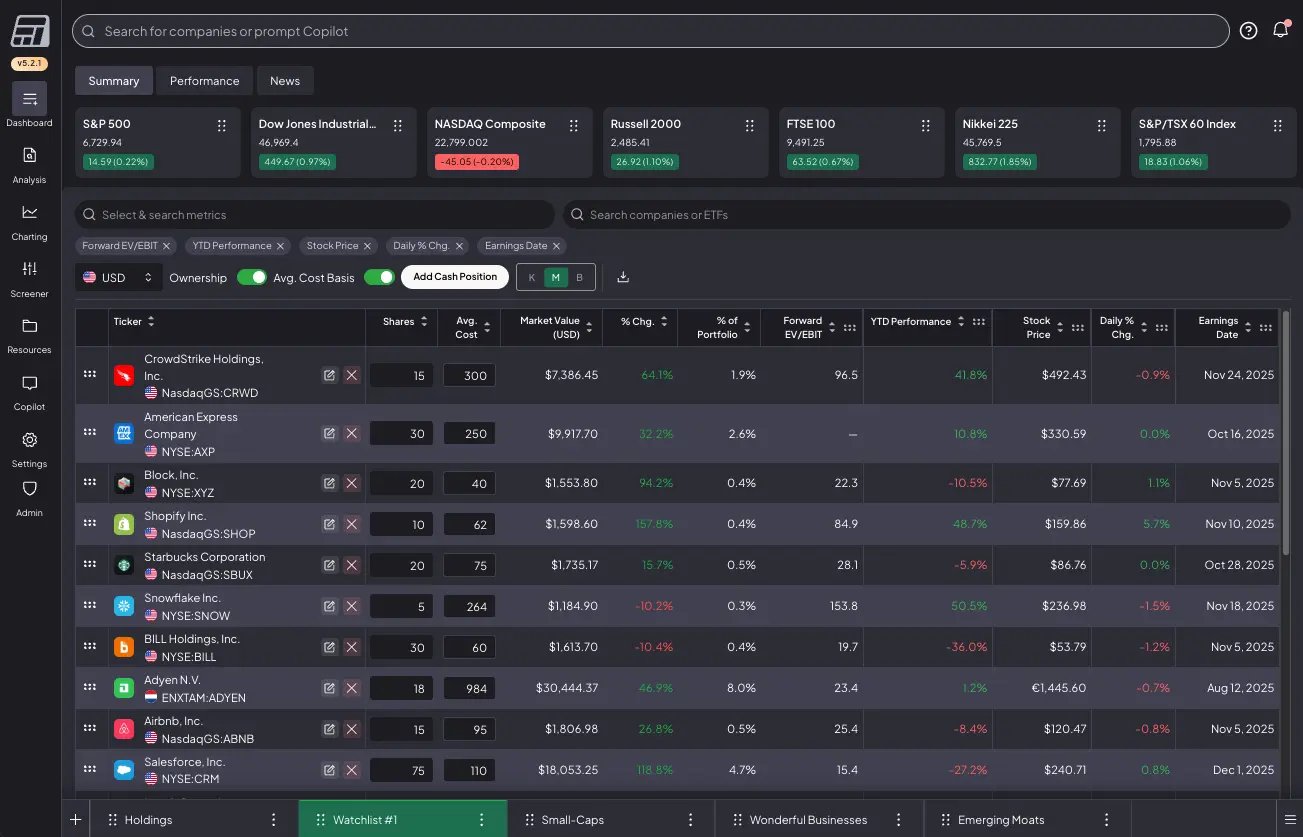

6. Best investment research terminal: Fiscal.ai

- Pricing: $49/month (after a two-week free trial)

Fiscal.ai is a web-based research terminal for fundamental investors. It aggregates everything from global financial statements and analyst estimates to 13F filings, KPI data, and hedge fund letters — all in one platform.

Beyond its breadth of coverage, Fiscal.ai stands out for its data quality, robust dashboard (pictured below), and integrated AI Copilot.

Some of its key features include:

- Nearly instant financial report updates — income statements, balance sheets, and cash flow statements are updated within minutes of a company's earnings report.

- Granular KPI database — more than 1 million company-specific data points (like Amazon's AWS revenue or Airbnb's Take Rate) are tracked across 2,500 global stocks.

- Built-in AI Copilot — a conversational AI that users can query throughout their research process.

For these reasons, Fiscal.ai is quickly becoming one of the more popular investment platforms among retail (and professional) investors, having recently surpassed 350,000 users.

Notably, it's also a data provider for a number of other popular platforms, including Perplexity Finance and Stock Analysis.

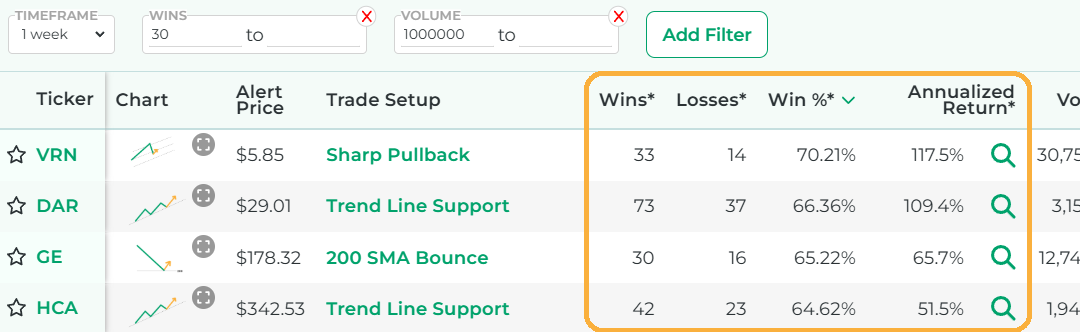

7. Best scanner for day & swing trading setups: Stock Market Guides

- Pricing: $95/month (get started)

Stock Market Guides built a custom scanner specifically for active traders.

The scanner searches through thousands of stocks and looks for trade setups in real time. But it doesn't stop there.

After identifying potential setups, the software looks through its database filled with hundreds of thousands of backtests to see how that specific trade setup has performed on that stock historically.

The result? A curated, real-time list of the historically best-performing trade setups:

With SMG's scanner, you never have to enter a trade blindly again — you will know the historical track record of every trade you take. If you're a trader, you know how big of an edge this can be.

SMG divides its services by type of trader: buy and hold, swing trader, or options trader. Prices for these range from $29/month to $69/month.

You can also get the bundle (the most popular plan) for $95/month.

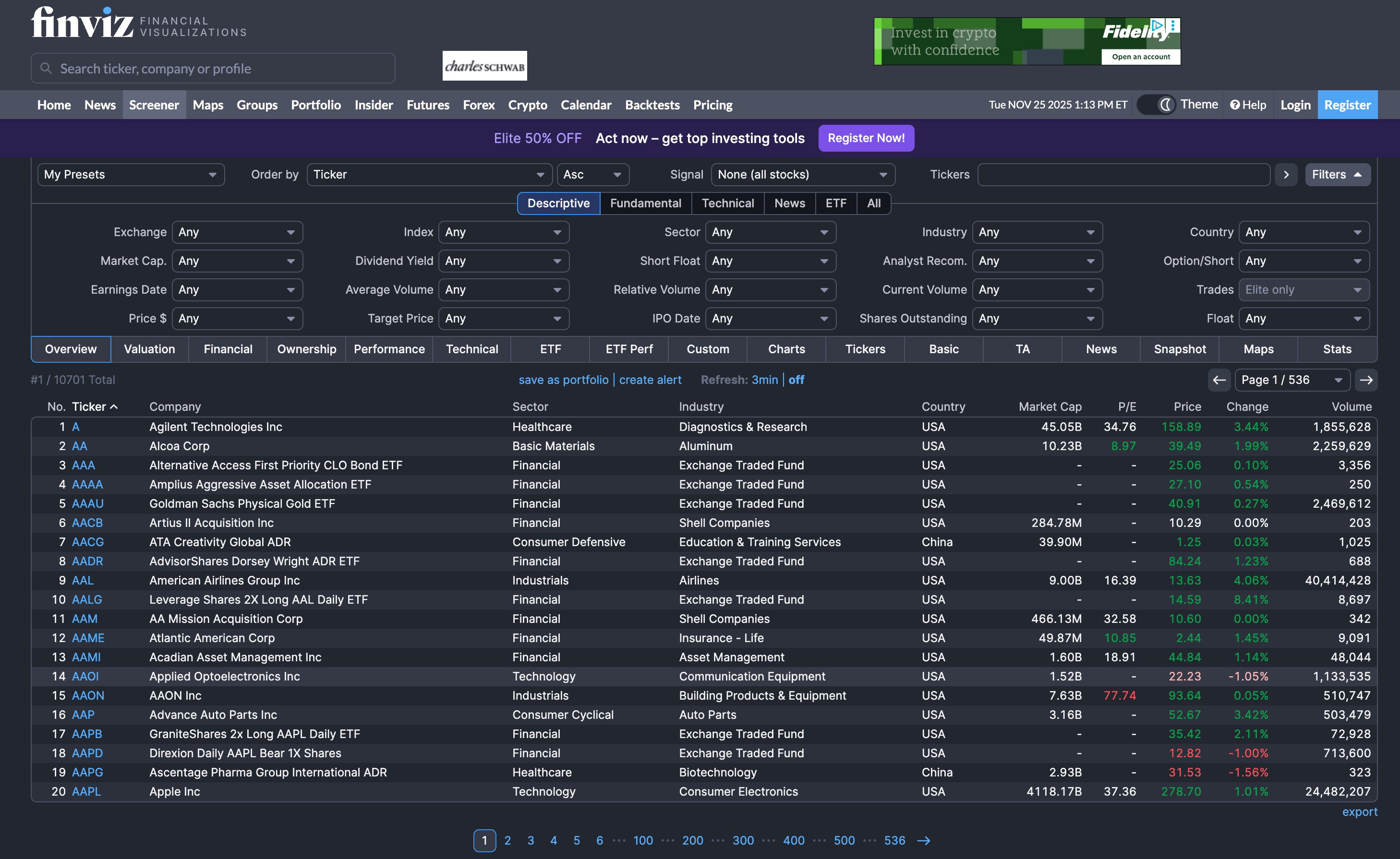

8. Best standalone stock screener: Finviz

- Pricing: Free

Finviz is a simple, fast, and powerful stock screener.

It's a flexible way to filter thousands of stocks based on nearly 100 data points like revenue growth, insider ownership, country, P/E ratio, RSI, and more.

The main downside is the growing number of ads and pop-ups, which have made the user experience more cluttered over time. That's a big reason why it ranks lower on this list despite its excellent screening capabilities.

Still, if your main priority is finding stocks that meet specific criteria, Finviz is the best pure screener on the internet.

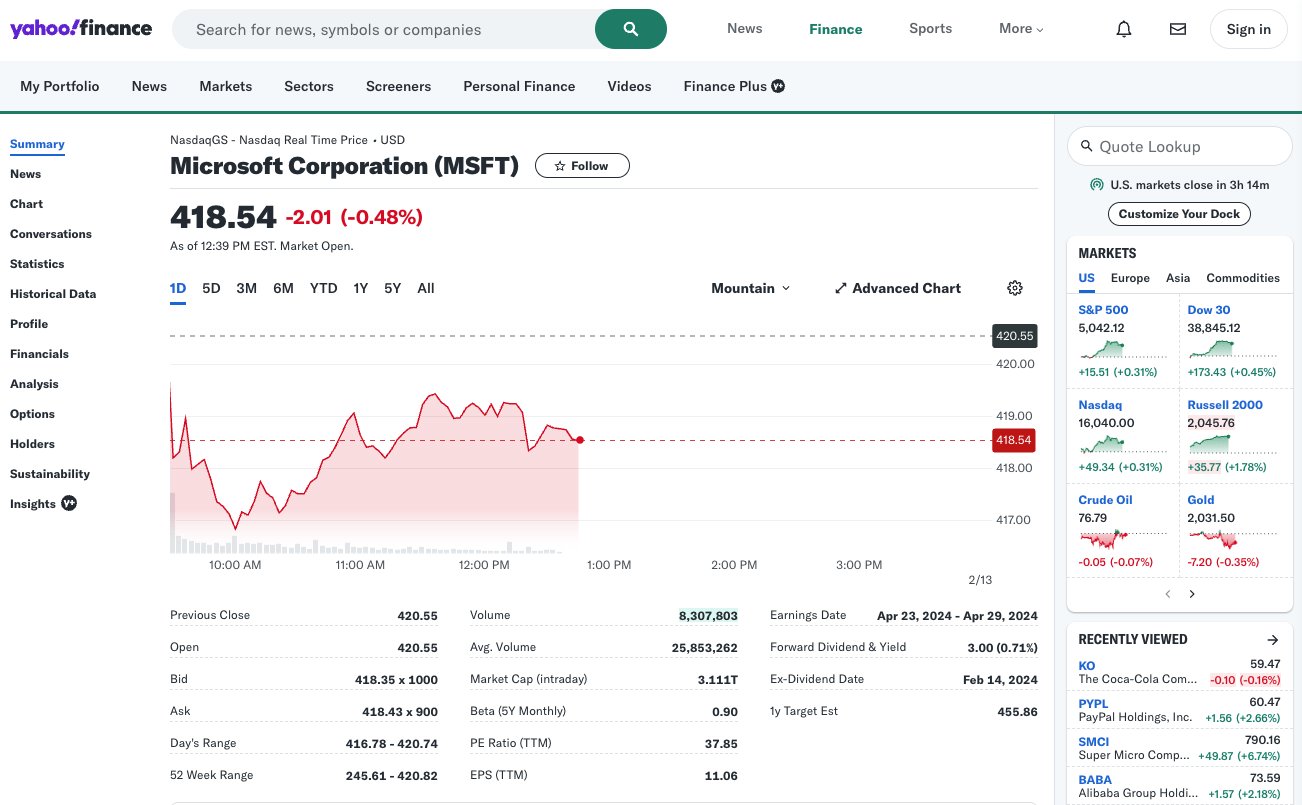

9. Best for the latest news: Yahoo Finance

- Pricing: Free

Yahoo Finance has long been a popular free stock research website.

It has all of the fundamental data (financial statements, ratios, analysis, and more) you need to research thousands of stocks from around the globe.

Yahoo Finance also aggregates thousands of news articles per day from financial websites and analysts. If you're looking to get a pulse on a stock, you can check out the stock's newsfeed on Yahoo Finance.

That said, and I might be biased, I can't think of a good reason why you'd choose Yahoo Finance over Stock Analysis.

Honorable mentions

Here's a list of tools that didn't make the main list but may be useful for your research.

| Category | Sites |

| General tools | |

| Specialized research | |

| Other useful websites |

|

How to choose a stock research website

There are a number of factors to consider when choosing a website to use for stock research, but I think it boils down to: what type of investor you are, the quality of the site's data, and the cost of the service.

1. What type of investor are you?

Are you a day trader or a swing trader? Are you a long-term investor? Are you retired, nearing retirement, or just starting your career? Do you invest in stocks, ETFs, mutual funds, options, crypto, or some combination of them all?

These questions will help narrow down what type of platform you should be considering.

For instance, short-term traders likely want a site with real-time data and strong charting capabilities, like TradingView, or a trade setup scanner like Stock Market Guides.

Long-term investors, on the other hand, may be looking for a free place to do some fundamental analysis on individual stocks or ETFs (like Stock Analysis) or mutual funds (like Morningstar).

2. Does the source provide accurate information?

If the website doesn't provide up-to-date, high-quality data, you shouldn't be using it.

When evaluating a platform, be sure to check where it's sourcing its data from. Is it connected to reputable providers? Does it even tell you where the data is from?

For example, Stock Analysis has a Data Disclaimer page that tells users we get our data from trusted providers like S&P Global, Nasdaq Data Link, and Fiscal.ai.

High-quality data isn't cheap. Be sure the site you're using isn't cutting costs by using low-quality sources.

3. Is it worth the cost?

The final consideration is cost. Some sites are free, while others are not.

Relative to the features and benefits offered, is the subscription a good value?

Don't be afraid to pay for a service. A good stock research website should more than offset its price by helping you achieve higher returns and increase your confidence in your investments.

How we chose the best stock research websites

When evaluating investing products and services, we take the following into consideration:

- Core offering: How good the product or service is — i.e., how accurate the data is, how many features the site has, and how much users like it.

- Cost: Overall price and value for money.

- Usability: What the interface looks like, how easy it is to navigate, design elements and features, and general accessibility.

- Credibility: Quality of the data, as well as company and brand reputation.

- Audience: Who the product is for, the uses and applications, whether it actually works, if it's the best option available, and any limitations therein.

- Offers: Whether there is a special offer for signing up or any discounts.

Final verdict

That's my roundup of the best stock research websites in 2026.

To recap, you saw a little bit of everything on this list — from Stock Analysis, a completely free way to research stocks; to Motley Fool, a done-for-you stock recommendation service; to Seeking Alpha, which falls somewhere in between.

I also covered TradingView, which, in my opinion, is the best platform for charts and technical analysis; Morningstar, a site often forgotten by retail investors but regularly used by financial advisors; Stock Market Guides, a trade setup scanner for active traders; and Fiscal.ai, the best research terminal.

You can easily take your investing to the next level with one or several of these sites.