The 6 Best Swing Trading Alert Services

Unlike day trading, swing trading doesn't require you to sit in front of a screen all day, though that doesn't mean it's hands-off. You still end up spending hours scanning charts and waiting for the right setup.

Instead, you can subscribe to a swing trading alert service.

These services do the heavy lifting of scanning for and identifying trade setups, only sending you their best ideas. This way, you can spend less time hunting for trades and more time acting on high-quality setups.

But not all swing trade alert services are worth your time or money. Some are run by experienced traders with a proven track record, while others are little more than flash and good marketing. That's why I compiled this list.

Here are the six best swing trading alert services in 2026.

Summary view

- Best overall: Mindful Trader

- Best swing trading scanner: Stock Market Guides

- Best for momentum investing: Alpha Picks

- Best for long-term options picks: Delta Options

- Best swing trading control center: Benzinga Pro

- Best for becoming a full-time trader: Bear Bull Traders

Disclaimer: Ratings are my opinion. Actual results may vary, and past performance does not guarantee future results. All investors should do their own due diligence.

1. Best overall: Mindful Trader

- Rating:

- Cost: $47/month

Mindful Trader is a swing trading service run by Eric Ferguson, an economics major from Stanford with a love for math and statistics.

Eric spent four years researching and analyzing stock market data. He backtested hundreds of strategies and ran thousands of simulations to find patterns and trade setups with statistical edges.

He's been a full-time trader ever since.

Eric trades algorithmically, relying on rules and statistics to guide his decisions. While he doesn't expect to win every trade, he trusts the results of his backtesting and is confident in the long-term profitability of his strategy.

There are a few areas where Mindful Trader stands out:

- Transparency: Eric is very transparent about the trades he takes, why he takes them, and their results. He puts his name on everything.

- Easy to follow: Eric posts each of his trades — both stocks and options — on his website in a simple way, and also has a position-sizing calculator that tells you how many shares or contracts to buy.

- Subscriber success: Eric genuinely wants his subscribers to have success trading and makes his personal email available for any questions.

Eric trades both stocks and options and generally holds each position for 2–4 days. There are typically 1–3 new trades per day and around 10 per week.

2. Best swing trading scanner: Stock Market Guides

- Rating:

- Cost: $49/month

Like Mindful Trader, Stock Market Guides is also built on years of backtested data and research.

However, instead of an individual placing trades you can follow, Stock Market Guides is a software that scans for and presents trade ideas based on a variety of strategies.

Every trade idea it shows has a backtested edge, and every trade alert shows how that particular combination of stock + setup has performed historically.

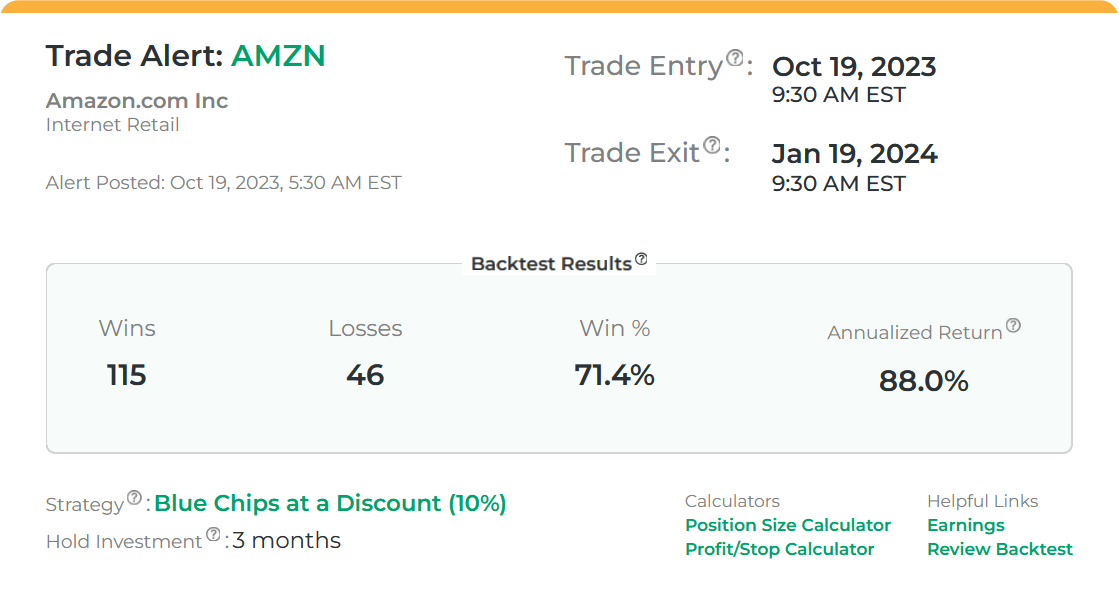

For example, the following alert was triggered on Amazon using the strategy “Blue Chips at a Discount":

The alert shows you the historical win percentage of that strategy on Amazon (71.4%) and its annualized return (88%).

While historical price action can't tell you exactly how a stock will perform today, it can give you an indication of where it may move next. This is a massive advantage.

Because of how many different strategies there are to choose from, you can get as many as 30 or more swing trading alerts from Stock Market Guides every day.

Most trades last between three days and two weeks.

3. Best for momentum investing: Alpha Picks

- Rating:

- Cost: $499/year (new members can get their first year for $449 through our link)

Alpha Picks is a stock-picking newsletter service that invests based on momentum.

While it's technically not a swing trading service (its average holding period is ~1.5 years), it earns a spot on this list because of its performance and because its strategy follows swing trading principles.

Buy and sell decisions are made based on momentum and technical and quantitative analysis — it's a swing trading service, just on a longer-than-usual timeframe.

Like other swing trading services, Alpha Picks doesn't get every trade right and often picks stocks that lose money.

This is part of the strategy, though, as the team expects its winners to more than offset the losers. And that's exactly what has happened so far.

Since its launch in July 2022, Alpha Picks' average pick has beaten the S&P by 3.4x.

You can read more details about its performance in my Alpha Picks Review.

Plus, because of its long-term focus, there are typically only 2–3 trade alerts per month, making it much easier to follow than other swing trading services.

4. Best for long-term options picks: Delta Options

- Rating:

- Cost: $119/month or $949/year

Delta Options is another service with a unique take on swing trading.

For starters, it — like Alpha Picks — typically holds positions for 1–2 years as opposed to 1–2 weeks like most swing trading services.

Additionally, instead of investing in individual stocks, the service buys deep-in-the-money call options with expiration dates more than one year into the future. These options simulate owning regular shares but require less capital.

As a result, the gains and losses on individual positions can be quite large. For instance, its positions in POWL and MHO gained more than 2,000% each, but it's also had several picks lose more than -80%.

However, as a whole, the portfolio has outpaced the S&P 500 by 8x since its launch (172.22% vs 20.39%).

Obviously, this strategy isn't for everyone. The built-in leverage of these options multiplies gains and losses and can make for a volatile portfolio.

The team also notes that the strategy is best suited for portfolios of at least $100,000, with 5–10% carved out for their trades and the bulk left in traditional assets.

What I like most is that there's no hype. It's a simple service run by traders who take the same trades with their own money, stay transparent about results, and don't make any overblown promises.

5. Best swing trading control center: Benzinga Pro

- Rating:

- Cost: Starting at $37/month

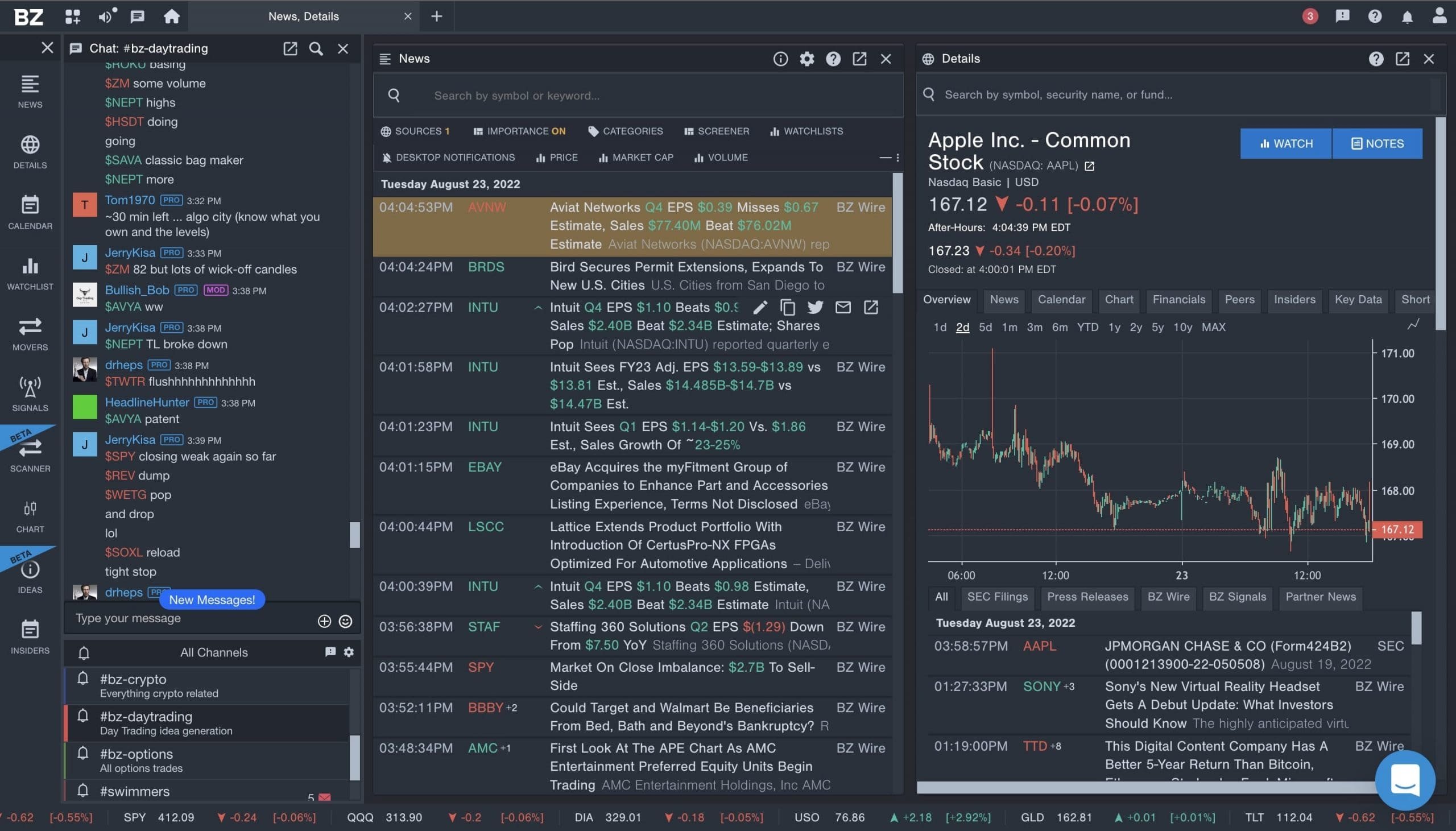

Benzinga Pro is a “control center” for day and swing traders. It is a platform with trading information, a stock screener, market data, and real-time news.

Unlike the other services on this list, Benzinga Pro itself doesn't send trade alerts. It's simply a tool for experienced, self-directed traders.

That said, you can set custom trade alerts, which will send you a notification when a stock you're watching hits a certain price point or other criteria are met. Your notifications can come in the form of desktop alerts or emails.

Additionally, there is a very active chat room where traders share the moves they're making each day.

This service isn't for beginners, but if you're an intermediate or advanced trader and are looking for a platform to help you spend less time in front of your screens and take your trading to the next level, you may be interested in trying Benzinga Pro.

6. Best for becoming a full-time trader: Bear Bull Traders

- Rating:

- Cost: Starting at $99/month

Bear Bull Traders was founded by Canadian trader Andrew Aziz.

The service was originally launched as a trading alert service, but has since morphed into a community-based offering that helps traders make a full-time income from their trading.

Aziz still sends trade alerts, as do a few other lead traders, but that's now just one part of the service. There is also a real-time chatroom, a live trading screen, and a trade ideas scanner — all of which serve as pillars of the service.

Additionally, there is weekly training, in-person conferences, and online education. You can also get access to experienced mentors and trading psychologists.

If you do join Bear Bull Traders, keep an eye out for notifications from Brian Pezim. Pezim posts the vast majority of the swing trading alerts, usually around 2–3 per week.

How we chose the best swing trading alert services

When evaluating investing products and services, we take the following into consideration:

- Core offering: How was our experience testing the service? What's the win rate? How much money will a new member make in their first year and beyond?

- Price/fees: Overall price, value for money, average cost per month, and how that compares to competitors.

- Usability: How easy is the service to follow? Are the trade alerts simple to read and implement?

- Credibility: Track record, quality of advice, transparency, and brand reputation.

- Audience: Who the product is for, whether it actually works for its target audience, if it's the best option available, and any limitations therein.

- Offers: Whether there is a special offer for signing up or any discounts.

Final verdict

If you're having a hard time determining which of these services is best for you, try answering the following questions:

- How many trade alerts per week would you like to receive?

- How important is it for you to learn the strategies behind the trades you're taking?

- Would you rather receive alerts from a specific trader or use software that triggers alerts based on predefined rules?

Based on your answers to these questions, you should be able to narrow the list above down to one or two options. From there, you can pick one, test it out, and see if it's a good fit.