What Is Multiple on Invested Capital (MOIC)?

MOIC stands for "multiple on invested capital." It's a metric used to evaluate an investment's return relative to the amount of capital invested.

Unlike return on investment (ROI), internal rate of return (IRR), or other investment return calculations that show returns as percentages, MOIC shows returns as a multiple.

This has a couple benefits:

- It's simple. MOIC is simple to calculate and simple to understand, especially when evaluating returns on investments that have doubled, tripled, or more.

- It shows returns irrespective of time. Because MOIC does not involve time-weighted calculations, it's a more useful way to measure investments that have "lumpy" returns (that is, investments which are priced infrequently).

For these reasons, MOIC has become a popular choice among private equity and venture capital firms.

Keep reading to learn how to calculate MOIC, why it's used over other methods (especially in PE and VC settings), when it shouldn't be used, and more.

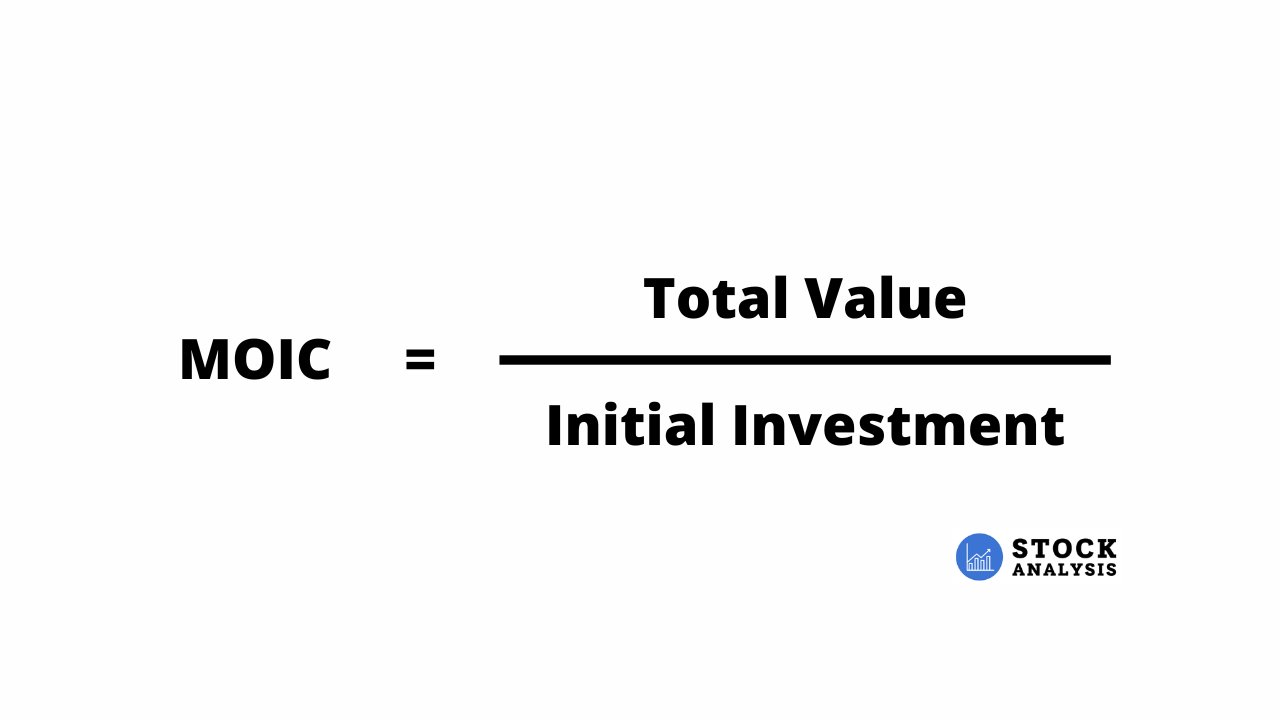

How to calculate MOIC

Here's the formula for calculating MOIC:

- Total value: Current (or exited) value of the investment plus any realized income since the investment was made.

- Initial investment: The total amount of capital deployed.

For example, a $1,000 investment that has doubled to $2,000 has a MOIC of 2.0x. A $10,000 investment that is now worth $45,000 has a 4.5x MOIC.

The higher the MOIC of an investment, the better.

Let's say a private equity (PE) firm invested $5 million in ABC Corp. Over the next three years, the PE firm receives $2 million in dividends (realized value) and the value of its stake in ABC Corp rises from $5 million to $15 million (unrealized value).

The firm's MOIC would be as follows:

MOIC = $2 million + $10 million / $5 million = 2.4x

Notice

The formula ignores time, focusing exclusively on the absolute performance of the investment.

While most commonly used for Total Return (which includes both realized and unrealized gains), MOIC can be expressed on either an unrealized or realized basis:

- Unrealized MOIC: This figure is inclusive of investments in the portfolio not yet sold, such as unrealized gains (which will be subject to fluctuations until the investment is sold).

- Realized MOIC: The figure is inclusive of returns that have already been paid out, such as interest, dividends, or other forms of cash flow where the profits have been locked in.

Net MOIC

You may also see the term “Net MOIC” used. Net MOIC uses values from which fees and other expenses borne by limited partners (LPs) have been deducted.

Why use MOIC?

There are several benefits to using MOIC over other return metrics:

- Simplicity: MOIC is not complicated — it simply measures how much money an investment returns compared to the amount of money invested. For example, an MOIC of 2x means your investment doubled. Most investment returns are put in percentages, which can make for some weird figures after an investment returns >100% (as you'll see below).

- Ignores time: MOIC does not consider the time value of money. Using MOIC, an investment that doubles in one month is viewed the same as an investment that doubles in one year. This can be a disadvantage or an advantage, depending on the context.

- Clarity: MOIC, because it's a simple ratio, is easily understood by all investors and stakeholders. This can be useful in discussions where stakeholders have varying degrees of financial acumen.

These characteristics make MOIC particularly useful for private equity and venture capital firms. This is because their investments are typically longer, have irregular cash flows, and can earn many times their money.

As mentioned above, one of the primary reasons for using MOIC is because speaking in percentage terms can be weird. For example, if a $10 stock:

- Doubles to $20, it has a 100% return ($20 - $10 / $10), whereas its MOIC is 2x

- Triples to $30, it has a 200% return ($30 - $10 / $10), whereas its MOIC is 3x

- 20x's to $200, it has a 1,900% return ($200 - $10 / $10), whereas its MOIC is 20x

Percentage returns factor in the cost of the investment.

In each of these cases, it's clearer to speak in terms of MOIC than it is in percentage ROI.

MOIC in private equity

In general, private equity (and especially venture capital, a subcategory of private equity) is more focused on taking big swings that could lead to big outcomes than it is on how long it takes for those outcomes to play out.

PE and VC firms are often looking for investments to 5x, 10x, 50x, or 100x. Although the faster the better, these investors aren't too particular about how much time it takes to generate these returns.

If they can correctly pick a huge winner, how long it takes to play out will become a distant secondary concern.

Additionally, because of its simplicity — especially on investments that have doubled, tripled, or more — MOIC has become an increasingly popular way of calculating returns at private equity firms.

It's also appearing in more pitch decks and in PE firms' forecasts as a way of screening potential investments and comparing existing investments.

What is considered a good MOIC?

A MOIC of more than 1.0x indicates the investment has generated a positive return. Beyond that, target MOICs vary by industry and investment strategy.

For instance, a MOIC of 1.5x over five years in a commercial real estate fund may be a good return, while the same MOIC of 1.5x over five years in a venture capital fund (where the risk taken is much higher) may be quite poor.

Generally speaking, the riskier the investments in a fund, the higher the target MOIC of each investment.

Many venture capital funds will have a target MOIC of 10x on each individual investment. This way, even if 9 out of 10 investments go to $0, the fund will still break even if the other investment hits its 10x target.

You can use a fund's target MOIC to gauge the risk it's taking with each of its investments.

Can MOIC be negative?

No, MOIC cannot be negative. The lowest an MOIC ratio can be is 0x, which would represent a complete loss of capital.

Any MOIC lower than 1.0x would indicate the investment has lost money, meaning the current value of the investment is less than the amount of capital initially invested.

Drawbacks to using MOIC

The greatest benefit of using MOIC is its simplicity. It's a clear formula that everyone can understand. However, this comes with some drawbacks.

As mentioned above, when using MOIC, every investment with the same MOIC is considered equal. If Investment A takes one year to double and Investment B takes ten years to double, both have a 2x MOIC and are viewed as equivalent investments.

The problem is, if given the choice, every investor would prefer Investment A over Investment B.

Additionally, MOIC doesn't account for the amount of risk taken, though the same can be said for a number of investment performance metrics.

Be sure to read an investment fund's objectives and make sure its risk profile aligns with your financial goals.

MOIC vs CoC vs IRR vs ROI

Here's a look at some of the most commonly used formulas for calculating investment returns:

| MOIC | IRR | CoC | ROI | |

| Type of calculation | Multiple | Percentage | Percentage | Percentage |

| What it tells you | Measures how many times the initial investment has been returned | Measures the annualized rate of return | Measures the cash flow generated by an investment | Measures the cumulative rate of return |

| Complexity of calculation | Simple | More complex | Moderate | Moderate |

| Time consideration | Ignores time | Accounts for time | Ignores time | Is often used for both |

| Primary use cases | Private equity, real estate | Used widely | Real estate, LBOs | Used widely |

Below is more detail about how these formulas compare, including examples.

What's the difference between MOIC and IRR?

While MOIC measures the total return on an investment as a multiple of invested capital, Internal Rate of Return (IRR) is a percentage that represents the annualized rate of return.

Unlike MOIC, IRR can compare investments with varying investment timelines.

For example, an investment with a 2x MOIC in three years equals an IRR of 24%, whereas a 2x MOIC in 10 years equals an IRR of 7%.

What's the difference between MOIC and CoC?

While MOIC measures total return (both realized and unrealized), CoC measures the annual cash income generated by an investment relative to the amount of cash invested.

CoC is used to measure liquidity and the periodic cash flow performance, which is crucial for income-generating assets like real estate.

For example, a rental property that was bought with $100,000 generated $5,000 in annual cash flow and appreciated by $5,000. It would have a MOIC of 1.1x and a CoC return of 5%.

What's the difference between MOIC and ROI?

While MOIC assesses the total return as a multiple of the investment capital, ROI calculates the percentage return relative to its initial cost.

It's like MOIC, but it subtracts the cost of the investment from the numerator and shows the return as a percentage.

For example, a stock that increases from $20 to $45 has a MOIC of 2.25x and a ROI of 125%.

Why are there so many formulas for calculating investment returns?

Different industries use different formulas for measuring returns because of their varied investment strategies and characteristics.

For instance, real estate investments involve the use of leverage (via debt) and produce regular cash flows, while private equity investments are more speculative and more likely to become huge winners (or complete losers).

Investors use different formulas for calculating returns because each metric provides unique insights tailored to specific aspects of investment performance, such as overall return, annualized efficiency, and cash flow.

Each formula is suitable for different types of investments and evaluation needs.

This allows investors to focus on the important aspects of each investment and accurately compare various investment opportunities.