Zacks Review: Should You Pay for Premium in 2026?

Zacks Investment Research is a stock, ETF, and mutual fund research platform designed to help individual investors make smarter trading and investing decisions.

The platform is centered around a proprietary stock rating system developed by Len Zacks, an MIT-trained researcher who started the company in 1978 after identifying what he called “the most powerful force impacting stock prices.”

What exactly is that force, and does the Zacks system still work in 2026? I break it all down in this review, along with my thoughts after testing Zacks Premium myself (including a few things that didn't sit right).

Is Zacks Premium worth it?

- Overall rating:

- My take: No, Zacks Premium is not worth the $249 annual cost.

Zacks made its name by tracking earnings per share (EPS) revisions — a novel idea when Len Zacks introduced it in the late 1970s.

At the time, that kind of insight may have given investors a real edge. But the investing landscape has changed. Today, we have the internet, instant news, analyst consensus data, and platforms that aggregate it all in real time.

EPS revisions aren't a secret anymore. They're widely tracked, quickly priced in, and already reflected in most fundamental stock research. In my opinion, whatever edge Zacks Rank once had is long gone.

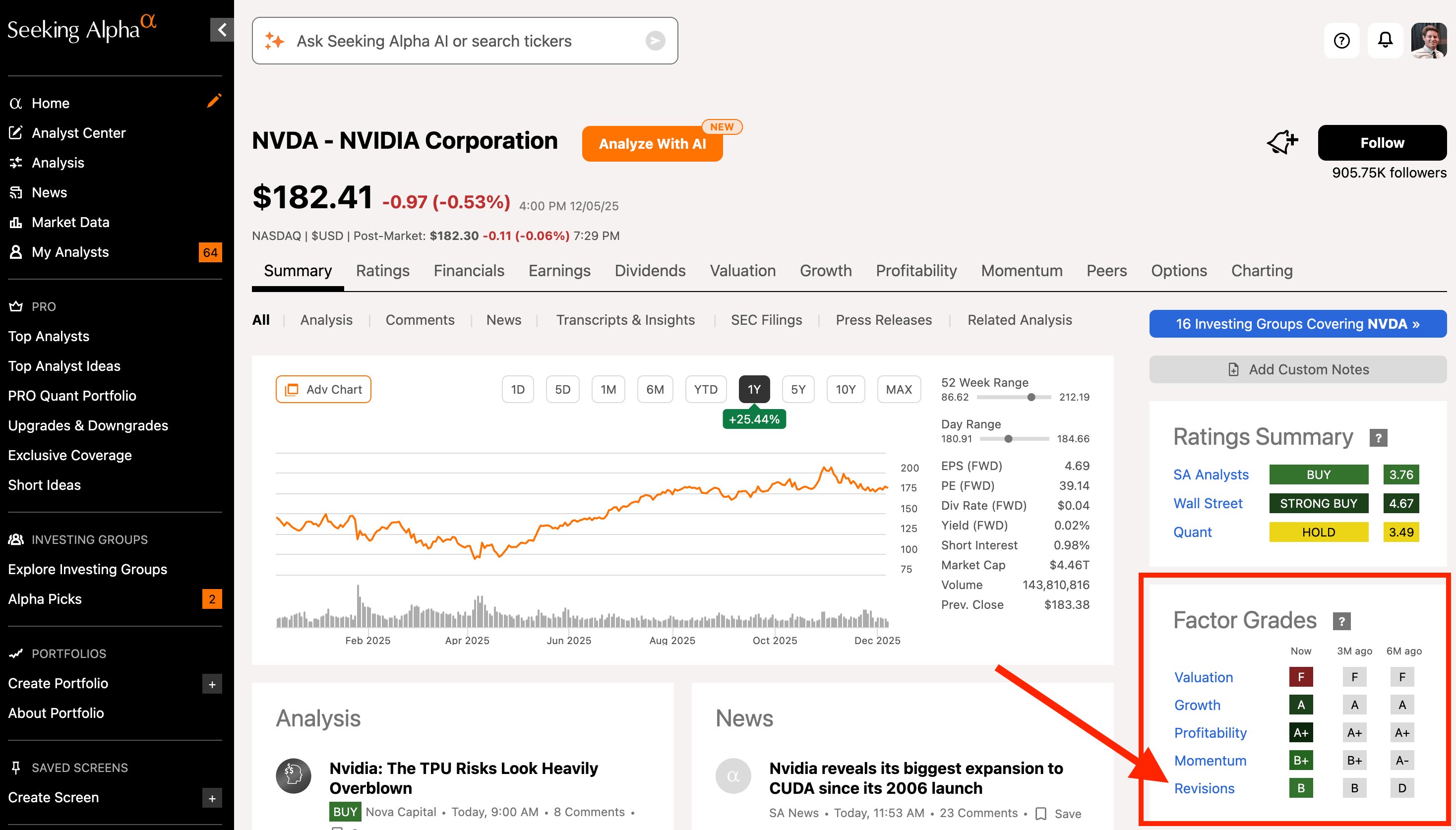

If you're looking for a modern investment research platform, you'd be better off with something more comprehensive (like Seeking Alpha, which includes EPS revisions as a single check in a much larger toolkit).

You can read my full Seeking Alpha Review here.

Here's why I think the Zacks system no longer holds up in 2026.

What is Zacks Investment Research?

Zacks Investment Research was founded in 1978 by Len Zacks, an MIT-trained Ph.D. who spent nearly a decade studying patterns in stock price movements.

His key insight: changes in Wall Street analysts' earnings estimates tend to predict future stock performance. When analysts revise their EPS forecasts upward, stock prices often follow.

This idea became the foundation of the Zacks Rank — a proprietary stock rating system that still drives the platform today.

Zacks positions itself as a quantitative research firm that helps individual investors filter out noise and focus on what it believes is the single most important factor influencing stock prices: earnings estimate revisions.

What is the Zacks Rank system?

Zacks Rank is a quantitative stock-rating system that grades stocks on a scale from #1 (Strong Buy) to #5 (Strong Sell).

The rankings are based on analyst earnings estimate revisions, positive and negative, which Len Zacks observed as the strongest force impacting stock prices.

In short, upward revisions are bullish, while downward revisions are bearish.

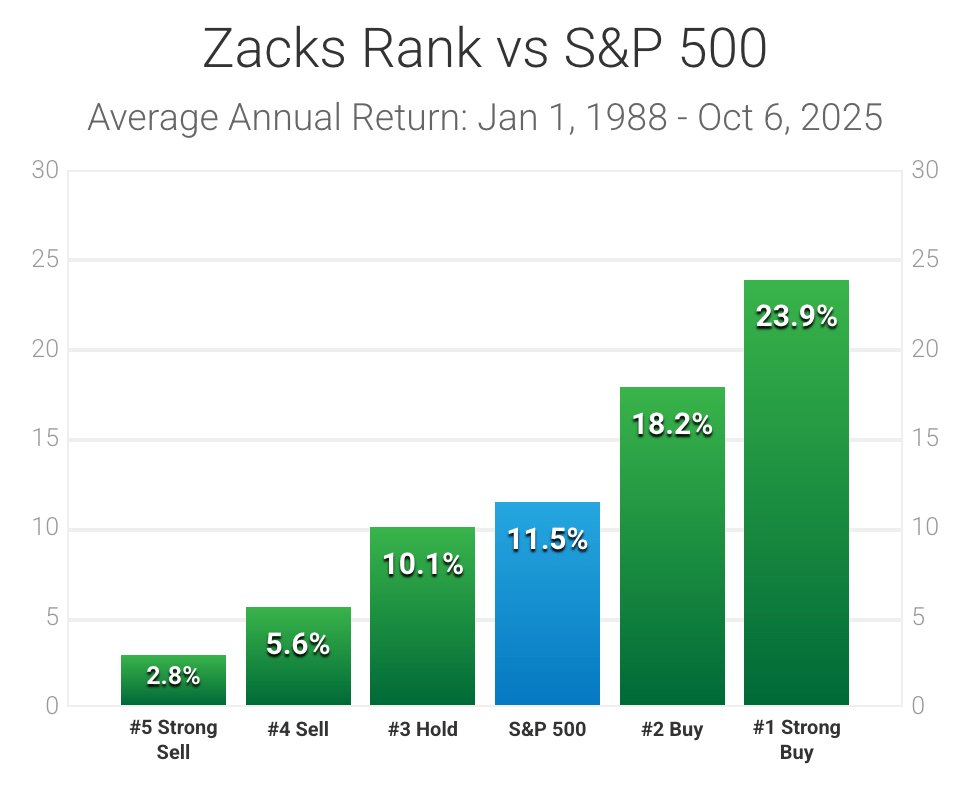

Only the top 5% of stocks earn a #1 Strong Buy rating. According to Zacks, this list has historically delivered more than double the annual return of the S&P 500 over the past 35+ years:

How it works

Let's say a stock is trading at a forward P/E of 20x and next year's EPS estimate is $1, implying a price per share of $20.

Now imagine two analysts revise their estimates upward, boosting the average forecast to $1.50. If the market still values the stock at 20x forward earnings, it should be worth $30. With shares still at $20, Zacks might assign it a #1 Strong Buy or #2 Buy.

Flip the situation: if analysts lower their EPS estimates to $0.75, the implied price drops to $15. At $20 per share, the stock might earn a #4 Sell or #5 Strong Sell.

More about Zacks Rank

Zacks tracks more than 500,000 earnings estimates across thousands of companies and updates its ratings daily.

It then aggregates that data and assigns a rank to each stock based on four key factors:

- Agreement: The higher the percentage of analysts revising their estimates upward, the better the score. For example, 80% revising higher is more bullish than 20%.

- Magnitude: The larger the revision, the better the score. A 50% increase is more bullish than a 10% increase.

- Upside: The bigger the difference between Zacks' most accurate estimate and the average estimate, the better the score.

- Surprise: Companies with positive earnings surprises in the past are more likely to surprise again in the future.

These factors are recalculated daily, which means stock rankings are constantly updating based on the latest analyst data.

It's worth noting: While Zacks Rank is the centerpiece, the platform also includes other tools — like stock screeners, expert picks, research reports, and industry rankings.

However, all of these support the same core belief that earnings estimate revisions drive stock prices.

What does Zacks Premium offer?

Zacks Premium is one of four membership tiers on Zacks:

| Free | Premium | Investor Collection | Ultimate | |

| Description | Basic info | Core service for long-term investors | Bundle of 8 subscription services for long-term investors | Access to all 21 portfolio recommendation services |

| Price | Free | $249/year | $59/month or $495/year | $299/month or $2995/year |

Since the focus of this article is on the Premium plan, here's a closer look at what's included with that subscription:

- Zacks #1 Rank List: A list of 220 “best in class” stocks based on the Zacks Rank system.

- Equity research reports: In-depth write-ups and 6– to 12–month price targets on over 1,000 stocks.

- Zacks Industry Rank: A tool to identify the strongest-performing industries — and the best stocks within them.

- Earnings ESP filter: A proprietary metric that tries to predict earnings surprises before they happen.

- Pre-built stock screens: 45+ screeners designed by Zacks to help you find stocks likely to outperform.

- Focus List: A curated group of 50 stocks expected to beat the market over the next year.

- Zacks Confidential: Exclusive stock picks and commentary from Zacks' in-house analysts.

Despite the long feature list, whether you should subscribe to Zacks Premium comes down to one thing: whether the Zacks Rank system is still viable in 2026.

In my view, it isn't.

Personally, I'd rather pay for Seeking Alpha. It includes nearly everything Zacks offers (albeit in a different format), plus more nuanced investment research, a better user experience, and a lower price.

The 3 problems with Zacks

I have three core issues with the Zacks Rank system and, by extension, paying for a Zacks Premium subscription. They are:

- The system is outdated.

- Paying for premium is unnecessary.

- The performance reporting is limited.

1. The system is outdated

The key question you need to answer when evaluating Zacks Premium is this: Do you believe the Zacks Rank is still a viable way to predict future stock prices?

I don't.

The stock market is one of the most efficient markets in the world. That means prices almost instantly reflect all publicly available information, including analyst earnings estimate revisions.

For the Zacks Rank system to work, it would need to 1) have found a market inefficiency, and 2) have that inefficiency go unnoticed by millions of investors, analysts, and institutions trading every day.

That might've been true in 1978. But I don't think it's true today. Investors now fully understand how earnings revisions impact prices and instantly price them in.

I think this is further validated by the number of services Zacks sells. If Zacks Rank were truly that effective, it would speak for itself. But instead of focusing exclusively on that one strategy, Zacks bundles it with dozens of bonus features, lists, filters, and reports.

You might come across a decent trade idea or two, but I wouldn't rely on the Zacks Rank as a standalone investment strategy. The market is too complex for one signal to consistently outperform.

And to be blunt, the Zacks website feels just as dated as the underlying strategy. It's clunky, hard to navigate, and gives the impression it hasn't been updated in years.

2. You don't actually need Zacks Premium

Even if you believe in the Zacks Rank system, you don't need to pay for a subscription to use it.

You can go to the Zacks website right now, search for any stock, and see its rank—for free. For example, Tesla (TSLA) is currently marked a #5 Strong Sell.

There's no paywall. No limit on how many tickers you can check.

So what exactly are you paying for?

The main thing behind the paywall is the Zacks #1 Rank List — the list of the top 5% of stocks based on earnings estimate revisions.

But after spending some time digging through the list, I realized it wasn't for me.

I'm a long-term investor, and most of the stocks on the list had weak fundamentals or lacked the kind of quality I look for. They weren't stocks I was interested in buying, regardless of what Zacks Rank said.

That said, shorter-term traders who care more about price movement and less about long-term fundamentals might get more value out of it than I did.

3. Performance reporting limitations

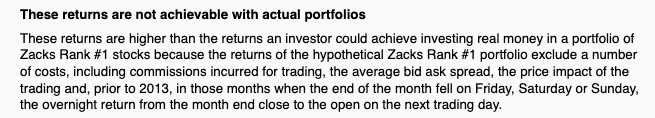

One of Zacks' biggest selling points is the performance charts — like the ones shown above and below — that highlight how well their #1 Rank stocks have supposedly done over time.

But when you dig into the fine print, the numbers start to look a bit less compelling.

Up until 2013, the portfolios were rebalanced monthly. After that, they switched to weekly rebalancing. This is notable for long-term investors, as the stated returns should only be expected by swing traders.

Even if you are actively trading each week, Zacks doesn't include commissions, slippage, bid-ask spreads, or any other trading costs in its performance calculations:

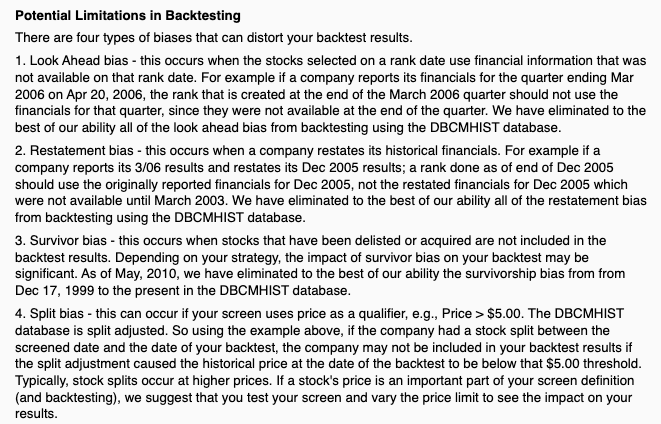

Zacks also doesn't offer traditional backtests that you can independently verify. For investors who want to confirm its results by backtesting, the company puts forth the following disclosure:

In other words, don't expect to get the same results as you'll find on its performance page.

While Zacks isn't alone in polishing its performance data, that doesn't mean it should be overlooked. It's the kind of thing you'd expect from a lesser-known newsletter or "trading guru" — not a firm that wants to be seen as a trusted research brand.

Final word

Tracking EPS revisions may have worked in the 1970s, but investing in 2026 is a different game.

Markets are far more efficient today, and information moves instantly. Whatever edge Len Zacks discovered back then has almost certainly been priced away.

Yes, you can still use EPS revisions to help you gauge how analysts feel about a company's earnings, but know that millions of other investors are also using the same data.

Revisions should be just one piece of data when considering investing in a stock, not your entire due diligence process.

Furthermore, even if you're curious about a stock's Zacks Rank, you don't need to pay for it. You can look up any stock for free on their site.

That's why I recommend Seeking Alpha Premium instead. It includes EPS revisions (via the Factor Scorecard), but goes much deeper — offering analyst commentary, quant ratings, dividend grades, and far more.

For a limited time, you can get $30 off Seeking Alpha Premium and start with a 7-day free trial using this link.

.png)