Lam Research Corporation (LON:0JT5)

London · Delayed Price · Currency is GBP · Price in USD

London · Delayed Price · Currency is GBP · Price in USD | Market Cap | 226.69B +169.8% |

| Revenue (ttm) | 15.25B +26.8% |

| Net Income | 4.61B +44.7% |

| EPS | 3.61 +48.1% |

| Shares Out | n/a |

| PE Ratio | 49.20 |

| Forward PE | 40.08 |

| Dividend | 0.74 (0.30%) |

| Ex-Dividend Date | Dec 3, 2025 |

| Volume | 3,856 |

| Average Volume | 13,794 |

| Open | 237.10 |

| Previous Close | 234.64 |

| Day's Range | 236.20 - 245.76 |

| 52-Week Range | 62.31 - 255.11 |

| Beta | 1.78 |

| RSI | 61.29 |

| Earnings Date | Jan 28, 2026 |

About Lam Research

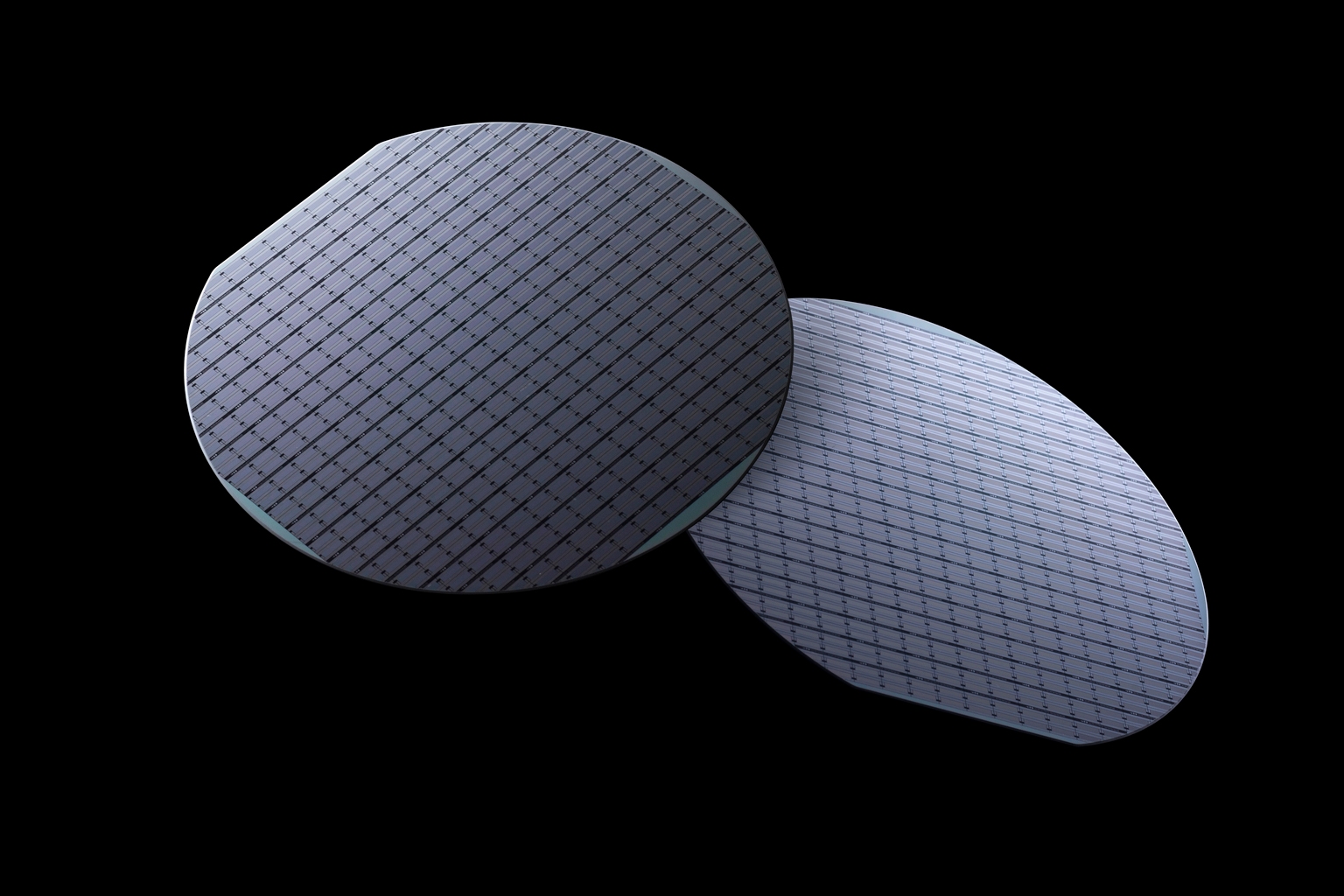

Lam Research Corporation designs, manufactures, markets, refurbishes, and services semiconductor processing equipment used in the fabrication of integrated circuits in the United States, China, Korea, Taiwan, Japan, Southeast Asia, and Europe. The company offers ALTUS systems to deposit conformal or selective films for tungsten or molybdenum metallization applications; SABRE electrochemical deposition products for copper interconnect transition that offers copper damascene manufacturing; SPEED gapfill high-density plasma chemical vapor depositi... [Read more]

Financial Performance

In fiscal year 2025, Lam Research's revenue was $18.44 billion, an increase of 23.68% compared to the previous year's $14.91 billion. Earnings were $5.36 billion, an increase of 39.98%.

Financial numbers in USD Financial StatementsNews

Vanguard FTSE Social Index Fund Sells 1,648 Shares of Lam Research Corp (LRCX)

Vanguard FTSE Social Index Fund Sells 1,648 Shares of Lam Research Corp (LRCX)

Vanguard Russell 1000 Growth Index Fund Buys 143,801 Shares of Lam Research Corp (LRCX)

Vanguard Russell 1000 Growth Index Fund Buys 143,801 Shares of Lam Research Corp (LRCX)

Lam Research: Don't Chase The Stock (Rating Downgrade)

Lam Research is fundamentally robust, showing strong growth, margin expansion, and solid guidance. But read why LRCX is downgraded to Hold.

Migdal Insurance & Financial Holdings Ltd. Buys 207,469 Shares of Lam Research Corp (LRCX)

Migdal Insurance & Financial Holdings Ltd. Buys 207,469 Shares of Lam Research Corp (LRCX)

Our Top 10 High Growth Dividend Stocks - February 2026

The article provides a methodology for selecting high-growth dividend-paying stocks, focusing on dividend growth and sustainability rather than high current yield. We use our proprietary models to rat...

Leelyn Smith, LLC Sells 1,771 Shares of Lam Research Corp (LRCX)

Leelyn Smith, LLC Sells 1,771 Shares of Lam Research Corp (LRCX)

Lam Research Named Top Semiconductor Pick As AI-Driven Manufacturing Supercycle Shifts Into High Gear

BofA Securities analyst Vivek Arya said Lam Research Corp (NASDAQ: LRCX) is well-positioned to capitalize on a strong, multi-year wafer fab equipment upcycle driven by AI and advanced chip demand . $...

Lam Research Named Top Semiconductor Pick As AI-Driven Manufacturing Supercycle Shifts Into High Gear

Arya said meetings with Lam CFO Doug Bettinger reinforced management's confidence that clean-room constraints — not demand — will limit the upcycle.

Vanguard Information Technology Index Fund Sells 299,701 Shares of Lam Research Corp (LRCX)

Vanguard Information Technology Index Fund Sells 299,701 Shares of Lam Research Corp (LRCX)

Vanguard Russell 3000 Index Fund Buys 2,058 Shares of Lam Research Corp (LRCX)

Vanguard Russell 3000 Index Fund Buys 2,058 Shares of Lam Research Corp (LRCX)

Artisan Select Equity Fund Q4 2025 Portfolio Activity

The semiconductor business is notoriously cyclical. In the past, the boom times led to overcapacity and periods of poor performance. Our top-performing stocks this quarter were Samsung, Alphabet and L...

Vanguard S&P 500 Value Index Fund Sells 3,138 Shares of Lam Research Corp (LRCX)

Vanguard S&P 500 Value Index Fund Sells 3,138 Shares of Lam Research Corp (LRCX)

Vanguard U.S. Quality Factor ETF Sells 222 Shares of Lam Research Corp (LRCX)

Vanguard U.S. Quality Factor ETF Sells 222 Shares of Lam Research Corp (LRCX)

Vanguard U.S. Multifactor ETF Buys 1,443 Shares of Lam Research Corp (LRCX)

Vanguard U.S. Multifactor ETF Buys 1,443 Shares of Lam Research Corp (LRCX)

Biggest S&P 500 Winners Last 5, 10, 20 Years

The S&P 500's annualized total return over the last five years has been roughly 13.5%, but the average stock currently in the index has seen an annualized total return about 2.6 percentage points less...

How Lam Research Stock Rewrote The Playbook

During the year-long duration concluding on 2/13/2026, Lam Research (LRCX) experienced a stock increase of 185%, driven by rapid revenue growth and margins amid thriving AI-driven markets. However, a ...

Is Lam Research (LRCX) a Buy as Wall Street Analysts Look Optimistic?

According to the average brokerage recommendation (ABR), one should invest in Lam Research (LRCX). It is debatable whether this highly sought-after metric is effective because Wall Street analysts' re...

Vanguard U.S. Momentum Factor ETF Buys 68,142 Shares of Lam Research Corp (LRCX)

Vanguard U.S. Momentum Factor ETF Buys 68,142 Shares of Lam Research Corp (LRCX)

Vanguard U.S. Minimum Volatility ETF Sells 8,275 Shares of Lam Research Corp (LRCX)

Vanguard U.S. Minimum Volatility ETF Sells 8,275 Shares of Lam Research Corp (LRCX)

Lam Research Corporation Announces Participation at Upcoming Conferences

FREMONT, Calif., Feb. 17, 2026 /PRNewswire/ -- Lam Research Corp. (Nasdaq: LRCX) today announced that Doug Bettinger, Executive Vice President and Chief Financial Officer, will participate in the foll...

Lam Research Deepens Investment in Boise to Support Projected Growth in U.S. Semiconductor Manufacturing

U.S. Senator Risch, Micron and Community Leaders Celebrate New Lam Office; Lam Builds on Three Decades in the 'City of Trees' BOISE, Idaho, Feb. 17, 2026 /PRNewswire/ -- In a ribbon-cutting ceremony t...

Notable ETF Outflow Detected - SPY, MU, AMD, LRCX

Looking today at week-over-week shares outstanding changes among the universe of ETFs covered at ETF Channel, one standout is the State Street SPDR S&P 500 ETF Trust (Symbol: SPY) where we have detect...

PGIM Quant Solutions Large-Cap Value Fund Sells 3,700 Shares of Lam Research Corp (LRCX)

PGIM Quant Solutions Large-Cap Value Fund Sells 3,700 Shares of Lam Research Corp (LRCX)

Goldman Sachs Technology Opportunities Fund Buys 55,677 Shares of Lam Research Corp (LRCX)

Goldman Sachs Technology Opportunities Fund Buys 55,677 Shares of Lam Research Corp (LRCX)

Goldman Sachs Large Cap Value Fund Buys 17,781 Shares of Lam Research Corp (LRCX)

Goldman Sachs Large Cap Value Fund Buys 17,781 Shares of Lam Research Corp (LRCX)