Murata Manufacturing Co., Ltd. (TYO:6981)

Japan · Delayed Price · Currency is JPY

Japan · Delayed Price · Currency is JPY | Market Cap | 6.69T +42.8% |

| Revenue (ttm) | 1.78T +3.5% |

| Net Income | 189.84B -8.6% |

| EPS | 103.02 -6.9% |

| Shares Out | 1.82B |

| PE Ratio | 35.67 |

| Forward PE | 23.03 |

| Dividend | 60.00 (1.63%) |

| Ex-Dividend Date | Mar 30, 2026 |

| Volume | 10,215,100 |

| Average Volume | 9,770,495 |

| Open | 3,722.00 |

| Previous Close | 3,666.00 |

| Day's Range | 3,647.00 - 3,753.00 |

| 52-Week Range | 1,825.50 - 3,753.00 |

| Beta | 0.65 |

| RSI | 70.07 |

| Earnings Date | Feb 2, 2026 |

About Murata Manufacturing

Murata Manufacturing Co., Ltd. develops, manufactures, and sells ceramic-based passive electronic components and solutions in Japan and internationally. It operates through three segments: Components, Devices & Modules, and Other. The company offers capacitors; inductors; high frequency device and communication modules, including surface acoustic wave filters, RF modules, multilayer resin substrates, and connectivity modules; lithium-ion secondary batteries; and sensors; antennas and related products; baluns; and batteries. It also offers Femte... [Read more]

Financial Performance

In fiscal year 2025, Murata Manufacturing's revenue was 1.74 trillion, an increase of 6.29% compared to the previous year's 1.64 trillion. Earnings were 233.76 billion, an increase of 29.27%.

Financial StatementsNews

Murata Manufacturing (MRAAY) Reports 2.9% Revenue Growth in Nine-Month Period

Murata Manufacturing (MRAAY) Reports 2.9% Revenue Growth in Nine-Month Period

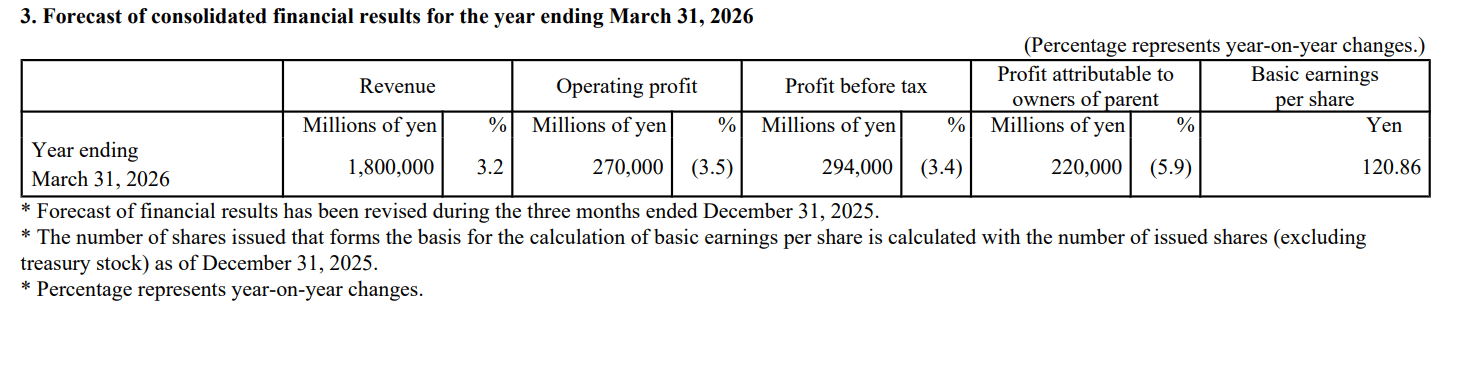

Murata Manufacturing GAAP EPS of ¥85.68, revenue of ¥1370.23B; updates FY outlook

Murata Manufacturing press release (MRAAY): Q3 GAAP EPS of $85.68. Revenue of $1370.23B (+2.9% Y/Y).

Murata Manufacturing GAAP EPS of ¥71.77, revenue of ¥902.78B; updates FY outlook

Earnings To Watch: Murata Manufacturing Co Ltd (TSE:6981) Reports Q2 2026 Result

Earnings To Watch: Murata Manufacturing Co Ltd (TSE:6981) Reports Q2 2026 Result

QuantumScape Q3 FY2025 Earnings Call Transcript

QuantumScape Corp. (NYSE: QS) released its third-quarter earnings report after Wednesday’s closing bell. Below are the transcripts from the Q3 earnings call. QS stock is moving. See the details here....

Murata Manufacturing Co., Ltd. 2025 Q1 - Results - Earnings Call Presentation

Murata Manufacturing reports Q1 results; FY guidance unchanged

Murata Launches World’s First High-Frequency Filter Using XBAR Technology for 5G, Wi-Fi 7, and Future 6G Networks

KYOTO, Japan — Murata Manufacturing Co., Ltd. (TOKYO: 6981) (ISIN: JP3914400001) has announced the mass production and commercial shipment of the world’s first*1 high-frequency filter using XBAR techn...

US Stock Futures, Nikkei Climb On Trump's Electronics Tariff Pause: iPhone Parts Makers Surge In Tokyo

U.S. stock futures rose following President Donald Trump’s decision to pause tariffs on consumer electronics products on Sunday, after a whirlwind week for the markets. Nasdaq Futures led the way with...

Murata Announces Production of ‘CELLNETTA’ – the World’s First Metal Cell Fractionation Filter

KYOTO, Japan — Murata Manufacturing Co., Ltd. (TOKYO: 6981) (ISIN: JP3914400001) announced today that has successfully commercialized and mass produced “CELLNETTA,” the world’s first*1 metal cell frac...

iPhone parts maker Murata eyes India base

CHENNAI: Japanese iPhone component maker Murata Manufacturing has started test production in India and is exploring to shift certain part of its produ.

Boost for ‘Make in India’! iPhone parts maker looks at supply chain shifts toward India

Murata Manufacturing Co. is considering shifting some production to India due to growing demand and business continuity. They plan to begin capacitor packaging and distribution there by fiscal 2026, a...

Murata Manufacturing GAAP EPS of ¥107.56, revenue of ¥1.33B; reaffirms FY outlook

Murata Develops the World’s Smallest Class 006003-inch Size (0.16 mm x 0.08 mm) Chip Inductor

KYOTO, Japan — Murata Manufacturing Co., Ltd. (TOKYO:6981) (ISIN:JP3914400001) announces the development of the world’s smallest class 006003-inch size (0.16 mm x 0.08 mm) chip inductor, which will be...

Murata HCR Redefines Automotive Timing Devices With the Total Frequency Tolerance of ±40PPM Under -40°C to +125°C Operation

KYOTO, Japan — Murata Manufacturing Co., Ltd. (TOKYO:6981) (ISIN:JP3914400001) unveils a cutting-edge electronic timing device featuring exceptional accuracy ±40ppm and reliability even in wide-temper...

Murata SCH1633-D01 Sets a New Standard for Automotive 6DoF Sensor

KYOTO, Japan — Murata Manufacturing Co., Ltd. (TOKYO: 6981) (ISIN: JP3914400001) is expanding its range of innovative Six Degrees-of-Freedom devices with the introduction of the SCH1633-D01. The micro...

Murata’s Revolutionary Stretchable Printed Circuit Elevates Wearable Medical Devices

KYOTO, Japan — Murata Manufacturing Co., Ltd. (TOKYO: 6981) (ISIN: JP3914400001) reveals an innovative new Stretchable Printed Circuit (SPC) technology marking a significant development in printed cir...

Murata Manufacturing reports FQ2 results

Murata Manufacturing (MRAAY) reports FQ2 Basic GAAP EPS of ¥34.15 and revenue of ¥461.77B, a 4.3% increase year-over-year.

Murata Manufacturing's Earnings Outlook

Murata Manufacturing (OTC: MRAAY) is set to give its latest quarterly earnings report on Friday, 2024-11-01. Here's what investors need to know before the announcement. Analysts estimate that Murata ...

Murata Unveils the World’s Smallest Multilayer Ceramic Capacitor with the First 006003-inch Size (0.16mm×0.08mm) Device

KYOTO, Japan — Murata Manufacturing Co., Ltd. (TOKYO: 6981) (ISIN: JP3914400001) has expanded its innovative range of multilayer ceramic capacitors (MLCCs) with yet another groundbreaking addition. Ex...

Murata Manufacturing: Gearing Up For A Demand Ramp-Up

Murata Manufacturing has formed a new JV to secure its production capacity. With demand from the auto industry ramping up, the expanded capacity is a positive step.

Murata Manufacturing: Profit From The Falling Yen With This Tech Components Firm

Murata Manufacturing is a leading Japanese maker of electronic components. Shares have gotten beaten up due to the double whammy of the slumping outlook for the tech industry and the falling Japanese ...

Chip stocks could plunge another 25% as ‘we are entering the worst semiconductor downturn in a decade,' analyst says

After a rough few months for semiconductor stocks, one Wall Street analyst expects the pain to continue and predicted Tuesday that “we are entering the worst semiconductor downturn in a decade.”

Chip stocks tanked as pandemic demand for electronics slumped, but there are still some winners

After two years of unprecedented chip sales and demand related to the COVID-19 pandemic, a long-feared reversal has struck the semiconductor industry, but some markets are still performing strongly — ...

Resonant Shares Jump 260% on Murata Acquisition News

Shares of Resonant Inc. ( RESN , Financial) skyrocketed nearly 260% during Tuesday's extended trading session following the announcement that Murata Electronics North America Inc., a wholly-owned subs...