Banco Santander, S.A. (WSE:SAN)

Poland

· Delayed Price · Currency is PLN

Poland

· Delayed Price · Currency is PLN | Market Cap | 457.13B |

| Revenue (ttm) | 212.43B |

| Net Income (ttm) | 52.37B |

| Shares Out | n/a |

| EPS (ttm) | 3.38 |

| PE Ratio | 8.73 |

| Forward PE | 8.46 |

| Dividend | 0.73 (2.40%) |

| Ex-Dividend Date | Apr 29, 2025 |

| Volume | 823 |

| Average Volume | 1,653 |

| Open | 30.50 |

| Previous Close | 30.30 |

| Day's Range | 29.84 - 30.59 |

| 52-Week Range | 16.00 - 30.59 |

| Beta | 1.29 |

| RSI | 59.90 |

| Earnings Date | Apr 30, 2025 |

About Banco Santander

Banco Santander, S.A. provides various financial products and services to individuals, small and medium-sized enterprises, large corporations, and public entities worldwide. The company operates through five segments: Retail & Commercial Banking, Digital Consumer Bank, Corporate & Investment Banking, Wealth Management & Insurance, and Payments. It offers demand and time deposits, mutual funds, and current and savings accounts; mortgages, consumer finance, loans, and various financing solutions; and project finance, debt capital markets, global ... [Read more]

Financial Performance

In 2024, Banco Santander's revenue was 50.80 billion, an increase of 10.97% compared to the previous year's 45.78 billion. Earnings were 11.95 billion, an increase of 12.94%.

Financial numbers in EUR Financial StatementsNews

How Spanish-owned bank TSB was born in a tiny Scottish village

The world's oldest savings bank is set to be bought over by Santander in a £1.7bn deal.

Santander's TSB takeover: What it means for your account

Santander's acquisition of TSB for £2.9 billion could reshape UK banking, affecting 5 million account holders. Here's what it might mean

Spain's Santander buys TSB Bank to boost presence in the UK

The Spanish lender is about to become the third-largest bank in the UK by share of personal current accounts, after the deal is closed.

UK has always been a key market for Santander, says CFO

José García Cantera, the CFO of Santander, discusses the bank's acquisition of U.K. lender TSB.

UK has always been a key market for Santander, says CFO

Jos Garca Cantera, the CFO of Santander, discusses the bank's acquisition of U.K. lender TSB.

Santander doubles down on UK presence amid Spain's banking M&A turmoil

Santander is bolstering its British foothold with the proposed acquisition of TSB, despite the recent underperformance of its own U.K. branch.

Santander CFO on Buying TSB, Banking Consolidation, BBVA's Bid for Sabadell

Santander CFO Jose Garcia Cantera discusses the lender's decision to agree to buy Sabadell's UK unit TSB. Speaking on Bloomberg Television, Cantera says "most" of the savings from buying TSB will come...

TSB brand could disappear from high streets in £2.65bn Santander takeover deal

Santander said it plans a ‘rationalisation’ of the overall branch network.

Banking: Santander Agrees to Buy Sabadell's UK Unit TSB

Banco Santander SA agreed to buy Banco Sabadell SA's UK unit for £2.65 billion ($3.64 billion) in an all-cash transaction. The enlarged firm would be the third-largest UK bank by personal current acco...

Santander Holdings USA, Inc. Announces 2025 Stress Capital Buffer

BOSTON--(BUSINESS WIRE)--The Board of Governors of the Federal Reserve System (the “Federal Reserve”) informed Santander Holdings USA, Inc. (“SHUSA”) on June 27, 2025, of SHUSA's updated stress capita...

Santander Buys TSB: Big Cheque, Bigger Ambitions

Santander is buying TSB for £2.65 billion to bulk up in UK retail banking. It's a scale play, not a transformation. The post Santander Buys TSB: Big Cheque, Bigger Ambitions appeared first on Investom...

TSB to be sold to Santander for up to £2.9bn

Sabadell is selling the High Street bank but there's no comment on whether the brand will remain.

Santander bank deal could mean TSB name disappears from UK high street

Santander is to buy TSB, becoming the UK's third biggest bank in the process.

Santander to acquire UK-based TSB from Sabadell in £2.65B cash deal

Santander to buy UK high street lender TSB for £2.65bn

Spanish bank beat British rival Barclays which also put in a formal bid for the Sabadell-owned unit

Santander to buy TSB for £2.65bn amid fears of branch closures and job losses

Purchase would be third major change of ownership for high street lender in 13 years The Spanish bank Santander is buying the British high street lender TSB for £2.65bn, raising fears of job cuts and ...

10 European Dividend Stocks That Could Beat Their U.S. Counterparts

So far in 2025, European stocks have left U.S. ones in the dust.

Sabadell agrees to sell TSB to Santander for 2.65 bln pounds, Expansion says

Spanish bank Sabadell has decided to sell its British unit TSB to Santander for 2.65 billion pounds ($3.64 billion), Spanish newspaper Expansion said on Tuesday.

Exclusive: Santander bid would value tsb at more than $3.2 billion, source says

Santander is among bidders that submitted a binding offer for Spanish lender Sabadell's British unit TSB, two sources with knowledge of the matter told Reuters.

Santander to Sell 7 Branches Amid Digital-First Transformation

Santander Bank has made a deal to sell seven branches in Pennsylvania as it continues its transformation into a national, digital-first bank. [contact-form-7] The firm agreed to sell the branches to S...

Santander to sell seven Pennsylvania branches to Community Bank

Santander said on Wednesday it had agreed to sell seven branches in the Allentown, Pennsylvania area to U.S.-based Community Bank as the Spanish lender pivots towards becoming a digital-first bank in ...

Santander Bank to sell seven branches to Community Bank

Santander Bank Announces Agreement to Sell Seven Branches to Community Bank, N.A.

BOSTON--(BUSINESS WIRE)--Santander Bank, N.A. (“Santander Bank” or “Santander”) today announced that it has entered into an agreement with Community Bank, N.A. (“Community Bank”), a subsidiary of Comm...

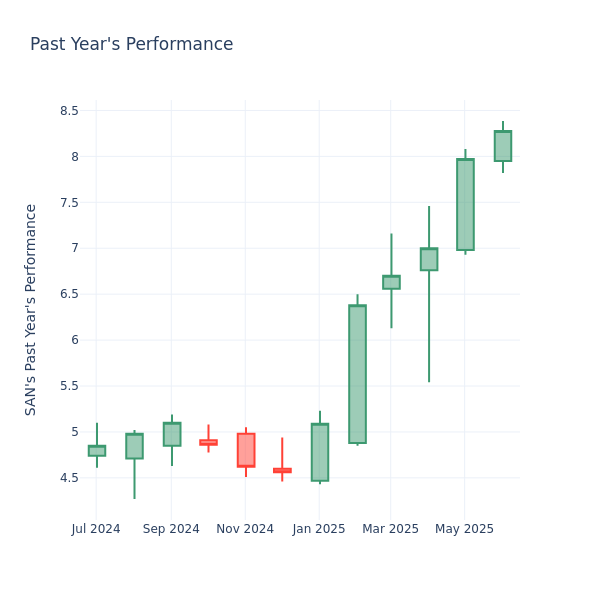

A Look Into Banco Santander Inc's Price Over Earnings

In the current session, the stock is trading at $8.20, after a 2.50% increase. Over the past month, Banco Santander Inc. (NYSE: SAN) stock increased by 2.80% , and in the past year, by 78.73% . With ...

Our Top 10 High Growth Dividend Stocks - June 2025

The article provides a methodology for selecting high-growth dividend-paying stocks, focusing on dividend growth and sustainability rather than high current yield. We use our proprietary models to rat...