Accounts Payable (AP)

Accounts payable (AP) are the outstanding short-term debts owed by a company to its creditors or suppliers.

They are calculated by adding up all the credit given to a company by suppliers:

Accounts payable = the sum of all credits owed by the company

Analyzing accounts payable is useful for investors because as part of a company's cash flow management, changes in AP can provide critical insights into the business.

AP are also used to calculate the AP turnover ratio, or the speed at which the company is paying off its accounts payable within a specific time period.

Below is an overview of accounts payable, including the formula and uses.

What are accounts payable (AP)?

Accounts payable are short-term debts owed by a company to its suppliers or creditors.

AP represent the money owed for goods or services that have been received by the company but not yet paid for. Essentially, accounts payable are like a short-term loan.

Accounts payable are usually due within 15, 30, or 45 days. If a company doesn't pay off its accounts within the arranged period, it will have defaulted on the short-term debt.

This may mean the company has to pay a late fee or lose its line of credit with that supplier.

Being given a period of time in which to pay, rather than having to do it right away, is a benefit suppliers offer in order to remain competitive and attractive to customers.

In contrast to accounts payable are accounts receivable (AR), which represent the money customers owe a company for goods and services that are not yet paid for.

For a business, AR represent what's owed to the company, while AP represent what the company owes others. Both are an important part of cash flow management.

SummaryAccounts payable represent the money a company owes for goods and services it has received but not yet paid for. These are usually due within 15, 30, or 45 days.

How to calculate accounts payable

AP are the total of all the credits given to the company from its suppliers and creditors within a set time period. Therefore, by adding those all up, you can find the total AP:

Accounts payable = the sum of all credits owed by the company

Where can you find AP?

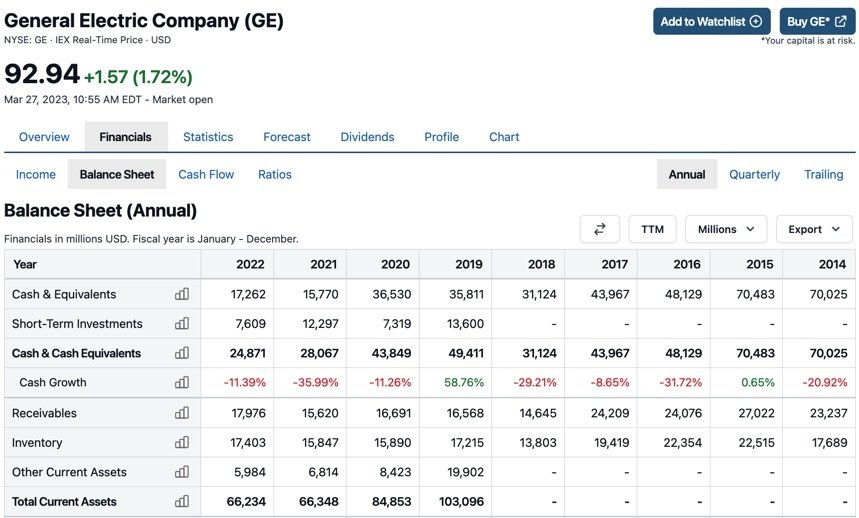

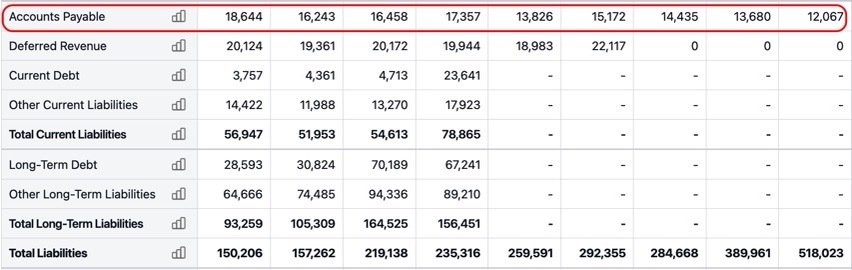

AP are shown on a company's balance sheet.

They are considered current liabilities since the company will have to pay them in the near future. The total listed on the balance sheet is the amount due at a specific point in time.

Below is an example where you can see accounts payable listed on General Electric's (GE) balance sheet.

Source: GE's Balance Sheet

Changes in total AP from the previous period can be seen on the cash flow statement.

For the creditor or supplier company, the same amount will be shown as part of their accounts receivable.

SummaryYou can calculate the total accounts payable by adding up all the outstanding credits a business has. AP is also listed on a company's balance sheet.

What are the benefits of accounts payable?

Accounts payable are essentially short-term loans. This offers a company the benefit of not having to find the cash needed to pay for the goods or services until a later date.

Companies must manage their AP to ensure that they have the cash needed to pay on the due dates. If they can't do this, they may be charged a late fee, could be given tighter credit terms in the future, or the supplier may refuse to do later business with them altogether.

From the company's perspective, it can be advantageous to have a longer period to pay, while for the supplier, a shorter period can be more advantageous. Sometimes suppliers offer special terms to their customers for paying early, such as a small discount on total cost.

Companies can also try to manage their AP against their AR, which represents what they're owed by other companies, to their best advantage.

For example, they may extend the time they get to pay their own debt while getting what they are owed by other companies as quickly as possible.

They can then use this extra cash to make their business more profitable.

For companies that have a quick turnaround time for selling their end product, it may be possible to receive payment for sales before AP debts are due, which can be advantageous.

SummaryAccounts payable are beneficial to a company because they free up some capital in the short term. Companies can also strategically use AP and AR to their best advantage.

What are the uses of accounts payable?

Accounts payable are useful when analyzing the financial health of a company.

For example, if a company's AP are increasing over time, then the company is expanding its use of credit to procure the goods and services it needs, rather than paying for them outright.

This could indicate a number of scenarios, both good and bad.

It could mean the company doesn't have the cash to pay for goods and services right away, indicating the business is stretching itself too far and getting into too much short-term debt.

Alternatively, it might mean the company has managed to increase the amount of credit it's getting from its suppliers, which it can then use to its advantage.

Or, as long as accounts payable are growing proportionately to assets and liabilities, increased AP can simply mean the company is growing.

What's most important is to keep an eye out for major changes in AP. It's useful to then assess these further and see what's actually going on with the business.

Additionally, the AP turnover ratio can be used to assess how quickly a company is paying its creditors and suppliers. This is discussed below.

SummaryAccounts payable can be used to analyze the financial health of a company. Any big changes in numbers over time should be investigated further.

How investors use AP: the AP turnover ratio

The AP turnover ratio is used to measure a company's short-term liquidity.

It does this by calculating the rate at which a company is paying its creditors and suppliers, showing how many times the company is able to pay off its AP during a given period.

The ratio is calculated by dividing the total supplier purchases by the average AP amount over the period, like so.

AP turnover = total supply purchases / ((beginning AP + ending AP) / 2)

AP turnover ratio example

Below is an example calculation for a women's clothes retailer, in U.S. millions.

| Total supply purchases | $10M |

| Beginning AP | $7M |

| Ending AP | $3M |

| AP turnover | 10 / ((7+3) / 2) = 2 |

This shows that the company has an AP turnover ratio of 2. It shows how quickly a company pays off its short-term debts, which in this case is twice per year.

By analyzing the ratio over time, you can see whether any changes are due to factors that are good or bad for the company.

For the company in the example above, if the turnover ratio is increasing, that means the company is paying its debts off more quickly. However, it could then be missing out on the freed-up cash that could be used for other profit-making opportunities.

If, on the other hand, the ratio was falling, it could indicate that the company is struggling with cash flow and unable to pay its bills.

Overall, it's a balance, and any major changes are worth investigating further.

SummaryThe AP turnover ratio is used to assess a company's short-term liquidity, revealing the rate at which a company is paying off its creditors and suppliers. Any major changes over time are worth investigating further.

The takeaway

Accounts payable are the short-term debts owed by a company to its creditors and suppliers for goods and services that have not yet been paid for.

AP are helpful to companies since they are effectively short-term loans.

Accounts payable are considered a current liability and therefore shown on a company's balance sheet in that section. Changes in AP are accounted for in the cash flow statement.

If a company's AP change substantially over time, it could be a sign that there is an issue with the business's management of its cash flow. Investors should investigate further to see whether the company is struggling to find the cash to pay off these short-term debts.

Additionally, the AP turnover ratio is used to calculate the speed at which a company is paying off its outstanding AP. Here again, it's important to assess the trends over time.