Effective Tax Rate

The effective tax rate is the percentage of income a corporation or individual pays in taxes.

For corporations, it's calculated by dividing total taxes by earnings before taxes, like so:

Corporate effective tax rate = total taxes / earnings before taxes

In contrast to the corporate income tax rate, which is the rate set by the government, the effective tax rate represents what's actually paid, accounting for deductions.

This is a useful number because it's specific to each company, allowing you to see what a corporation pays in taxes and how that compares to other companies.

Below is an overview of the effective tax rate and how it works for both companies and individuals, as well as how it compares to the corporate income and marginal tax rates.

What is the effective tax rate?

The effective tax rate is the portion of a person or company's income that's paid in taxes.

This differs from the legal tax rates that are set by the government for corporations, as the effective tax rate accounts for all deductions or tax expenditures.

For companies, the effective tax rate represents the payment owed on pre-tax profits, and it's often considerably lower than the corporate income tax rate.

Worth noting, the current U.S. federal corporate tax rate is 21%. You can read more about how it works in our overview here.

For individuals, the effective tax rate is the payment owed on taxable income. This number is often much lower than the marginal tax rate, which rises as an individual's income pushes them into higher tax brackets.

Generally, the effective tax rate number refers to the federal income owed. However, you could calculate it to account for state and local taxes as well.

SummaryThe effective tax rate is the percentage of income paid in taxes. It differs from the corporate tax rate (for corporations) and marginal tax rate (for individuals) as it calculates what's actually owed versus the rates set by the government.

Corporate effective tax rate: formula and example

The corporate effective tax rate represents the portion of income a company pays in taxes.

Here is the formula to calculate it:

Corporate effective tax rate = total taxes / earnings before taxes

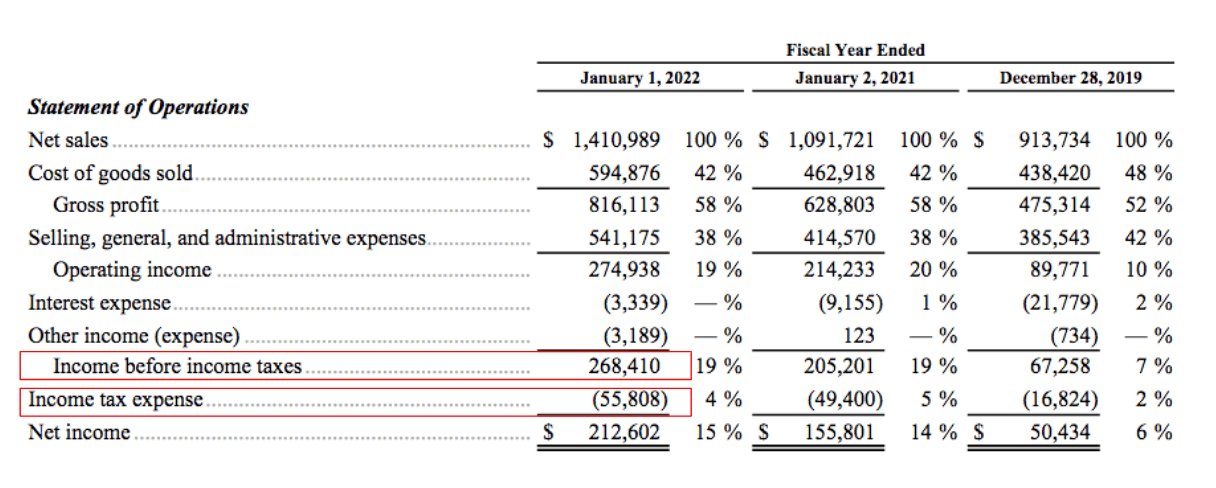

To see how this works, it's helpful to walk through an example. The below calculation uses the statement of operations, which provides the inputs you'll need, for Yeti Holdings Inc. (YETI).

The statement of operations is part of a company's 10-K filing, which is an annual report detailing the financials of a publicly traded company.

These comprehensive reports also provide information on executive compensation, earnings per share, legal proceedings, corporate governance, and more.

Source: Yeti's 10-K

Using the above numbers, you can calculate the effective tax rate for Yeti as follows:

Yeti effective tax rate = $55,808 / $268,410 = 0.2079

To get the percentage, simply multiply by 100 to arrive at 20.79%.

SummaryA company's effective tax rate is calculated by dividing total taxes by earnings before taxes. You can find the data needed for this on a company's statement of operations, which is part of its 10-K filing.

Effective tax vs corporate income tax

The corporate income tax rate is the rate set by the government, while the effective rate is what's actually paid. Most of the time, companies' effective tax rate is much lower.

As mentioned earlier, the current U.S. federal corporate tax rate is 21%.

Additionally, keep in mind that 44 states and the District of Columbia (D.C.) also mandate state taxes. The rate varies considerably from state to state, though the highest rate is New Jersey's 11.5% and the lowest is North Carolina's 2.5% (1).

Data published by the Organisation for Economic Co-Operation and Development (OECD) shows that the composite effective average tax rate for corporations in the US is 22.3% (2).

Internationally, the effective average tax rate for corporations varies considerably. For example, in Chile, this number is 37.9% while in Ireland it is just 12.4% (2).

In recent years, some economists and analysts have pointed out that some Fortune 500 companies use complex loopholes to dramatically reduce their effective tax rate.

Research also shows that major corporations like Ford, Chevron, and Bank of America all paid an effective tax rate of less than 5% in 2021 (3).

Furthermore, AT&T, AIG, and Charter Communications all had a negative effective tax rate in 2021 because they received tax refunds (3).

This is because companies can dramatically reduce their tax obligations by writing off business expenses related to operating the company. There's a long list of items that can be used, such as legal services, healthcare benefits, travel expenses, and many others.

The idea behind this is that tax breaks encourage innovation. For example, research and development tax credits could help companies have more money for scientific research.

However, maximizing deductions is generally a major focus for companies, and this is how their effective tax rates end up being much lower than the corporate income tax rate (4).

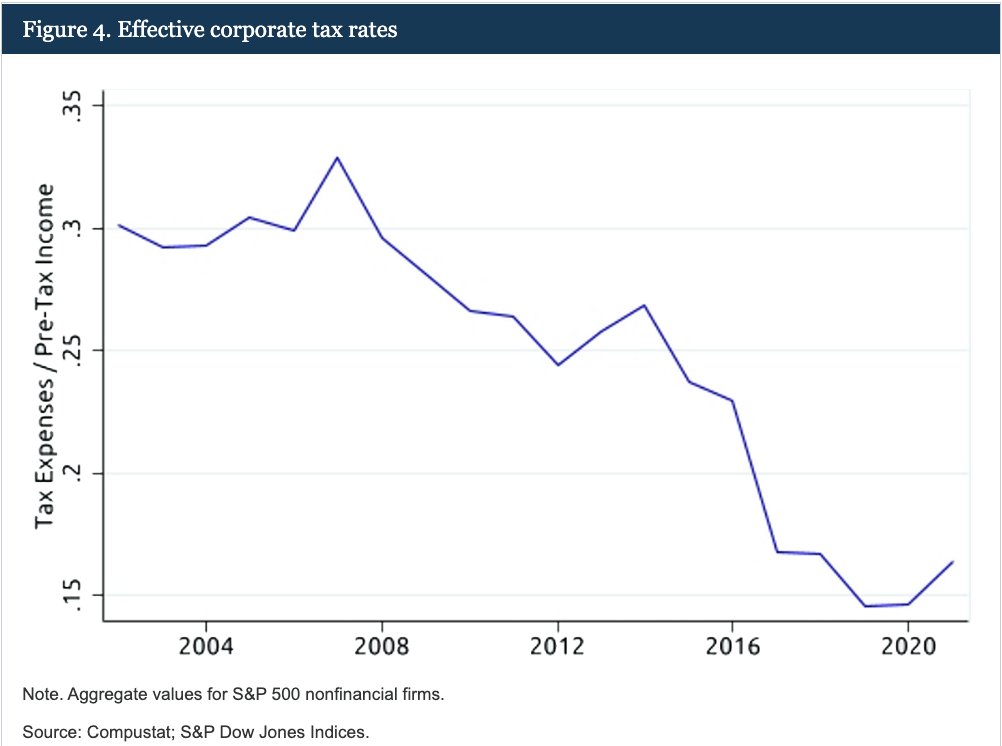

It's also worth noting that corporate income tax rates have declined over time, so the effective tax rate has gone down commensurately.

Source: The Federal Reserve

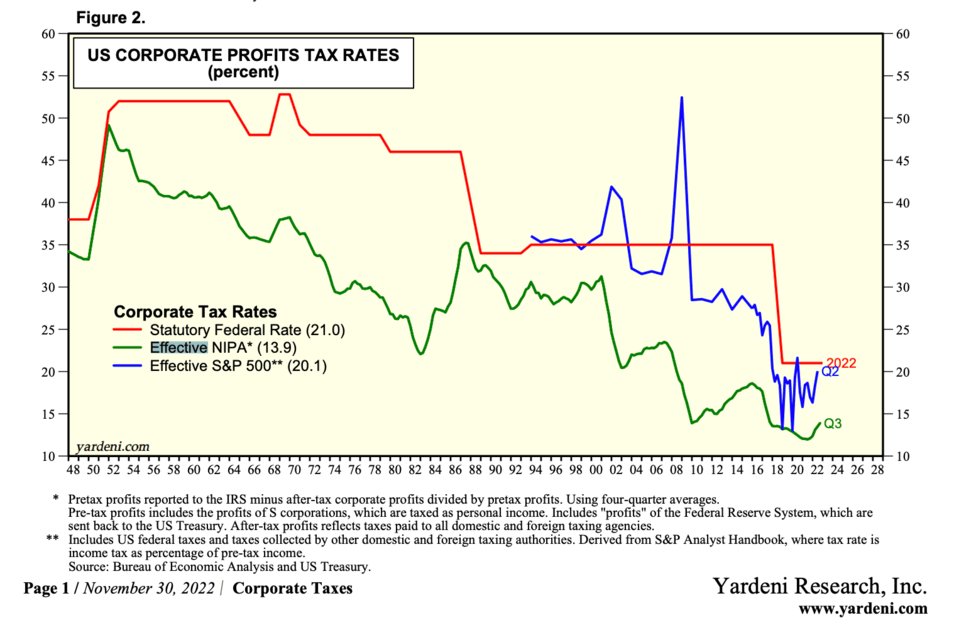

Nevertheless, you can see that the effective tax rate is still consistently lower than the corporate income tax rate, with a few exceptions, in the chart below.

Source: Yardeni Research

SummaryThe effective tax rate is the portion of earnings a company pays in taxes, while the corporate income tax rate is the base rate set by the government. Generally, the effective tax rate is much lower due to deductions, geography, and other factors.

Individual effective tax: formula and example

Individuals are also required to file taxes, and an effective rate is at play here as well.

Here is the formula for calculating an individual's effective tax rate:

Individual effective tax rate = total tax / taxable income

You can find the numbers used in the formula on your IRS Form 1040. Here's where each input you'll need is located:

- Total tax: Line 24

- Taxable income: Line 15

Worth noting, income refers to both earned and unearned income:

- Earned income: Wages, commissions, salary, and bonuses

- Unearned income: Interest income on saving accounts, dividends from stocks, and bond interest

As an example, consider an individual who paid $24,000 in total tax and had a taxable income of $95,000 in salary, a $5,000 bonus, and $1,000 in income from savings interest and dividends.

This person's total taxable income would be $95,000 + $5,000 + $1,000 = $101,000.

Individual effective tax rate = 24,000 / 101,000 = 0.2376

You can then express this as a percentage by multiplying it by 100 to arrive at 23.76%.

SummaryThe effective tax rate for individuals is the percentage of income a person ends up paying in taxes. Calculating this number requires your total tax and taxable income, which can be found on your IRS Form 1040.

Effective tax rate vs marginal tax rate

The marginal tax rate refers to an individual's tax bracket. It differs from the effective tax rate, which is the actual amount the person will end up paying in taxes.

The effective tax rate is less than the marginal tax rate because income is taxed in stages at progressively higher rates. As you reach different income tiers, the tax rate also rises.

This does not mean all of your income is subject to the highest rate once you move into a new bracket. Instead, income is divided into tiers and the first dollars are taxed at a lower rate.

Here are the tax brackets:

| Tax rate | Taxable income |

| 10% | Up to $20,550 |

| 12% | $20,551 to $83,550 |

| 22% | $83,551 to $178,150 |

| 24% | $178,151 to $340,100 |

| 32% | $340,101 to $431,900 |

| 35% | $431,901 to $647,850 |

| 37% | Over $647,850 |

Below is an example for a married couple filing jointly. They have $135,000 in taxable income.

Their taxes owed break down as follows:

| Tax rate | Taxes owed |

| 10% | $20,550 x 10% = $2,055 |

| 12% | ($83,550 - $20,550) x 12% = $7,560 |

| 22% | ($135,000 - $83,550) x 22% = $11,319 |

| 24% | Not applicable |

| 32% | Not applicable |

| 35% | Not applicable |

| 37% | Not applicable |

The sum of these three amounts is $20,934 in total federal tax owed. Because the top bracket determines marginal tax, the couple's marginal tax rate is 22%.

However, the couple's effective tax rate is as follows:

Effective tax rate = $20,934 / $135,000 = 0.1550

Multiplied by 100 to get a percent, this is 15.50%.

SummaryThe marginal tax rate refers to an individual's tax bracket, while the effective tax rate refers to the actual percentage of income paid in taxes. The effective tax rate will always be lower than the marginal rate.

The takeaway

The effective tax rate for an individual or a corporation is the percentage of income they pay in taxes.

For companies, it differs from corporate income tax, which is the legally set tax rate. The effective tax rate is what's ultimately paid once all deductions are accounted for.

For individuals, the effective tax rate is also what's actually paid in taxes. It differs from the marginal rate, which refers to the top tax bracket a person is earning in.

Generally, the effective rate for both corporations and individuals is lower than the set rates.