Selling, General, and Administrative (SG&A) Expenses

Selling, general, and administrative (SG&A) expenses are a company's overhead costs for its day-to-day operations, such as office supplies and salaries.

SG&A is calculated by adding general and administrative expenses to selling expenses:

SG&A = selling expenses + general & administrative expenses

Understanding SG&A expenses is important for managing overhead costs, knowing where to cut costs if needed, and sustaining profitability.

Sometimes, the terms SG&A and operating expenses are used interchangeably. However, SG&A is only one type of operating expense.

Below is an overview of SG&A, including examples, how it is accounted for, and how it differs from other operating expenses.

What is SG&A?

Selling, general, and administrative (SG&A) expenses account for the essential costs of running the day-to-day business operations.

There are two parts to SG&A costs: selling expenses and general and administrative expenses.

Selling expenses are direct, meaning at the time of the sale, as well as indirect, meaning before and after the sale. General and administrative expenses refer mainly to the day-to-day overhead costs.

Here are a few examples of expenses classified as SG&A:

- Salaries and wages (other than direct labor for production employees)

- Advertising and marketing

- Insurance

- License fees

- Office supplies

- Accounting costs

- Maintenance and repairs

- Distribution expenses

- Rent

- Travel

- Utilities

- Vehicle expenses

- Legal fees

- Equipment not associated with manufacturing

A company's SG&A budget plays a major role in its success and profitability. This type of expense is also very vulnerable to cost-cutting measures.

In accounting, SG&A costs are considered operating expenses.

Notably, SG&A costs do not include the cost of goods sold (COGS). COGS differs from SG&A in that it includes the expenses necessary for product manufacturing, such as labor, materials, etc.

SG&A also excludes research and development (R&D) costs, as well as depreciation and amortization, which are different categories of operating expenses.

It's common to see the terms SG&A and operating expenses used to mean the same thing, but this is inaccurate since SG&A is only one type of operating expense.

SummarySG&A accounts for the costs that are essential to running the business, such as rent, salaries, office supplies, and more. It's one type of operating expense, separate from COGS and R&D.

Types of SG&A expenses

As mentioned above, SG&A is the combination of two types of expenses: selling (S) and general and administrative (G&A).

Breaking these terms down adds further context to a company's operations.

For instance, a company may sometimes report selling expenses separate from G&A expenses if one is significantly higher than the other.

Below is further information on how to classify expenses into either S or G&A.

Selling expenses (S)

Selling expenses are often divided into two categories: direct and indirect costs.

- Direct costs: Expenses incurred once a product is sold, thus tied to the fulfillment of orders. These costs can include packing and shipping expenses, delivery charges, logistics, and sales commissions.

- Indirect costs: Pre- or post-sale expenses. These costs may include marketing, advertising, base wages for salespeople, telephone bills, and travel costs.

General and administrative expenses (G&A)

General and administrative (G&A) expenses are commonly known as a company's overhead.

These are the day-to-day costs a company incurs for its operations and functionality, regardless of whether or not it generates a profit.

Typical G&A expenses include the salaries of administrative and management staff, rent, utilities, legal fees, HR expenses, and insurance payments.

SummarySelling (S) expenses are either direct, meaning incurred only once a product is sold, or indirect, meaning incurred before or after a sale. General and administrative (G&A) expenses are the day-to-day operational costs.

How to calculate SG&A expenses

The formula for calculating SG&A expenses is simple:

SG&A = selling expenses + general & administrative expenses

You can find SG&A expenses listed on the income statement. The individual costs making up a company's SG&A are not usually shown.

Tips for calculating SG&A

If you need to calculate SG&A yourself, here are a few tips to keep in mind:

- Categorize operating expenses: SG&A expenses are operating expenses, but should be listed separately from R&D, depreciation and amortization, and COGS.

- Remove non-operating expenses: Interest, taxes, capital expenditures (CapEx), and other non-operating expenses are not SG&A expenses.

- Identify expense categories: Sort expenses into line items categorized into “selling” and “general & admin” columns. This will help organize and sum expenses.

- Set a reporting period: SG&A can be calculated monthly, quarterly, or annually, though expenses are nominal and only close at the end of the accounting period.

- Note the accounting method: If you follow cash basis accounting, only fully paid SG&A costs are recognized. If you follow accrual basis accounting, you include both paid-for and incurred SG&A costs.

Example calculation

To help visualize how this works, consider the following example.

A small e-commerce business follows the accrual method of accounting, calculating SG&A expenses monthly. A sample month's expenses were:

- Wages: $20,000

- Rent: $3,000

- Marketing: $1,000

- Website/app maintenance: $2,000

- Legal: $1,000

- Distribution costs: $2,700

- Utilities: $300

The expenses added together total USD $30,000 for the month's SG&A expenses.

While most of these expenses are fixed costs, distribution costs are variable. It's important to keep an eye on this cost month-to-month to assess the profitability and trends.

SummarySG&A expenses are usually already calculated on the income statement by adding up selling expenses and general and administrative expenses. If you need to calculate SG&A yourself, such as for your own business, keep in mind the above tips.

SG&A vs other expenses

Accounting for SG&A is relatively simple, though there are some important factors to consider here as well — namely, how SG&A compares to other expenses.

1. The difference between SG&A and COGS

As an operating expense, SG&A includes essential expenses for a company's day-to-day operations yet excludes COGS and any costs related to producing goods and services.

COGS covers the expenses necessary to manufacture a product, including labor, materials, and related overhead expenses. SG&A covers almost every other operating expense, excluding R&D and depreciation and amortization.

2. The different types of operating expenses

It's common to use the terms SG&A and operating expenses interchangeably, but keep in mind that SG&A is only one type of operating expense.

3. R&D expenses

R&D expenses are a company's investment in itself, money put toward developing new products, improving existing offerings, and remaining competitive in the marketplace.

Examples of R&D expenses include:

- Salaries for R&D staff

- Research supplies

- Licensing fees for intellectual property

- Software

- Payments to partners or universities

- Lab equipment

- Costs for research facilities

4. Depreciation and amortization expenses

Depreciation and amortization are non-cash operating expenses.

Depreciation refers to expenses related to a fixed asset's usage, allocating costs based on wear and tear throughout the asset's useful life.

Amortization expenses work the same way, except they represent intangible assets. For instance, a trademark, patent, or mortgage payment are amortization expenses.

The accounting for these is slightly different, though they are often listed together.

5. Non-operating expenses

Non-operating expenses are costs incurred by a business that are unrelated to core operations.

Most commonly, non-operating expenses include interest payments, tax provisions, and capital expenditures (CapEx).

Other examples include:

- Restructuring expenses

- Gain or loss on the selling of an asset

- One-time expenses for unusual occurrences or damages

- Lawsuit settlement expenses

- Dividends paid

- Issuance of shares

SummaryAccounting for SG&A is relatively simple, though it's important to separate other expenses such as R&D, COGS, non-operating expenses, and depreciation and amortization.

Real-life examples of SG&A

SG&A expenses can be reported differently, depending on the company.

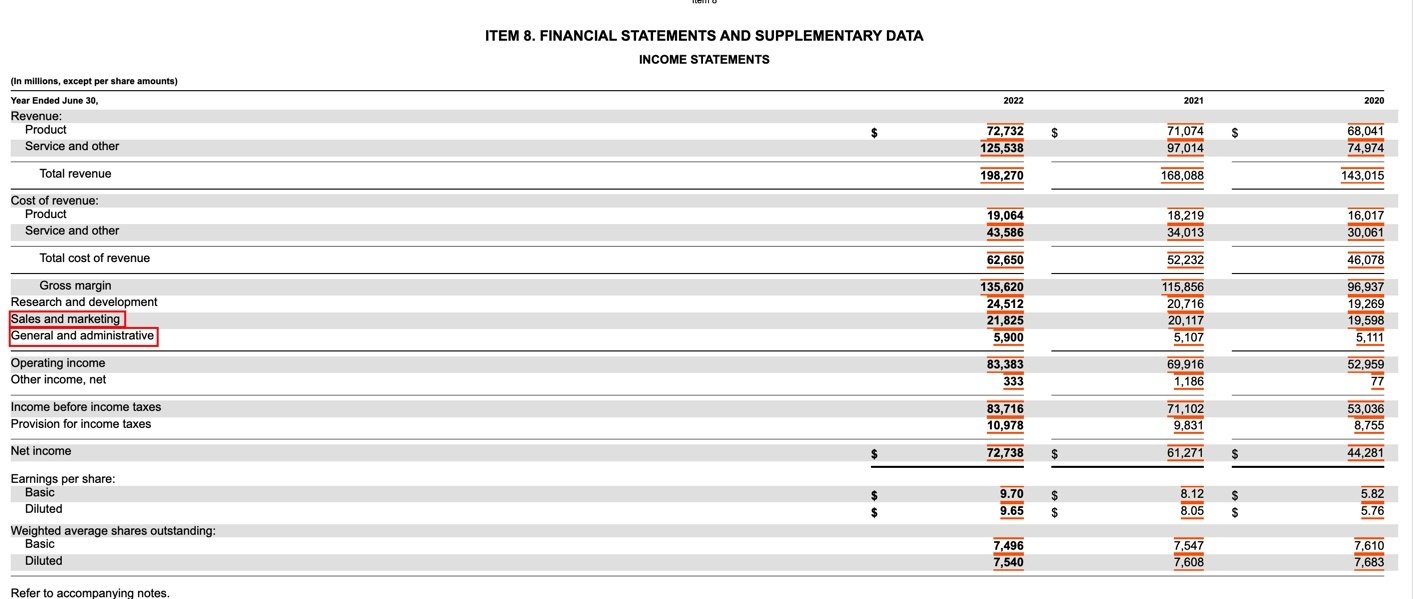

Below are two real-life income statement examples from Microsoft Inc.'s (MSFT) 10-K form and Netflix, Inc.'s (NFLX) latest 10-Q filing.

Microsoft

First, let's review Microsoft's statement, which covers the fiscal year that ended on June 30, 2022.

Source: Microsoft's 10-K

Notice how “sales and marketing” is one expense, while “general and administrative” is an individual line item. These are separate from “research and development.”

COGS, or in this case, “cost of revenue” stands above these items, while “income before income taxes” and “provision for income taxes” are the bottom line items above net income.

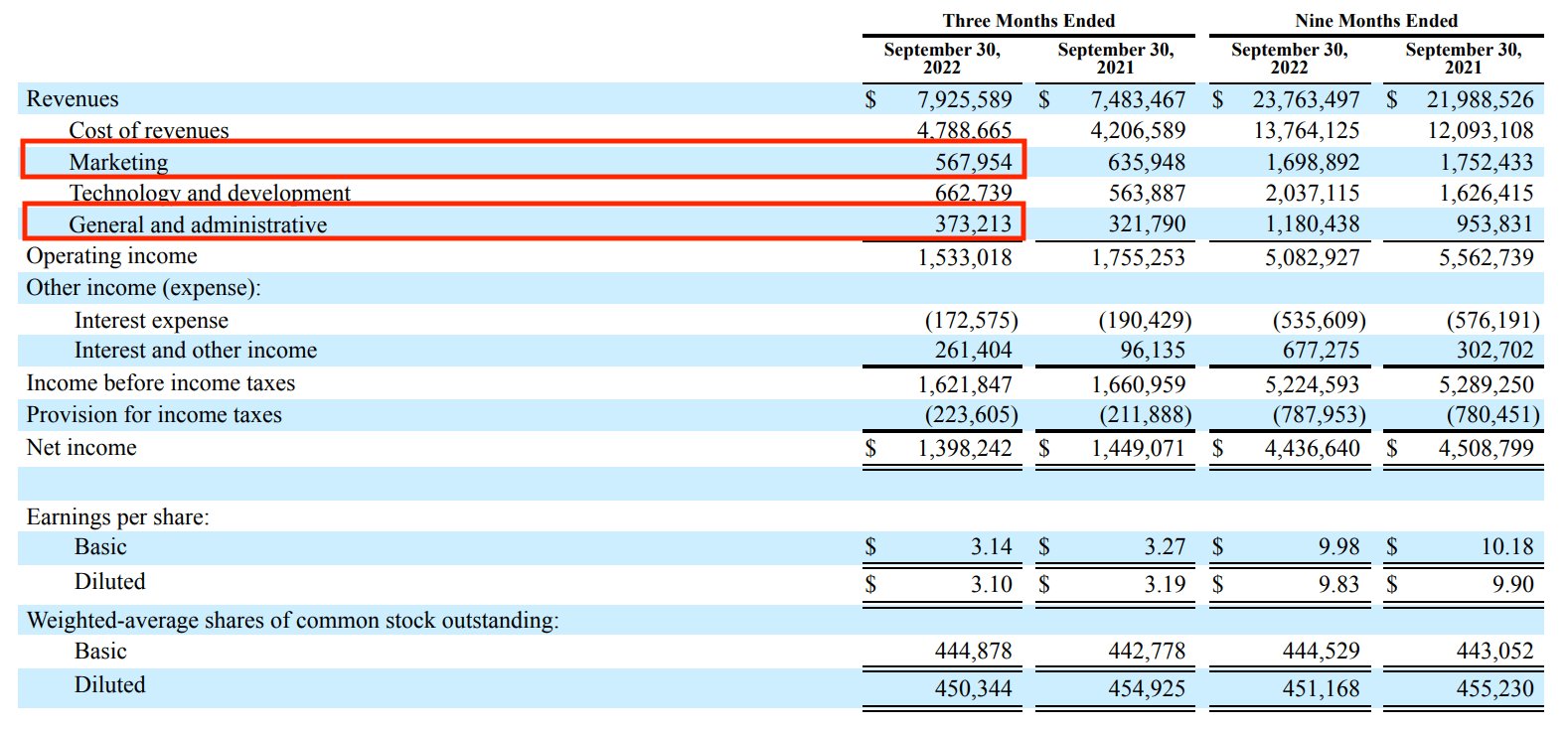

Netflix

Next, let's look at Netflix's 10-Q for the quarter that ended on September 30, 2022. It reports SG&A differently than Apple.

Source: Netflix's 10-Q

COGS, also listed here as “cost of revenues,” comes first. “Technology and development” refers to R&D. Selling expenses are listed in the form of “marketing,” and “general and administrative” has an individual line item.

The bottom line expenses, such as “interest expense” and “provision for income taxes,” come next.

Sometimes, operating expenses are listed under an “operating expenses” heading, though this is not always the case, as seen in these examples.

SummarySG&A costs, while always operating expenses, can be reported in different ways. Some large companies may report SG&A as one expense, while others may separate the “S” from the “G&A.”

The SG&A ratio

SG&A can also be used to calculate the SG&A ratio, which is an additional metric that calculates SG&A as a percentage of sales.

Here is the formula:

SG&A ratio = SG&A expenses / total sales revenue

You can then multiply the result by 100 to get the ratio.

This metric is most helpful when looking at trends over time or comparing to peers.

For example, if SG&A rises significantly but sales do not, the business will become less profitable. If SG&A goes down, while sales rise, the business will become more profitable.

Importantly, reducing SG&A expenses means less revenue will yield more profit, which is why SG&A is often a target for cost-cutting measures.

What can be considered a “good” SG&A ratio for a company depends on a few factors, including industry, age, growth trajectory, and more.

For this reason, it's important not to get too hung up on a “good” SG&A number. The metric can provide useful insights but doesn't tell the whole story. For example, a young company may have a significantly higher SG&A ratio than a more established one.

Likewise, what can be considered a “good” industry average varies by sector, as some industry averages are known to be lower or higher than the general average.

SummaryThe SG&A sales ratio can be used to monitor the trends of a company's SG&A expenses in relation to sales, providing insight into profit or helping benchmark to industry averages. This may also be used when making cost-cutting decisions.

The takeaway

SG&A costs are some of the most integral to a company's day-to-day operations.

Whether indirect or direct selling costs, general expenses like rent and utilities, or administrative costs like salaries and legal fees, SG&A costs are essential.

Reported separately from COGS and other operating expenses, companies can evaluate SG&A to assess the break-even or profitability points.

This is why SG&A expenses are often the first to go if a company is trying to reduce costs.

By keeping close tabs on SG&A expenses, a company can more efficiently manage its overhead, make cost-cutting decisions, and remain profitable.