Depreciation and Amortization

Depreciation and amortization are two methods for expensing the cost of an asset over time.

The main differences are in the types of assets they account for, as depreciation covers physical assets while amortization covers non-physical assets.

There are several ways to calculate depreciation, but here is the most common formula:

Depreciation expense = (cost - salvage value) / useful years

Amortization is calculated as follows:

Amortization expense = cost / useful years

The purpose of depreciation and amortization is to spread the cost of an asset over its useful life. Both are recorded on the income statement and later become tax deductions. They are also used together in the EBITDA calculation.

While both methods have a similar purpose, there are a few key differences. Below are detailed overviews of both terms, including how they compare and how to calculate them.

What is depreciation?

Depreciation is the expense method used for a fixed, tangible asset. It represents the asset's loss in value over time and is a way to depreciate the cost over the asset's useful life.

Examples of tangible, or physical, assets include vehicles, machinery, computers, buildings, and tools. To be considered a fixed asset, an asset must:

- Have a useful life that is greater than one year

- Be used as part of the business's operations for long-term benefits

- Be illiquid, meaning that it cannot be quickly converted to cash

Some fixed assets also have a salvage value, which is the estimated amount a company can expect to gain when they finally sell the asset. This usually occurs when the business can no longer use the asset.

Salvage value matters because it is subtracted from the asset's original cost when calculating depreciation.

Note that some assets have a zero or near-zero salvage value because the company expects to use the asset until it can be used no more.

SummaryDepreciation is the expense method used to account for the loss in value over time of fixed, tangible assets. Examples of tangible assets include machinery and buildings.

How to calculate depreciation

There are several ways to calculate depreciation. The most common method is called straight-line depreciation.

Here is the formula:

Depreciation expense = (cost - salvage value) / useful years

With this method, the company depreciates the asset by the same amount every year.

There are alternative methods that can be used to distribute the asset's cost differently, which will be discussed later on.

Example calculation

To visualize the straight-line depreciation method, consider the following example.

A company purchases an industrial printer for making professional brochures and pamphlets. The cost of the printer is USD $200,000.

The company estimates that when they no longer have use for the printer, they will be able to sell it for USD $5,000 — this is the salvage value.

The company also estimates that the useful life of the printer will be eight years. They determine this number based on their understanding of printer technology trends.

In other words, they believe that in eight years they will have access to faster, more efficient printers and that this printer will be sufficiently worn down.

The calculation in this example is as follows:

Depreciation expense = ($200,000 - $5,000) / 8 = $24,375

The resulting figure of $24,375 will appear as an annual expense on the income statement.

SummaryTo calculate straight-line depreciation, the company needs to know the cost of the asset, its useful life, and its salvage value, if any.

What is amortization?

Amortization is the expense method used for an intangible asset. Like depreciation, it is a way to distribute the asset's cost over its useful life.

Intangible assets are those that are not physical, such as licenses, trademarks, copyrights, and patents.

Amortization is almost always calculated using the straight-line method because a business cannot prove how its use of an intangible asset will increase or decrease from year to year.

For example, it is nearly impossible to measure if a patent or a license is used more in year one than it is in year two.

Additionally, an intangible asset has no salvage value because it cannot be resold. Therefore, the amortization calculation does not include any accounting for resale value.

SummaryAmortization is the expense method used to account for the loss in value over time of intangible assets such as trademarks or copyrights. It's almost always calculated using the straight-line method.

How to calculate amortization

The straight-line amortization calculation formula is:

Amortization expense = cost / useful years

Example calculation

To visualize straight-line amortization, consider the following example.

A wireless speaker company purchases a patent allowing them to use a new, more efficient process for making the Bluetooth components for their speakers.

The purchase price of the patent is USD $50,000 and the agreement stipulates that the patent will expire in ten years.

However, the business knows that the useful life of the patent is, in fact, shorter than ten years because industry trends clearly show that the process for manufacturing Bluetooth products will continue to improve dramatically in the coming years.

A new, better process is likely to emerge in the next five years, at which point the patent's useful life will be over.

In this example, the calculation is:

Amortization expense = $50,000 / 5 = $10,000

SummaryThe amortization formula is a simple calculation of dividing the cost of the asset by its useful life in years.

Other ways to calculate depreciation

In addition to the straight-line depreciation method, there are four other ways to calculate the long-term expense of a fixed asset. They are:

- The declining balance method

- The double declining balance method

- The sum of years digits method

- The units of production method

Below is more information about each method.

1. Declining balance method

Declining balance depreciation is used when the company wants to expense a greater portion of an asset early in its life and a lesser amount later in its life.

This approach is appropriate for fixed assets that lose their value quickly, such as an item of technology that is likely to become obsolete within a short period.

Here, the business expenses the same percentage of the asset's value each year. Because the percentage is applied to a constantly shrinking number, the dollar value of the expense becomes smaller with each passing year.

For example, an asset costing $21,000 with a $1,000 salvage value and a useful life of ten years would depreciate at $2,000 per year under the straight-line method.

However, under the declining balance method, the business uses a depreciation rate which is expressed as a percentage. In this example, the depreciation rate has been set at 20%.

Therefore, the asset depreciates as follows:

| Year | Calculation | Depreciation | End-of-year value |

| 1 | 20% x ($21,000 - $1,000) | $4,000 | $16,000 |

| 2 | 20% x ($16,000) | $3,200 | $12,800 |

| 3 | 20% x ($12,800) | $2,560 | $10,240 |

| 4 | 20% x ($10,240) | $2,048 | $8,192 |

And so on, until year ten, which is the end of the item's useful life.

2. Double declining balance method

This method also expenses more of the asset earlier in its life. The difference, however, is that with this method the business doubles the rate used in the straight-line method.

For example, let's say a business purchases an industrial mixer for $10,000 with a $1,000 salvage value and a useful life of five years.

Under the double declining method, the business first calculates the straight-line depreciation as 1/5 years of useful life, which equals 20%.

Then, the business doubles this number. As a result, they deduct 40% of the book value in year one. In year two, the business deducts 40% again.

The expensing looks like this:

| Year | Calculation | Depreciation | End-of-year value |

| 1 | 40% x $10,000 | $4,000 | $6,000 |

| 2 | 40% x $6,000 | $2,400 | $3,600 |

| 3 | 40% x $3,600 | $1,440 | $2,160 |

This expense continues until the asset's book value reaches its salvage value.

3. Sum of years method

With this method, the business adds the digits of the asset's useful life, with the resulting total representing a denominator. The business then expenses a portion of the asset by using a numerator that represents each of those years.

For example, an asset that cost $40,000 with no salvage value and a useful life of eight years would be calculated using the following steps:

- 1+2+3+4+5+6+7+8 = 36

- Place the remaining life in years over 36. In the first year, this number is 8.

- 8/36 = .22 or 22%

- 22% x $40,000 = $8,800

- Expense $8,800 of the asset in the first year.

In year two, the business will expense the asset using 7/36 = 19%. Therefore, the year-two depreciation expense is $40,000 x 19% = $7,600.

In year three, the business will expense the asset using 6/36 = 16%. Therefore, the year-three depreciation expense is $40,000 x 16% = $6,400.

This is summarized in the table below:

| Year | Percentage | Calculation | Depreciation |

| 1 | 8/36 = 22% | 22% x $40,000 | $8,800 |

| 2 | 7/36 = 19% | 19% x $40,000 | $7,600 |

| 3 | 6/36 = 16% | 16% x $40,000 | $6,400 |

4. Units of production method

With this method, the company calculates the depreciation expense based on the number of units the asset produces rather than the number of years in its useful life.

For example, an architectural firm might purchase a high-end 3D printer for generating detailed, scale models. The cost is $45,000 and there is no salvage value. They determine that the machine is capable of producing 800,000 3D-printed pieces over its lifetime.

In year one, the printer generates 175,000 units. Therefore, the depreciation expense is calculated as:

Year 1 = (175,000 / 800,000) x ($45,000 – $0) = $9,843

In year two, the machine produces 200,000 units. Therefore, the year-two depreciation expense is calculated as:

Year 2 = (200,000 / 800,000) x ($45,000 – $0) = $11,250

SummaryThere are several ways to calculate depreciation. Choosing the best method often depends on the kind of fixed asset being expensed as well as how it's used.

Depreciation vs amortization: what's the difference?

There are four key differences between depreciation and amortization.

- Asset type: Depreciation is used to expense fixed, tangible assets, while amortization is used to expense intangible assets.

- Methodology: Depreciation can be calculated in several ways, while amortization is almost always calculated using the straight-line method.

- Salvage value: Depreciation accounts for the asset's salvage value, while amortization does not use salvage value since intangible assets don't have one.

- Underlying theory: Depreciation can reduce the asset's value over time, while amortization evenly spreads the cost of the asset over a period.

In some instances, depreciation and amortization are intentionally treated as non-cash items on the statement of cash flow. This is because depreciation and amortization do not reflect cash flow — they only reflect the usage of an asset.

The two terms are also commonly used together, most notably in the EBITDA formula:

EBITDA = net income + taxes + interest expense + depreciation and amortization

Depreciation and amortization example

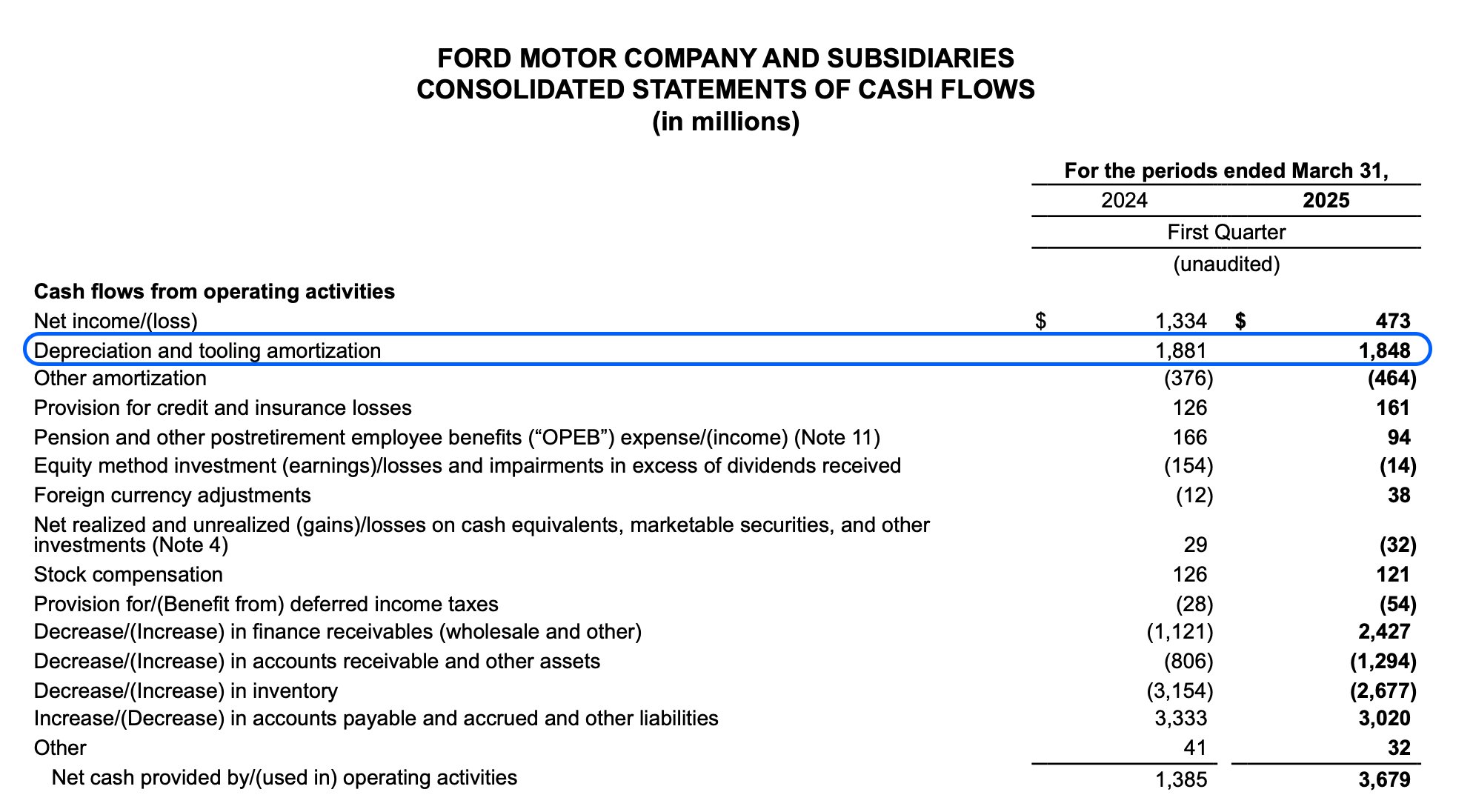

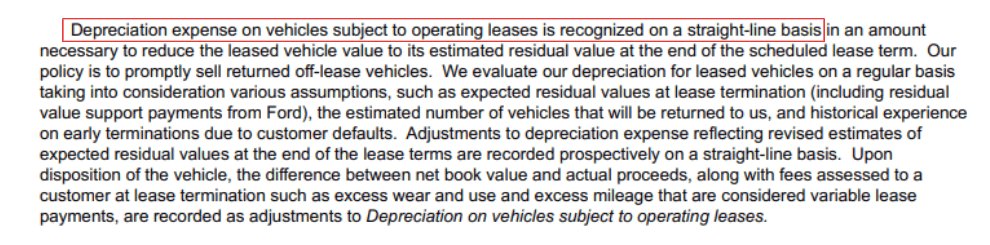

Below is an example of the depreciation and amortization expense for Ford (F), which comes from the company's 10-Q filing with the SEC.

The description of Ford's depreciation method is also found on their 10-K filing.

Because both depreciation and amortization are using the straight-line method, the two items can be combined into a single figure in the filing.

SummaryThe biggest differences between depreciation and amortization are the types of assets for which they are used as well as how they distribute costs over time.

The takeaway

When a business acquires an asset, they need to account for it in a way that shows how the asset depreciates in value over its useful life.

Depreciation and amortization are two ways of doing this, depending on the asset type.

Depreciation is a calculation used to expense a fixed asset that is tangible, while amortization is a calculation used to expense an intangible asset. Depreciation can also show the asset's loss in value over time, while amortization evenly spreads the cost of the asset over a period.

Amortization is more straightforward to calculate, as it's almost always calculated using the straight-line method. On the other hand, there are several ways to calculate depreciation.

Though they have key differences, depreciation and amortization are generally used together to account for assets' loss in value over time.