Who Determines Recessions?

An organization called the National Bureau of Economic Research (NBER) is responsible for determining when recessions begin and end in the U.S.

More specifically, a committee within the NBER called the Business Cycle Dating Committee is a group of experts who determine the starts and ends of recessions.

How is a recession determined?

Many people believe that a recession is two consecutive quarters of negative gross domestic product (GDP) growth. If the economy contracts for two quarters in a row, that means the economy is in a recession.

However, this is more accurately called a "technical" recession. It is an often-used label in other economies around the world, but the NBER uses a different approach for the U.S. economy.

The NBER defines recessions as significant declines in economic activity that last from a few months to more than one year. They don't only look at GDP, but also gross domestic income (GDI).

In addition, they use some economic data that's reported monthly as opposed to quarterly. This includes industrial production, employment, and retail sales.

Here's what the top five economic indicators used by the NBER represent:

- Gross domestic product (GDP): The value of all goods and services produced by the economy. Recessions always come with negative GDP growth.

- Gross domestic income (GDI): This is the value of all income in the economy, including salaries and taxes.

- Industrial production: The manufacturing sector usually declines in a recession, which can be measured by reduced industrial production.

- Employment: Jobs are always lost in a recession, and unemployment goes up.

- Retail sales: People tend to have less money, so they spend less. This causes a decline in retail sales.

Keep in mind that the NBER does not publish specific numbered criteria for these indicators. But they look at them to determine when the economy is declining.

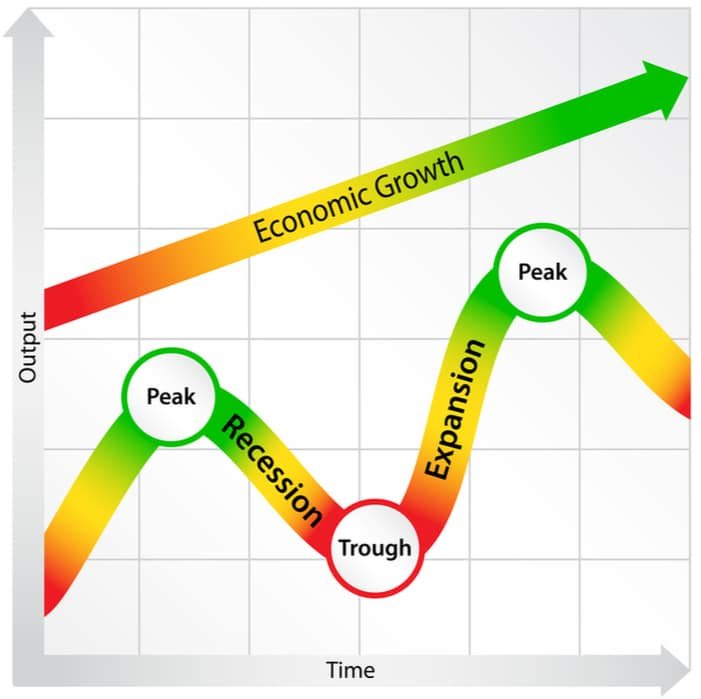

Normal business and economic cycles are characterized by growth in the economy (termed expansions), followed by periodic declines (called recessions).

The expansions tend to occur slowly, over 5–10 years, while the recessions are quick and last for a few months to over a year.

The NBER defines the time period of the recession as starting in the month when the economy peaked, and then ending in the month that the economy bottomed out.

In other words, the recession begins right at the top of the peak and ends at the bottom of the trough, just as the economy starts growing again.

Conversely, the expansion is the time period between recessions. It begins at the bottom of the trough of the economic cycle, then ends at the top of the peak.

The NBER does not give exact dates, but they do say in which month of the year the recession began and ended. For example, the Great Recession of 2007–2009 began in December 2017 and ended in June 2009.

The U.S. economy saw a long period of expansion after that, the longest in modern history, but it was ended by the COVID-19 pandemic.

When is a recession determined?

When the start of a recession is officially announced by the NBER, the economy has already been in a recession for many months.

For example, the Great Recession of 2007–2009 started in December 2007, but it wasn't officially announced until December 2008 — a year later.

This recession also ended in June 2009, but the NBER didn't officially announce the end until September 2010.

The long delay is understandable because it's impossible to say when the economy reached a peak until many months after it happened. It takes time to see whether a decline is just a temporary reduction in growth or an actual recession.

Usually, the stock market and economy have started to decline long before the recession gets announced. Conversely, they are also well on their way to recovery when the NBER calls the end of the recession.

Here's an overview of the latest peaks and troughs, as of mid-2023, in the economic cycle and the exact dates they were officially announced by the NBER:

| Turning Point Date | Peak or Trough | Announcement Date |

| April 2020 | Trough | July 19, 2021 |

| February 2020 | Peak | June 8, 2020 |

| June 2009 | Trough | September 20, 2010 |

| December 2007 | Peak | December 1, 2008 |

| November 2001 | Trough | July 17, 2003 |

| March 2001 | Peak | November 26, 2001 |

| March 1991 | Trough | December 22, 1992 |

| July 1990 | Peak | April 25, 1991 |

| November 1982 | Trough | July 8, 1983 |

| July 1981 | Peak | January 6, 1982 |

| July 1980 | Trough | July 8, 1981 |

| January 1980 | Peak | June 3, 1980 |

Source: The National Bureau of Economic Research

The official announcements by the NBER have historically lagged behind the beginnings and ends of recessions by 6 to 21 months.

Recession vs depression: what's the difference?

A distinction is often made between a recession and a depression. Put simply, a depression is a very long and severe recession. It can last for years, as opposed to months.

However, the NBER does not make a distinction between a recession and a depression. There are no clear rules about who decides when we are in a depression.

However, some have defined an economic depression as a recession lasting 2 or more years, or a recession with a decline in GDP of more than -10%.

An example of a depression is the Great Depression, which started in 1929 and lasted in some form until the late 1930s.

Learn more about recessions and depressions here.

Recessions are about the economy, not the stock market

It's important for investors to realize that recessions are strictly about the economy, not the stock market. The NBER does not look at the stock market to determine when a recession begins and ends.

Expansions and recessions are terms used for the economy, while bull markets and bear markets are terms used for the stock market. A bear market is when stock prices have declined by 20% or more from the previous peak.

Bear markets can technically happen independently of recessions.

However, the stock market has historically declined significantly during a recession and then gone up significantly during recovery and expansion. This makes sense because corporate earnings tend to follow the economy.

The stock market is also forward-looking, so the market often starts going down before the recession starts. It may also start going up before the recession ends.

For example, the stock market reached a peak in October 2007, two months before the Great Recession started, and 14 months before it was announced.

Conversely, the stock market bottomed out and started going up again in March 2009, three months before the Great Recession ended, and 16 months before the end of the recession was announced.