9 Best Alternative Investment Platforms

Your stock-bond portfolio might be outdated.

That's because an increasing number of investors have begun adding alternative investments to their portfolios.

In fact, BlackRock's portfolio advisory business has shifted from using the traditional 60-40 stock-bond portfolio to a 50% stock, 30% bond, and 20% alternative assets split.

Alternative investments:

- May generate higher returns

- May be good hedges against inflation

- Offer diversification outside of stock and bond markets

For these reasons, it's no surprise investors are adding them to their portfolios.

And thanks to a number of alternative investment platforms, these assets are no longer limited to the top 1%. Investors anywhere can add private market investments to their portfolios.

Here's my list of the 11 best alternative investment platforms.

What's an alternative investment platform?

Before getting into the list, we first need to cover what constitutes an alternative investment.

Traditional assets are stocks, bonds, and cash — so any asset outside of those three is considered an alternative asset.

This includes real estate, art, collectibles, cryptocurrency, private credit, private equity, and more.

However, since most alternative assets are not available on traditional investing platforms (such as a brokerage account), you need an account on an alternative investment platform to access them.

Most of these platforms specialize in one asset class, though some offer more. Willow Wealth, for example, offers ten.

Are you an accredited or retail investor?

Some of these platforms are only available to accredited investors. You qualify as an accredited investor if you meet one of the following criteria:

- You have an annual income of $200,000 individually or $300,000 jointly

- Your net worth exceeds $1,000,000 (excluding your primary residence)

- You are a qualifying financial professional

If you don't meet one of these criteria, you're a retail investor (don't worry, there are great options for you, too).

Here's my list of the best alternative investing platforms available right now.

A quick look at the best platforms

- Best overall: Willow Wealth

- Best for private credit: Percent

- Best for venture capital: Fundrise

- Best for pre-IPO investments: Hiive

- Best for single-family real estate: Arrived

- Best for commercial real estate projects: EquityMultiple

- Best for private REIT investing: RealtyMogul

- Best for art investing: Masterworks

- Best for farmland: AcreTrader

Keep reading for detailed breakdowns of each platform listed above.

Disclaimer: Ratings are my opinion. Actual results may vary, and past performance does not guarantee future results. All investors should do their own due diligence.

1. Willow Wealth: best overall

- Our rating:

- Asset(s): Real estate, art, private credit, cryptocurrencies, VC, private equity, notes, infrastructure, and a multi-asset class fund

- Accreditation requirement: Primarily accredited

Willow Wealth (formerly Yieldstreet) offers ten alternative assets all under a single login, making it the premier platform for private market investing.

Since 2015, a diversified private markets portfolio — consisting of private equity, credit, and real estate — has outpaced the traditional 60/40 stock-bond mix by several percentage points per year:

Source: Willow Wealth

But the bigger story is risk. That same portfolio delivered a 2.2 efficiency ratio, more than double the 0.9 of the 60/40 portfolio — meaning investors got higher returns with significantly less volatility.

This blend of performance and risk reduction is exactly why alternatives deserve a place in the modern portfolio. And if diversification into alternatives is your goal, there's no better platform than Willow Wealth.

Willow Wealth allows you to invest in individual deals if you want, but most investors use one of its Managed Portfolios, which spread your investment across a variety of private market deals.

There are three Managed Portfolios (Income, Balanced, and Growth) you can choose from, depending on your goals.

Additionally, what helps Willow Wealth earn the top spot on this list is its Alternative Income Fund.

The income-focused fund invests across multiple asset classes and is professionally managed, so you get all the benefits of private market diversification without all the work.

More importantly, the Alternative Income Fund is available to all — not just accredited — investors.

If you're looking for diversification outside of public markets, there's no better platform than Willow Wealth — which is why investors have invested more than $6 billion on it since 2015.

Primary benefit: More private market asset classes than any other platform.

2. Percent: best for private credit

- Our rating:

- Asset(s): Private credit

- Accreditation requirement: Accredited only

Percent gives you access to the $3.17 trillion private credit market, one of the most popular asset classes for income-focused (and institutional) investors.

"Middle market" private companies (those with annual revenue between $10 million and $1 billion) are too big for traditional banks but can't issue bonds on the public markets, so they must turn to the private credit markets for financing.

Since the money is harder to come by, the terms tend to be very favorable for lenders. Private credit deals typically entail:

- Higher yields

- Shorter durations

- Secured debt (loans are backed by assets)

Not to mention, private credit is largely uncorrelated with public markets, making it an excellent tool for diversification.

Here's how it stacks up against other asset classes:

Source: Percent

For these reasons, private credit is becoming increasingly popular among yield-focused investors. And Percent is the best platform for accessing it.

Since its launch, investors have invested nearly $1.7 billion across 917 deals on the platform. Matured deals have averaged a 14.47% annual coupon rate and a 3% default rate.

It's not hard to see why 89% of investors on Percent choose to re-invest in a second deal.

While Willow Wealth offers some private credit deals, I've found Percent often has a larger inventory of investments to choose from, so it may be worth it to have an account on both platforms.

Plus, Percent is offering a welcome bonus of up to $500 when new investors make their first investment. For more information, read my full Percent Review.

Primary benefit: Largest inventory of private credit deals.

3. Fundrise: best for venture capital

- Our rating:

- Asset(s): Venture capital and real estate

- Accreditation requirement: Any investor

Fundrise was one of the first platforms to offer crowdfunded real estate investing, enabling anyone to invest in real estate with as little as $10.

While it's still best known for its real estate offerings, I put it on this list for another reason: the Fundrise Innovation Fund. The Innovation Fund is an alternative investment fund that buys stakes in private, high-growth technology companies.

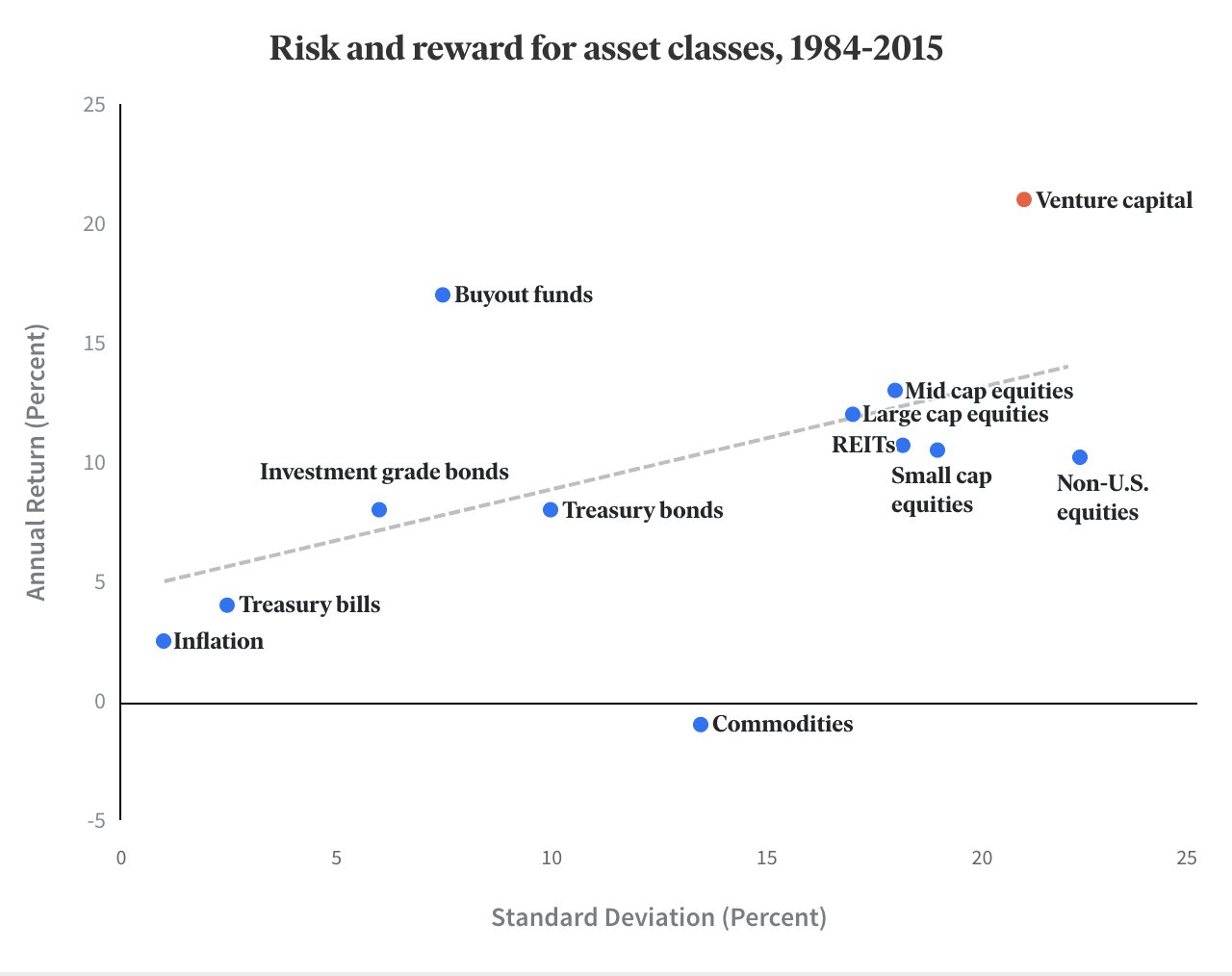

Fundrise launched the fund to give retail investors access to venture capital — one of the best-performing asset classes over the last 40 years:

Source: Fundrise

The fund has positions in Databricks, OpenAI, Anthropic, Ramp, Canva, and more.

The Innovation Fund is available to all investors and has a minimum investment of just $10.

Primary benefit: Retail investors can invest in a venture capital fund filled with many of today's hottest startups.

4. Hiive: best for pre-IPO investments

- Our rating:

- Asset(s): Private companies

- Accreditation requirement: Accredited only

Hiive is the best platform for investing in pre-IPO companies.

There are over 3,000 private companies with shares for sale on Hiive. Some of the most actively traded companies on its platform are SpaceX, xAI, Anthropic, Perplexity, Figure AI, and Epic Games.

Source: Hiive

Hiive connects accredited investors with employees, venture capitalists, and angel investors who own shares of private companies.

Similar to a traditional stock exchange, sellers create listings by setting a price and number of available shares. Once a listing is created, buyers can accept the seller's asking price or place bids on the shares.

Once two parties agree on a price, Hiive's team handles the legal process of getting the shares transferred from the seller to the buyer.

Now you can buy shares of private companies right alongside the venture capitalists and private equity firms who know the real money is made before the IPO, not after.

Primary benefit: Invest in private, VC-backed companies.

5. Arrived: best for single-family real estate

- Our rating:

- Asset(s): Single-family homes

- Accreditation requirement: Any investor

Arrived is a real estate crowdfunding platform that allows anyone to invest in real estate with as little as $100.

Arrived is solely focused on single-family homes. It purchases properties for both long-term and short-term (vacation) rentals. Like all real estate investments, Arrived investors benefit from both rental income and price appreciation.

Source: Arrived

But unlike traditional real estate investing, you don't need to do any of the work.

Arrived takes care of everything — it evaluates, buys, lists, and manages every property. You don't have to worry about studying the market, legal contracts, closing costs, maintenance, repairs, or tenants.

After purchasing a new property, the company will securitize and make shares available for purchase on its platform. Then, you sit back and collect your “rental income,” which comes in the form of dividends.

Primary benefit: Build a real estate portfolio starting with just $100.

6. EquityMultiple: best for commercial real estate projects

- Our rating:

- Asset(s): Commercial real estate projects

- Accreditation requirement: Accredited only

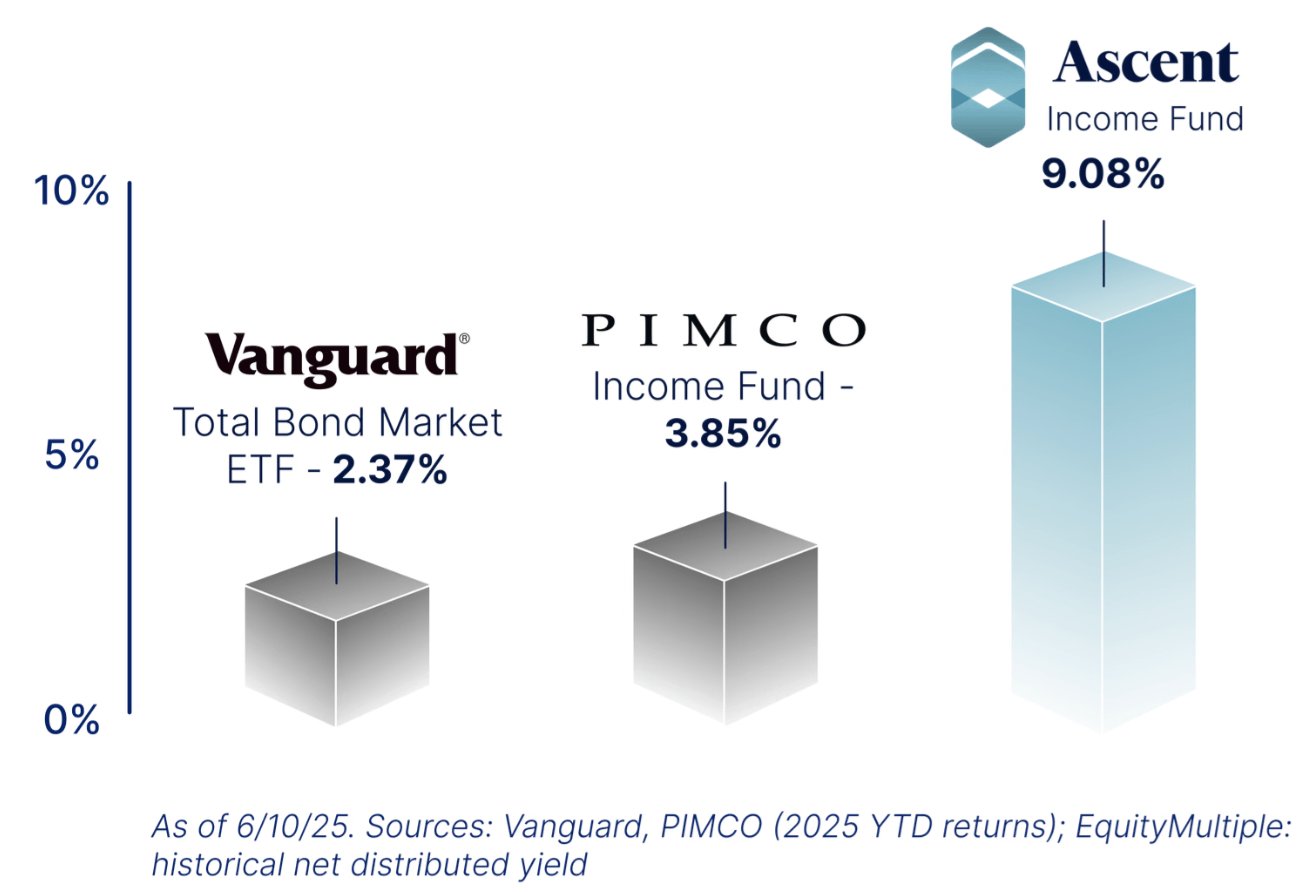

EquityMultiple is a crowdfunding real estate platform focused on commercial real estate, and is quickly growing in popularity thanks to a few unique offerings.

For example, the Ascent Income Fund targets stable income by taking senior debt positions, so every investment is backed by real assets. The historical distribution yield is 9.08%. The minimum investment is $5,000.

Source: EquityMultiple

In today's economic environment, you may be interested in short-term investments with high single-digit yields. To that end, EquityMultiple offers Alpine Notes.

Alpine Notes are a series of short-term notes that come in 3-, 6-, and 9-month terms with fixed APYs of 6%, 7%, and 7.35%, respectively. The capital raised through Alpine Notes is used as a line of credit for EquityMultiple's core real estate investments.

Primary benefit: Invest in commercial real estate via short-term notes, equity, and/or funds.

7. RealtyMogul: best for private REIT investing

- Our rating:

- Asset(s): Commercial, multifamily, and single-family real estate

- Accreditation requirement: Primarily accredited

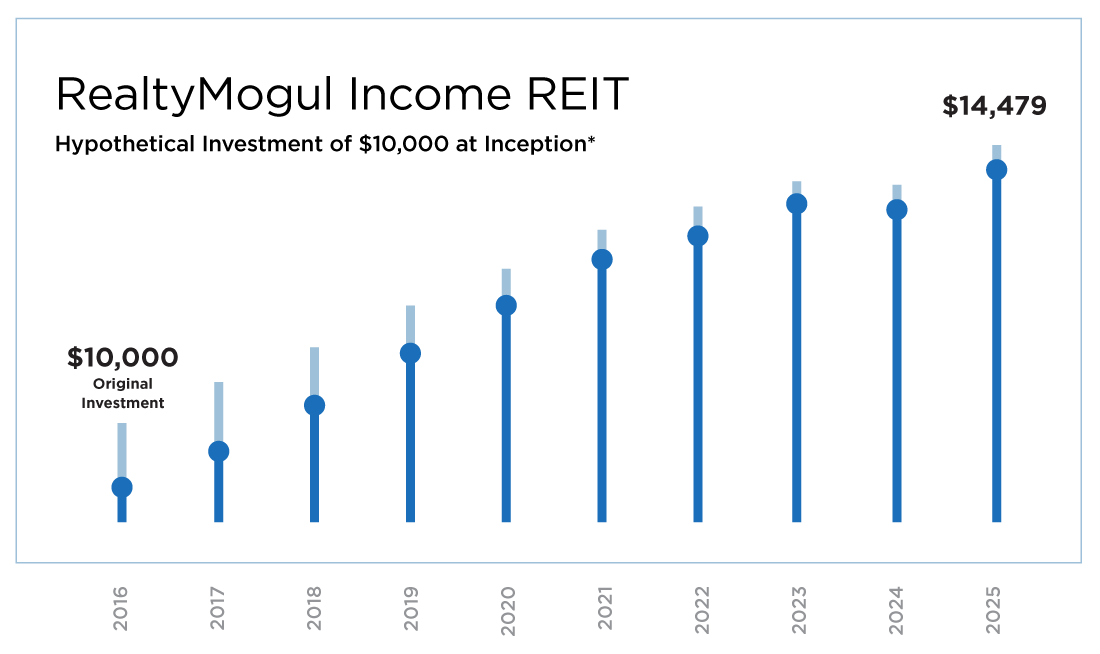

RealtyMogul gives you access to both commercial and residential real estate under one login.

The platform offers investments in real estate projects like industrial parks, mixed-use facilities, and residential developments. These projects have a $25,000 minimum investment.

But the main reason RealtyMogul makes this list is because of its Income and Growth REITs, which have $5,000 minimum investments and are available to all investors.

Source: RealtyMogul

REITs are known for providing investors with stable cash flow (in the form of dividends, which are tax-efficient), liquidity, stability, and diversification.

Since the Income REIT's inception in 2016, it has distributed monthly dividends of 6% (net of fees) for 108 consecutive months. These distributions have totaled $44.8 million to date.

Primary benefit: Private real estate investing via REITs.

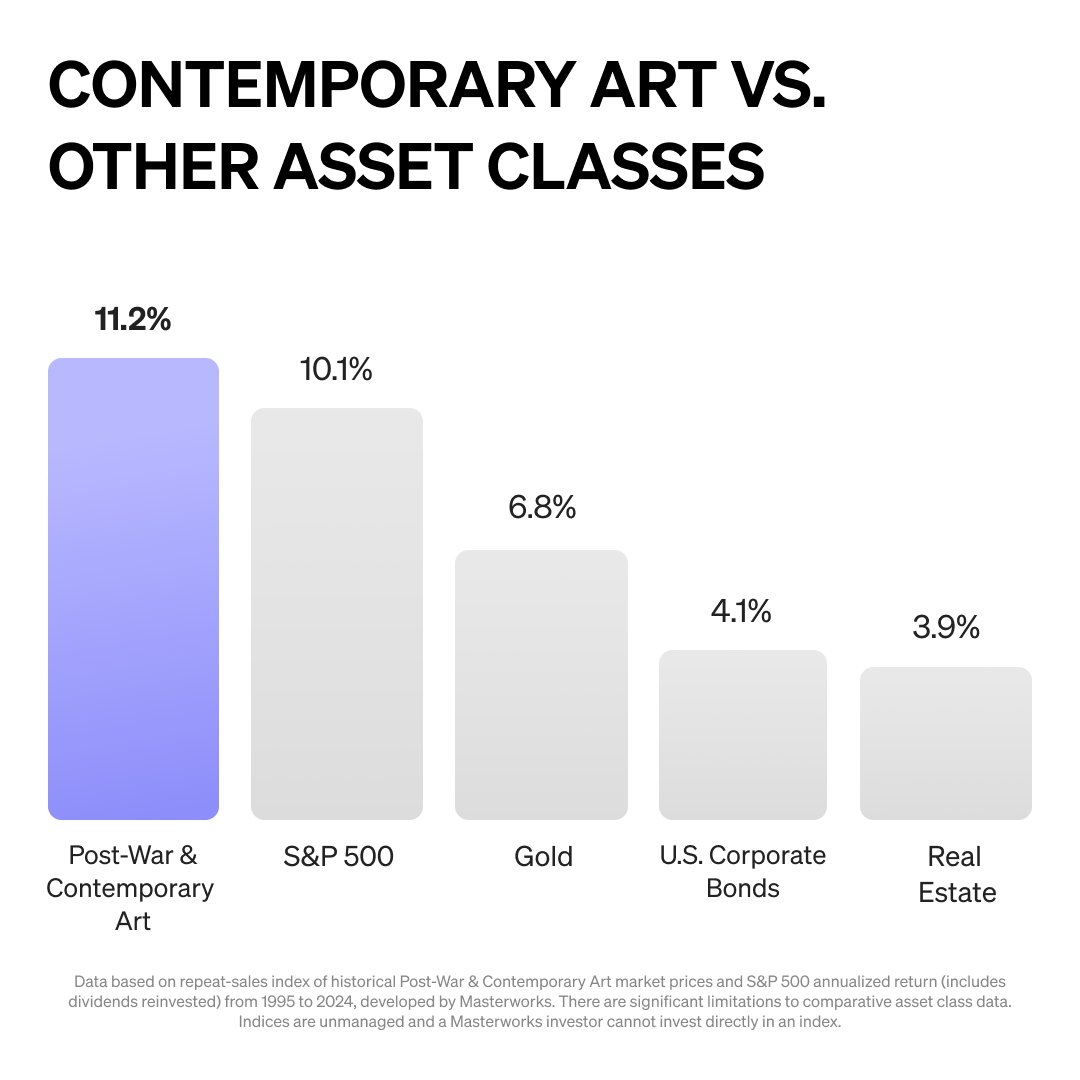

8. Masterworks: best for art investing

- Our rating:

- Asset(s): Fine art

- Accreditation requirement: Any investor

Masterworks is the best way to invest in contemporary art, a long-time favorite investment of the ultrawealthy.

Why art? It offers a unique combination of price appreciation and stability.

Source: Masterworks

Art is rare, can appreciate, and has historically been inflation- and recession-proof. And, until recently, art investing required time, skill, and a lot of money.

Now, Masterworks's team of experts scours the world for artists and paintings, purchasing only those with the most momentum.

After purchasing the art, the company securitizes it with the SEC, which allows its users to invest in individual shares.

To realize returns, investors can sell their shares to other users on the platform or wait until the Masterworks team sells the painting and the proceeds are distributed.

If you're serious about art as an investment vehicle, then Masterworks is the obvious choice.

Primary benefit: Specialization in fine art investing.

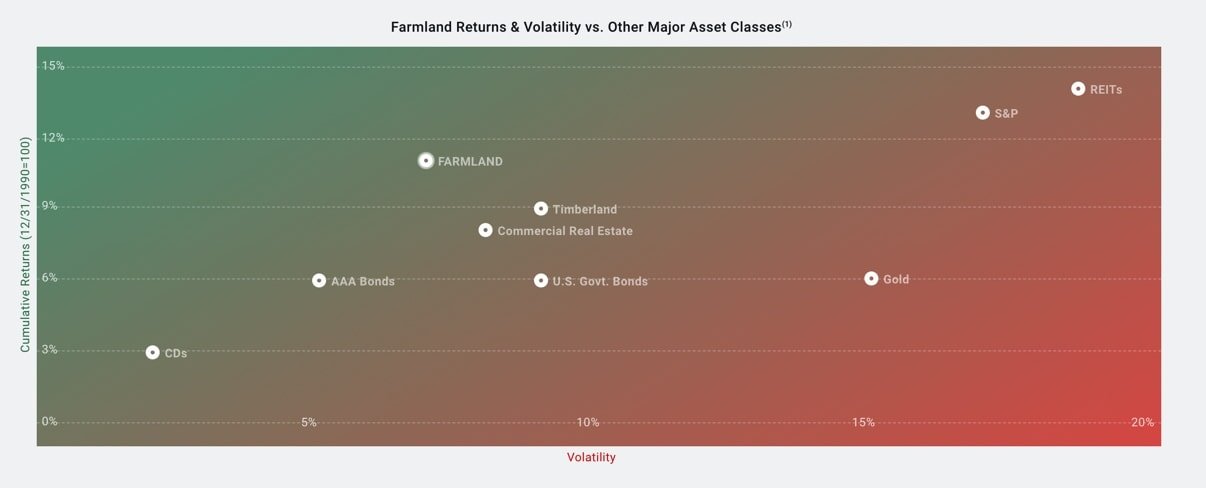

9. AcreTrader: best for farmland

- Our rating:

- Asset(s): Farmland

- Accreditation requirement: Accredited only

AcreTrader offers another type of real estate to invest in — farmland.

We will always need food, regardless of inflation, economic conditions, or the stock market. Couple that with a rapidly growing global population, and farmland looks like a pretty compelling investment.

Historically, its return/volatility ratio has been exceptional.

Source: AcreTrader

AcreTrader connects investors with farmers — timber, alfalfa, soybeans, corn, and more. Each new listing must pass a thorough due diligence process by AcreTrader's team of expert analysts, which only approves ~5% of deals.

The target holding periods range from 5–10 years. During that period, the farmers pay rent to AcreTrader, which distributes it among the investors. At the time of the sale, any price appreciation, pro rata rent, and principal are returned to investors.

The median realized IRR has been around 15%.

Primary benefit: The only platform where you can invest in shares of farmland.

What's the most popular private market investing platform?

This is a hard question to answer because not every platform releases this data to the public, and some information may be outdated.

Here are a few of the most popular from what data is available:

- Willow Wealth has 500,000+ investors who have invested more than $6 billion on the platform.

- Fundrise manages nearly $3 billion on behalf of 385,000+ investors.

- Masterworks has 1+ million investors and over $1 billion invested.

The most popular alternative investment is real estate. The U.S. real estate market alone is estimated to be worth close to $4 trillion. Of the platforms on this list, the best options for investing in real estate are Fundrise and Arrived.

How we chose the best alternative platforms

When evaluating investing products and services, we consider the following.

- Core offering: How good is the product or service?

- Price/fees: Overall price, value for money, average cost per month, and any hidden fees.

- Usability: What the interface looks like, whether the site is easy to use and navigate, the inclusion of modern design elements and features, and accessibility.

- Credibility: Quality of information and data, as well as company and brand reputation.

- Audience: Who the product is for, the range of uses and applications, whether it actually works for its target audience, if it's the best option available, and any limitations therein.

- Offers: Whether there is a special offer for signing up or any discounts.

Final verdict

The data is pretty clear — alternatives have historically provided excellent diversification outside of public markets and have the potential for outperformance.

At this point, you may be ready to follow BlackRock's lead and invest up to 20% of your portfolio into one or more of the investment platforms listed above.

Where to allocate that 20% (or however much you decide) is up to you, based on your own goals and investing style. Each of the assets and platforms on this list has its own benefits.

My favorites from this list are:

- Willow Wealth, because of its diverse offering of alternative assets. Plus, if you can't decide which specific alternatives you'd like to invest in, its Alternative Income Fund is an easy way to get exposure to a broad range of private markets, whether you're an accredited or retail investor.

- Percent, because it gives accredited investors access to the extremely popular private credit market. Double-digit yields, maturity dates of less than 1 year, and low default rates — what's not to like?

- Fundrise and Arrived, because they give retail investors access to a venture capital fund and real estate investments with exceptionally low minimum investments.

Remember, past performance does not guarantee future results. Always do your own research before investing.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.

.png)