How to Buy Canva Stock Before Its IPO

Canva is an online design platform that provides user-friendly design tools for non-technical designers.

I've been using it for the last three years and I'll be the first to say that it's crazy good. But you don't have to take my word for it.

As of October 2023, the company reported a run rate of $1.7 billion in annualized revenue. Worth noting, this number was $1.4 billion just 6 months ago.

Canva has 16 million paying subscribers, 150 million monthly users, and added 65 million users in the past year.

Furthermore, according to Canva's case studies, 85% of Fortune 500 companies use the platform.

But it's still a private company, which means there is no Canva stock symbol and you can't buy it in your brokerage account. But even though it's not planning to IPO until at least 2025, you can invest in it today.

Read on to learn how.

Can you buy Canva stock?

Canva is still a private company, which means you can't buy its stock in your brokerage account.

The company indicated it will not go public until 2025 or 2026, once the IPO market warms up again.

To date, Canva has raised $581 million over 17 funding rounds, and has many additional private equity firms waiting to buy in.

The company has garnered the attention of big name investors like Sequoia, T. Rowe Price, Franklin Templeton and Disney (DIS) CEO Bob Iger, who joined as both an investor and strategic advisor.

That, coupled with its $1.7 billion revenue run rate and its being profitable since 2017, means it's in no hurry to go public.

But that doesn't mean you can't invest in it today.

2 ways to buy Canva stock in 2024

There are two ways to buy Canva stock, depending on whether you're an accredited or retail investor.

Are you an accredited or retail investor?

You qualify as an accredited investor if you meet one of the following criteria:

- You have an annual income of $200,000 individually or $300,000 jointly

- Your net worth exceeds $1,000,000 (excluding your primary residence)

If you're an accredited investor, the first section is for you. If you don't qualify as an accredited investor, skip to the second section, which is for retail investors.

1. As an accredited investor

Hiive is a marketplace where accredited investors can buy shares of high-growth, VC-backed startups and private companies, including Stripe, OpenAI, and Canva:

On Hiive, sellers (which include employees, venture capitalists, and angel investors) can list their shares and set their own asking prices. Buyers can either accept the asking prices or place bids and negotiate directly with the sellers.

After a successful transaction, the seller pays the fees (there are no fees for buying) and the shares are transferred to the buyer.

Register for Hiive and start investing in private companies today:

2. As a retail investor

While only accredited investors can invest directly in Canva, there is also a good way for retail investors to get involved.

Retail investors can own a portion of Canva via Fundrise's Innovation Fund, which buys stakes in private, high-growth technology companies. The fund has positions in Databricks, Roblox, Block, and, as of September 2023, Canva.

Fundrise invested $6.2 million — its 3rd largest stake — most likely at a valuation of $40 billion.

How to buy the Canva IPO

Canva has not made any IPO filings with the SEC and there are no estimates of the Canva IPO date. That said, the company recently mentioned 2025 or 2026 as possibilities.

When it does go public, the stock symbol might be something like CNVA or CANV, and you'll need a brokerage account to buy shares.

If you don't have a brokerage account, we recommend Public.

On Public, you can Invest in stocks, ETFs, Treasuries, and cryptocurrencies, all on one of the most well-designed investing platforms.

Who owns the company?

CEO Melanie Perkins and COO Cliff Obrecht, the married co-founders of Canva, are estimated to own about 18% each. Cameron Adams, a third founder, owns about 9%.

The other ~55% is owned by early employees and private equity investors including Bob Iger, Franklin Templeton, Sequoia Capital, T. Rowe Price, Blackbird Ventures, and others. Of the 45 investors, 42 are institutional investors and three are angel investors.

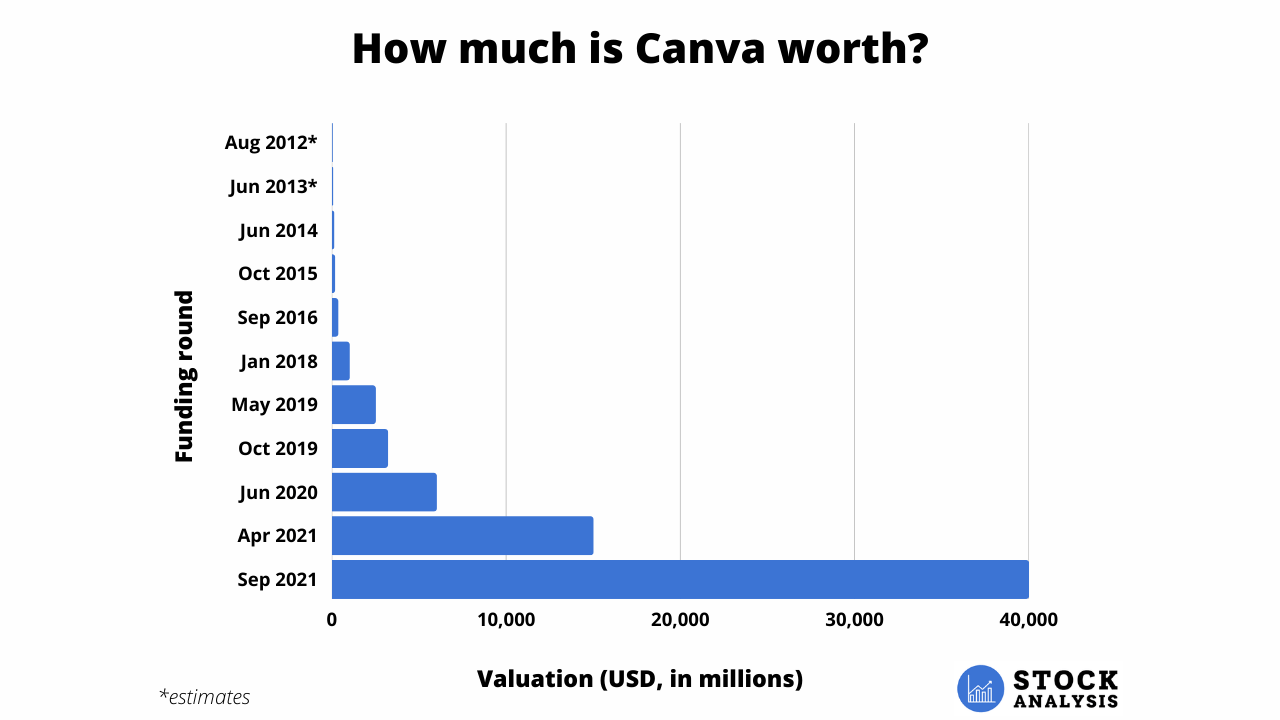

Canva valuation chart

If you're wondering how much Canva is worth, it depends on who you ask.

Its last external funding round came in September 2021 and valued the company at $40 billion. The lead investor of that round was T. Rowe Price, which has since marked down its valuation by 67.6%, down to ~$13 billion.

Last summer, Blackbird — one of Australia's largest venture capital firms — also marked down its prized stake in Canva by 36% to $25.6 billion.

But in August 2023, Coatue and ICONIQ, two US-based VC firms, invested in a secondary transaction at a $39 billion valuation.

Based on external funding rounds, here's how Canva's valuation has changed over time:

.png)