What Do Stock Analyst Ratings Mean? Buy, Sell, Hold, and More

Stock analysts use different words for their ratings depending on the firm where they work.

Some use simple terms like Buy, Sell, or Hold.

But some use more nuance. For instance, what's the difference between Strong Buy, Outperform, and Overweight? Which one is more bullish?

Here's everything you need to know about stock analysts, what their ratings mean, and how you can use these ratings to make better investing decisions.

What do stock analysts do?

There are two types of stock analysts: buy-side and sell-side.

- Buy-side analysts: These analysts work for money managers — think mutual funds, pension funds, and hedge funds — and help their portfolio managers make investment decisions.

- Sell-side analysts: You're probably most familiar with these — they're the ones being interviewed on TV and issuing public-facing ratings and price targets. They work for investment banks, brokerage firms, and other financial institutions.

A sell-side analyst is given a certain industry to research, like technology or banking, and is expected to provide ongoing research on companies within that industry.

Stock analysts typically have degrees and/or certifications in finance, economics, accounting, or a related field. After working as a junior analyst for several years, high-performing analysts are promoted to senior research roles.

They analyze financial statements, listen to quarterly conference calls, conduct studies, and may also get in direct contact with a company's management and key customers.

After completing their research, an analyst will make predictions on a company's earnings per share (EPS) and revenue for the coming quarters and years. They also set a 12-month price target — that is, where they think the stock price will be in one year.

Then, they assign a rating like Buy, Sell, Hold, etc.

If a stock is trading well below where the analyst thinks it's worth, it will receive a Buy rating. If a stock is trading well above where they think it should be, it will be marked with a Sell rating.

You may have access to these ratings through your brokerage or stock research website, but there's an easier way to see the ratings for all of the stocks you own or are considering investing in on Stock Analysis. More on this below.

What do stock analyst ratings mean?

Depending on which firm they work at, analysts use varying sets of ratings.

For instance, one firm might use Buy, Sell, and Hold; another firm could use Strong Buy, Outperform, Neutral, Underperform, and Strong Sell; and another firm may use the numbers 1–5.

But they all mean the same thing. Every rating can fit into one of five categories:

On this scale, the further to the left, the more bullish the analyst is on the stock. The further to the right, the more bearish.

Here's how you can think of each of these categories:

- Buy: Also called "Strong Buy," a Buy rating is a recommendation to buy the stock. It implies that the stock is likely to perform very well.

- Outperform: Also termed "Overweight," Outperform is a mild buy rating and implies that the stock is likely to have higher returns than the overall stock market.

- Hold: A Hold rating is a neutral rating. This rating says there is no reason to buy the stock, but no particular reason to sell it either.

- Underperform: Also termed "Underweight," an Underperform rating means that the stock is likely to perform slightly worse than the market as a whole.

- Sell: Sometimes called "Strong sell," a Sell rating is pretty rare and usually only given if the analyst is extremely bearish on the stock. This rating implies that the stock should be sold or even shorted.

If you want to understand exactly what an individual rating means, you should look up the analyst's firm to find their official definition.

What are upgrades and downgrades?

When an analyst changes a previous recommendation, it's known as an upgrade or downgrade.

For example, changing from a Hold to an Outperform is an upgrade and indicates the analyst is more bullish on the company than they were previously. Conversely, changing from a Hold to a Sell is a downgrade and indicates bearishness.

Upgrades and downgrades frequently lead to significant price movement, especially if they are accompanied by a big adjustment to the analyst's price target.

Where to get stock analyst ratings

As mentioned above, your brokerage may give you access to some analyst ratings.

However, the best place to get stock ratings is via a website that tracks this data, like Stock Analysis. We have coverage on more than 4,600 Wall Street analysts.

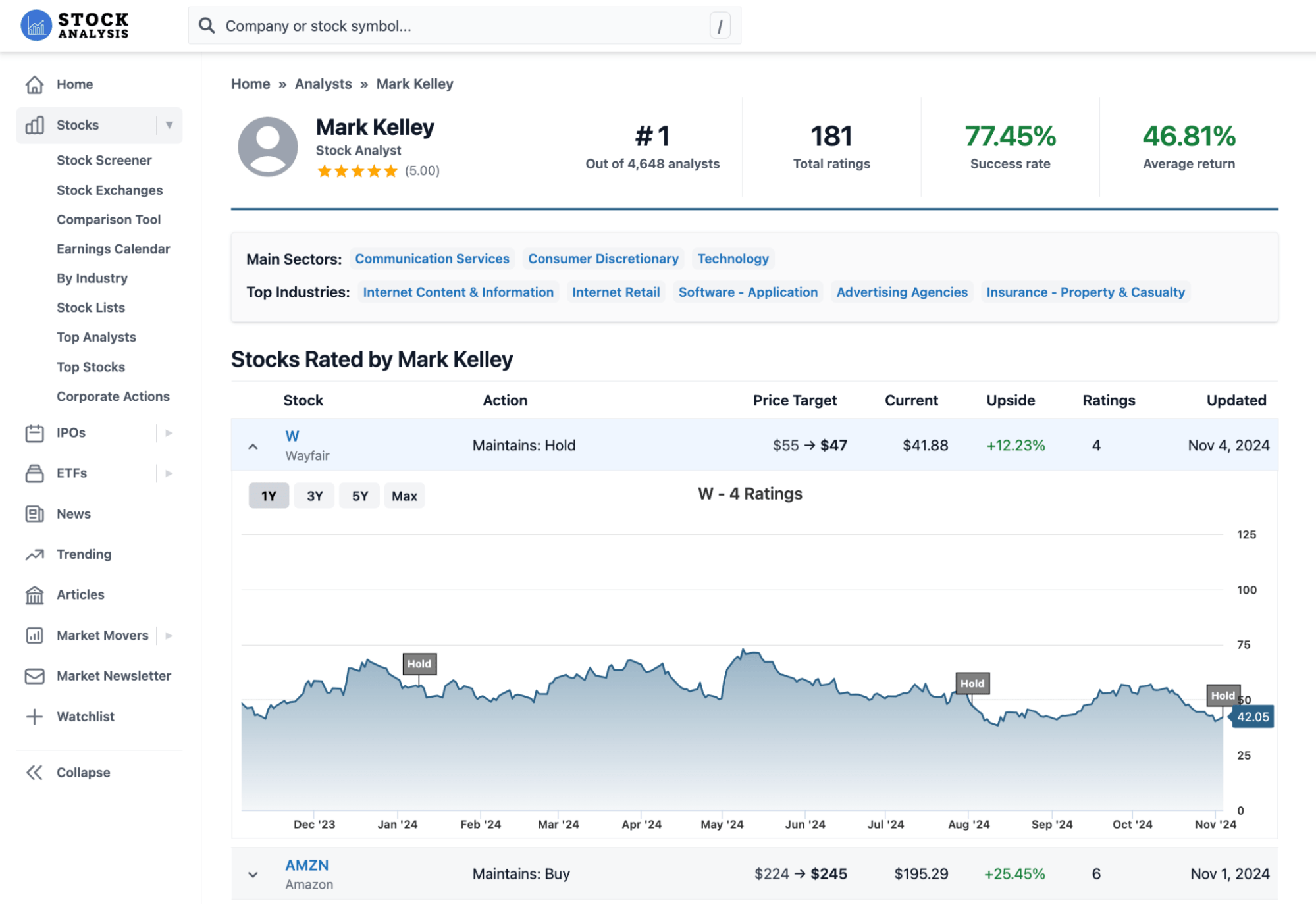

For each analyst, we show what stocks they cover, their ratings on each, the history of their ratings, and how their recommendations have performed.

Here's what that looks like:

If you're looking for investment ideas, check out our list of Top Analysts. We ranked every analyst in our database by win rate, average return, number of ratings, and recency of ratings.

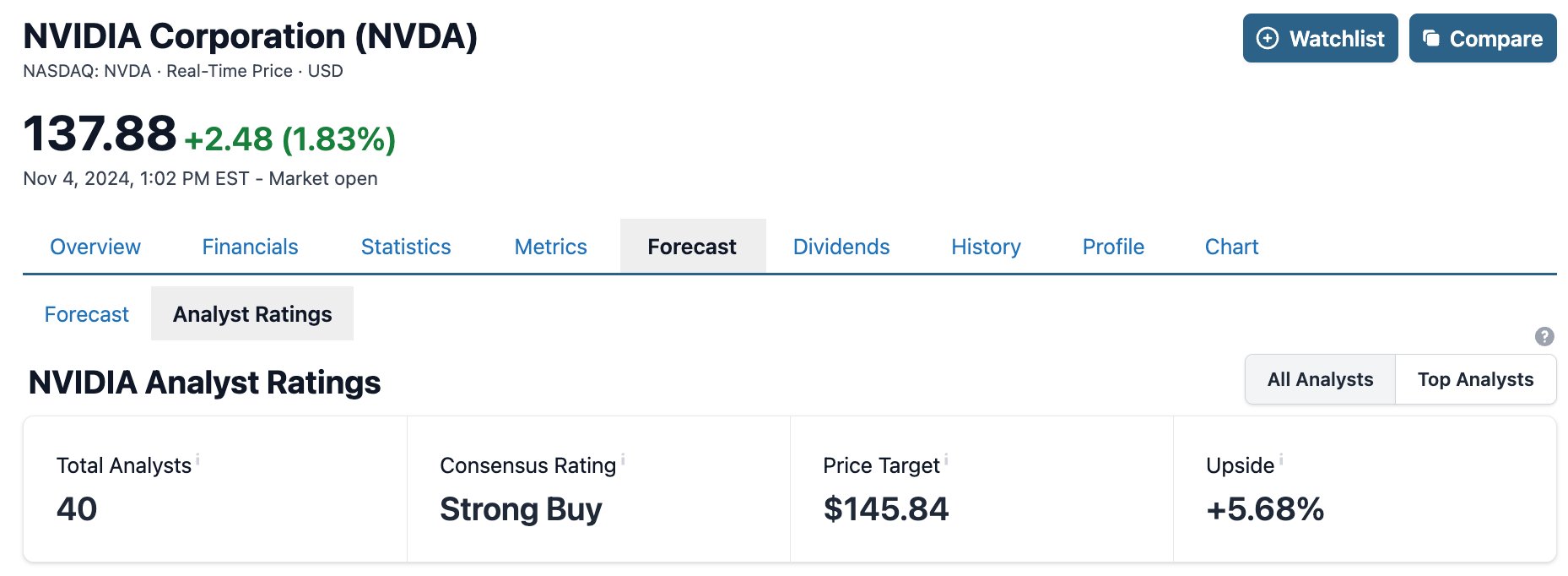

Additionally, you can use our data to analyze stocks you own or are considering adding to your portfolio. We aggregate all of the ratings, price targets, and revenue and EPS forecasts so you always know what Wall Street thinks about a certain stock.

For example, here's what analysts currently think about Nvidia:

We also average all of a stock's ratings and provide a Consensus Rating and an average price target:

Free accounts get access to ratings data, recommendation trends, and three years' worth of forecasts.

To unlock all forecasts and complete access to our database of Top Analysts (and our other tools and data), you can go Pro for $9.99/month.

Should you invest based on analyst ratings?

While professional stock analysts are smart and well paid, they aren't perfect, as you can see by their success rates.

Analysts are frequently wrong about stocks, so you shouldn't take any individual ratings too seriously. Even the top analysts are wrong sometimes.

However, these opinions can be useful to understand the sentiment around a certain company and how it is expected to perform. Analyst ratings and price targets may not always be that useful, but their revenue and EPS projections are often quite accurate.

All that to say, analyst ratings and projections are great to have as additional data points, but you still need to do your own research.

This doesn't mean that analysts are bad at their jobs. Instead, it reflects how incredibly hard it is to predict what stock prices will do in the short term.