How to Buy Redwood Materials Stock

In 2019, Tesla co-founder (and CTO for 15 years) JB Straubel announced he was leaving the company to focus on his own startup. The company he founded: Redwood Materials.

Redwood Materials was created to create a circular supply chain for batteries. It initially focused on recycling scrap from battery production and consumer electronics like cell phones and laptops.

Redwood processes that scrap and extracts materials that are traditionally mined, like lithium, nickel, cobalt, and copper. The materials are then sold to battery producers.

The company has continued to expand from its original base, adding cathode manufacturing and, more recently, energy storage.

In 2025, the company launched Redwood Energy, an energy-storage business that repurposes EV batteries that are no longer suitable for vehicles but still have meaningful capacity.

Instead of sending those batteries straight to recycling, Redwood turns them into stationary micro-grids that can supply power to AI data centers and large-scale industrial sites.

That move into energy storage helped set the stage for a major funding round. After raising $350 million in its Series E in October 2025, additional investors joined the round in January, pushing the total raised to $425 million.

Straubel already has experience building a technology company from nothing to a $100 billion valuation, and many investors are betting he will have similarly spectacular results with his new venture.

That said, he doesn't seem to be in any hurry to take his company public. But that doesn't mean you can't invest in it today.

Here's how to buy Redwood Materials stock now, even while it's a private company.

Is Redwood Materials publicly traded?

Redwood Materials is not a public company, which means you can't purchase shares of it in your regular brokerage account, and there is no Redwood Materials stock symbol yet.

Redwood has received plenty of interest from private equity firms and venture capitalists, so there's no need for it to turn to the public markets right now.

At this point, the company has not made any indication of an IPO in the near future.

But there are still a few ways you can invest in it before its IPO.

How to buy Redwood Materials stock in 2026

Here's how to invest in Redwood Materials as an accredited investor or as a retail investor.

Accreditation requirements

You can qualify as an accredited investor if:

- You have an annual income of $200,000 individually or $300,000 jointly.

- Your net worth exceeds $1,000,000, excluding your primary residence.

- You are a qualifying financial professional with a Series 7, 65, or 82 license.

If you're an accredited investor, the first section below is for you.

If you don't qualify as an accredited investor, then you're a retail investor, and you can skip to the second section below.

1. As an accredited investor

Hiive is a secondary marketplace platform that allows accredited investors to buy shares of high-growth, VC-backed startups and private companies.

There are 3,000+ companies on Hiive, including Stripe, OpenAI, and Redwood Materials:

There are 22 live orders of Redwood Materials stock available on Hiive.

Each of these listings is made by separate sellers, who may have varying asking prices and volumes offered. Sellers may be employees, venture capital firms, or angel investors.

Buyers can either accept the asking price and volume as listed or place a bid. There are no intermediaries, so you can negotiate directly with the sellers.

2. As a retail investor

While there's no way for you to invest directly in Redwood Materials right now, here are a few ideas for gaining indirect exposure.

Invest in Redwood Materials' investors

While Redwood Materials has primarily received funding from private equity and venture capital firms, there are a handful of public companies that have invested in it.

By buying these companies' stocks, you can gain indirect exposure to Redwood Materials.

- Ford (F) invested $50 million in Redwood in September 2021. This investment has likely grown to about $105 million, about 0.2% of Ford's market capitalization.

- T. Rowe Price (TROW) participated in the company's Series D round in August 2023, which raised $1 billion in funding at a valuation of over $5 billion.

- Goldman Sachs (GS) also participated in its Series D and joined its Series E, which brought in $425 million at a valuation of over $6 billion.

- Google (GOOGL) and Nvidia (NVDA) were also investors in the Series E.

While you will get indirect exposure to Redwood Materials through an investment in any of these companies, the size of their stakes is very small compared to the total size of their businesses, making this an extremely indirect way to invest in Redwood.

Invest in Redwood Materials' partners and competitors

Redwood Materials currently partners with:

- Car manufacturers: Tesla (TSLA), Toyota (TM), Ford (F), Volkswagen (VWAGY), General Motors (GM), Volvo (STO:VOLV.B), and BMW (FRA:BMW)

- Others: Panasonic (PCRFY), Amazon (AMZN), and The Southern Company (SO)

All of these companies are supplying Redwood with batteries for recycling or purchasing battery materials from it.

Alternatively, while Redwood Materials is the leader in the industry, there are a couple of publicly traded battery-recycling companies you may be interested in:

- RecycLiCo Battery Materials (AMYZF), a $19-million company

- KULR Technology Group (KULR), a $138-million company

You could also invest in EV manufacturers. If electric batteries become cheaper, electric vehicles will likely become more affordable and increase in popularity.

- Tesla

- ChargePoint (CHPT)

- General Motors

- BYD Company Limited (BYDDF)

- Lucid Group (LCID)

- Rivian (RIVN)

Wait for the IPO

Rumors of a Redwood Materials IPO have been circulating for years, but the company has yet to file an S-1 with the SEC (which would kick off the IPO process).

Given the company's easy access to private equity, there's no rush for it to go public before it's ready. When it does finally go public, you'll need a brokerage account to buy shares.

If you don't have a brokerage account, we recommend Public. On Public, you can invest in stocks, ETFs, Treasuries, and cryptocurrencies, all on one of the most well-designed investing platforms.

Does Tesla own Redwood Materials?

No, Tesla does not own Redwood Materials.

Tesla co-founder and former long-time CTO JB Straubel founded Redwood Materials. That said, the two companies seem to have close ties, and a partnership has already been formed.

In early 2021, the U.S. Department of Energy loaned $2 billion to Redwood Materials to build its first major plant near Reno, Nevada.

It's no coincidence this facility is going in near Tesla's Gigafactory in Sparks, Nevada, which already sends its battery waste to the nearest Redwood Materials facility.

It's also worth noting that Straubel serves as an independent director on the Tesla board of directors.

Musk and Straubel are clearly still on very good terms, and their two businesses will likely be leaning on each other in the years to come.

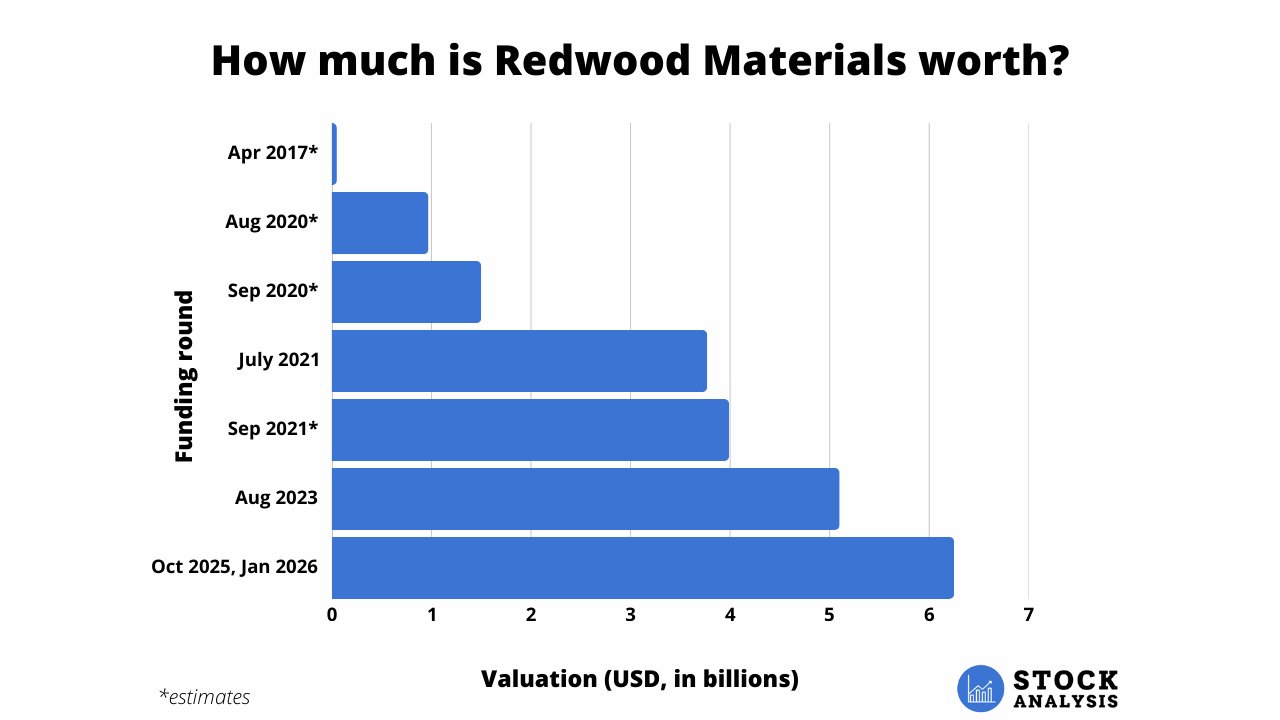

Redwood Materials valuation chart

Redwood Materials most recently raised $425 million at a valuation of more than $6 billion. The round was initially closed in October 2025 but was reopened for an extension in January 2026.

In total, Redwood has raised $2.3 billion since being founded.

Here's how its valuation has changed over time:

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.

.png)