How to Invest in Zipline Instant Delivery & Logistics

Drone delivery isn't science fiction anymore — it's already happening. And over the next decade, it could completely reshape how goods move through the world.

One of the biggest players leading that shift is Zipline.

While most of its competitors are still experimenting with test flights and pilot programs, Zipline has quietly scaled into the world's largest autonomous delivery service.

Its drones have flown over 100 million miles and have made nearly 2 million deliveries across Africa, Asia, and the U.S. Zipline carries everything from life-saving medical supplies to everyday goods — serving hospitals, businesses, and homes.

For investors who believe drone logistics will be a core part of the future, Zipline is one of the most compelling ways to get exposure to the space.

The only question left is: how can you invest in Zipline stock now?

Is Zipline publicly traded?

Zipline is not publicly traded, which means you can't buy it in your regular brokerage account. There is no Zipline stock symbol.

While an eventual IPO seems likely, Zipline hasn't provided any clear timeline. I expect the company is waiting for drone delivery to gain broader adoption before stepping into the public markets.

However, if you're not willing to wait for it to become publicly traded, there is a way to buy Zipline stock while it's still a private company.

How to buy Zipline stock in 2026

Are you an accredited or retail investor?

You qualify as an accredited investor if you meet one of the following criteria:

- You have an annual income of $200,000 individually or $300,000 jointly

- Your net worth exceeds $1,000,000 (excluding your primary residence)

If you're an accredited investor, the first section is for you. If you don't qualify as an accredited investor, skip to the second section, which is for retail investors.

How to buy Zipline stock as an accredited investor

Hiive is a secondary marketplace platform that allows accredited investors to buy shares of private, VC-backed startups.

There are thousands of private companies listed on Hiive, including Zipline:

As of the time of this writing, there are 21 listings of Zipline stock available on Hiive.

Each of these listings is made by a separate seller who may be an employee, venture capital firm, or angel investor. Each seller creates their own listing, setting an ask price and quantity of shares for sale.

After registering for Hiive, buyers can see the complete order book for every company on the platform. They see all bids, asks, and recent transactions.

From there, buyers can accept a seller's asking price as listed or place bids and negotiate directly with sellers. They can also add a company to their watchlist and get notified of any new listings or transactions.

Use the button below to register and see what price shares of Zipline are trading for on Hiive:

How to invest in Zipline stock as a retail investor

If you're not an accredited investor, there are still ways to get exposure to Zipline's business before its IPO. The best way is via the ARK Venture Fund.

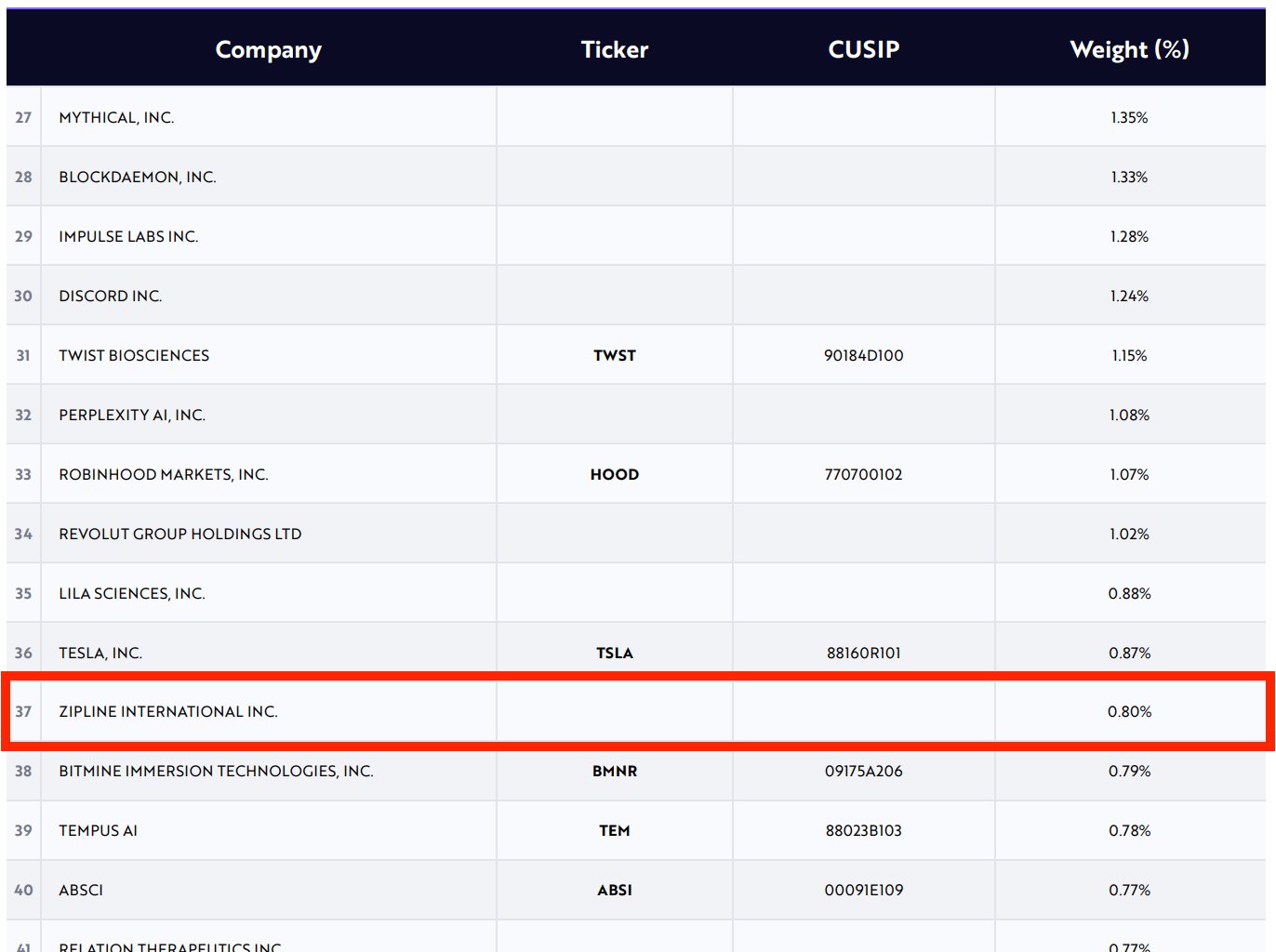

The ARK Venture Fund is a venture capital fund that invests in disruptive technology companies. It invests in both publicly and privately held companies, including Zipline.

However, as of December 2025, Zipline makes up just 0.80% of the fund — its 37th largest holding:

Given it's such a small portion of the fund, this is a very indirect means of gaining exposure to Zipline. But if you like the rest of the companies in the fund (which include SpaceX, OpenAI, and xAI), you may want to invest in it anyway.

The fund has a minimum investment of $500 and has total annual fees of 2.90%. It is available to all U.S.-based investors, though only accredited investors can invest via the ARK website. Retail investors can invest via SoFi.

Additionally, Goldman Sachs (GS) participated in Zipline's Series C and D funding rounds. So, technically, you can gain exposure to Zipline by buying Goldman Sachs stock.

That said, Goldman Sachs is a $263 billion company. Even if it owned 10% of Zipline, its stake would still be worth just ~0.15% of the entire business. Like the ARK Venture Fund, this is an extremely indirect way to gain exposure to Zipline.

You're likely better off waiting for the company's IPO (more on that below).

Who are Zipline's competitors?

Zipline isn't the only company working on drone delivery solutions. If you're bullish on the industry in general, you may be interested in investing in one of its publicly traded competitors.

Here are a few to consider:

- Amazon (AMZN) is developing delivery drones through its Prime Air program. Even if Zipline has the more advanced drone technology, Amazon's extensive network of warehouses and distribution hubs will give it a major advantage when it comes to executing large-scale delivery operations.

- Alphabet (GOOGL), through its Wing subsidiary, is testing drone deliveries for small packages like food, medicine, and household items in the U.S., Australia, and Finland.

- UPS (UPS) has partnered with drone companies to explore medical and commercial deliveries via its UPS Flight Forward division, which was one of the first to receive FAA drone airline certification.

- Walmart (WMT) is piloting drone deliveries in partnership with several startups, including Zipline, to bring same-day delivery to customers in select markets.

- EHang (EH), a Chinese company, is developing autonomous aerial vehicles, including cargo drones, and has conducted various delivery tests in Asia and Europe.

Since each of these is a public company, these are much more accessible ways to invest in the drone industry than trying to buy Zipline while it's still a private company.

When will Zipline IPO?

While the chances of an eventual IPO are extremely high, the Zipline IPO date has not yet been set, and the company has made no indication of a timeline for its public offering.

Although the FAA has approved certain use cases, drone deliveries are still a long way from becoming mainstream. Zipline's IPO likely won't happen until these regulations are further relaxed.

After its public debut, you will be able to look up its stock symbol and buy it in your brokerage account.

If you don't have a brokerage account, we recommend Public. Invest in stocks, ETFs, Treasuries, corporate bonds, and cryptocurrencies all under the same login. Create a Public account for free.

Who owns Zipline company stock?

To date, Zipline has raised over $1 billion from 42 investors.

Its list of investors includes Sequoia Capital, GV, Goldman Sachs, Andreessen Horowitz, Katalyst Ventures, Oakhouse Partners, and Reinvent Capital, though how much of the company any of these firms own is unknown.

Co-founders Keller Rinaudo Cliffton (CEO), Keenan Wyrobek (CTO), William Hetzler, and Phu Nguyen all likely own stock, as do other key employees. Their exact ownership splits are also unknown.

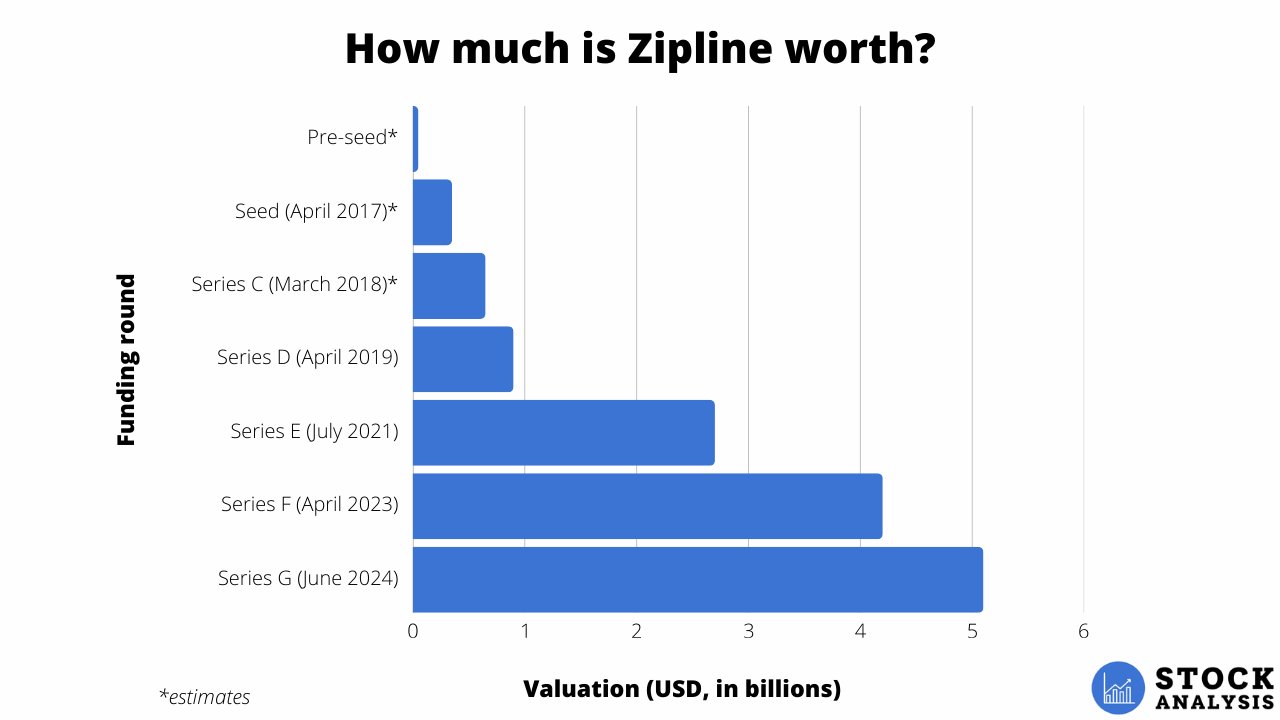

Zipline valuation history

Zipline's most recent funding round was its $350 million Series G in June 2024, which valued the company at $5.1 billion.

This was up ~21% from the $4.2 billion it received in April 2023.

Here's a look at how its valuation has changed over time:

Frequently asked questions

Below are a few more questions people often ask about Zipline.

How can I buy Zipline stock?

Zipline stock has not been made available to the public via an IPO or SPAC. The only way to invest in Zipline currently is by investing through a platform like Hiive or investing indirectly in companies that own stakes in Zipline or will benefit from its business.

How much is Zipline stock?

Zipline stock is not yet publicly traded.

What is the Zipline stock symbol?

Zipline is still a privately held company, so there is no Zipline stock symbol.

Who owns Zipline Delivery & Logistics?

Zipline is partially owned by co-founders Keller Rinaudo Cliffton, CTO Keenan Wyrobek, William Hetzler, and Phu Nguyen, along with key employees and 40+ other investors and investment firms.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.

.png)